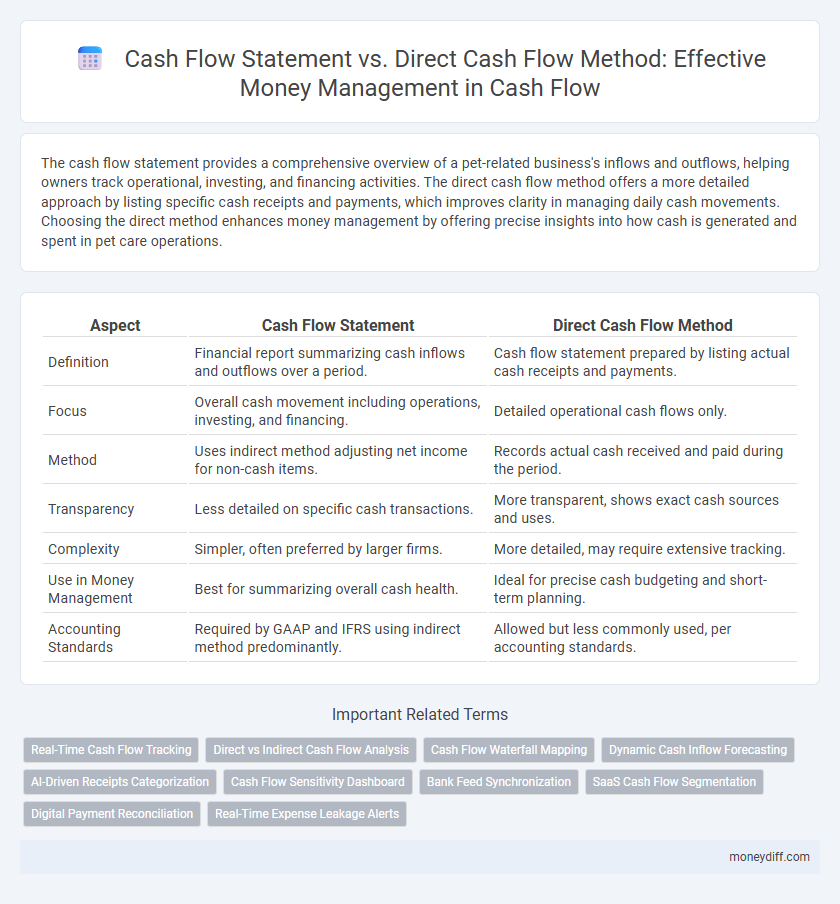

The cash flow statement provides a comprehensive overview of a pet-related business's inflows and outflows, helping owners track operational, investing, and financing activities. The direct cash flow method offers a more detailed approach by listing specific cash receipts and payments, which improves clarity in managing daily cash movements. Choosing the direct method enhances money management by offering precise insights into how cash is generated and spent in pet care operations.

Table of Comparison

| Aspect | Cash Flow Statement | Direct Cash Flow Method |

|---|---|---|

| Definition | Financial report summarizing cash inflows and outflows over a period. | Cash flow statement prepared by listing actual cash receipts and payments. |

| Focus | Overall cash movement including operations, investing, and financing. | Detailed operational cash flows only. |

| Method | Uses indirect method adjusting net income for non-cash items. | Records actual cash received and paid during the period. |

| Transparency | Less detailed on specific cash transactions. | More transparent, shows exact cash sources and uses. |

| Complexity | Simpler, often preferred by larger firms. | More detailed, may require extensive tracking. |

| Use in Money Management | Best for summarizing overall cash health. | Ideal for precise cash budgeting and short-term planning. |

| Accounting Standards | Required by GAAP and IFRS using indirect method predominantly. | Allowed but less commonly used, per accounting standards. |

Understanding Cash Flow Statements: An Overview

Cash flow statements provide a detailed record of cash inflows and outflows, crucial for effective money management by highlighting operating, investing, and financing activities. The direct cash flow method lists specific cash receipts and payments, offering clear visibility into actual cash transactions, which enhances budgeting accuracy. This contrasts with the indirect method that adjusts net income for non-cash items, making the direct method a preferred tool for precise cash monitoring and liquidity assessment.

What is the Direct Cash Flow Method?

The Direct Cash Flow Method records actual cash receipts and payments, providing a clear overview of cash inflows and outflows from operating activities. This approach lists specific cash transactions such as cash collected from customers and cash paid to suppliers, enhancing transparency in money management. Compared to indirect methods, the direct method offers more detailed insights into a company's cash position, facilitating better financial planning and liquidity management.

Key Differences Between Cash Flow Statement and Direct Method

The cash flow statement provides a comprehensive overview of a company's cash inflows and outflows categorized into operating, investing, and financing activities, while the direct cash flow method specifically lists all major operating cash receipts and payments. The direct method offers a detailed and transparent view of cash transactions like cash received from customers and cash paid to suppliers, facilitating granular money management and cash forecasting. Key differences include the presentation format and level of detail, with the direct method enhancing clarity for cash flow analysis but being less commonly used due to its complexity in data collection.

Importance of Accurate Cash Flow Reporting

Accurate cash flow reporting is crucial for effective money management, ensuring businesses maintain liquidity and meet financial obligations. The cash flow statement, whether using the direct cash flow method or indirect method, provides transparent insights into operating, investing, and financing activities. The direct method offers more detailed information on actual cash receipts and payments, enhancing decision-making and financial forecasting accuracy.

Direct Cash Flow Method: Pros and Cons

The direct cash flow method provides a clear and detailed view of cash inflows and outflows by listing specific sources and uses of cash, aiding precise money management and decision-making. Its advantages include enhanced transparency and easier identification of operational cash trends, while drawbacks involve the time-consuming nature of data collection and preparation compared to the indirect method. Businesses focused on real-time cash tracking often prefer this method despite the complexity of maintaining comprehensive transaction records.

Indirect vs Direct Cash Flow Method: Which Is Better for Money Management?

The indirect cash flow method adjusts net income for changes in balance sheet accounts to reconcile to cash flow from operating activities, offering simplicity and alignment with accrual accounting. The direct cash flow method records cash inflows and outflows from operating activities explicitly, providing clearer visibility into cash sources and uses, which enhances money management decisions. Choosing between the indirect and direct methods depends on the need for detailed cash transaction insights versus streamlined financial reporting and ease of preparation.

Essential Components of a Cash Flow Statement

A cash flow statement consists of three essential components: operating activities, investing activities, and financing activities, providing a comprehensive view of a company's cash inflows and outflows. The direct cash flow method reports actual cash receipts and payments, offering detailed visibility into cash management, while the indirect method adjusts net income for non-cash transactions and changes in working capital. Understanding these components helps businesses monitor liquidity, assess financial health, and make informed money management decisions.

Impact of Cash Flow Methods on Financial Decision-Making

The choice between the cash flow statement and the direct cash flow method significantly impacts financial decision-making by providing different levels of transparency and detail on cash inflows and outflows. The direct method offers precise information on operating cash receipts and payments, enabling more accurate short-term cash management and liquidity forecasting. In contrast, the indirect method, commonly used in cash flow statements, focuses on reconciling net income to net cash from operations, which supports long-term financial planning and profitability analysis.

Common Mistakes in Cash Flow Management

Common mistakes in cash flow management include relying solely on the indirect cash flow method, which can obscure the actual timing of cash inflows and outflows, leading to poor liquidity decisions. The direct cash flow method offers clearer visibility by recording actual cash transactions, helping managers better forecast and control operational cash requirements. Neglecting detailed cash flow statements often results in inaccurate cash flow projections and increased risk of cash shortages or overestimations in business planning.

Best Practices for Managing Cash Flow in Business

The cash flow statement provides a comprehensive overview of a business's inflows and outflows, essential for evaluating liquidity and financial health. The direct cash flow method offers a detailed approach by recording specific cash transactions, enabling more precise monitoring of operating activities. Combining both methods supports best practices in cash flow management, ensuring accurate forecasting, timely payments, and optimized working capital.

Related Important Terms

Real-Time Cash Flow Tracking

Real-time cash flow tracking enhances the direct cash flow method by providing immediate visibility of cash inflows and outflows, enabling more precise money management decisions. Unlike the indirect method used in traditional cash flow statements, this approach facilitates proactive monitoring and swift adjustments to maintain optimal liquidity.

Direct vs Indirect Cash Flow Analysis

The direct cash flow method reports actual cash receipts and payments, providing a straightforward view of cash inflows and outflows crucial for precise money management. In contrast, the indirect method adjusts net income for non-cash transactions, offering a reconciled link between accrual accounting and cash flow but potentially obscuring the real-time cash position.

Cash Flow Waterfall Mapping

Cash flow statements provide a structured overview of cash inflows and outflows, while the direct cash flow method details each specific cash transaction, enhancing cash flow waterfall mapping by clearly illustrating the sequential distribution of cash across operational, investing, and financing activities. This granular visibility facilitates precise money management, enabling businesses to pinpoint liquidity sources and prioritize cash allocation effectively within the cash flow waterfall framework.

Dynamic Cash Inflow Forecasting

The cash flow statement using the direct cash flow method provides a clear, detailed tracking of inflows and outflows, enhancing dynamic cash inflow forecasting by allowing businesses to predict liquidity needs accurately. This approach supports real-time money management decisions by identifying precise cash sources and timing, improving operational efficiency and financial planning.

AI-Driven Receipts Categorization

AI-driven receipts categorization enhances the direct cash flow method by automating the classification of income and expenses, providing real-time, accurate cash flow insights that improve money management decisions. This technology outperforms traditional cash flow statements by reducing manual errors and accelerating cash flow analysis, enabling businesses to optimize liquidity and forecast financial health with greater precision.

Cash Flow Sensitivity Dashboard

The Cash Flow Sensitivity Dashboard provides real-time analysis of cash flow variations by comparing the Cash Flow Statement with the Direct Cash Flow Method, enabling precise tracking of inflows and outflows for optimized money management. This tool highlights sensitivity to operational changes, enhancing predictive accuracy and cash liquidity planning across financial periods.

Bank Feed Synchronization

The Cash Flow Statement provides a comprehensive overview of inflows and outflows over a period, while the Direct Cash Flow Method offers real-time tracking of cash transactions through Bank Feed Synchronization, enabling accurate and up-to-date money management. Bank Feed Synchronization streamlines reconciliation by automatically importing and categorizing bank transactions, enhancing cash flow visibility and financial decision-making efficiency.

SaaS Cash Flow Segmentation

The cash flow statement provides a comprehensive overview by categorizing operating, investing, and financing activities, whereas the direct cash flow method segments cash inflows and outflows in real time, offering SaaS companies more precise visibility into subscription revenues, customer payments, and operational expenses. SaaS cash flow segmentation enhances money management by aligning cash movements with subscription lifecycles, improving forecasting accuracy and liquidity optimization.

Digital Payment Reconciliation

The cash flow statement provides a comprehensive overview of a company's cash inflows and outflows, while the direct cash flow method specifically details cash transactions, enhancing accuracy in tracking receipts and payments. Digital payment reconciliation streamlines this process by automatically matching digital transactions with ledger entries, reducing errors and improving real-time cash flow management.

Real-Time Expense Leakage Alerts

The cash flow statement provides a comprehensive overview of a company's inflows and outflows, but the direct cash flow method enhances real-time money management by offering instant expense tracking and leakage alerts. This enables businesses to promptly identify and address unauthorized or unexpected expenditures, improving financial control and operational efficiency.

Cash flow statement vs direct cash flow method for money management. Infographic

moneydiff.com

moneydiff.com