Wire transfers remain a trusted method for sending large sums securely across banks, often used for international transactions due to their broad acceptance. Real-time payments offer instant fund transfers within domestic networks, providing convenience and immediacy for everyday banking needs. Choosing between them depends on factors like transfer speed, cost, and geographical reach.

Table of Comparison

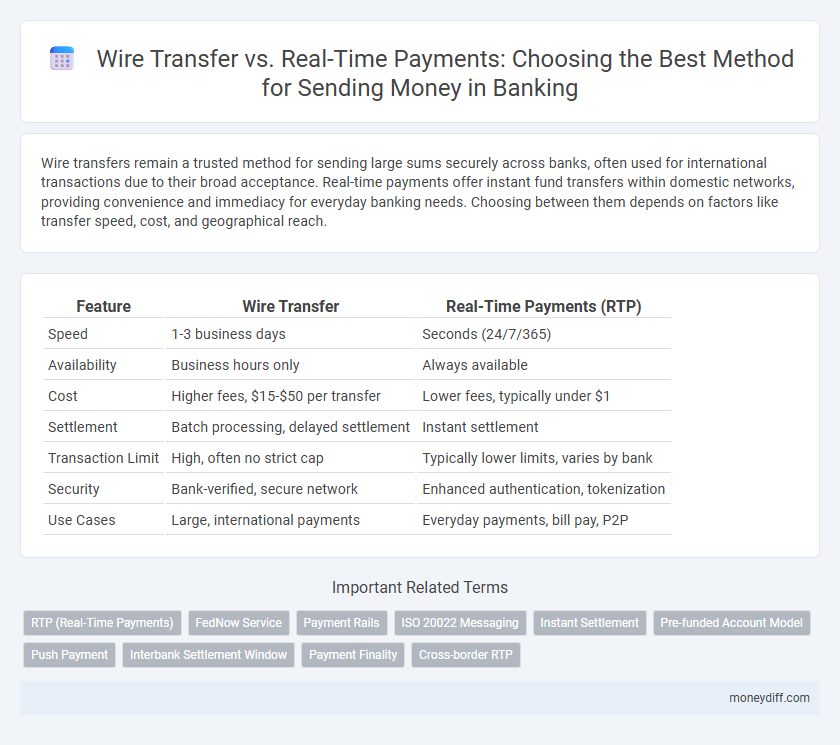

| Feature | Wire Transfer | Real-Time Payments (RTP) |

|---|---|---|

| Speed | 1-3 business days | Seconds (24/7/365) |

| Availability | Business hours only | Always available |

| Cost | Higher fees, $15-$50 per transfer | Lower fees, typically under $1 |

| Settlement | Batch processing, delayed settlement | Instant settlement |

| Transaction Limit | High, often no strict cap | Typically lower limits, varies by bank |

| Security | Bank-verified, secure network | Enhanced authentication, tokenization |

| Use Cases | Large, international payments | Everyday payments, bill pay, P2P |

Overview of Wire Transfers and Real-Time Payments

Wire transfers are traditional methods for sending large sums securely between banks, typically taking 1 to 3 business days to process. Real-Time Payments (RTP) enable instantaneous funds transfer, offering 24/7 availability and immediate settlement between participating financial institutions. Both methods provide secure options, but RTP systems are increasingly favored for their speed and convenience in consumer and business transactions.

Key Differences Between Wire Transfers and RTP

Wire transfers typically involve higher fees, longer processing times, and operate primarily during business hours, while Real-Time Payments (RTP) provide instant settlement 24/7 with lower transaction costs. Wire transfers often require detailed recipient information and clearing through intermediary banks, whereas RTP leverages modern payment networks enabling direct bank-to-bank transfers without intermediaries. Security protocols in wire transfers rely on traditional banking networks, whereas RTP incorporates enhanced real-time fraud detection and verification measures.

Speed of Transaction: Wire Transfer vs Real-Time Payments

Wire transfers typically take several hours to one business day to complete, depending on the sending and receiving banks and the geographic locations involved. Real-time payments offer instantaneous fund transfers, enabling near-instantaneous availability of money in the recipient's account 24/7. The speed advantage of real-time payments significantly enhances cash flow management for individuals and businesses compared to traditional wire transfers.

Cost Comparison: Fees and Charges

Wire transfers typically involve higher fees, with banks charging flat rates ranging from $25 to $50 for domestic transactions and up to $75 or more for international transfers. Real-Time Payments (RTP) usually have lower or no fees, making them a cost-effective option for sending small to medium amounts instantly. The reduced costs of RTP are due to automated processing and lower intermediary involvement, contrasting with the traditional wire transfer system's multiple handling steps and correspondent banking fees.

Security Measures and Fraud Prevention

Wire transfers utilize established banking networks with multi-factor authentication and encryption protocols to ensure secure fund transfers, minimizing fraud risks through traceable transaction records. Real-Time Payments (RTP) leverage immediate verification methods and continuous monitoring tools that detect unusual activity in real time, significantly enhancing fraud prevention. Both systems implement advanced security measures, but RTP's instant processing demands robust, adaptive fraud detection frameworks to protect users from evolving threats.

Accessibility and Availability

Wire transfers typically require bank account details and are processed during business hours, leading to limited accessibility and slower availability for recipients. Real-time payments operate 24/7 across multiple platforms and financial institutions, providing instant fund transfers and greater accessibility for users worldwide. The continuous availability and broad network reach of real-time payments make them a more convenient option for urgent and anytime money transfers.

User Experience and Convenience

Wire transfers provide reliable, secure cross-border money transfers but often involve delayed processing times and higher fees, impacting user convenience. Real-time payments offer instant fund availability and improved transaction transparency, enhancing user experience by enabling immediate access to funds and reducing uncertainty. For everyday transactions and urgent payments, real-time payments deliver superior efficiency and ease compared to traditional wire transfers.

International vs Domestic Transfers

Wire transfers dominate international money transfers, offering secure, reliable, and widely accepted methods for moving large sums across borders with settlement times typically ranging from one to five business days. Real-time payments excel in domestic transactions, providing instant fund availability and 24/7 processing, enhancing convenience and cash flow management for businesses and individuals. While wire transfers support complex international banking networks and currency conversions, real-time payments are primarily designed for fast, low-cost settlements within a single country's banking infrastructure.

Use Cases: When to Choose Wire Transfer or RTP

Wire transfers are ideal for high-value, cross-border payments requiring guaranteed settlement and extensive banking network access, especially in scenarios involving international business transactions or large one-time purchases. Real-Time Payments (RTP) are best suited for domestic, low to medium-value transactions needing immediate funds availability, such as payroll disbursements, bill payments, or peer-to-peer transfers. Selecting between wire transfer and RTP depends on transaction urgency, amount, geographic scope, and cost sensitivity.

Future Trends in Money Transfer Technologies

Wire transfers remain the backbone of high-value, cross-border transactions, leveraging established banking networks for secure fund movement. Real-time payment systems are rapidly expanding, driven by advancements in blockchain and distributed ledger technologies that enable instant settlement and enhanced transparency. Future trends indicate a convergence of these methods, integrating AI-driven fraud detection and open banking APIs to deliver faster, more efficient, and globally accessible payment solutions.

Related Important Terms

RTP (Real-Time Payments)

Real-Time Payments (RTP) enable instant fund transfers between banks, improving transaction speed and availability compared to traditional wire transfers that typically require several hours to days for processing. RTP systems support 24/7/365 operations, provide enhanced transparency with real-time transaction status updates, and reduce payment errors through immediate verification.

FedNow Service

FedNow Service enables instant, 24/7 real-time payments, offering businesses and consumers faster fund transfers compared to traditional wire transfers that can take hours or days and often operate only during banking hours. This real-time payment system enhances liquidity management and reduces settlement risk by processing transactions within seconds on a secure, nationwide platform.

Payment Rails

Wire transfers utilize traditional banking networks like SWIFT and Fedwire, offering secure but often slower cross-border payment rails with higher fees. Real-Time Payments leverage modern APIs and instant settlement networks such as RTP and Faster Payments, providing near-instantaneous domestic transfers with lower costs and enhanced transaction transparency.

ISO 20022 Messaging

ISO 20022 messaging enhances both wire transfers and real-time payments by providing standardized, richer data formats that improve transaction transparency and efficiency. Wire transfers benefit from ISO 20022 through streamlined cross-border settlements, while real-time payments leverage this standard for instant, reliable fund transfers supported by detailed, interoperable payment instructions.

Instant Settlement

Wire transfers typically settle within hours to days depending on the banking networks involved, while real-time payments enable instant settlement by processing transactions within seconds, offering immediate fund availability. Instant settlement through real-time payments reduces counterparty risk and enhances liquidity management for both individuals and businesses.

Pre-funded Account Model

Wire transfers typically rely on a pre-funded account model where funds are secured in advance before initiation, ensuring transaction certainty but potentially tying up liquidity. Real-time payments, while sometimes incorporating pre-funded accounts, emphasize instant settlement and fund availability, reducing the need for prolonged liquidity reserves and enabling faster transaction finality.

Push Payment

Wire transfers typically involve batch processing with higher fees and slower settlement times, whereas real-time payments (RTP) enable instant push payment settlements, enhancing liquidity and cash flow management for businesses and consumers. RTP systems leverage advanced payment networks like The Clearing House RTP Network to provide 24/7 availability, irrevocability, and immediate funds availability, optimizing financial operations.

Interbank Settlement Window

Wire transfers typically involve an interbank settlement window ranging from a few hours to several business days, depending on the banks and networks involved, while real-time payments enable instant interbank settlement, allowing funds to be available within seconds. The difference in settlement speed significantly impacts cash flow management and payment certainty for businesses and consumers.

Payment Finality

Wire transfers typically offer payment finality within one to three business days after processing by intermediary banks, ensuring a secure and irrevocable transfer of funds. Real-Time Payments (RTP) provide immediate payment finality within seconds, allowing instant fund availability and irrevocability, enhancing liquidity and reducing settlement risk.

Cross-border RTP

Cross-border Real-Time Payments (RTP) enable near-instantaneous settlement and enhanced transparency compared to traditional wire transfers, which typically involve longer processing times and higher fees due to intermediary banks and currency conversions. RTP systems leverage blockchain or distributed ledger technology to reduce friction and provide end-to-end tracking, significantly improving the speed and reliability of international money transfers.

Wire Transfer vs Real-Time Payments for sending money. Infographic

moneydiff.com

moneydiff.com