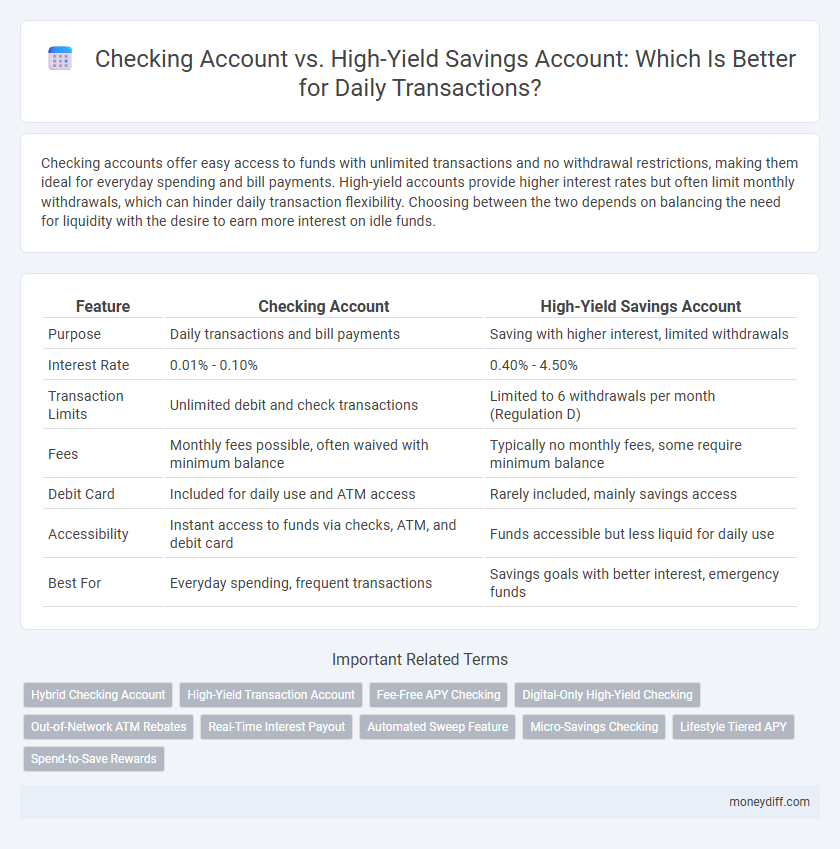

Checking accounts offer easy access to funds with unlimited transactions and no withdrawal restrictions, making them ideal for everyday spending and bill payments. High-yield accounts provide higher interest rates but often limit monthly withdrawals, which can hinder daily transaction flexibility. Choosing between the two depends on balancing the need for liquidity with the desire to earn more interest on idle funds.

Table of Comparison

| Feature | Checking Account | High-Yield Savings Account |

|---|---|---|

| Purpose | Daily transactions and bill payments | Saving with higher interest, limited withdrawals |

| Interest Rate | 0.01% - 0.10% | 0.40% - 4.50% |

| Transaction Limits | Unlimited debit and check transactions | Limited to 6 withdrawals per month (Regulation D) |

| Fees | Monthly fees possible, often waived with minimum balance | Typically no monthly fees, some require minimum balance |

| Debit Card | Included for daily use and ATM access | Rarely included, mainly savings access |

| Accessibility | Instant access to funds via checks, ATM, and debit card | Funds accessible but less liquid for daily use |

| Best For | Everyday spending, frequent transactions | Savings goals with better interest, emergency funds |

Understanding Checking Accounts

Checking accounts offer immediate access to funds with features such as unlimited withdrawals, debit card usage, and check writing, making them ideal for daily transactions. These accounts typically have low or no interest rates but prioritize liquidity and convenience over earnings. Customers benefit from maintenance fee waivers through minimum balances or direct deposits, which optimize the account's cost-effectiveness for everyday banking needs.

What Is a High-Yield Savings Account?

A high-yield savings account offers significantly higher interest rates compared to a standard checking account, making it ideal for growing your savings while earning more on your deposits. Unlike checking accounts, which prioritize liquidity and unlimited transactions, high-yield savings accounts typically limit withdrawals to maintain higher yields on your balance. These accounts are best suited for funds not immediately needed for daily transactions, combining safety through FDIC insurance and competitive returns that outperform traditional savings options.

Key Differences Between Checking and High-Yield Accounts

Checking accounts offer easy access to funds with unlimited transactions and typically no minimum balance, making them ideal for daily transactions and bill payments. High-yield accounts provide higher interest rates, often 10 to 20 times greater than traditional checking accounts, but usually have limitations on monthly withdrawals and require higher minimum balances. The primary difference lies in liquidity and earning potential, with checking accounts prioritizing convenience while high-yield accounts focus on maximizing interest income.

Accessibility and Convenience for Daily Transactions

Checking accounts offer unmatched accessibility and convenience for daily transactions, allowing unlimited withdrawals, debit card usage, and easy bill payments without fees. High-yield accounts provide higher interest rates but often restrict transaction frequency and limit ATM access, making them less practical for everyday spending. Choosing a checking account ensures seamless money management with immediate fund availability and widespread acceptance for day-to-day needs.

Interest Rates: Maximizing Earnings

Checking accounts typically offer minimal or no interest, making them less effective for maximizing earnings on daily transactions. High-yield accounts provide significantly higher interest rates, often ranging from 3% to 5% APY, which can enhance returns on accessible funds. Choosing a high-yield account for everyday spending allows customers to earn more while maintaining liquidity.

Fees and Charges to Consider

Checking accounts typically incur lower monthly fees and offer free or low-cost access to everyday transactions such as ATM withdrawals and debit card purchases. High-yield accounts often come with higher minimum balance requirements and limited transaction capabilities, which may lead to overdraft fees and penalties if daily spending needs are not carefully managed. Evaluating maintenance fees, overdraft charges, and transaction limits is crucial when choosing between these accounts for routine financial activities.

Account Features and Benefits

Checking accounts offer unlimited transactions, easy access via debit cards, and no withdrawal limits, making them ideal for daily spending and bill payments. High-yield accounts provide significantly higher interest rates, often ranging from 3% to 5% APY, but may limit the number of monthly withdrawals and lack immediate transaction access. Choosing between these depends on prioritizing liquidity and convenience versus maximizing interest earnings on transactional funds.

Security and Fraud Protection

Checking accounts offer robust security features such as FDIC insurance, real-time transaction alerts, and zero-liability fraud protection, making them ideal for daily transactions with frequent access. High-yield accounts typically provide similar regulatory protections but may lack the same immediate fraud monitoring and debit card usage, potentially limiting their effectiveness for everyday spending. Prioritizing accounts with multi-factor authentication and encryption protocols ensures enhanced fraud prevention and secure management of daily financial activities.

When to Use Checking vs High-Yield Accounts

Checking accounts are ideal for daily transactions due to unlimited withdrawals, easy access via debit cards, and no or low minimum balance requirements. High-yield accounts offer superior interest rates but often impose limits on monthly transactions and have less immediate access, making them better suited for saving rather than frequent spending. Optimizing cash flow involves using checking accounts for routine expenses while allocating surplus funds to high-yield accounts to maximize interest earnings.

Making the Right Choice for Your Financial Needs

Checking accounts offer unlimited transactions with easy access through debit cards and ATMs, making them ideal for daily expenses and bill payments. High-yield accounts provide significantly higher interest rates but may limit monthly withdrawals, impacting everyday liquidity. Choosing the right account depends on balancing the need for frequent transactions against maximizing interest earnings to suit your financial habits.

Related Important Terms

Hybrid Checking Account

A Hybrid Checking Account combines the accessibility of a traditional checking account with higher interest rates similar to a high-yield account, making it ideal for daily transactions and maximizing earnings on available balances. This type of account typically offers features such as unlimited withdrawals, ATM fee reimbursements, and online banking tools, providing both convenience and enhanced financial growth.

High-Yield Transaction Account

High-yield transaction accounts offer competitive interest rates typically ranging from 1.5% to 4.0% APY, significantly outperforming traditional checking accounts with near-zero returns. These accounts combine the liquidity and unlimited transactions of checking accounts with the growth potential of savings, making them ideal for daily spending while maximizing interest earnings.

Fee-Free APY Checking

Fee-Free APY Checking accounts combine the convenience of daily transaction access with competitive interest rates, outperforming traditional checking accounts that typically offer no or minimal APY. These accounts eliminate monthly fees and minimum balance requirements, making them ideal for consumers seeking both liquidity and yield in everyday banking.

Digital-Only High-Yield Checking

Digital-only high-yield checking accounts offer significantly higher interest rates compared to traditional checking accounts, making them ideal for daily transactions while maximizing returns on accessible funds. These accounts often provide lower fees, enhanced mobile banking features, and seamless online management, catering to tech-savvy consumers seeking both convenience and financial growth.

Out-of-Network ATM Rebates

High-yield checking accounts often include out-of-network ATM rebates, reimbursing fees charged when using ATMs outside the bank's network, which can save customers significant money on everyday withdrawals. Standard checking accounts typically do not offer these rebates, resulting in higher out-of-pocket costs for frequent ATM users.

Real-Time Interest Payout

Checking accounts typically offer instant access to funds with minimal or no interest, making them ideal for daily transactions and immediate liquidity. High-yield accounts provide significantly higher interest rates but often lack real-time interest payout and may restrict transaction frequency, reducing flexibility for everyday spending.

Automated Sweep Feature

The Automated Sweep feature in high-yield accounts transfers excess funds into interest-bearing savings automatically, maximizing earnings while maintaining liquidity for daily checking transactions. Unlike standard checking accounts that offer minimal interest, this feature ensures seamless access to funds with the added benefit of higher returns on idle balances.

Micro-Savings Checking

Micro-Savings Checking accounts combine the convenience of traditional checking accounts with automated savings features, enabling seamless daily transactions while accumulating interest on spare change. Unlike High-Yield Savings accounts, Micro-Savings Checking offers immediate access to funds without withdrawal restrictions, making it ideal for managing everyday expenses and incremental savings growth.

Lifestyle Tiered APY

Checking accounts typically offer easy access to funds with low or no interest, making them ideal for daily transactions, while high-yield accounts provide tiered APY rates that increase with higher balances, benefiting customers who maintain larger funds and seek to maximize interest earnings without sacrificing liquidity. Consumers should evaluate lifestyle spending patterns and balance thresholds to optimize the tiered APY benefits of high-yield accounts against the convenience of checking accounts for everyday financial activities.

Spend-to-Save Rewards

Checking accounts offer immediate access to funds with minimal fees, making them ideal for daily transactions, while high-yield accounts provide better interest rates but may limit spending flexibility. Spend-to-save rewards programs linked to checking accounts encourage daily use by offering cashback or points, combining convenience with savings benefits.

Checking Account vs High-Yield Account for daily transactions. Infographic

moneydiff.com

moneydiff.com