Overdraft protection and Buy Now Pay Later (BNPL) offer distinct advantages for short-term credit needs, with overdraft protection providing a safety net for checking account holders by covering transactions that exceed their balance. BNPL allows consumers to split purchases into manageable installments, often interest-free if paid on time, making it ideal for planned expenses. Choosing between these options depends on spending habits and the urgency of funds, with overdraft protection suited for unexpected shortfalls and BNPL better for budgeting larger purchases.

Table of Comparison

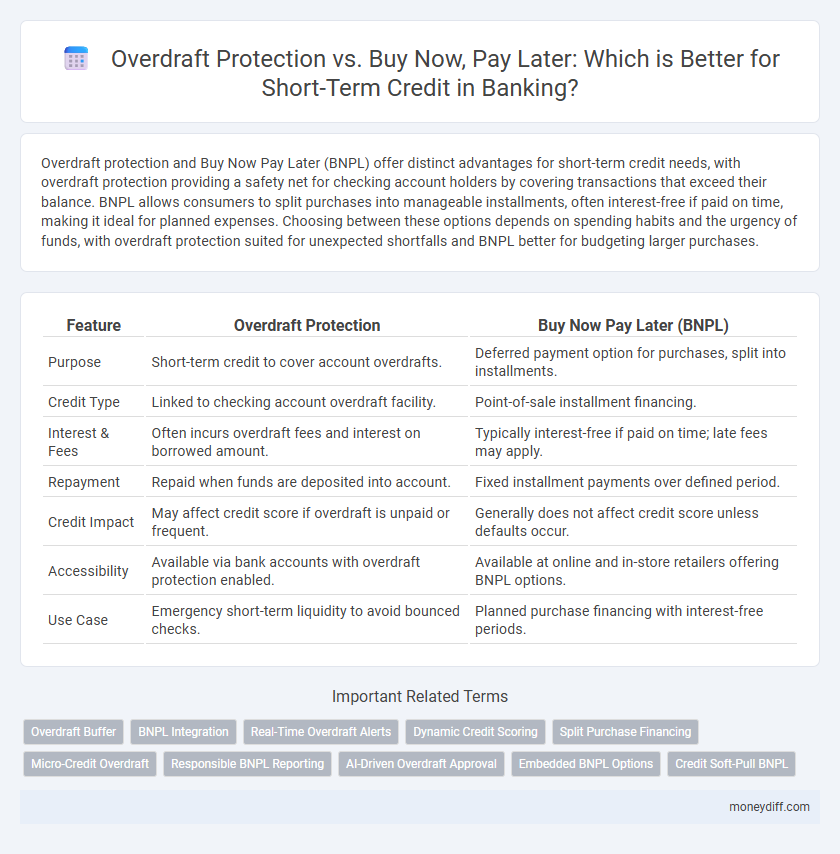

| Feature | Overdraft Protection | Buy Now Pay Later (BNPL) |

|---|---|---|

| Purpose | Short-term credit to cover account overdrafts. | Deferred payment option for purchases, split into installments. |

| Credit Type | Linked to checking account overdraft facility. | Point-of-sale installment financing. |

| Interest & Fees | Often incurs overdraft fees and interest on borrowed amount. | Typically interest-free if paid on time; late fees may apply. |

| Repayment | Repaid when funds are deposited into account. | Fixed installment payments over defined period. |

| Credit Impact | May affect credit score if overdraft is unpaid or frequent. | Generally does not affect credit score unless defaults occur. |

| Accessibility | Available via bank accounts with overdraft protection enabled. | Available at online and in-store retailers offering BNPL options. |

| Use Case | Emergency short-term liquidity to avoid bounced checks. | Planned purchase financing with interest-free periods. |

Understanding Short-Term Credit Options

Overdraft Protection offers immediate access to funds by covering transactions that exceed your checking account balance, typically linked to a savings account or line of credit with low fees. Buy Now Pay Later (BNPL) allows consumers to split purchases into interest-free installments, providing transparent repayment schedules without affecting bank accounts directly. Evaluating factors such as cost, repayment flexibility, and impact on credit scores is essential for choosing the best short-term credit solution in banking.

What is Overdraft Protection?

Overdraft protection is a banking service that automatically covers transactions when an account balance falls below zero, preventing declined payments and overdraft fees. It links a checking account to a savings account, credit card, or line of credit for seamless short-term credit access. This service provides immediate financial relief during unexpected expenses, ensuring account holders maintain payment continuity without incurring high-interest debt typically associated with Buy Now Pay Later options.

How Buy Now, Pay Later Works

Buy Now, Pay Later (BNPL) allows consumers to split purchases into interest-free installments over a set period, typically ranging from weeks to months, offering a flexible alternative to traditional credit. Unlike overdraft protection, which covers shortfalls in checking accounts often with fees and interest, BNPL directly finances specific transactions without immediately impacting account balances. This method simplifies budgeting by breaking payments into manageable amounts and can increase purchasing power without incurring typical overdraft or credit card interest charges.

Comparing Fees: Overdraft vs BNPL

Overdraft protection fees typically involve a fixed charge per transaction, ranging from $30 to $35, which can accumulate quickly with frequent use, while Buy Now Pay Later (BNPL) services often offer interest-free periods but may impose late fees that vary between $5 and $30 depending on the provider. Unlike overdraft fees that apply immediately after exceeding account balances, BNPL fees usually arise only if repayments are missed, providing more predictable cost management for consumers. Banks and BNPL providers differ in transparency and fee structures, making it crucial to review terms carefully to avoid unexpected debt from short-term credit solutions.

Credit Impact: Overdraft Protection vs BNPL

Overdraft Protection typically results in fewer negative credit impacts if managed responsibly, as it often functions as a short-term extension of the checking account without formal credit checks or reporting. Buy Now Pay Later (BNPL) services may report payment history to credit bureaus, meaning missed or late payments can directly harm credit scores. Consumers should assess overdraft fees and BNPL terms carefully, as both affect credit but through different mechanisms and risk profiles.

Ease of Access and Approval Criteria

Overdraft protection provides immediate access to funds linked to a checking account, often with minimal approval requirements based on existing account standing and income verification. Buy Now Pay Later (BNPL) services require a soft credit check and may impose spending limits, potentially slowing access during purchase attempts. Banks typically offer overdraft protection as a seamless, pre-approved safety net, whereas BNPL platforms assess applicants per transaction, influencing ease of access and approval certainty.

Repayment Schedules and Flexibility

Overdraft protection offers an automatic, short-term credit extension linked to a checking account, typically requiring repayment with the next deposit, ensuring immediate liquidity but limited flexibility in scheduling payments. Buy Now Pay Later (BNPL) services allow consumers to split purchases into multiple installments over weeks or months, providing greater control over repayment timing and often including interest-free options. While overdraft protection minimizes late fees by covering unexpected shortfalls, BNPL enhances budgeting capabilities by enabling planned, scheduled payments aligned with cash flow.

Potential Risks and Pitfalls

Overdraft protection can lead to high fees and increased debt if account holders frequently exceed their balance, potentially harming credit scores due to unpaid overdrafts. Buy Now Pay Later (BNPL) services may encourage overspending and postpone debt accumulation, with risks including hidden fees, missed payments, and negative impacts on credit reports. Both options require careful budgeting to avoid financial strain and long-term credit damage.

When to Choose Overdraft Protection

Overdraft protection is ideal when immediate access to funds is needed to cover unexpected expenses or avoid costly non-sufficient funds fees on checking accounts. It provides a seamless safety net by linking a savings account, credit card, or line of credit to prevent declined transactions and maintain financial stability. Consumers should choose overdraft protection over Buy Now Pay Later when the priority is avoiding payment disruptions rather than financing specific purchases over time.

When BNPL Makes More Sense

Buy Now Pay Later (BNPL) makes more sense than overdraft protection for short-term credit when the purchase amount is planned and affordable within the BNPL repayment period, avoiding high overdraft fees and potential account penalties. BNPL services often offer interest-free installments, providing transparent repayment schedules and helping consumers manage cash flow without incurring expensive overdraft charges. Consumers with stable income and predictable expenses benefit from BNPL's structured payments, reducing the risk of overdraft negative balances and improving credit management.

Related Important Terms

Overdraft Buffer

Overdraft protection offers an overdraft buffer that automatically covers transactions exceeding the account balance, preventing declined payments and overdraft fees, making it a seamless short-term credit solution. Unlike Buy Now Pay Later, which spreads costs over installments, overdraft buffers provide immediate liquidity without fixed repayment schedules or interest charges, enhancing account holder flexibility.

BNPL Integration

Buy Now Pay Later (BNPL) integration offers seamless short-term credit by allowing customers to split purchases into interest-free installments, enhancing checkout flexibility and boosting sales conversion rates. Unlike overdraft protection, which covers negative balances with potential fees and interest, BNPL solutions provide transparent repayment options without impacting bank account overdraft limits.

Real-Time Overdraft Alerts

Real-time overdraft alerts provide immediate notifications when account balances approach or fall below zero, enabling proactive management of short-term credit and preventing costly fees. Unlike Buy Now Pay Later options, overdraft protection with instant alerts offers direct oversight of checking accounts, ensuring timely access to funds without deferred payment complexities.

Dynamic Credit Scoring

Dynamic credit scoring enhances overdraft protection by continuously analyzing real-time financial behavior to assess risk, offering tailored short-term credit limits that reduce default rates. Buy Now Pay Later services leverage dynamic credit models to instantly evaluate consumers' repayment capacity, enabling flexible installment options while minimizing credit risk exposure for lenders.

Split Purchase Financing

Split purchase financing in banking offers a flexible short-term credit solution by allowing consumers to divide payments across multiple transactions, enhancing cash flow management compared to traditional overdraft protection which covers insufficient funds but may incur high fees. Buy Now Pay Later (BNPL) services integrate split purchase financing to provide interest-free installments, promoting responsible spending without immediate account overdrafts.

Micro-Credit Overdraft

Micro-credit overdraft offers a flexible short-term credit solution by allowing account holders to withdraw funds beyond their balance with minimal interest, effectively preventing transaction declines and overdraft fees. Compared to Buy Now Pay Later services, micro-credit overdrafts integrate seamlessly with traditional banking accounts, providing immediate liquidity without requiring separate application processes or installment plans.

Responsible BNPL Reporting

Responsible BNPL reporting ensures transparent credit assessments and timely payments, reducing the risk of debt accumulation compared to overdraft protection, which often incurs high fees and immediate interest charges. Integrating BNPL data into credit bureaus enhances consumer credit profiles while promoting responsible borrowing behaviors in short-term credit scenarios.

AI-Driven Overdraft Approval

AI-driven overdraft approval leverages machine learning algorithms to assess real-time transaction data and credit behavior, enabling banks to offer personalized short-term credit limits with higher accuracy and reduced risk. Compared to Buy Now Pay Later options, AI-enhanced overdraft protection provides instant access to funds without deferred payments, minimizing customer debt accumulation and improving financial flexibility.

Embedded BNPL Options

Embedded Buy Now Pay Later (BNPL) options offer a seamless, interest-free short-term credit solution directly integrated into the checkout process, contrasting with traditional overdraft protection that often incurs fees and higher interest rates. These embedded BNPL services enhance consumer purchasing power while providing banks with innovative revenue streams and improved customer engagement through tailored credit offerings.

Credit Soft-Pull BNPL

Overdraft protection offers immediate coverage for short-term banking shortfalls by linking a checking account to a savings or credit account, often without impacting credit scores through a soft pull. Buy Now Pay Later (BNPL) services provide flexible payment options for purchases with a credit soft-pull that minimizes credit score impact while enabling consumer access to deferred payments.

Overdraft Protection vs Buy Now Pay Later for short-term credit Infographic

moneydiff.com

moneydiff.com