The cash flow statement provides a comprehensive overview of all cash inflows and outflows within a business, summarizing operating, investing, and financing activities. Direct cash flow analysis focuses specifically on tracking actual cash receipts and payments, offering more immediate visibility into liquidity for day-to-day money management. Combining both approaches enhances financial decision-making by balancing detailed operational insights with a broader strategic perspective.

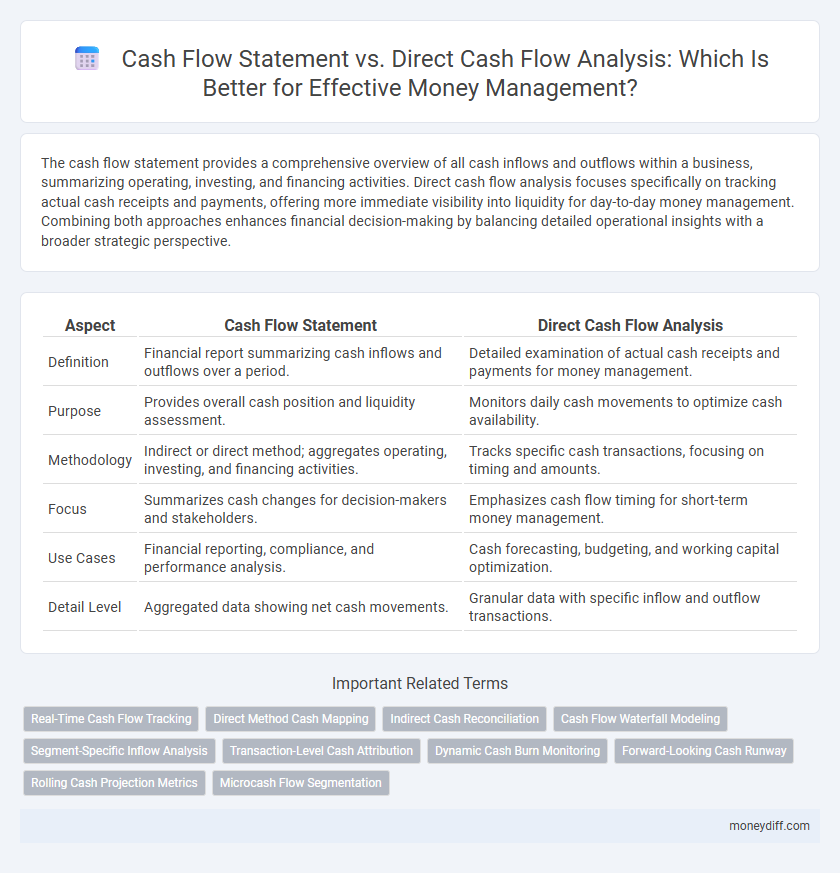

Table of Comparison

| Aspect | Cash Flow Statement | Direct Cash Flow Analysis |

|---|---|---|

| Definition | Financial report summarizing cash inflows and outflows over a period. | Detailed examination of actual cash receipts and payments for money management. |

| Purpose | Provides overall cash position and liquidity assessment. | Monitors daily cash movements to optimize cash availability. |

| Methodology | Indirect or direct method; aggregates operating, investing, and financing activities. | Tracks specific cash transactions, focusing on timing and amounts. |

| Focus | Summarizes cash changes for decision-makers and stakeholders. | Emphasizes cash flow timing for short-term money management. |

| Use Cases | Financial reporting, compliance, and performance analysis. | Cash forecasting, budgeting, and working capital optimization. |

| Detail Level | Aggregated data showing net cash movements. | Granular data with specific inflow and outflow transactions. |

Understanding Cash Flow Statements in Money Management

Cash flow statements provide a structured overview of a company's cash inflows and outflows classified into operating, investing, and financing activities, essential for accurate money management. Direct cash flow analysis offers a detailed examination of actual cash transactions, enabling more precise monitoring of liquidity and short-term financial health. Understanding both tools enhances cash management strategies by revealing cash availability and aiding in forecasting financial stability.

What Is Direct Cash Flow Analysis?

Direct cash flow analysis involves evaluating cash inflows and outflows by examining individual transactions, providing a granular view of how money is moving within a business. This approach contrasts with the cash flow statement, which summarizes cash activities into operating, investing, and financing sections, offering a broad overview. By focusing on specific cash receipts and payments, direct cash flow analysis enables precise money management and better short-term liquidity forecasting.

Key Differences: Cash Flow Statement vs Direct Cash Flow Analysis

The Cash Flow Statement provides a structured summary of cash inflows and outflows across operating, investing, and financing activities, adhering to accounting standards for financial reporting. Direct Cash Flow Analysis emphasizes tracking actual cash transactions in real-time, offering immediate insights for day-to-day money management and liquidity assessment. Key differences lie in the statement's formal aggregation versus the analysis's real-time detail and practical application for managing cash effectively.

The Structure of a Cash Flow Statement

The structure of a cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities, providing a detailed view of cash inflows and outflows. This format enables precise tracking of cash generated or spent in core business operations, asset purchases, and capital funding, offering a comprehensive overview of liquidity. Direct cash flow analysis complements this by isolating specific cash transactions, enhancing money management through targeted insights on cash timing and availability.

How Direct Cash Flow Analysis Tracks Cash Movement

Direct cash flow analysis tracks cash movement by recording actual cash inflows and outflows from operating, investing, and financing activities, providing a real-time view of liquidity. Unlike the cash flow statement, which reconciles net income with cash changes using accrual accounting adjustments, direct analysis offers granular detail on each cash transaction. This method enhances money management by enabling precise monitoring of cash availability and timing for better financial decision-making.

Advantages of Cash Flow Statements in Personal Finance

Cash flow statements provide a comprehensive overview of income and expenses, enabling individuals to track where their money originates and how it is spent over a specific period. This detailed documentation helps identify spending patterns, allowing for better budgeting and financial planning. Using cash flow statements in personal finance improves cash management by highlighting trends and potential shortfalls before they impact financial stability.

Benefits of Direct Cash Flow Analysis for Budgeting

Direct cash flow analysis provides a granular view of cash inflows and outflows, enabling precise budget adjustments based on actual spending patterns. This method enhances financial control by identifying timing mismatches and liquidity gaps that traditional cash flow statements may overlook. Utilizing direct cash flow analysis supports proactive money management, ensuring adequate cash reserves and optimized allocation for operational needs.

When to Use a Cash Flow Statement vs Direct Cash Flow Analysis

A cash flow statement provides a comprehensive overview of a company's liquidity by summarizing operating, investing, and financing activities, essential for periodic financial reporting and assessing overall financial health. Direct cash flow analysis offers a granular view of cash inflows and outflows, ideal for real-time money management and optimizing daily operational decisions. Use a cash flow statement for strategic planning and investor communication, while direct cash flow analysis is best for immediate cash position monitoring and tactical financial adjustments.

Common Mistakes in Cash Flow Reporting and Analysis

Common mistakes in cash flow reporting include misclassifying operating, investing, and financing activities, which can distort a company's liquidity position. Direct cash flow analysis often overlooks timing differences and non-cash transactions that affect the accuracy of cash flow projections. Proper segregation and reconciliation in cash flow statements ensure more reliable money management and financial decision-making.

Choosing the Right Method for Effective Money Management

Selecting the appropriate cash flow method is essential for effective money management, as the cash flow statement provides a comprehensive overview of inflows and outflows categorized by operating, investing, and financing activities. Direct cash flow analysis offers detailed tracking of actual cash receipts and payments, enabling precise control over daily liquidity. Businesses seeking transparency and detailed operational insight often prefer direct analysis, while entities valuing strategic financial reporting typically rely on the cash flow statement.

Related Important Terms

Real-Time Cash Flow Tracking

Real-time cash flow tracking provides immediate visibility into cash inflows and outflows, enabling proactive money management beyond the periodic snapshots offered by traditional cash flow statements. Direct cash flow analysis offers granular insights by categorizing transactions as they occur, improving accuracy and responsiveness in financial decision-making.

Direct Method Cash Mapping

Direct Method Cash Mapping provides a detailed visualization of cash inflows and outflows by categorizing actual cash transactions, enhancing precision in money management compared to the indirect approach used in traditional cash flow statements. This method facilitates real-time tracking of operational cash movements, enabling businesses to optimize liquidity and improve financial decision-making based on granular data.

Indirect Cash Reconciliation

The cash flow statement utilizes indirect cash reconciliation to adjust net income for non-cash transactions and changes in working capital, providing a comprehensive view of operating cash inflows and outflows. This method contrasts with direct cash flow analysis by offering detailed insights into the sources and uses of cash, enhancing money management decisions through accurate cash position assessment.

Cash Flow Waterfall Modeling

Cash flow statement provides a comprehensive summary of cash inflows and outflows, while direct cash flow analysis breaks down specific cash sources and uses for granular money management. Cash Flow Waterfall Modeling prioritizes cash allocation by layering obligations from operating expenses to financing costs, enhancing precision in forecasting liquidity and optimizing cash reserves.

Segment-Specific Inflow Analysis

Segment-specific inflow analysis in cash flow statements provides detailed insight into individual business units' revenue streams, enhancing precision in money management. Direct cash flow analysis complements this by tracking actual cash movements, enabling real-time assessment of segment liquidity and operational efficiency.

Transaction-Level Cash Attribution

Transaction-level cash attribution in cash flow statements provides granular insights into individual cash inflows and outflows, enabling precise tracking of operational, investing, and financing activities. Direct cash flow analysis leverages this detailed data to enhance money management by identifying specific transaction impacts on liquidity, improving forecasting accuracy and financial decision-making.

Dynamic Cash Burn Monitoring

Cash flow statements provide a historical overview of cash inflows and outflows, while direct cash flow analysis offers real-time insights crucial for dynamic cash burn monitoring, enabling precise tracking of expenditure rates against available liquidity. This proactive approach allows businesses to anticipate funding gaps and optimize money management strategies for sustained financial health.

Forward-Looking Cash Runway

The Cash Flow Statement provides a historical overview of inflows and outflows, while direct cash flow analysis emphasizes real-time tracking to project a Forward-Looking Cash Runway, crucial for proactive money management. Accurately estimating the runway duration enables businesses to plan for liquidity needs and avoid potential cash shortfalls.

Rolling Cash Projection Metrics

Rolling cash projection metrics offer a dynamic view of future cash positions by continuously updating cash inflows and outflows in a direct cash flow analysis, enabling precise short-term money management. Unlike the traditional cash flow statement, which provides a historical snapshot, rolling projections forecast liquidity trends, helping businesses anticipate funding needs and optimize operational decisions.

Microcash Flow Segmentation

Cash flow statements provide a comprehensive overview of cash inflows and outflows across operating, investing, and financing activities, while direct cash flow analysis focuses on real-time tracking of specific cash transactions for refined money management. Microcash Flow Segmentation enhances this approach by categorizing granular cash movements, enabling precise financial control and improved liquidity forecasting.

Cash flow statement vs direct cash flow analysis for money management. Infographic

moneydiff.com

moneydiff.com