Historical cash flow reviews provide a detailed analysis of past financial inflows and outflows, highlighting patterns and trends that inform business performance assessment. Rolling cash flow projections offer dynamic, forward-looking estimates that adjust regularly to reflect changing conditions and improve short-term financial planning accuracy. Combining historical data with rolling forecasts enhances cash flow management by blending proven insights with flexible, real-time adjustments.

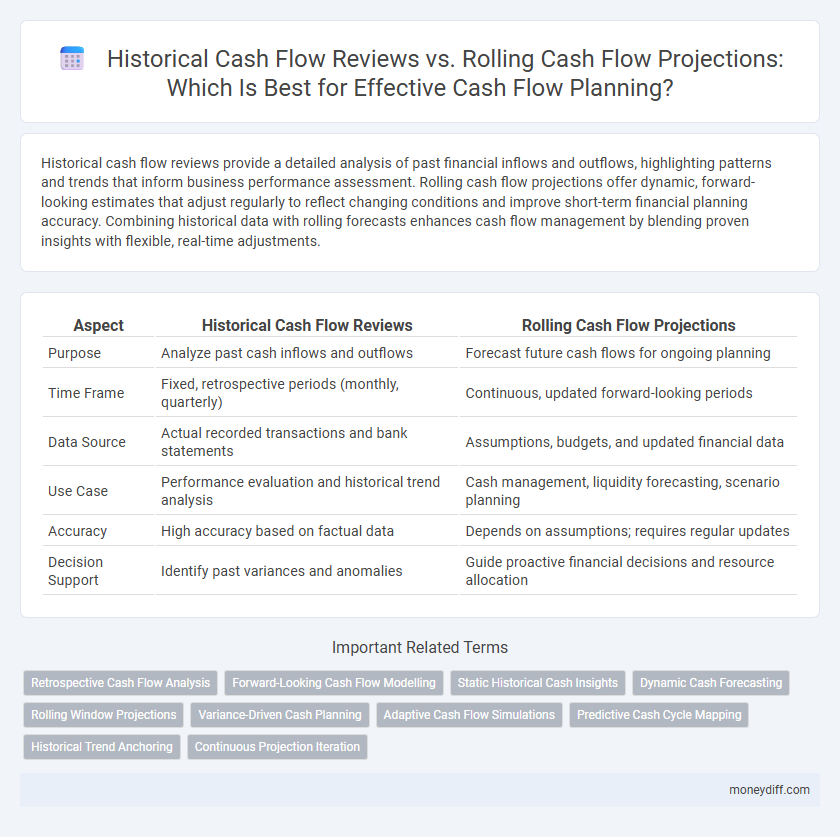

Table of Comparison

| Aspect | Historical Cash Flow Reviews | Rolling Cash Flow Projections |

|---|---|---|

| Purpose | Analyze past cash inflows and outflows | Forecast future cash flows for ongoing planning |

| Time Frame | Fixed, retrospective periods (monthly, quarterly) | Continuous, updated forward-looking periods |

| Data Source | Actual recorded transactions and bank statements | Assumptions, budgets, and updated financial data |

| Use Case | Performance evaluation and historical trend analysis | Cash management, liquidity forecasting, scenario planning |

| Accuracy | High accuracy based on factual data | Depends on assumptions; requires regular updates |

| Decision Support | Identify past variances and anomalies | Guide proactive financial decisions and resource allocation |

Introduction: Understanding Cash Flow Analysis

Historical cash flow reviews provide a detailed record of past cash inflows and outflows, enabling businesses to identify spending patterns and liquidity trends over time. Rolling cash flow projections continuously update future cash estimates based on real-time data, allowing for more dynamic and responsive financial planning. Combining these methods enhances accuracy in cash management and supports strategic decision-making by bridging past performance with future predictions.

Defining Historical Cash Flow Reviews

Historical cash flow reviews analyze past financial transactions to assess liquidity patterns, identify trends in inflows and outflows, and evaluate operational efficiency over a defined period. These reviews provide concrete data on actual cash movements, enabling businesses to understand how previous decisions impacted their financial health. By examining historical cash flow statements, companies gain valuable insights to support future budgeting and risk management strategies.

Exploring Rolling Cash Flow Projections

Rolling cash flow projections offer dynamic, real-time insights by continuously updating forecast data, allowing businesses to anticipate liquidity needs and adjust strategies proactively. Unlike historical cash flow reviews that analyze past transactions, rolling forecasts incorporate current market trends, sales pipelines, and expense forecasts for more accurate financial planning. This forward-looking approach enhances decision-making, supports risk management, and improves the alignment of cash reserves with operational demands.

Key Differences Between Historical and Rolling Cash Flow Methods

Historical cash flow reviews analyze past financial inflows and outflows to assess actual liquidity performance over specific periods, providing concrete data for retrospective evaluation. Rolling cash flow projections continuously update future cash estimates by incorporating real-time data and revised assumptions, enabling dynamic and forward-looking financial planning. The key difference lies in historical analysis focusing on accuracy of recorded cash movements, while rolling projections emphasize flexibility and adaptability in forecasting future cash positions.

Advantages of Historical Cash Flow Reviews

Historical cash flow reviews provide precise insights derived from actual financial transactions, enabling more accurate assessments of past performance and trends. They help identify recurring cash inflows and outflows, enhancing the reliability of budgeting by anchoring forecasts to real data. This method also uncovers discrepancies or anomalies in previous cash management, fostering better financial control and accountability.

Benefits of Rolling Cash Flow Projections

Rolling cash flow projections provide businesses with dynamic, real-time financial insights that improve accuracy in forecasting future liquidity needs compared to static historical cash flow reviews. By continuously updating projections based on the latest data, companies can quickly adapt to changes in revenue streams, expenses, and market conditions, enhancing decision-making and risk management. This proactive approach supports effective working capital optimization and strategic growth planning, driving stronger financial stability.

Limitations and Challenges of Historical Cash Flow Analysis

Historical cash flow reviews provide valuable insights but face limitations such as reliance on past data that may not accurately predict future cash positions during volatile market conditions. These analyses often struggle with incomplete or outdated information, hindering effective short-term financial planning. Consequently, businesses risk underestimating cash flow volatility, which can lead to poor liquidity management and missed opportunities.

Common Pitfalls in Rolling Cash Flow Planning

Rolling cash flow projections frequently suffer from overreliance on optimistic assumptions, leading to inaccurate forecasts that can impair financial decision-making. Inadequate updates and failure to incorporate real-time data distort the dynamic nature of cash flows, causing misalignment with actual liquidity positions. Ignoring seasonality and irregular cash flows further exacerbates planning errors, increasing the risk of cash shortfalls and unnecessary borrowing costs.

Integrating Historical and Rolling Approaches for Optimal Cash Management

Integrating historical cash flow reviews with rolling cash flow projections enhances accuracy and responsiveness in cash management by combining actual performance data with future forecasts. This blended approach allows businesses to identify trends, anticipate cash shortages, and adjust plans dynamically to maintain liquidity. Utilizing both methods creates a robust framework for optimizing working capital and supporting strategic financial decision-making.

Best Practices for Effective Cash Flow Forecasting

Historical cash flow reviews provide valuable insights into past financial performance, helping identify recurring patterns and seasonal fluctuations that influence liquidity. Rolling cash flow projections enhance planning accuracy by continuously updating forecasts based on real-time data, enabling agile responses to changing market conditions and operational needs. Best practices for effective cash flow forecasting involve integrating historical data with dynamic projections, leveraging advanced analytics tools, and regularly collaborating with finance, sales, and operations teams to ensure comprehensive and actionable cash flow management.

Related Important Terms

Retrospective Cash Flow Analysis

Retrospective Cash Flow Analysis provides comprehensive insights into past liquidity patterns by evaluating historical cash inflows and outflows, enabling more accurate identification of recurring trends and anomalies. This approach enhances financial planning by grounding projections in verified data, offering a reliable foundation compared to purely forward-looking Rolling Cash Flow Projections.

Forward-Looking Cash Flow Modelling

Forward-looking cash flow modelling relies on rolling cash flow projections to provide dynamic, real-time insights that adapt to changing market conditions and operational variables. Historical cash flow reviews offer valuable context but lack the predictive accuracy necessary for proactive financial planning and strategic decision-making.

Static Historical Cash Insights

Static historical cash flow reviews provide fixed snapshots of past financial performance, enabling identification of recurring cash patterns and trends essential for analyzing liquidity risks. These insights, though limited in forecasting flexibility, offer a reliable foundation for benchmarking actual cash movements against planned budgets in robust financial planning.

Dynamic Cash Forecasting

Historical cash flow reviews offer valuable insights into past financial performance, while rolling cash flow projections enhance planning accuracy by continuously updating forecasts based on real-time data and market trends. Dynamic cash forecasting integrates these elements to provide agile, forward-looking liquidity management that adjusts to evolving business conditions.

Rolling Window Projections

Rolling cash flow projections provide a dynamic forecasting approach that continuously updates cash positions based on real-time data, enabling more accurate and flexible financial planning compared to static historical cash flow reviews. This method enhances liquidity management by anticipating future cash inflows and outflows within a defined rolling window, supporting proactive decision-making and risk mitigation.

Variance-Driven Cash Planning

Variance-driven cash planning leverages historical cash flow reviews to identify discrepancies between actual and forecasted figures, enabling more accurate adjustments in rolling cash flow projections. This approach enhances liquidity management by continuously refining forecasts based on past variance patterns, reducing the risk of cash shortfalls and optimizing operational funding.

Adaptive Cash Flow Simulations

Historical cash flow reviews provide valuable insights into past liquidity patterns by analyzing actual inflows and outflows over specific periods, while rolling cash flow projections offer dynamic, continuously updated forecasts that adjust to real-time data and changing business conditions. Adaptive cash flow simulations enhance planning accuracy by integrating both historical trends and forward-looking variables, enabling more responsive and precise cash management decisions.

Predictive Cash Cycle Mapping

Historical cash flow reviews provide valuable insights into past financial performance but often lack the agility needed for dynamic decision-making, whereas rolling cash flow projections enable continuous updates that reflect real-time changes in operational variables. Predictive Cash Cycle Mapping integrates these projections by forecasting cash inflows and outflows across specific business cycles, enhancing accuracy in liquidity management and strategic planning.

Historical Trend Anchoring

Historical cash flow reviews anchor financial planning by providing concrete data on past inflows and outflows, enabling accurate identification of spending patterns and revenue cycles. Rolling cash flow projections enhance this approach by continuously updating forecasts based on recent trends, improving cash management and liquidity planning.

Continuous Projection Iteration

Rolling cash flow projections enable continuous projection iteration by incorporating real-time data updates, enhancing forecast accuracy compared to static historical cash flow reviews. This dynamic approach allows businesses to adjust cash flow plans proactively, optimizing liquidity management and financial decision-making.

Historical cash flow reviews vs Rolling cash flow projections for planning. Infographic

moneydiff.com

moneydiff.com