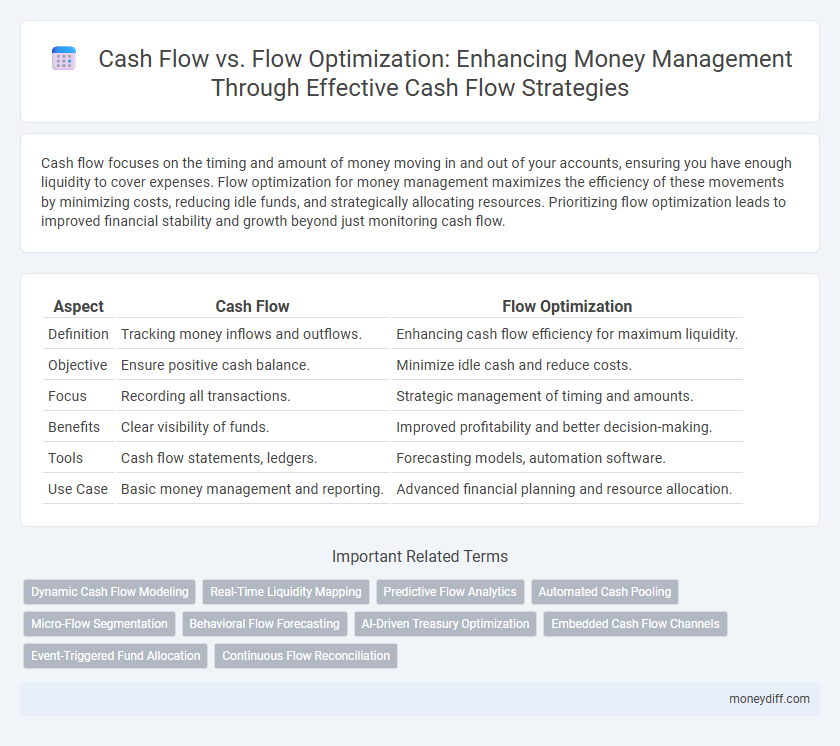

Cash flow focuses on the timing and amount of money moving in and out of your accounts, ensuring you have enough liquidity to cover expenses. Flow optimization for money management maximizes the efficiency of these movements by minimizing costs, reducing idle funds, and strategically allocating resources. Prioritizing flow optimization leads to improved financial stability and growth beyond just monitoring cash flow.

Table of Comparison

| Aspect | Cash Flow | Flow Optimization |

|---|---|---|

| Definition | Tracking money inflows and outflows. | Enhancing cash flow efficiency for maximum liquidity. |

| Objective | Ensure positive cash balance. | Minimize idle cash and reduce costs. |

| Focus | Recording all transactions. | Strategic management of timing and amounts. |

| Benefits | Clear visibility of funds. | Improved profitability and better decision-making. |

| Tools | Cash flow statements, ledgers. | Forecasting models, automation software. |

| Use Case | Basic money management and reporting. | Advanced financial planning and resource allocation. |

Understanding Cash Flow in Money Management

Cash flow represents the actual inflow and outflow of money within a business or personal finances, crucial for assessing liquidity and operational health. Flow optimization focuses on strategically managing these cash movements to maximize efficiency, reduce costs, and enhance profitability. Understanding cash flow enables informed decisions that maintain positive balances and support sustainable financial growth.

The Concept of Flow Optimization Explained

Flow optimization in money management focuses on strategically directing cash inflows and outflows to maximize liquidity and investment potential, enhancing overall financial stability. Unlike basic cash flow tracking, flow optimization integrates forecasting, expense prioritization, and timely payments to ensure funds are efficiently allocated. This concept helps businesses and individuals avoid cash shortages while capitalizing on surplus funds through optimized allocation and investment timing.

Key Differences Between Cash Flow and Flow Optimization

Cash flow refers to the actual movement of money in and out of a business or personal accounts, reflecting liquidity at a given time. Flow optimization focuses on strategically managing and improving these cash movements to maximize efficiency and financial stability. Key differences lie in cash flow's emphasis on tracking real-time funds versus flow optimization's goal of enhancing processes to increase available capital and reduce bottlenecks.

The Importance of Cash Flow Analysis

Cash flow analysis is essential for effective money management as it provides detailed insights into the timing and magnitude of cash inflows and outflows, enabling better financial planning and ensuring liquidity. Unlike flow optimization, which focuses on improving efficiency of fund allocation and utilization, cash flow analysis primarily detects potential shortfalls or surpluses, helping businesses maintain solvency and meet obligations. Accurate cash flow analysis improves decision-making by identifying trends, forecasting future cash positions, and supporting strategic investment control.

Implementing Flow Optimization Strategies

Implementing flow optimization strategies enhances cash flow by prioritizing the efficient allocation of funds, reducing bottlenecks, and maximizing liquidity for operational needs. Techniques such as automating receivables, negotiating better payment terms, and leveraging real-time cash flow monitoring improve financial agility and support sustainable growth. Optimized cash flows ensure businesses maintain solvency while investing strategically in growth opportunities.

Tools for Tracking and Improving Cash Flow

Cash flow management relies on precise tools such as budgeting software, cash flow forecasting applications, and real-time financial dashboards to monitor inflows and outflows accurately. Flow optimization enhances money management by integrating automation platforms like AI-driven analytics and payment scheduling systems to minimize delays and maximize liquidity. Effective use of these digital tools supports better decision-making, reduces financial risks, and improves overall cash flow health.

Benefits of Optimizing Financial Flows

Optimizing financial flows enhances cash flow management by ensuring timely inflows and controlled outflows, reducing liquidity risks and improving operational efficiency. Effective flow optimization supports accurate forecasting, allowing businesses to allocate resources strategically and avoid unnecessary borrowing costs. This approach leads to increased financial stability, improved decision-making, and maximized returns on available capital.

Common Mistakes in Cash Flow vs. Flow Optimization

Common mistakes in cash flow management include neglecting to forecast accurately, leading to liquidity shortages and delayed payments. In contrast, flow optimization errors often involve overcomplicating processes or ignoring real-time data, which hampers efficient fund allocation and reduces operational agility. Both issues undermine effective money management by causing cash bottlenecks and missed investment opportunities.

How to Balance Cash Flow and Flow Optimization

Balancing cash flow and flow optimization involves strategically managing the timing and amount of cash inflows and outflows to maintain liquidity while maximizing operational efficiency. Implementing cash forecasting tools and automating payment processes ensures real-time visibility and reduces delays, enabling businesses to optimize working capital. Prioritizing high-impact expenses and monitoring receivables accelerates cash turnover, supporting sustainable financial health and growth.

Making Data-Driven Decisions for Smarter Money Management

Effective cash flow management involves accurately tracking income and expenses to maintain liquidity, while flow optimization leverages data analytics to streamline cash movements and reduce inefficiencies. Utilizing real-time financial data enables businesses to forecast cash needs, identify patterns, and allocate resources more strategically. Integrating cash flow with flow optimization tools drives smarter money management by enhancing decision-making accuracy and improving overall financial stability.

Related Important Terms

Dynamic Cash Flow Modeling

Dynamic Cash Flow Modeling enhances money management by providing real-time projections of inflows and outflows, enabling precise adjustments that optimize liquidity and investment opportunities. This approach outperforms static cash flow analysis by accounting for variability and timing, significantly improving financial planning accuracy and cash utilization efficiency.

Real-Time Liquidity Mapping

Real-time liquidity mapping enhances cash flow management by providing instantaneous visibility into available funds, enabling precise allocation and reducing idle cash. Flow optimization leverages this data to streamline financial operations, maximize investment opportunities, and improve overall money management efficiency.

Predictive Flow Analytics

Predictive Flow Analytics enhances cash flow management by forecasting future inflows and outflows based on historical data and market trends, enabling precise liquidity planning and risk mitigation. Unlike traditional flow optimization, which focuses on immediate allocation efficiency, predictive analytics provides proactive insights for strategic decision-making and sustainable financial stability.

Automated Cash Pooling

Automated cash pooling enhances cash flow management by centralizing funds across multiple accounts, enabling real-time liquidity optimization and reducing idle balances. This flow optimization technique improves interest income, minimizes overdraft risks, and streamlines intra-company fund transfers for efficient money management.

Micro-Flow Segmentation

Micro-Flow Segmentation enables precise analysis of cash flow patterns by breaking down transactions into granular categories, facilitating targeted flow optimization strategies for enhanced money management. This approach improves liquidity forecasting and allocates resources efficiently, maximizing operational cash availability and minimizing financial risks.

Behavioral Flow Forecasting

Behavioral Flow Forecasting analyzes spending patterns and income behavior to enhance cash flow accuracy, enabling precise prediction of future financial positions. This method optimizes money management by aligning cash flow timing with individual financial habits, reducing liquidity risks and improving fund allocation efficiency.

AI-Driven Treasury Optimization

AI-driven treasury optimization leverages machine learning algorithms to analyze real-time cash flow patterns, enabling precise prediction and efficient allocation of financial resources. This technology enhances liquidity management by automating cash flow forecasting, minimizing idle funds, and optimizing investment strategies to maximize returns and reduce risks.

Embedded Cash Flow Channels

Embedded cash flow channels integrate automated payment and collection processes directly within business operations, enhancing liquidity management and reducing the need for manual intervention. Optimizing these channels boosts real-time cash flow visibility and accelerates transaction cycles, leading to improved working capital efficiency and financial agility.

Event-Triggered Fund Allocation

Event-triggered fund allocation enhances cash flow management by automatically adjusting money distribution based on real-time financial events, ensuring optimal liquidity and minimizing idle cash. This approach outperforms traditional flow optimization by dynamically responding to market fluctuations, payment cycles, and operational needs to maximize fund efficiency.

Continuous Flow Reconciliation

Continuous Flow Reconciliation enhances cash flow management by providing real-time tracking and adjustment of inflows and outflows, ensuring precise liquidity measurement. This method reduces discrepancies and improves decision-making compared to traditional flow optimization, which often relies on periodic batch processing and forecast assumptions.

Cash flow vs Flow optimization for money management. Infographic

moneydiff.com

moneydiff.com