Income statement analysis highlights profitability by comparing revenues and expenses, providing an overview of financial performance, but it may overlook the timing of cash inflows and outflows. Cash flow waterfall analysis breaks down the movement of cash across operating, investing, and financing activities, offering a detailed view of liquidity and cash availability. Effective money management relies more on cash flow waterfall analysis to ensure adequate cash is on hand for obligations, rather than solely on income statement figures.

Table of Comparison

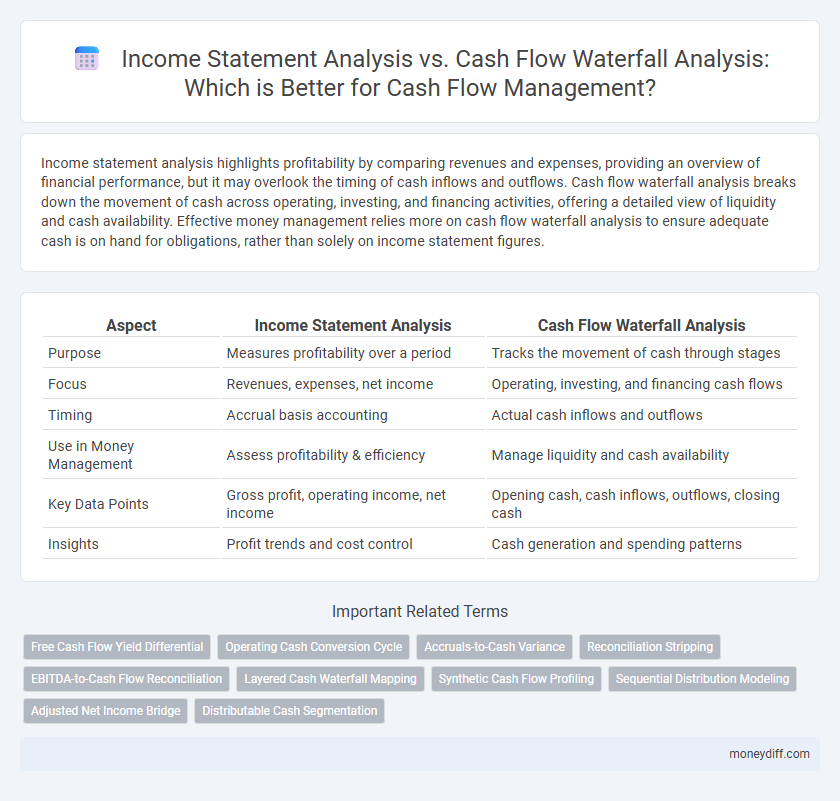

| Aspect | Income Statement Analysis | Cash Flow Waterfall Analysis |

|---|---|---|

| Purpose | Measures profitability over a period | Tracks the movement of cash through stages |

| Focus | Revenues, expenses, net income | Operating, investing, and financing cash flows |

| Timing | Accrual basis accounting | Actual cash inflows and outflows |

| Use in Money Management | Assess profitability & efficiency | Manage liquidity and cash availability |

| Key Data Points | Gross profit, operating income, net income | Opening cash, cash inflows, outflows, closing cash |

| Insights | Profit trends and cost control | Cash generation and spending patterns |

Understanding Income Statement Analysis

Income statement analysis focuses on evaluating revenues, expenses, and net income to assess a company's profitability over a specific period. It highlights operational efficiency and cost management by examining gross profit margins and operating expenses but does not reflect cash inflows and outflows directly. Understanding this analysis is essential for forecasting earnings and budgeting but requires supplementation with cash flow waterfall analysis to capture liquidity and cash management dynamics.

What is Cash Flow Waterfall Analysis?

Cash Flow Waterfall Analysis is a detailed method that tracks the sequential allocation of cash inflows and outflows across different financial obligations, ensuring precise money management. Unlike Income Statement Analysis, which focuses on profitability and revenue recognition, Cash Flow Waterfall Analysis provides real-time visibility into the liquidity position by categorizing cash usage for operational costs, debt servicing, and capital expenditures. This approach enhances cash flow forecasting accuracy, helping businesses prioritize payments and maintain solvency.

Key Differences Between Income Statement and Cash Flow Waterfall

Income statement analysis highlights profitability by detailing revenues and expenses over a specific period, while cash flow waterfall analysis tracks the actual inflows and outflows of cash, providing a real-time view of liquidity. The income statement includes non-cash items like depreciation, whereas the cash flow waterfall focuses solely on cash transactions, making it crucial for managing day-to-day cash availability. Understanding these differences enables more effective money management by ensuring profits align with cash position to avoid liquidity issues.

Importance of Income Statement in Money Management

The income statement provides a detailed overview of a company's profitability by capturing revenues, expenses, and net income over a specific period, which is crucial for assessing operational efficiency and future earnings potential. Understanding income statement elements such as gross profit margin, operating expenses, and net profit helps managers make informed decisions about cost control and revenue enhancement, directly influencing strategic planning. While cash flow waterfall analysis tracks actual cash inflows and outflows, the income statement's importance lies in revealing underlying profit trends that guide sustainable money management and investment strategies.

Advantages of Cash Flow Waterfall for Financial Planning

Cash flow waterfall analysis provides a detailed, chronological visualization of cash inflows and outflows, enabling precise identification of liquidity availability and timing. This method enhances money management by prioritizing debt repayments, operational expenses, and investments, ensuring optimal allocation of funds. Unlike income statement analysis, which reflects accrued revenues and expenses, cash flow waterfall delivers actionable insights into actual cash movements essential for robust financial planning.

Income Statement Analysis: Strengths and Limitations

Income statement analysis offers insights into a company's profitability by detailing revenues, expenses, and net income, which aids in assessing operational efficiency and cost management. However, it does not reflect actual cash movements, limiting its effectiveness for cash flow management due to non-cash expenses like depreciation and accrual accounting practices. Relying solely on income statement analysis may obscure liquidity issues that are critical for maintaining sufficient working capital and meeting short-term obligations.

Cash Flow Waterfall: Insights for Cash Management

Cash flow waterfall analysis provides a detailed breakdown of cash inflows and outflows, revealing the timing and priority of cash movements critical for effective money management. Unlike income statement analysis, which focuses on profitability, cash flow waterfall emphasizes liquidity by tracking operational, investing, and financing cash streams. This granular visibility helps businesses optimize working capital, anticipate cash shortages, and strategically allocate resources to maintain financial stability.

When to Use Income Statement vs. Cash Flow Waterfall

Income statement analysis is ideal for assessing profitability and operational performance over a specific period, highlighting revenue, expenses, and net income. Cash flow waterfall analysis is crucial for examining the timing and sequence of cash inflows and outflows, ensuring liquidity management and identifying potential cash shortfalls. Use income statement analysis for profitability insights and cash flow waterfall analysis for real-time cash management and forecasting.

Real-World Examples: Income Statement and Cash Flow Analysis

Income statement analysis highlights net profit by comparing revenues and expenses over a period, offering a snapshot of profitability but often missing timing differences in cash movements. Cash flow waterfall analysis breaks down actual cash inflows and outflows in stages--operating, investing, and financing activities--to provide a clear picture of liquidity and cash availability. For example, a company may report strong net income on the income statement while the cash flow waterfall reveals negative operating cash flow due to delayed customer payments, emphasizing the importance of integrating both analyses for effective money management.

Best Practices for Integrating Both Analyses in Money Management

Combining income statement analysis with cash flow waterfall analysis enhances money management by providing a comprehensive view of profitability and liquidity. Best practices include aligning revenue recognition with actual cash inflows, monitoring operating cash flow variances, and prioritizing expense management based on cash availability rather than accrual-based metrics. This integrated approach ensures accurate forecasting, timely decision-making, and improved financial stability.

Related Important Terms

Free Cash Flow Yield Differential

Free Cash Flow Yield Differential reveals discrepancies between net income and actual cash generation, highlighting the importance of cash flow waterfall analysis over traditional income statement analysis for accurate money management. This metric provides investors with a clearer picture of liquidity and operational efficiency by capturing real cash available for reinvestment or debt servicing beyond accounting profits.

Operating Cash Conversion Cycle

Income statement analysis provides a snapshot of profitability, but the Operating Cash Conversion Cycle in cash flow waterfall analysis reveals how efficiently a company manages its working capital by tracking the time between cash outflows for purchases and inflows from sales. This metric is crucial for optimizing liquidity and ensuring sufficient cash availability for daily operations, unlike income statements that may include non-cash revenues and expenses.

Accruals-to-Cash Variance

Income statement analysis highlights accrual-based revenues and expenses, which can obscure actual cash availability, whereas cash flow waterfall analysis traces the timing and magnitude of cash inflows and outflows, providing a clearer view of liquidity. Monitoring the Accruals-to-Cash Variance reveals discrepancies between reported earnings and realized cash, enabling more accurate cash management and financial decision-making.

Reconciliation Stripping

Income statement analysis provides a snapshot of profitability through revenues and expenses but often includes non-cash items, making it less effective for real-time money management. Cash flow waterfall analysis, enhanced by reconciliation stripping, isolates actual cash inflows and outflows to accurately track liquidity and support precise financial decision-making.

EBITDA-to-Cash Flow Reconciliation

EBITDA-to-Cash Flow Reconciliation bridges income statement analysis and cash flow waterfall analysis by adjusting earnings for non-cash items and changes in working capital to reveal true cash generation, essential for effective money management. This reconciliation highlights discrepancies between reported profitability and actual liquidity, enabling more informed decisions on cash allocation and financial planning.

Layered Cash Waterfall Mapping

Layered Cash Waterfall Mapping provides a detailed breakdown of cash inflows and outflows, enabling precise identification of liquidity stages beyond traditional Income Statement Analysis, which mainly focuses on net profit and revenue recognition. This method enhances money management by visually tracing cash movement through successive allocation layers, ensuring optimized cash utilization and timely debt servicing.

Synthetic Cash Flow Profiling

Synthetic Cash Flow Profiling offers a more dynamic and granular approach to money management by integrating cash flow waterfall analysis with income statement data, revealing timing gaps and liquidity constraints often obscured in traditional income statement analysis. This method enhances predictive accuracy for cash inflows and outflows, enabling businesses to optimize working capital and ensure robust financial health by synchronizing reported earnings with actual cash movements.

Sequential Distribution Modeling

Income statement analysis provides a snapshot of profitability while cash flow waterfall analysis offers a detailed view of sequential distribution modeling, highlighting the precise timing and allocation of cash inflows and outflows critical for effective money management. Sequential distribution modeling ensures that cash is allocated methodically across operating expenses, debt servicing, and reinvestment needs, optimizing liquidity and financial stability.

Adjusted Net Income Bridge

Adjusted Net Income Bridge provides a crucial link between income statement analysis and cash flow waterfall analysis by reconciling net income with actual cash movements, highlighting non-cash expenses and working capital changes. This approach enhances money management accuracy by transforming accrual-based earnings into real-time liquidity insights, enabling better forecasting and operational decision-making.

Distributable Cash Segmentation

Income statement analysis provides insights into profitability while cash flow waterfall analysis reveals actual cash availability for money management by segmenting distributable cash into operating, investing, and financing activities. Distributable cash segmentation helps identify how much cash can be allocated to dividends, reinvestments, or debt servicing, enhancing precision in financial decision-making.

Income statement analysis vs cash flow waterfall analysis for money management. Infographic

moneydiff.com

moneydiff.com