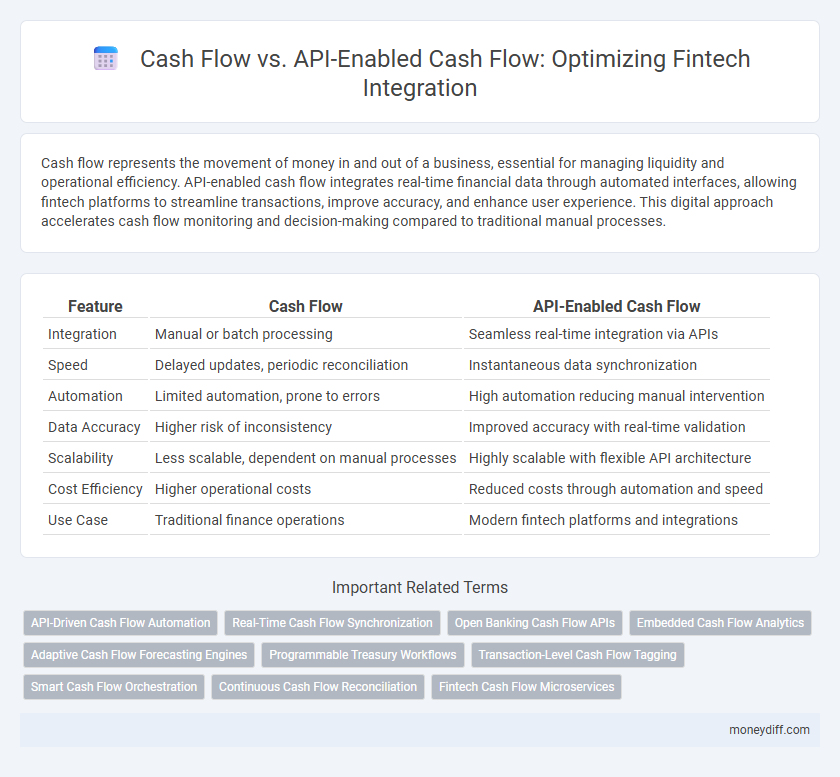

Cash flow represents the movement of money in and out of a business, essential for managing liquidity and operational efficiency. API-enabled cash flow integrates real-time financial data through automated interfaces, allowing fintech platforms to streamline transactions, improve accuracy, and enhance user experience. This digital approach accelerates cash flow monitoring and decision-making compared to traditional manual processes.

Table of Comparison

| Feature | Cash Flow | API-Enabled Cash Flow |

|---|---|---|

| Integration | Manual or batch processing | Seamless real-time integration via APIs |

| Speed | Delayed updates, periodic reconciliation | Instantaneous data synchronization |

| Automation | Limited automation, prone to errors | High automation reducing manual intervention |

| Data Accuracy | Higher risk of inconsistency | Improved accuracy with real-time validation |

| Scalability | Less scalable, dependent on manual processes | Highly scalable with flexible API architecture |

| Cost Efficiency | Higher operational costs | Reduced costs through automation and speed |

| Use Case | Traditional finance operations | Modern fintech platforms and integrations |

Understanding Traditional Cash Flow Management

Traditional cash flow management relies on manual tracking of inflows and outflows, often resulting in delayed visibility and potential inaccuracies. API-enabled cash flow integrates real-time data access and automation, enhancing precision and enabling seamless connectivity with fintech platforms. Understanding these differences is crucial for optimizing financial operations and improving liquidity forecasting.

The Limitations of Manual Cash Flow Processes

Manual cash flow processes often suffer from delays, errors, and lack of real-time visibility, hindering accurate financial forecasting and decision-making for fintech applications. API-enabled cash flow integration automates transaction updates, ensures instantaneous data synchronization, and enhances the accuracy of liquidity management across platforms. This technological advancement eliminates bottlenecks associated with manual reconciliation, enabling seamless cash flow monitoring and improved operational efficiency.

Introduction to API-Enabled Cash Flow

API-enabled cash flow revolutionizes traditional cash flow management by automating real-time financial data exchange between fintech platforms and business systems. This technology enhances cash flow accuracy, accelerates transaction processing, and enables seamless integration with various financial services. Leveraging API connectivity allows businesses to optimize liquidity management and improve forecasting precision through continuous, transparent data flow.

Key Differences Between Traditional and API-Driven Cash Flow

Traditional cash flow management relies heavily on manual processing and batch updates, often causing delays in transaction visibility and reconciliation. API-enabled cash flow leverages real-time data exchange, allowing seamless integration with fintech platforms for instant updates, automatic categorization, and enhanced liquidity insights. This shift improves accuracy, accelerates decision-making, and enhances customer experience by enabling continuous cash flow monitoring and forecasting.

Benefits of API Integration in Cash Flow Management

API-enabled cash flow management significantly enhances real-time transaction tracking and accuracy compared to traditional cash flow methods. Integrating APIs allows seamless data synchronization between financial platforms, reducing manual errors and accelerating reconciliation processes. This streamlined automation improves liquidity forecasting and supports dynamic decision-making essential for fintech innovation.

Real-Time Data Access and Automated Reconciliation

Cash flow management benefits significantly from API-enabled cash flow, which offers real-time data access, allowing fintech platforms to monitor transactions instantly and make informed financial decisions. Automated reconciliation streamlines the cash flow process by reducing manual errors and accelerating the matching of payments with invoices, enhancing accuracy and operational efficiency. These capabilities enable businesses to optimize liquidity management, improve forecasting, and ensure seamless integration with fintech ecosystems.

Enhancing Financial Transparency with API-Enabled Solutions

Cash flow visibility improves significantly with API-enabled solutions in fintech integration, offering real-time access to transaction data and liquidity positions. These APIs enable automated data synchronization between financial platforms, reducing errors and enhancing the accuracy of cash flow forecasts. Enhanced transparency supports better decision-making for businesses by providing up-to-date insights into cash movements and financial health.

Security Considerations in API-Based Cash Flow

API-enabled cash flow offers enhanced security measures such as tokenization, encryption, and real-time fraud detection, reducing risks compared to traditional cash flow processes. Implementing robust authentication protocols like OAuth and multi-factor authentication ensures secure access to sensitive financial data during fintech integration. Continuous monitoring and compliance with industry standards such as PCI-DSS and GDPR are critical to maintaining data integrity and preventing unauthorized transactions in API-based cash flow systems.

Fintech Integration: Use Cases and Industry Examples

Cash flow management leverages API-enabled cash flow to provide real-time transaction data, enhancing accuracy and liquidity visibility for fintech platforms. Integrating APIs enables seamless connection with banking systems, automating reconciliation, fraud detection, and cash forecasting to optimize financial decision-making. Industry examples include payment gateways, lending platforms, and accounting software that utilize API-driven cash flow for improved operational efficiency and customer experience.

Choosing the Right Cash Flow Solution for Your Business

Evaluating cash flow versus API-enabled cash flow for fintech integration involves assessing real-time transaction data accessibility, automation capabilities, and seamless connectivity with financial platforms. API-enabled cash flow solutions enhance accuracy and speed by integrating directly with banking systems, facilitating instant liquidity management and reducing manual reconciliation errors. Businesses prioritizing scalability and operational efficiency benefit from API-driven cash flow tools that support dynamic financial decision-making and streamlined cash monitoring.

Related Important Terms

API-Driven Cash Flow Automation

API-driven cash flow automation transforms traditional cash flow management by enabling real-time transaction data integration, streamlining reconciliation, and enhancing liquidity forecasting for fintech platforms. This automation reduces manual errors, accelerates cash flow visibility, and supports dynamic decision-making through seamless API connectivity.

Real-Time Cash Flow Synchronization

Real-time cash flow synchronization through API-enabled cash flow integration allows fintech platforms to access and update financial data instantly, improving accuracy and decision-making speed compared to traditional cash flow methods that rely on periodic manual updates. This seamless data exchange enhances liquidity management, reduces reconciliation errors, and supports dynamic financial forecasting for businesses and consumers.

Open Banking Cash Flow APIs

Open Banking Cash Flow APIs enhance traditional cash flow management by providing real-time access to transaction data and payment initiation, enabling fintech platforms to automate financial workflows and improve accuracy. API-enabled cash flow integration empowers businesses with seamless account aggregation, faster reconciliation, and predictive liquidity insights critical for smarter financial decision-making.

Embedded Cash Flow Analytics

Embedded Cash Flow Analytics enhances traditional cash flow analysis by integrating real-time data through API-enabled cash flow solutions, allowing fintech platforms to provide dynamic, accurate financial insights and forecasting. This seamless integration boosts operational efficiency and supports proactive decision-making by delivering granular cash flow metrics directly within fintech ecosystems.

Adaptive Cash Flow Forecasting Engines

Adaptive Cash Flow Forecasting Engines leverage real-time data and machine learning algorithms to enhance the accuracy of cash flow predictions compared to traditional cash flow models. API-enabled cash flow integration allows fintech platforms to dynamically access and analyze transactional data, enabling more responsive and precise cash flow management for businesses.

Programmable Treasury Workflows

Cash flow management enhanced by API-enabled cash flow integration allows fintech platforms to automate and customize treasury workflows, improving liquidity forecasting and real-time transaction visibility. Programmable treasury workflows facilitate seamless reconciliation, payment automation, and fund allocation, driving operational efficiency and reducing manual intervention.

Transaction-Level Cash Flow Tagging

Transaction-level cash flow tagging enhances API-enabled cash flow by providing granular visibility into each transaction's source and destination, enabling fintech platforms to offer precise cash flow analysis and real-time reconciliation. This granular tagging improves accuracy in cash flow forecasting and compliance monitoring, surpassing traditional aggregated cash flow methods that often lack detailed transaction insights.

Smart Cash Flow Orchestration

Smart Cash Flow Orchestration leverages API-enabled cash flow to provide real-time liquidity management, seamless transaction integration, and enhanced financial visibility for fintech platforms. This approach outperforms traditional cash flow methods by enabling automated, data-driven decision making and improving cash forecasting accuracy through interconnected financial systems.

Continuous Cash Flow Reconciliation

Continuous cash flow reconciliation leverages API-enabled cash flow systems to provide real-time transaction updates and automated ledger adjustments, significantly reducing discrepancies and manual errors. This seamless integration enhances financial accuracy and operational efficiency for fintech platforms by enabling instant cash flow visibility and streamlined reconciliation processes.

Fintech Cash Flow Microservices

Fintech cash flow microservices enhance traditional cash flow management by enabling real-time, API-driven transaction processing and data integration across multiple financial platforms. This API-enabled cash flow approach allows seamless automation, improved liquidity forecasting, and more precise cash management compared to conventional cash flow systems.

Cash flow vs API-enabled cash flow for fintech integration. Infographic

moneydiff.com

moneydiff.com