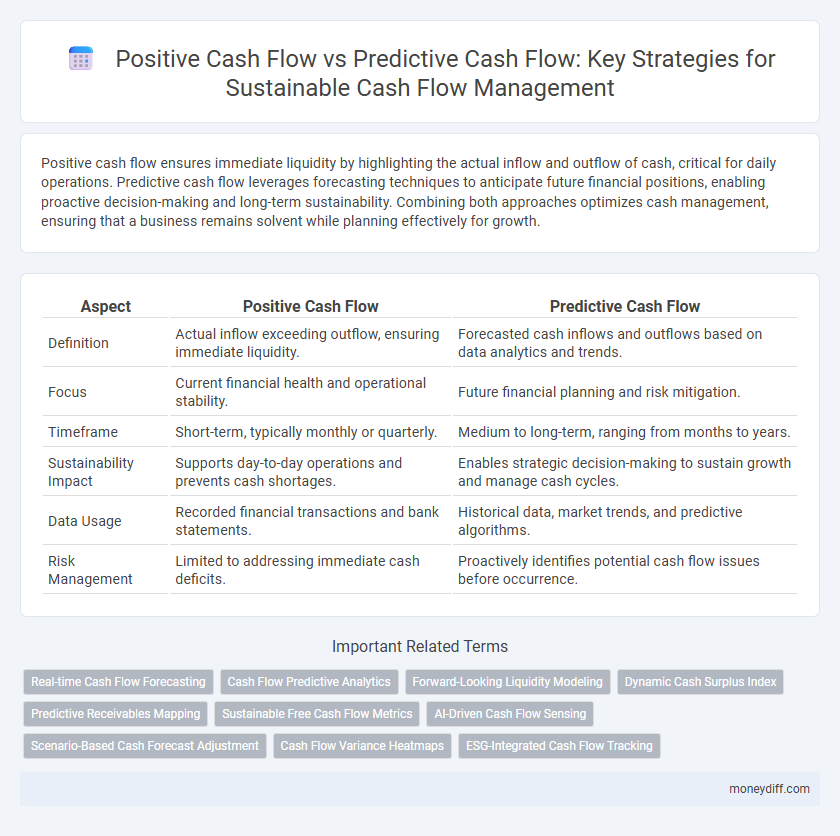

Positive cash flow ensures immediate liquidity by highlighting the actual inflow and outflow of cash, critical for daily operations. Predictive cash flow leverages forecasting techniques to anticipate future financial positions, enabling proactive decision-making and long-term sustainability. Combining both approaches optimizes cash management, ensuring that a business remains solvent while planning effectively for growth.

Table of Comparison

| Aspect | Positive Cash Flow | Predictive Cash Flow |

|---|---|---|

| Definition | Actual inflow exceeding outflow, ensuring immediate liquidity. | Forecasted cash inflows and outflows based on data analytics and trends. |

| Focus | Current financial health and operational stability. | Future financial planning and risk mitigation. |

| Timeframe | Short-term, typically monthly or quarterly. | Medium to long-term, ranging from months to years. |

| Sustainability Impact | Supports day-to-day operations and prevents cash shortages. | Enables strategic decision-making to sustain growth and manage cash cycles. |

| Data Usage | Recorded financial transactions and bank statements. | Historical data, market trends, and predictive algorithms. |

| Risk Management | Limited to addressing immediate cash deficits. | Proactively identifies potential cash flow issues before occurrence. |

Understanding Positive Cash Flow

Positive cash flow signifies a company's ability to generate more cash inflows than outflows, ensuring operational stability and covering expenses without external financing. Understanding positive cash flow involves analyzing cash receipts from sales, investments, and financing activities to maintain liquidity and avoid insolvency. It serves as a foundation for predictive cash flow models that forecast future financial health, enabling sustainable business growth and strategic decision-making.

What Is Predictive Cash Flow?

Predictive cash flow uses historical data, market trends, and advanced analytics to forecast future cash inflows and outflows, enabling businesses to anticipate financial challenges before they occur. Unlike positive cash flow, which reflects actual surplus funds at a given time, predictive cash flow provides strategic foresight to maintain liquidity and ensure long-term sustainability. By leveraging predictive cash flow models, companies can optimize working capital management and make informed decisions to support steady growth and operational resilience.

Key Differences Between Positive and Predictive Cash Flow

Positive cash flow represents the actual inflow of cash exceeding outflows during a specific period, indicating current financial health and operational efficiency. Predictive cash flow uses historical data and forecasting models to estimate future cash inflows and outflows, enabling proactive management and strategic planning for long-term sustainability. Key differences revolve around real-time financial status versus forward-looking financial forecasts, with positive cash flow reflecting liquidity at present and predictive cash flow guiding future investment and expense decisions.

The Role of Positive Cash Flow in Business Sustainability

Positive cash flow ensures a business maintains liquidity to meet operational expenses, invest in growth opportunities, and withstand financial challenges, directly contributing to long-term sustainability. Predictive cash flow analysis provides foresight into future financial positions, enabling proactive decision-making and risk management. Combining positive cash flow with predictive insights supports continuous operational stability and strategic planning essential for sustainable business success.

Leveraging Predictive Cash Flow for Strategic Planning

Leveraging predictive cash flow enhances strategic planning by providing foresight into future financial positions, enabling businesses to allocate resources efficiently and anticipate cash shortages before they occur. Positive cash flow indicates current financial health, but predictive cash flow models integrate historical data and market trends to forecast cash inflows and outflows, supporting proactive decision-making. Incorporating predictive cash flow analytics drives sustainability by optimizing investment timing, managing liquidity risks, and aligning operations with long-term financial goals.

Benefits of Real-Time Cash Flow Analysis

Real-time cash flow analysis enhances sustainability by providing immediate insights into a company's liquidity and financial health, enabling proactive decision-making to avoid shortfalls. Positive cash flow confirms current financial stability, while predictive cash flow forecasts future inflows and outflows, helping businesses anticipate challenges and optimize resource allocation. Combining both approaches supports long-term sustainability by ensuring continuous operational funding and strategic growth.

How Predictive Cash Flow Supports Long-Term Growth

Predictive cash flow leverages historical data and financial forecasting models to anticipate future inflows and outflows, enabling businesses to proactively manage resources and avoid liquidity crises. This forward-looking approach supports long-term growth by identifying potential funding gaps and investment opportunities before they occur, fostering strategic decision-making. Unlike positive cash flow, which reflects current surplus, predictive cash flow ensures sustainable financial health through continuous planning and risk mitigation.

Common Challenges in Managing Cash Flow

Positive cash flow ensures immediate financial stability by tracking actual inflows and outflows, while predictive cash flow forecasts future cash positions to anticipate funding needs. Common challenges in managing cash flow include inaccurate forecasting, unexpected expenses, and timing mismatches between receivables and payables. Effective cash flow management requires integrating real-time data with predictive analytics to improve accuracy and sustain long-term financial health.

Integrating Predictive Tools for Sustainable Cash Flow

Integrating predictive tools enables businesses to forecast cash inflows and outflows accurately, ensuring sustainable cash flow management beyond relying solely on positive cash flow snapshots. Predictive cash flow analytics utilize historical data, market trends, and real-time indicators to anticipate financial fluctuations, reducing risks associated with liquidity shortages. This proactive approach supports strategic decision-making, enhances working capital efficiency, and fosters long-term financial stability.

Best Practices for Balancing Positive and Predictive Cash Flow

Maintaining a balance between positive cash flow and predictive cash flow is crucial for business sustainability, requiring accurate forecasting models and real-time financial monitoring. Implementing best practices such as regular cash flow analysis, integrating predictive analytics software, and contingency planning helps identify potential shortfalls before they impact operations. Prioritizing strong communication between finance teams and leadership ensures proactive decision-making and optimized cash management.

Related Important Terms

Real-time Cash Flow Forecasting

Positive cash flow ensures immediate operational stability, while predictive cash flow leverages real-time cash flow forecasting to anticipate future liquidity needs and optimize financial sustainability. Real-time cash flow forecasting integrates transaction data and market trends, enabling businesses to make proactive decisions that maintain steady capital and avoid cash shortages.

Cash Flow Predictive Analytics

Positive cash flow ensures a company maintains sufficient liquidity to meet current obligations, while predictive cash flow leverages advanced analytics and machine learning to forecast future cash positions, enabling more accurate planning and risk management. Implementing cash flow predictive analytics improves sustainability by identifying potential shortfalls early, optimizing working capital, and supporting strategic financial decisions that enhance long-term business stability.

Forward-Looking Liquidity Modeling

Positive cash flow reflects the real-time surplus of incoming funds over expenses, ensuring immediate operational sustainability, while predictive cash flow leverages forward-looking liquidity modeling to forecast future financial positions, enabling proactive decision-making to maintain long-term sustainability. Advanced predictive cash flow techniques integrate historical data and market trends to simulate various scenarios, optimizing capital allocation and risk management for enduring business viability.

Dynamic Cash Surplus Index

Positive cash flow indicates actual inflows exceeding outflows, ensuring immediate operational stability, while predictive cash flow uses forecasting models to anticipate future liquidity, enhancing long-term sustainability. The Dynamic Cash Surplus Index integrates real-time data with predictive analytics, offering a robust metric to manage cash reserves proactively and optimize financial health.

Predictive Receivables Mapping

Predictive Receivables Mapping enhances cash flow sustainability by forecasting incoming payments based on historical data and customer behavior patterns, allowing businesses to anticipate liquidity needs and optimize working capital. Positive cash flow indicates current financial health, but integrating predictive models ensures proactive management, reducing risks of shortfalls and supporting long-term operational stability.

Sustainable Free Cash Flow Metrics

Positive cash flow indicates the actual liquidity available at a given time, reflecting a company's immediate ability to meet obligations, while predictive cash flow uses forecasting models to estimate future cash inflows and outflows essential for strategic planning. Sustainable Free Cash Flow Metrics assess long-term cash generation after capital expenditures, providing a more accurate measure of financial health and business viability than traditional cash flow figures.

AI-Driven Cash Flow Sensing

AI-driven cash flow sensing enhances sustainability by accurately forecasting predictive cash flow patterns and identifying potential liquidity issues before they arise. Positive cash flow management combined with AI analytics ensures real-time optimization of financial resources, enabling proactive decision-making for long-term business stability.

Scenario-Based Cash Forecast Adjustment

Scenario-based cash forecast adjustment enhances predictive cash flow accuracy by incorporating potential market fluctuations and operational disruptions, enabling organizations to maintain positive cash flow and ensure long-term financial sustainability. Accurate forecasting models that integrate scenario analysis help businesses proactively adjust spending, optimize liquidity, and reduce the risks of cash shortfalls.

Cash Flow Variance Heatmaps

Positive cash flow provides a snapshot of actual financial health by highlighting surplus funds available over a specific period, while predictive cash flow uses statistical models and historical data to forecast future liquidity and identify potential variances. Cash flow variance heatmaps visualize discrepancies between projected and actual cash flows, enabling organizations to quickly detect and address sustainability risks by focusing on critical time frames and business units.

ESG-Integrated Cash Flow Tracking

Positive cash flow ensures immediate liquidity and operational stability, while predictive cash flow leverages ESG-integrated cash flow tracking to forecast long-term sustainability and align financial planning with environmental, social, and governance goals. This integration enables companies to proactively manage risks and opportunities related to ESG factors, enhancing resilience and investor confidence.

Positive cash flow vs Predictive cash flow for sustainability. Infographic

moneydiff.com

moneydiff.com