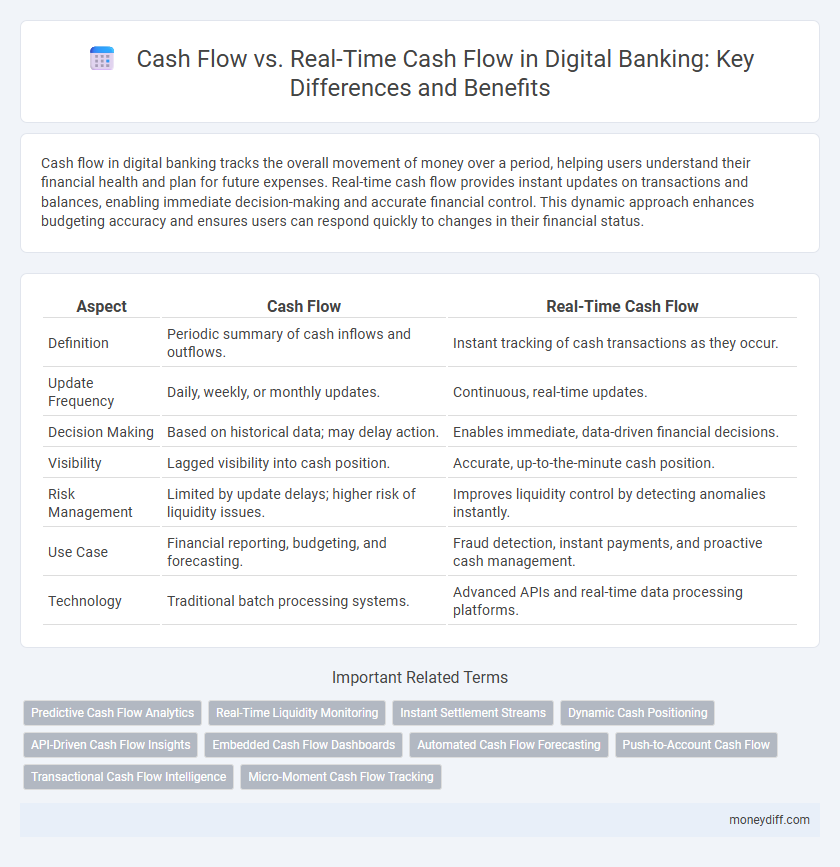

Cash flow in digital banking tracks the overall movement of money over a period, helping users understand their financial health and plan for future expenses. Real-time cash flow provides instant updates on transactions and balances, enabling immediate decision-making and accurate financial control. This dynamic approach enhances budgeting accuracy and ensures users can respond quickly to changes in their financial status.

Table of Comparison

| Aspect | Cash Flow | Real-Time Cash Flow |

|---|---|---|

| Definition | Periodic summary of cash inflows and outflows. | Instant tracking of cash transactions as they occur. |

| Update Frequency | Daily, weekly, or monthly updates. | Continuous, real-time updates. |

| Decision Making | Based on historical data; may delay action. | Enables immediate, data-driven financial decisions. |

| Visibility | Lagged visibility into cash position. | Accurate, up-to-the-minute cash position. |

| Risk Management | Limited by update delays; higher risk of liquidity issues. | Improves liquidity control by detecting anomalies instantly. |

| Use Case | Financial reporting, budgeting, and forecasting. | Fraud detection, instant payments, and proactive cash management. |

| Technology | Traditional batch processing systems. | Advanced APIs and real-time data processing platforms. |

Understanding Traditional Cash Flow in Digital Banking

Traditional cash flow in digital banking refers to the recording and analysis of cash movements based on periodic financial reports, typically reflecting transactions settled after a delay. This method provides a historical view of cash inflows and outflows, helping banks assess liquidity and financial health over standard reporting cycles. Understanding traditional cash flow allows digital banks to manage reserves, plan budgets, and comply with regulatory cash requirements despite the challenges of delayed transaction settlements.

What is Real-Time Cash Flow?

Real-time cash flow refers to the continuous monitoring and updating of cash inflows and outflows as transactions occur, enabling instant visibility into a digital banking account's liquidity status. Unlike traditional cash flow analysis, which relies on periodic reports and forecasts, real-time cash flow provides an up-to-the-minute snapshot, empowering businesses and individuals to make timely financial decisions. This immediate insight helps prevent overdrafts, optimize cash management, and improve overall financial agility in digital banking environments.

Key Differences: Cash Flow vs Real-Time Cash Flow

Cash flow refers to the net amount of cash moving in and out of a digital banking account over a specific period, typically reported in daily, weekly, or monthly intervals. Real-time cash flow provides instantaneous updates on cash transactions, allowing users and institutions to monitor liquidity and funds availability without delay. The key difference lies in timing accuracy, with real-time cash flow enabling immediate financial decisions and enhanced cash management compared to traditional periodic cash flow reporting.

Benefits of Real-Time Cash Flow Monitoring

Real-time cash flow monitoring in digital banking provides instant visibility into account balances and transaction activities, enabling faster decision-making and improved liquidity management. It reduces the risk of overdrafts and optimizes working capital by allowing businesses to respond immediately to cash inflows and outflows. Enhanced forecasting accuracy and operational efficiency are key benefits, supporting more effective financial planning and growth strategies.

Common Challenges in Traditional Cash Flow Management

Traditional cash flow management in digital banking often faces challenges such as delayed transaction recording, limited visibility into current account balances, and difficulties in forecasting due to outdated financial data. These constraints hinder timely decision-making and reduce the accuracy of cash flow projections, impacting liquidity management and operational efficiency. Real-time cash flow solutions address these issues by providing instantaneous updates and comprehensive monitoring, enabling better control and forecasting of digital banking transactions.

Impact of Real-Time Cash Flow on Financial Decision-Making

Real-time cash flow in digital banking provides instantaneous updates on account balances and transaction activities, enabling more precise and timely financial decisions. Unlike traditional cash flow reporting that relies on delayed data, real-time visibility reduces the risk of overdrafts and improves cash management efficiency. This immediacy empowers businesses and individuals to optimize liquidity, manage expenses proactively, and enhance overall financial stability.

How Digital Banks Enable Real-Time Cash Flow

Digital banks leverage advanced APIs and cloud-based platforms to provide customers with real-time cash flow monitoring, enabling instantaneous updates on account balances and transactions. These institutions enhance liquidity management by integrating AI-driven analytics that predict cash needs and optimize fund allocation. The seamless, real-time visibility into cash movement contrasts with traditional cash flow reporting, which often involves delayed data updates and limited forecasting accuracy.

Security Considerations for Real-Time Cash Flow

Real-time cash flow in digital banking demands advanced encryption protocols and multi-factor authentication to safeguard sensitive financial data against cyber threats. Continuous monitoring systems and anomaly detection algorithms are essential to prevent fraud and unauthorized transactions in real-time cash flow processes. Robust security frameworks ensure transaction integrity and increase customer trust by minimizing risks inherent in instant fund transfers.

Real-Life Use Cases: Cash Flow vs Real-Time Cash Flow

Real-time cash flow in digital banking offers instantaneous visibility into account activity, enabling businesses to make more informed financial decisions with up-to-the-minute data. Cash flow analysis traditionally relies on periodic reporting, which can delay the detection of liquidity issues or payment discrepancies. Use cases include real-time fraud detection, dynamic credit management, and immediate reconciliation, which are critical for maintaining operational efficiency and financial stability in fast-paced digital environments.

Future Trends: The Evolution of Cash Flow in Digital Banking

Future trends in digital banking emphasize real-time cash flow analysis, enabling instantaneous tracking and management of financial transactions compared to traditional cash flow methods. Advanced AI algorithms and blockchain technology enhance accuracy and transparency, facilitating proactive financial decision-making for businesses and consumers alike. This evolution supports seamless liquidity management and predictive cash flow forecasting, driving more efficient and agile digital banking experiences.

Related Important Terms

Predictive Cash Flow Analytics

Predictive cash flow analytics in digital banking leverage real-time cash flow data combined with historical trends to forecast future liquidity needs accurately. This approach enables proactive financial decision-making by identifying potential cash shortfalls or surpluses well before they occur, enhancing operational efficiency and risk management.

Real-Time Liquidity Monitoring

Real-time cash flow in digital banking enhances liquidity management by providing instantaneous visibility into cash positions, enabling proactive decision-making and minimizing liquidity risks. Unlike traditional cash flow analysis, real-time liquidity monitoring leverages advanced APIs and data analytics to track transactions continuously, ensuring accurate, up-to-the-minute financial insights.

Instant Settlement Streams

Instant Settlement Streams in digital banking revolutionize cash flow management by enabling real-time cash flow visibility and immediate transaction finality, enhancing liquidity control and operational efficiency. Unlike traditional cash flow, which operates on delayed settlement cycles, Instant Settlement Streams allow businesses to access funds instantly, reducing float time and optimizing working capital management.

Dynamic Cash Positioning

Dynamic cash positioning in digital banking leverages real-time cash flow data to provide instant visibility and accurate forecasting, enabling businesses to optimize liquidity management and reduce idle cash. Unlike traditional cash flow statements that offer historical snapshots, real-time cash flow integrates transactional data continuously, driving proactive financial decision-making and enhancing operational efficiency.

API-Driven Cash Flow Insights

API-driven cash flow insights enable digital banking platforms to provide real-time cash flow data, enhancing accuracy in tracking liquidity and forecasting financial health. Unlike traditional cash flow reports that rely on periodic updates, real-time cash flow integrates continuous transaction data via APIs, offering immediate visibility into cash positions and facilitating proactive financial management.

Embedded Cash Flow Dashboards

Embedded Cash Flow Dashboards in digital banking provide real-time cash flow insights by continuously tracking inflows and outflows, enabling faster financial decision-making and improved liquidity management. Unlike traditional cash flow statements that offer historical summaries, these dashboards deliver dynamic, up-to-the-minute data integrated within banking platforms for enhanced cash visibility and predictive analytics.

Automated Cash Flow Forecasting

Automated cash flow forecasting enhances digital banking by providing real-time cash flow insights, enabling businesses to make precise financial decisions with up-to-date liquidity data. Unlike traditional cash flow methods, real-time cash flow tools utilize AI and machine learning to dynamically predict inflows and outflows, improving accuracy and reducing manual errors.

Push-to-Account Cash Flow

Push-to-Account cash flow enables instant real-time cash transfers in digital banking, enhancing liquidity management and reducing settlement delays compared to traditional cash flow processes. This immediate fund availability improves operational efficiency by minimizing float times and enabling faster financial decision-making.

Transactional Cash Flow Intelligence

Transactional Cash Flow Intelligence in digital banking enhances cash flow management by providing real-time visibility into inflows and outflows, enabling precise forecasting and immediate liquidity adjustments. This dynamic approach surpasses traditional cash flow models by leveraging data analytics to identify spending patterns, optimize working capital, and reduce financial risks instantly.

Micro-Moment Cash Flow Tracking

Micro-moment cash flow tracking in digital banking enables users to monitor their cash movements instantly, providing real-time visibility into account balances and transactions. This immediate insight contrasts with traditional cash flow methods that rely on delayed updates, enhancing financial decision-making and preventing overdrafts.

Cash flow vs Real-time cash flow for digital banking. Infographic

moneydiff.com

moneydiff.com