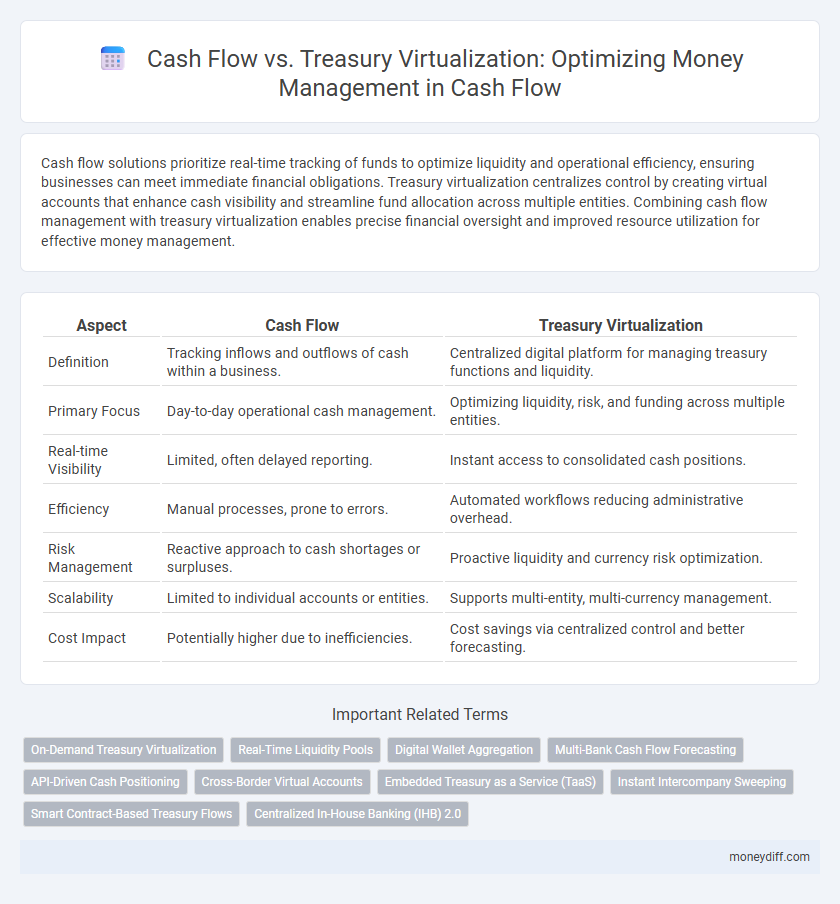

Cash flow solutions prioritize real-time tracking of funds to optimize liquidity and operational efficiency, ensuring businesses can meet immediate financial obligations. Treasury virtualization centralizes control by creating virtual accounts that enhance cash visibility and streamline fund allocation across multiple entities. Combining cash flow management with treasury virtualization enables precise financial oversight and improved resource utilization for effective money management.

Table of Comparison

| Aspect | Cash Flow | Treasury Virtualization |

|---|---|---|

| Definition | Tracking inflows and outflows of cash within a business. | Centralized digital platform for managing treasury functions and liquidity. |

| Primary Focus | Day-to-day operational cash management. | Optimizing liquidity, risk, and funding across multiple entities. |

| Real-time Visibility | Limited, often delayed reporting. | Instant access to consolidated cash positions. |

| Efficiency | Manual processes, prone to errors. | Automated workflows reducing administrative overhead. |

| Risk Management | Reactive approach to cash shortages or surpluses. | Proactive liquidity and currency risk optimization. |

| Scalability | Limited to individual accounts or entities. | Supports multi-entity, multi-currency management. |

| Cost Impact | Potentially higher due to inefficiencies. | Cost savings via centralized control and better forecasting. |

Defining Cash Flow and Treasury Virtualization

Cash flow refers to the net amount of cash and cash equivalents moving into and out of a business, critical for assessing liquidity and operational efficiency. Treasury virtualization is a modern money management technique that consolidates multiple cash accounts into a single virtual account, enhancing real-time visibility and control over funds. This approach streamlines cash flow management by enabling centralized monitoring without physically transferring funds between accounts.

Key Differences Between Cash Flow and Treasury Virtualization

Cash flow management tracks actual cash inflows and outflows to ensure liquidity for daily operations, while treasury virtualization centralizes and digitizes cash positions across multiple accounts and entities for optimized fund allocation. Cash flow emphasizes transactional timing and operational cash availability, whereas treasury virtualization leverages technology to provide a consolidated, real-time view of company-wide liquidity. Key differences include cash flow's focus on historical and short-term data versus treasury virtualization's use of predictive analytics and automation to enhance strategic decision-making in money management.

The Role of Cash Flow in Effective Money Management

Cash flow plays a critical role in effective money management by providing real-time visibility into inflows and outflows, enabling precise forecasting and liquidity optimization. Treasury virtualization complements cash flow management by centralizing funds and automating payments, reducing operational risks and enhancing cash control across multiple entities. Together, cash flow insights and treasury virtualization drive informed decision-making, improve working capital efficiency, and support strategic financial planning.

Treasury Virtualization: Modernizing Corporate Finance

Treasury virtualization transforms corporate finance by consolidating cash flow management across multiple entities into a centralized digital platform, enhancing liquidity visibility and control. This approach reduces the complexity and inefficiencies of traditional cash flow processes by integrating real-time data and automating cash pooling, leading to optimized working capital and reduced borrowing costs. By leveraging treasury virtualization, corporations gain superior risk management and strategic decision-making capabilities, aligning liquidity with business objectives in a dynamic market environment.

Benefits of Optimizing Cash Flow Control

Optimizing cash flow control enhances liquidity forecasting accuracy, reduces operational risks, and improves working capital efficiency. Treasury virtualization consolidates multiple cash pools into a single view, allowing real-time cash positioning and faster decision-making. These benefits lead to better financial agility, lower borrowing costs, and strengthened cash management strategies.

Advantages of Treasury Virtualization in Global Organizations

Treasury virtualization offers global organizations enhanced cash flow visibility by consolidating dispersed accounts into a centralized digital platform, enabling real-time liquidity management across multiple currencies. This approach reduces dependency on physical bank accounts and manual reconciliations, decreasing operational costs and minimizing currency risk. Furthermore, virtual treasury solutions improve regulatory compliance and facilitate faster decision-making through automated cash forecasting and seamless integration with enterprise financial systems.

Challenges in Implementing Cash Flow Strategies

Challenges in implementing cash flow strategies include inaccurate cash flow forecasting due to unpredictable market conditions and delayed receivables, which can disrupt liquidity management. Integrating treasury virtualization solutions often requires significant IT infrastructure upgrades and robust cybersecurity measures to protect sensitive financial data. Furthermore, aligning cash flow management processes with treasury virtualization demands cross-departmental coordination, creating complexity in change management and compliance adherence.

Overcoming Barriers to Treasury Virtualization

Overcoming barriers to treasury virtualization requires addressing data integration challenges and ensuring real-time visibility into cash flow across global operations. Implementing advanced automation and secure APIs enhances connectivity between disparate systems, facilitating accurate liquidity forecasting and centralized cash management. Emphasizing robust cybersecurity protocols and change management strategies helps organizations optimize treasury functions while maintaining compliance and operational agility.

Integrating Cash Flow Management with Treasury Virtualization

Integrating cash flow management with treasury virtualization enhances real-time liquidity visibility and optimizes fund allocation across global operations by leveraging centralized digital platforms. This approach enables dynamic forecasting and automated cash positioning, reducing manual interventions and improving working capital efficiency. Enterprises benefit from increased accuracy in cash forecasting and streamlined treasury operations, driving strategic decision-making and risk mitigation.

Choosing the Right Approach for Enhanced Money Management

Cash flow management focuses on tracking inflows and outflows to ensure liquidity, while treasury virtualization consolidates multiple cash accounts into a single virtual account for optimized control and real-time visibility. Choosing between cash flow management and treasury virtualization depends on the complexity of an organization's financial structure and the need for centralized oversight. Leveraging treasury virtualization enhances efficiency by reducing fragmented balances and streamlining payment processes, supporting improved decision-making and forecasting.

Related Important Terms

On-Demand Treasury Virtualization

On-demand treasury virtualization enables real-time liquidity management by consolidating cash flow data across multiple accounts and geographies, enhancing visibility and control over funds. This approach optimizes working capital by allowing treasury teams to virtualize balances instantly without physical fund transfers, reducing operational costs and improving cash forecasting accuracy.

Real-Time Liquidity Pools

Real-time liquidity pools enable instant aggregation and allocation of cash flow across multiple accounts, enhancing treasury virtualization by providing precise visibility and control over funds. This dynamic integration optimizes money management by reducing idle balances and improving forecasting accuracy in cash flow operations.

Digital Wallet Aggregation

Cash flow management benefits from treasury virtualization by enabling real-time visibility and control over dispersed funds through digital wallet aggregation, consolidating liquidity across multiple accounts into a unified platform. This integration optimizes working capital efficiency and supports seamless, instant payments while reducing reliance on physical cash and traditional bank accounts.

Multi-Bank Cash Flow Forecasting

Multi-bank cash flow forecasting enhances money management by consolidating real-time data across various financial institutions, improving liquidity visibility and enabling precise cash allocation. Integrating cash flow with treasury virtualization streamlines forecasting accuracy, reduces operational risks, and optimizes working capital deployment across global banking networks.

API-Driven Cash Positioning

API-driven cash positioning enhances cash flow accuracy by providing real-time visibility into transaction data and liquidity across multiple accounts, enabling dynamic allocation and forecasting. Treasury virtualization complements this by consolidating cash balances globally without physical fund transfers, optimizing liquidity management and reducing idle cash through seamless integration with cash flow APIs.

Cross-Border Virtual Accounts

Cross-border virtual accounts streamline cash flow management by consolidating multiple currency balances into a single treasury platform, reducing transfer costs and enhancing liquidity visibility across regions. This treasury virtualization approach optimizes money management by enabling real-time funds allocation, improving working capital efficiency, and mitigating foreign exchange risks in multinational operations.

Embedded Treasury as a Service (TaaS)

Embedded Treasury as a Service (TaaS) integrates real-time cash flow monitoring with advanced treasury virtualization, enabling precise liquidity management and automated fund allocation across multiple accounts. This fusion streamlines money management by providing granular visibility into cash positions while optimizing investment and funding decisions without disrupting core financial operations.

Instant Intercompany Sweeping

Instant intercompany sweeping enhances cash flow optimization by enabling real-time, automated transfer of funds between subsidiaries, reducing idle balances and improving liquidity management. Treasury virtualization integrates these processes into a centralized platform that provides comprehensive visibility and control over corporate cash positions across the entire organization.

Smart Contract-Based Treasury Flows

Smart contract-based treasury flows automate cash flow management by enabling transparent, real-time tracking and automated execution of financial obligations, reducing manual errors and enhancing liquidity control. This approach optimizes treasury virtualization by integrating blockchain technology to secure transactions and streamline fund allocation across decentralized platforms.

Centralized In-House Banking (IHB) 2.0

Centralized In-House Banking (IHB) 2.0 enhances cash flow management by integrating treasury virtualization, enabling real-time liquidity pooling and precise intercompany netting across global entities. This approach reduces external borrowing costs, optimizes intragroup funding, and improves overall financial agility by leveraging centralized cash visibility and control.

Cash flow vs Treasury virtualization for money management. Infographic

moneydiff.com

moneydiff.com