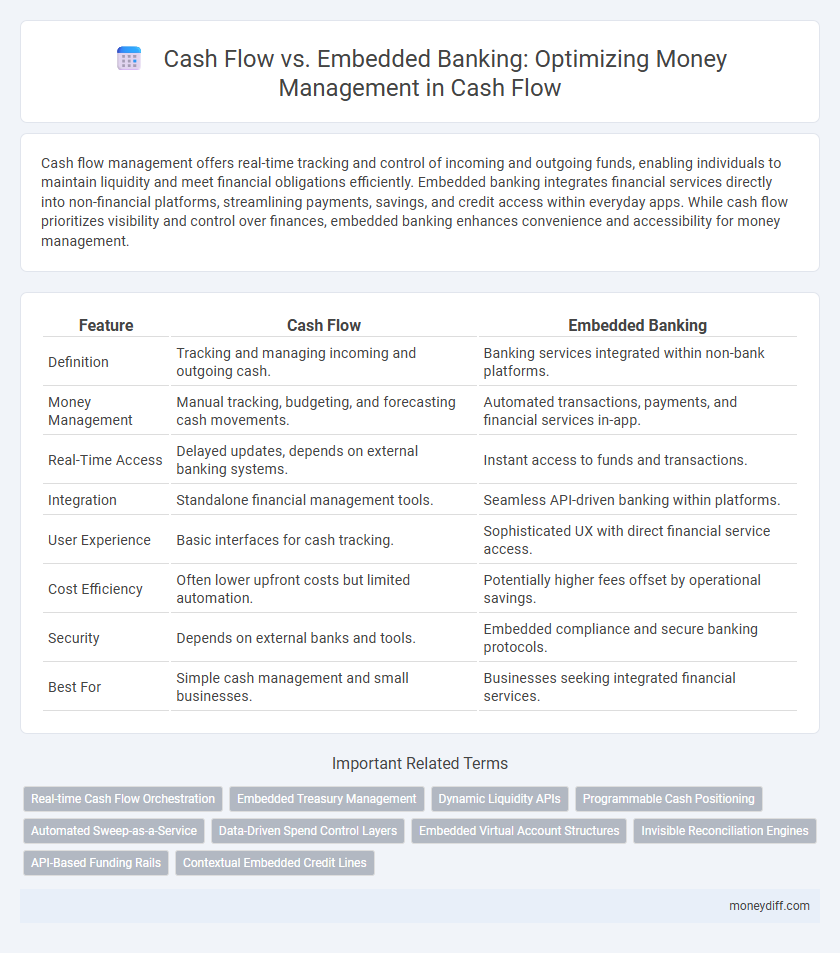

Cash flow management offers real-time tracking and control of incoming and outgoing funds, enabling individuals to maintain liquidity and meet financial obligations efficiently. Embedded banking integrates financial services directly into non-financial platforms, streamlining payments, savings, and credit access within everyday apps. While cash flow prioritizes visibility and control over finances, embedded banking enhances convenience and accessibility for money management.

Table of Comparison

| Feature | Cash Flow | Embedded Banking |

|---|---|---|

| Definition | Tracking and managing incoming and outgoing cash. | Banking services integrated within non-bank platforms. |

| Money Management | Manual tracking, budgeting, and forecasting cash movements. | Automated transactions, payments, and financial services in-app. |

| Real-Time Access | Delayed updates, depends on external banking systems. | Instant access to funds and transactions. |

| Integration | Standalone financial management tools. | Seamless API-driven banking within platforms. |

| User Experience | Basic interfaces for cash tracking. | Sophisticated UX with direct financial service access. |

| Cost Efficiency | Often lower upfront costs but limited automation. | Potentially higher fees offset by operational savings. |

| Security | Depends on external banks and tools. | Embedded compliance and secure banking protocols. |

| Best For | Simple cash management and small businesses. | Businesses seeking integrated financial services. |

Understanding Cash Flow in Modern Money Management

Cash flow represents the real-time movement of funds into and out of a business or personal account, providing critical insight into liquidity and financial health. Embedded banking integrates financial services such as payments, lending, and account management directly into non-bank platforms, enhancing seamless money management and improving cash flow visibility. Understanding cash flow in the context of embedded banking enables more efficient budgeting, real-time financial decision-making, and optimized operational cash cycles.

What is Embedded Banking?

Embedded banking integrates financial services directly within non-bank platforms, enabling seamless money management without redirecting users to external banks. This approach allows businesses to offer payments, lending, and cash flow management tools embedded in their own applications, enhancing user experience and financial control. Compared to traditional cash flow methods, embedded banking streamlines transactions and optimizes liquidity by providing real-time access to banking functions within existing workflows.

Key Differences: Cash Flow vs Embedded Banking

Cash flow management centers on tracking and optimizing the inflow and outflow of cash within a business to ensure liquidity and operational efficiency. Embedded banking integrates financial services directly into non-bank platforms, enabling seamless money management and real-time transactions within existing business processes. The key differences lie in cash flow's focus on internal financial health versus embedded banking's facilitation of external financial services, offering enhanced convenience and automation for money management.

How Embedded Banking Transforms Cash Flow Oversight

Embedded banking integrates financial services directly into business operations, enabling real-time cash flow tracking and automated transaction processing. This seamless integration reduces manual reconciliations and enhances accuracy in forecasting cash inflows and outflows. Businesses achieve improved liquidity management and strategic decision-making through continuous visibility and control over their cash flow.

Pros and Cons of Cash Flow Management Tools

Cash flow management tools offer real-time tracking of income and expenses, enabling businesses to maintain liquidity and avoid overdrafts, but they often lack integrated payment processing features found in embedded banking solutions. These tools improve budgeting accuracy and financial forecasting, yet can require manual data entry or rely on third-party integrations that may complicate workflows. While cash flow software enhances visibility into financial health, it may not support seamless fund transfers or lending services provided by embedded banking, limiting comprehensive money management capabilities.

Advantages of Embedded Banking Solutions

Embedded banking solutions streamline cash flow management by integrating banking services directly into business platforms, enabling real-time transaction processing and automated financial tracking. These solutions reduce reliance on external banking interfaces, minimizing delays and improving liquidity visibility. Enhanced control over payment flows and seamless access to credit contribute to optimized working capital and operational efficiency.

Integrating Cash Flow Management with Embedded Banking

Integrating cash flow management with embedded banking streamlines real-time transaction tracking and automated payment processing, enhancing liquidity insights for businesses. This synergy enables seamless reconciliation and predictive cash flow analysis, reducing manual errors while improving financial decision-making. Embedded banking solutions offer tailored financial services within existing platforms, optimizing money management by consolidating banking and cash flow operations.

Impact on Personal and Business Financial Decisions

Cash flow directly influences personal and business financial decisions by providing real-time visibility into income and expenses, enabling precise budgeting and effective liquidity management. Embedded banking integrates financial services within non-bank platforms, streamlining transactions, automating cash flow processes, and offering tailored financial insights that enhance decision-making efficiency. This seamless access to financial tools accelerates response times for managing working capital, investment opportunities, and risk mitigation in both personal finance and business operations.

Future Trends: Cash Flow and Embedded Banking Convergence

Future trends indicate a significant convergence between cash flow management and embedded banking, where real-time financial data integration allows seamless transaction processing and liquidity optimization. Businesses leveraging embedded banking platforms benefit from automated cash flow forecasting and instant access to credit, enhancing operational efficiency. Advanced APIs and AI-driven analytics will drive smarter decision-making, transforming money management into a more dynamic, adaptive process.

Choosing the Right Approach for Effective Money Management

Choosing between cash flow management and embedded banking depends on a business's operational complexity and financial goals. Cash flow management emphasizes tracking inflows and outflows to maintain liquidity and avoid insolvency, while embedded banking integrates financial services directly into business platforms for seamless transactions and automation. Effective money management often requires leveraging embedded banking solutions to enhance cash flow visibility, optimize working capital, and streamline payment processes.

Related Important Terms

Real-time Cash Flow Orchestration

Real-time cash flow orchestration enables businesses to optimize liquidity by seamlessly integrating Embedded Banking services, allowing instant visibility and control over transactions. This synergy enhances predictive cash flow management, reduces idle cash, and improves decision-making accuracy for money management strategies.

Embedded Treasury Management

Embedded Treasury Management integrates cash flow processes directly within financial platforms, enabling real-time visibility and automation of liquidity management, payments, and forecasting. This seamless approach outperforms traditional cash flow methods by enhancing accuracy, reducing manual effort, and optimizing working capital through embedded banking capabilities.

Dynamic Liquidity APIs

Dynamic Liquidity APIs enable real-time cash flow management by integrating embedded banking solutions, allowing businesses to optimize liquidity with precise fund allocation and immediate access to financial data. These APIs streamline money management by automating cash positioning, enhancing forecasting accuracy, and improving operational efficiency compared to traditional cash flow approaches.

Programmable Cash Positioning

Programmable cash positioning leverages embedded banking technology to automate real-time cash flow management, optimizing liquidity by dynamically allocating funds across accounts and investments. This integration enables precise control over cash movements, reducing manual intervention and enhancing financial agility for businesses.

Automated Sweep-as-a-Service

Automated Sweep-as-a-Service enhances cash flow management by seamlessly transferring surplus funds between accounts to optimize liquidity without manual intervention. Embedded banking integrates these automated sweeps within existing financial platforms, enabling real-time cash optimization and reducing idle balances for businesses.

Data-Driven Spend Control Layers

Cash flow management benefits from data-driven spend control layers by providing real-time insights and automated categorization to optimize liquidity, reduce overspending, and forecast future cash positions accurately. Embedded banking integrates these controls directly into financial platforms, enabling seamless transaction monitoring and personalized budgeting tools that enhance decision-making efficiency and financial stability.

Embedded Virtual Account Structures

Embedded virtual account structures enable granular cash flow management by segmenting funds into individual sub-accounts, providing real-time visibility and control over incoming and outgoing payments. This approach outperforms traditional cash flow methods by automating reconciliation, reducing manual errors, and optimizing liquidity across multiple business units or clients within a single banking platform.

Invisible Reconciliation Engines

Invisible Reconciliation Engines streamline cash flow management by automatically matching transactions and updating records in real-time, reducing errors and enhancing financial accuracy. Embedded banking leverages these engines to provide seamless money management within platforms, optimizing liquidity and operational efficiency without manual intervention.

API-Based Funding Rails

API-based funding rails in cash flow management enable seamless integration of embedded banking services, enhancing real-time liquidity tracking and automated payment processing. These advanced digital frameworks optimize transaction speeds and reduce operational costs compared to traditional cash flow systems, driving more efficient money management.

Contextual Embedded Credit Lines

Contextual Embedded Credit Lines integrate directly within cash flow systems, enabling real-time access to credit based on transactional data and liquidity needs, enhancing efficient money management. This seamless embedding contrasts with traditional cash flow models by providing dynamic, context-aware financing options that reduce reliance on external loans and improve working capital optimization.

Cash flow vs Embedded banking for money management. Infographic

moneydiff.com

moneydiff.com