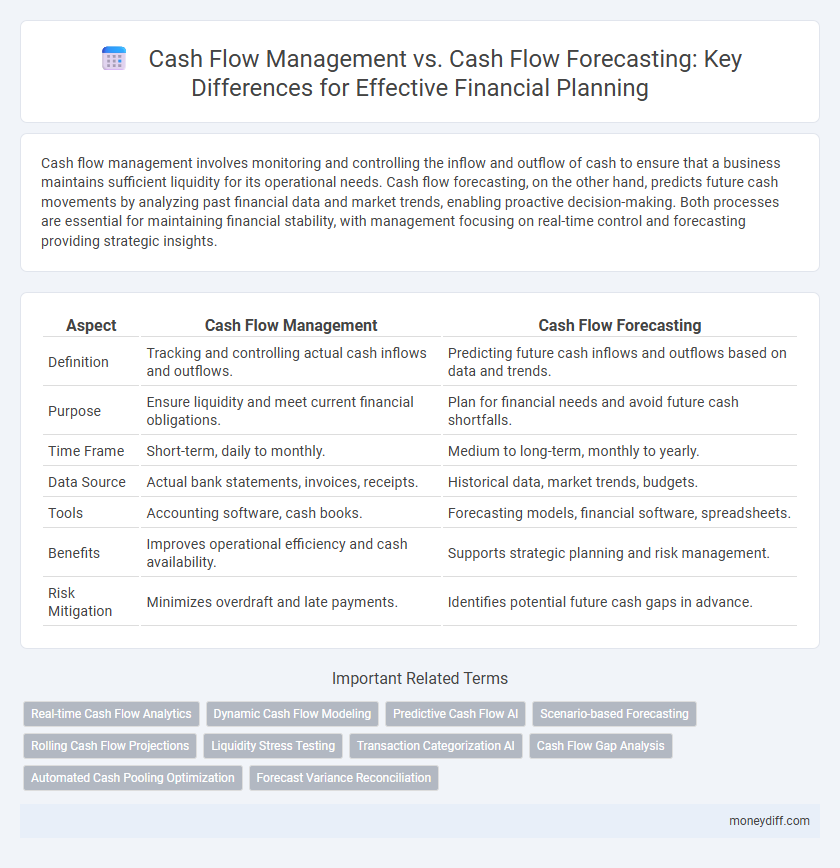

Cash flow management involves monitoring and controlling the inflow and outflow of cash to ensure that a business maintains sufficient liquidity for its operational needs. Cash flow forecasting, on the other hand, predicts future cash movements by analyzing past financial data and market trends, enabling proactive decision-making. Both processes are essential for maintaining financial stability, with management focusing on real-time control and forecasting providing strategic insights.

Table of Comparison

| Aspect | Cash Flow Management | Cash Flow Forecasting |

|---|---|---|

| Definition | Tracking and controlling actual cash inflows and outflows. | Predicting future cash inflows and outflows based on data and trends. |

| Purpose | Ensure liquidity and meet current financial obligations. | Plan for financial needs and avoid future cash shortfalls. |

| Time Frame | Short-term, daily to monthly. | Medium to long-term, monthly to yearly. |

| Data Source | Actual bank statements, invoices, receipts. | Historical data, market trends, budgets. |

| Tools | Accounting software, cash books. | Forecasting models, financial software, spreadsheets. |

| Benefits | Improves operational efficiency and cash availability. | Supports strategic planning and risk management. |

| Risk Mitigation | Minimizes overdraft and late payments. | Identifies potential future cash gaps in advance. |

Understanding Cash Flow Management

Cash flow management involves actively monitoring and controlling the inflow and outflow of cash to ensure sufficient liquidity for daily operations and financial obligations. Effective cash flow management helps businesses avoid insolvency by managing receivables, payables, and cash reserves in real time. Unlike cash flow forecasting, which predicts future financial positions, cash flow management focuses on the present cash position to optimize working capital and operational efficiency.

The Basics of Cash Flow Forecasting

Cash flow forecasting involves estimating future cash inflows and outflows to predict liquidity and ensure sufficient funds for operational needs. It uses historical data and assumptions about sales, expenses, and capital expenditures to create a financial roadmap. Effective cash flow forecasting helps businesses anticipate shortfalls, optimize working capital, and make informed financing decisions.

Key Differences Between Cash Flow Management and Forecasting

Cash flow management involves monitoring and controlling the actual inflows and outflows of cash to ensure liquidity and operational stability, whereas cash flow forecasting predicts future cash movements based on historical data, sales projections, and expense estimates. Effective cash flow management prioritizes real-time financial decisions to maintain solvency, while cash flow forecasting supports strategic planning by anticipating potential shortfalls or surpluses. Key differences include the time frame focus--current versus future--and the purpose, where management addresses immediate cash needs and forecasting guides long-term financial strategy.

Why Cash Flow Management Matters for Financial Health

Effective cash flow management ensures that a business maintains sufficient liquidity to cover operational expenses, preventing disruptions and insolvency. Cash flow forecasting provides predictive insights that enable informed decision-making by estimating future inflows and outflows, reducing financial uncertainty. Together, these practices safeguard financial stability, support strategic planning, and enhance the ability to seize growth opportunities.

The Role of Forecasting in Financial Planning

Cash flow forecasting plays a critical role in financial planning by predicting future cash inflows and outflows, enabling businesses to anticipate liquidity needs and avoid potential shortfalls. Accurate forecasts support informed decision-making, efficient budgeting, and strategic allocation of resources. Cash flow management relies on these projections to optimize day-to-day operations and maintain financial stability.

Essential Tools for Cash Flow Tracking and Forecasting

Effective cash flow management relies on essential tools like accounting software, cash flow statements, and real-time bank feeds to monitor inflows and outflows accurately. Cash flow forecasting benefits from predictive analytics tools, scenario planning models, and budgeting software to anticipate future financial positions and identify potential shortfalls. Utilizing integrated platforms that combine tracking and forecasting features ensures comprehensive financial oversight and improves decision-making accuracy.

Common Challenges in Cash Flow Management vs. Forecasting

Cash flow management faces common challenges such as unexpected expenses, delayed customer payments, and maintaining sufficient liquidity to cover operational costs. Cash flow forecasting struggles with accurately predicting future inflows and outflows due to market volatility, seasonal fluctuations, and changing customer behavior. Both require continuous monitoring and adjustment to prevent financial shortfalls and ensure business stability.

Best Practices for Accurate Cash Flow Forecasting

Accurate cash flow forecasting relies on detailed historical financial data, regular updates, and scenario analysis to predict future inflows and outflows effectively. Implementing best practices such as integrating real-time accounting software, monitoring seasonal trends, and maintaining communication with key stakeholders enhances forecast reliability. Distinguishing cash flow management, which focuses on day-to-day liquidity, from forecasting ensures proactive financial planning and improved decision-making.

Integrating Cash Flow Management and Forecasting Strategies

Integrating cash flow management and forecasting strategies enhances the accuracy of financial planning by combining real-time cash tracking with predictive analysis, enabling businesses to anticipate liquidity needs and optimize working capital. Effective cash flow management involves monitoring daily inflows and outflows, while forecasting projects future cash positions based on historical data and market trends. This synergy supports informed decision-making, reduces financial risks, and improves overall cash efficiency in business operations.

Measuring Success: KPIs for Cash Flow Optimization

Effective cash flow management hinges on tracking key performance indicators (KPIs) such as operating cash flow ratio, cash conversion cycle, and days sales outstanding to ensure liquidity and operational efficiency. Cash flow forecasting relies heavily on predictive KPIs like projected cash inflows and outflows, variance analysis, and forecast accuracy to anticipate financial needs and optimize working capital. Monitoring these KPIs collectively enables businesses to maintain financial stability, reduce cash shortages, and improve strategic decision-making for sustainable growth.

Related Important Terms

Real-time Cash Flow Analytics

Real-time cash flow analytics enhances cash flow management by providing up-to-the-minute insights into actual inflows and outflows, enabling more accurate and dynamic decision-making compared to traditional cash flow forecasting. This approach reduces financial uncertainty and improves liquidity planning by continuously monitoring transactions and adjusting forecasts based on current data trends.

Dynamic Cash Flow Modeling

Dynamic cash flow modeling enhances cash flow management by integrating real-time data to adjust financial strategies proactively, improving liquidity and operational decisions. Unlike static cash flow forecasting, it enables businesses to simulate multiple scenarios, optimizing working capital and reducing the risk of cash shortfalls.

Predictive Cash Flow AI

Predictive Cash Flow AI enhances cash flow forecasting by utilizing machine learning algorithms to analyze historical financial data and predict future cash inflows and outflows with high accuracy. Effective cash flow management relies on these advanced forecasts to optimize liquidity, prevent cash shortages, and improve strategic decision-making in business finances.

Scenario-based Forecasting

Scenario-based forecasting enhances cash flow management by providing dynamic predictions of financial outcomes under varying market conditions, enabling businesses to prepare for potential cash shortages or surpluses effectively. This approach integrates multiple financial scenarios, improving decision-making accuracy and strategic planning for sustaining liquidity.

Rolling Cash Flow Projections

Rolling cash flow projections enable dynamic cash flow management by continuously updating forecasts based on real-time financial data, improving liquidity planning and decision-making accuracy. Unlike static cash flow forecasting, this approach allows businesses to anticipate cash shortages or surpluses more effectively, optimizing short-term financing and operational budgets.

Liquidity Stress Testing

Cash flow management involves monitoring and optimizing the inflows and outflows to maintain sufficient liquidity, while cash flow forecasting predicts future cash positions to anticipate potential shortfalls. Liquidity stress testing enhances cash flow forecasting by simulating adverse scenarios, enabling businesses to assess resilience and ensure financial stability under unexpected liquidity pressures.

Transaction Categorization AI

Transaction Categorization AI enhances cash flow management by automatically sorting expenses and income into precise categories, enabling real-time financial insights and improved budget control. In cash flow forecasting, this AI-driven categorization allows for more accurate prediction models by analyzing historical transaction patterns, leading to better anticipation of future cash inflows and outflows.

Cash Flow Gap Analysis

Cash flow management involves monitoring and optimizing the timing of income and expenses to maintain liquidity, while cash flow forecasting projects future cash inflows and outflows to anticipate potential shortfalls. Cash Flow Gap Analysis identifies periods where projected cash outflows exceed inflows, enabling businesses to implement strategies such as securing short-term financing or adjusting payment schedules to bridge liquidity gaps.

Automated Cash Pooling Optimization

Automated cash pooling optimization enhances cash flow management by centralizing liquidity to reduce borrowing costs and maximize interest income, ensuring real-time visibility and control over cash positions. Cash flow forecasting leverages this automation to provide accurate projections, enabling proactive decision-making and efficient allocation of financial resources.

Forecast Variance Reconciliation

Cash flow management involves monitoring and controlling actual cash inflows and outflows to maintain liquidity, while cash flow forecasting predicts future cash positions based on expected revenues and expenses. Forecast variance reconciliation is essential in comparing forecasted versus actual cash flows, identifying discrepancies, and refining forecasting accuracy for improved financial decision-making.

Cash flow management vs Cash flow forecasting for finances. Infographic

moneydiff.com

moneydiff.com