Gross cash flow represents the total amount of money generated before any expenses are deducted, providing a clear picture of overall earnings. Net cash flow accounts for all outflows, including operating expenses and liabilities, offering a more accurate view of the available funds for money management. Understanding the difference between gross and net cash flow is essential for making informed financial decisions and maintaining healthy cash reserves.

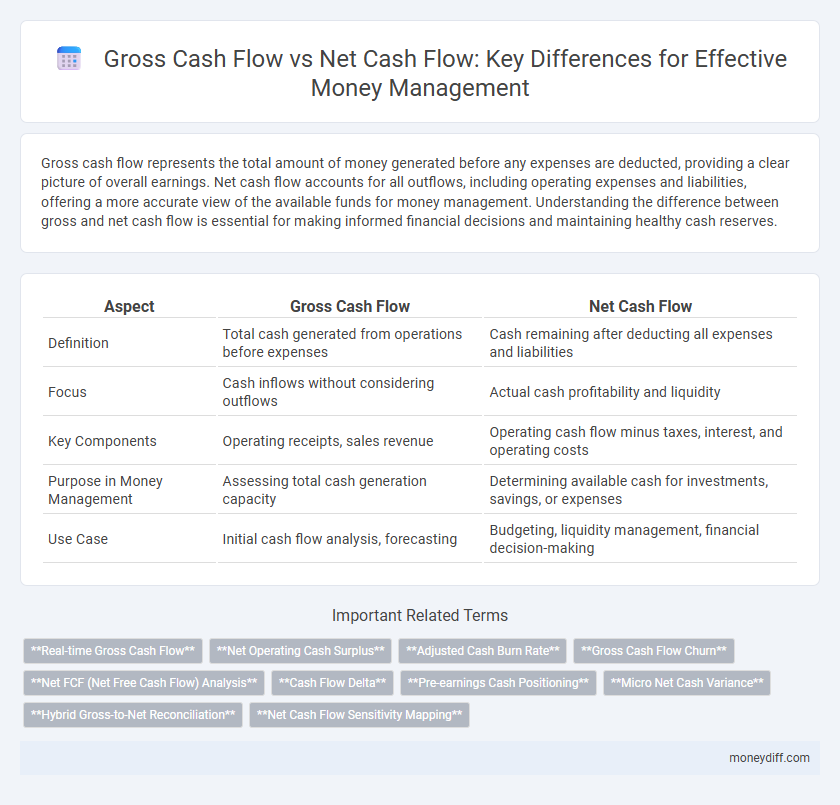

Table of Comparison

| Aspect | Gross Cash Flow | Net Cash Flow |

|---|---|---|

| Definition | Total cash generated from operations before expenses | Cash remaining after deducting all expenses and liabilities |

| Focus | Cash inflows without considering outflows | Actual cash profitability and liquidity |

| Key Components | Operating receipts, sales revenue | Operating cash flow minus taxes, interest, and operating costs |

| Purpose in Money Management | Assessing total cash generation capacity | Determining available cash for investments, savings, or expenses |

| Use Case | Initial cash flow analysis, forecasting | Budgeting, liquidity management, financial decision-making |

Introduction to Gross Cash Flow and Net Cash Flow

Gross cash flow represents the total cash generated from operating activities before any deductions, reflecting the company's ability to generate cash from its core business. Net cash flow accounts for all inflows and outflows, including operating, investing, and financing activities, showing the actual cash position over a period. Understanding both metrics is essential for accurate money management and assessing financial health.

Defining Gross Cash Flow: What You Need to Know

Gross cash flow represents the total cash generated by a business from its operations before any deductions for expenses, taxes, or investments. It provides a clear view of the company's ability to generate revenue in monetary terms, reflecting the raw cash inflow during a specific period. Understanding gross cash flow is essential for assessing liquidity and operational efficiency before accounting for outflows that impact net cash flow.

Understanding Net Cash Flow: A Clear Overview

Net cash flow represents the actual amount of cash generated or consumed during a specific period after accounting for all operational, investing, and financing activities, providing a precise indicator of financial health. Gross cash flow, in contrast, includes total cash inflows before deductions, often reflecting revenue or operational cash generation without considering expenses or liabilities. Understanding net cash flow enables businesses to assess liquidity more accurately, manage expenses effectively, and make informed decisions about investments and debt repayments.

Key Differences Between Gross and Net Cash Flow

Gross cash flow represents the total amount of cash generated from operating activities before any expenses are deducted, providing an overview of a company's cash inflows. Net cash flow accounts for all cash inflows and outflows, including operating costs, investments, and financing expenses, offering a clear picture of actual liquidity. Understanding the key difference between gross and net cash flow is essential for accurate money management and financial decision-making.

Why Gross Cash Flow Matters in Tracking Income

Gross cash flow represents total cash generated from operations before any expenses or liabilities are deducted, providing a clear picture of a company's revenue-generating ability. Tracking gross cash flow is essential for money management because it highlights the raw income potential, enabling better budgeting and investment decisions. It serves as a baseline for assessing financial health before accounting for operational costs, taxes, and debts reflected in net cash flow.

The Importance of Net Cash Flow for Financial Planning

Net cash flow, which accounts for all cash inflows and outflows including operating, investing, and financing activities, provides a comprehensive view of a company's liquidity and financial health. Unlike gross cash flow, net cash flow reflects the actual amount of cash available for debt repayment, investments, and daily expenses, making it critical for accurate financial planning and budgeting. Monitoring net cash flow helps businesses avoid shortfalls, optimize working capital, and make informed strategic decisions.

Gross Cash Flow vs Net Cash Flow: Which Is More Useful?

Gross cash flow represents the total cash generated from operating activities before any deductions, offering a clear view of a business's revenue-generating efficiency. Net cash flow accounts for all cash inflows and outflows, including expenses and investments, providing a comprehensive picture of actual liquidity. For money management, net cash flow is more useful as it reflects the true cash availability for operational needs, debt servicing, and growth investments.

Common Mistakes in Interpreting Cash Flow Data

Confusing gross cash flow with net cash flow often leads to inaccurate assessments of a company's financial health, as gross cash flow excludes crucial deductions like operating expenses and taxes. Many businesses mistakenly rely solely on gross cash flow, overlooking the impact of liabilities and capital expenditures that net cash flow accounts for. Accurate money management requires analyzing net cash flow to understand the actual liquidity available for operations and investment decisions.

Practical Tips for Managing Both Gross and Net Cash Flow

Track gross cash flow by recording all incoming revenue streams to understand total cash availability before expenses. Manage net cash flow by closely monitoring operating costs and liabilities, ensuring that outflows do not exceed inflows for sustainable liquidity. Use budgeting tools to forecast both gross and net cash flows, enabling proactive adjustments and improved financial planning.

Enhancing Money Management Through Effective Cash Flow Analysis

Gross cash flow represents the total inflow and outflow of cash before deducting operating expenses, providing a broad overview of a company's liquidity. Net cash flow offers a precise measure by subtracting all expenses, taxes, and investments, highlighting the actual cash available for money management decisions. Analyzing both metrics enables more informed budgeting, investment planning, and strategic financial management.

Related Important Terms

Real-time Gross Cash Flow

Real-time gross cash flow reflects the total inflows and outflows of cash without deductions, providing an immediate snapshot of liquidity for precise money management. Monitoring real-time gross cash flow enables businesses to optimize operational decisions, ensuring sufficient cash availability before accounting for expenses or liabilities.

Net Operating Cash Surplus

Net operating cash surplus represents the actual liquidity generated from core business operations after deducting operating expenses, distinguishing it from gross cash flow which includes all cash inflows without expenses accounted. Effective money management prioritizes net operating cash surplus to ensure sustainable operational funding and accurate financial health assessment.

Adjusted Cash Burn Rate

Gross cash flow represents the total inflows and outflows without accounting for non-operational expenses, while net cash flow reflects the actual liquidity after all expenses, including taxes and interest, are deducted. The Adjusted Cash Burn Rate refines net cash flow analysis by excluding one-time costs and irregular expenses, providing a clearer metric for sustainable money management and operational efficiency.

Gross Cash Flow Churn

Gross Cash Flow Churn measures the total cash lost due to customer attrition before accounting for any new cash inflows, providing a clear view of the revenue erosion impacting overall liquidity. Monitoring Gross Cash Flow Churn enables businesses to identify cash outflows linked to customer losses, facilitating more precise money management and strategic planning to improve financial stability.

Net FCF (Net Free Cash Flow) Analysis

Net Free Cash Flow (Net FCF) analysis focuses on the actual cash a company generates after deducting capital expenditures from operating cash flow, providing a clearer indicator of financial health and liquidity compared to gross cash flow. Monitoring Net FCF is essential for effective money management as it reveals the funds available for debt repayment, dividends, and reinvestment in growth opportunities.

Cash Flow Delta

Cash Flow Delta quantifies the difference between gross cash flow, which includes all cash inflows before expenses, and net cash flow, representing actual cash remaining after deducting operational costs and liabilities. Monitoring Cash Flow Delta is essential for effective money management as it highlights liquidity availability and financial health by revealing real-time cash variations.

Pre-earnings Cash Positioning

Gross cash flow reflects total cash generated before operating expenses and liabilities, offering a broad view of liquidity potential, while net cash flow accounts for all cash inflows and outflows, providing a precise measure of available funds for pre-earnings cash positioning. Effective money management hinges on analyzing gross cash flow for capacity assessment and net cash flow for actionable budgeting during periods before earnings are realized.

Micro Net Cash Variance

Gross cash flow represents total cash inflows before deducting expenses, while net cash flow accounts for all cash outflows, providing a clearer picture of actual liquidity. Micro Net Cash Variance analyzes the small-scale fluctuations in net cash flow, enabling precise money management by identifying minor discrepancies between expected and actual cash positions.

Hybrid Gross-to-Net Reconciliation

Hybrid Gross-to-Net Reconciliation integrates detailed gross cash flow data with net cash flow figures to provide a comprehensive view of liquidity, improving accuracy in money management decisions. This approach enables precise tracking of inflows and outflows, enhancing cash forecasting and optimizing working capital management.

Net Cash Flow Sensitivity Mapping

Net cash flow sensitivity mapping identifies how variations in revenue, expenses, and investment activities impact the net cash flow, providing critical insights into cash flow stability for effective money management. By analyzing these sensitivities, businesses can proactively adjust financial strategies to maintain liquidity and optimize operational efficiency.

Gross cash flow vs net cash flow for money management. Infographic

moneydiff.com

moneydiff.com