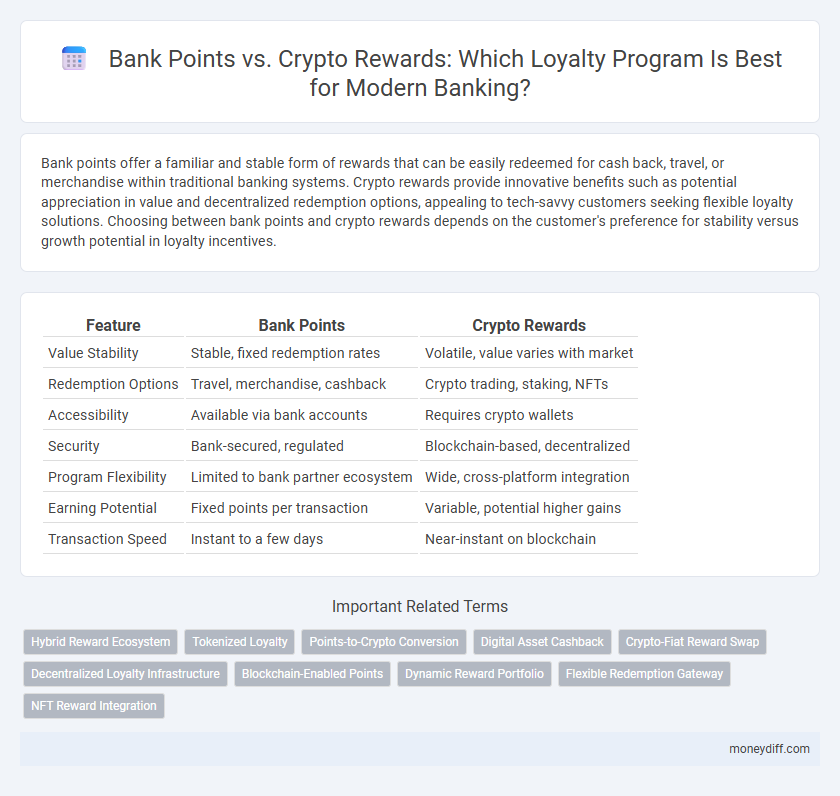

Bank points offer a familiar and stable form of rewards that can be easily redeemed for cash back, travel, or merchandise within traditional banking systems. Crypto rewards provide innovative benefits such as potential appreciation in value and decentralized redemption options, appealing to tech-savvy customers seeking flexible loyalty solutions. Choosing between bank points and crypto rewards depends on the customer's preference for stability versus growth potential in loyalty incentives.

Table of Comparison

| Feature | Bank Points | Crypto Rewards |

|---|---|---|

| Value Stability | Stable, fixed redemption rates | Volatile, value varies with market |

| Redemption Options | Travel, merchandise, cashback | Crypto trading, staking, NFTs |

| Accessibility | Available via bank accounts | Requires crypto wallets |

| Security | Bank-secured, regulated | Blockchain-based, decentralized |

| Program Flexibility | Limited to bank partner ecosystem | Wide, cross-platform integration |

| Earning Potential | Fixed points per transaction | Variable, potential higher gains |

| Transaction Speed | Instant to a few days | Near-instant on blockchain |

Understanding Bank Points: Traditional Loyalty Programs

Bank points in traditional loyalty programs represent a fixed value system tied to specific spending thresholds, allowing customers to redeem rewards such as cashback, travel discounts, or merchandise. These points are managed by financial institutions and often have expiration dates and limited transferability, creating a structured but less flexible reward mechanism. The predictability and stability of bank points appeal to consumers seeking straightforward rewards without exposure to market volatility, unlike crypto rewards.

The Rise of Crypto Rewards in Banking

Crypto rewards in banking loyalty programs have surged by over 150% in adoption rates since 2022, attracting tech-savvy consumers seeking decentralized asset incentives. Unlike traditional bank points, cryptocurrencies offer real-time exchangeability and potential value growth, driving increased user engagement and retention. Leading banks integrating blockchain technology now report a 35% higher redemption rate compared to conventional loyalty schemes.

Earning Mechanisms: Bank Points vs Crypto Rewards

Bank points in loyalty programs are typically earned through transaction volumes, with fixed ratios tied to spending categories like dining, travel, or retail, offering predictable accumulation rates. Crypto rewards leverage blockchain technology, providing dynamic earning mechanisms often influenced by market fluctuations and allowing users to gain tokens that can appreciate in value or participate in decentralized finance ecosystems. While bank points accrue steadily and are redeemed for set benefits, crypto rewards introduce volatility and potential for growth, appealing to users seeking both loyalty incentives and investment opportunities.

Redemption Options: Flexibility and Value

Bank points offer redemption options primarily within the bank's ecosystem, such as cashback, travel bookings, and gift cards, providing predictable value but limited flexibility. Crypto rewards introduce broader redemption possibilities including trading on exchanges, converting to various cryptocurrencies, or using tokens in decentralized finance platforms, enhancing flexibility but with fluctuating value. The choice between bank points and crypto rewards depends on the consumer's preference for stable redemption value versus dynamic, potentially higher-value options in emerging digital assets.

Security and Transparency of Rewards Systems

Bank points in loyalty programs rely on centralized databases that offer robust security features such as encryption and multi-factor authentication, ensuring customer data protection but are vulnerable to insider breaches. Crypto rewards, built on blockchain technology, provide enhanced transparency through immutable ledgers that allow users to verify transactions independently, reducing fraud risks. While crypto systems offer decentralized security benefits, they require users to manage private keys, introducing challenges in safeguarding rewards without compromising transparency.

Volatility of Crypto Rewards Compared to Stable Bank Points

Crypto rewards in loyalty programs are subject to significant volatility due to fluctuating market prices, which can drastically affect their value over short periods. Bank points typically maintain a stable and predictable worth, offering consistent redemption value for users. This stability makes bank points a less risky and more reliable option compared to the uncertain value of crypto rewards.

Accessibility: Who Can Use Bank Points or Crypto?

Bank points are widely accessible to anyone with a traditional bank account or credit card, making them easy to earn and redeem across numerous merchants and financial institutions. Crypto rewards, while growing in acceptance, require users to have a digital wallet and some familiarity with blockchain technology, which can limit accessibility for the average consumer. The adoption of crypto rewards is expanding as more platforms simplify user interfaces and regulatory clarity improves, but bank points remain more universally accessible due to established financial infrastructure.

Fees and Hidden Costs: What to Watch Out For

Bank points typically involve fewer fees and limited hidden costs since they are managed within traditional banking frameworks, whereas crypto rewards can incur transaction fees, wallet maintenance charges, and potential tax implications that may reduce overall value. Users should carefully review terms related to conversion rates, transfer fees, and platform-specific costs when opting for crypto rewards. Transparency in fee structures and understanding volatility risks are crucial for maximizing benefits in either loyalty program.

User Experience and Ease of Management

Bank points in loyalty programs offer users a straightforward redemption process with familiar value metrics and widespread acceptance across services, enhancing user experience through predictability and simplicity. Crypto rewards introduce flexibility and potential value appreciation but require users to navigate digital wallets, private keys, and market volatility, which may complicate management and reduce ease of use. Banks can streamline user experience by integrating crypto rewards into existing mobile platforms, providing intuitive interfaces and clear guidance to balance innovation with accessibility.

Future Trends: The Evolution of Loyalty Programs

Future trends in loyalty programs indicate a shift from traditional bank points towards crypto rewards, driven by blockchain technology's transparency and security. Financial institutions are increasingly adopting digital assets to enhance customer engagement and provide seamless, borderless redemption options. This evolution reflects broader fintech innovations aiming to create more personalized, flexible loyalty ecosystems with real-time value exchange.

Related Important Terms

Hybrid Reward Ecosystem

Bank points offer stability and broad acceptance within traditional financial networks, while crypto rewards introduce transparency and blockchain-driven security, creating a hybrid reward ecosystem that enhances customer engagement through flexible redemption options and cross-platform interoperability. This integration leverages the reliability of fiat-based incentives with the innovation of decentralized digital assets, optimizing loyalty programs for a modern, tech-savvy audience.

Tokenized Loyalty

Tokenized loyalty programs leverage blockchain technology to convert traditional bank points into secure, transparent, and easily tradable digital tokens, enhancing customer engagement and value flexibility. Unlike conventional crypto rewards, tokenized loyalty offers seamless redemption options across multiple platforms and ensures higher liquidity and interoperability within diverse financial ecosystems.

Points-to-Crypto Conversion

Bank points loyalty programs offer a traditional rewards system that can now be enhanced through points-to-crypto conversion, allowing customers to exchange accumulated bank points for cryptocurrencies like Bitcoin or Ethereum. This integration provides increased flexibility, potential for asset appreciation, and appeals to tech-savvy clients seeking to diversify rewards beyond conventional gift cards or cashback.

Digital Asset Cashback

Digital asset cashback in loyalty programs offers banking customers the advantage of seamless integration with cryptocurrency portfolios, providing enhanced flexibility and potential value growth compared to traditional bank points. Leveraging blockchain technology, these digital rewards enable instant redemption and transparent tracking, making them a more innovative alternative to conventional loyalty incentives.

Crypto-Fiat Reward Swap

Bank points typically offer fixed-value rewards redeemable within banking ecosystems, whereas crypto rewards provide dynamic value through blockchain assets that can be converted into fiat currency via crypto-fiat reward swaps, enhancing liquidity and flexibility for loyalty program users. This crypto-fiat exchange mechanism enables instant conversion of digital tokens into traditional money, optimizing real-time spending power and broadening redemption options beyond conventional bank benefits.

Decentralized Loyalty Infrastructure

Decentralized loyalty infrastructure leverages blockchain technology to offer enhanced transparency and security compared to traditional bank points, enabling real-time tracking and seamless redemption across multiple platforms. Crypto rewards provide immutable proof of ownership and global transferability, fostering user trust and increasing engagement through programmable incentives in banking loyalty programs.

Blockchain-Enabled Points

Blockchain-enabled points in banking loyalty programs offer transparent, immutable tracking and enhanced security compared to traditional bank points, enabling seamless redemption and exchange across multiple platforms. Crypto rewards provide increased flexibility and potential for value appreciation, integrating decentralized finance benefits into customer loyalty strategies.

Dynamic Reward Portfolio

Bank points offer predictable value and seamless integration with traditional financial products, while crypto rewards provide dynamic portfolios that can appreciate with market trends and enable flexible redemption options across multiple platforms. Dynamic reward portfolios in crypto loyalty programs enhance user engagement by leveraging blockchain transparency, allowing for real-time value tracking and customizable incentive strategies.

Flexible Redemption Gateway

Bank points offer a flexible redemption gateway with a wide range of options including travel, merchandise, and statement credits, allowing customers to tailor rewards to their preferences. Crypto rewards enable seamless integration with digital wallets and decentralized platforms, providing innovative redemption possibilities such as converting points into cryptocurrency or using them for blockchain-based services.

NFT Reward Integration

Bank points offer traditional, stable redemption options within financial institutions, while crypto rewards introduce blockchain-based incentives with potential appreciation and liquidity advantages. NFT reward integration enhances loyalty programs by providing unique, verifiable digital assets that can represent exclusive benefits, trading opportunities, and deeper customer engagement through decentralized ownership.

Bank Points vs Crypto Rewards for loyalty programs. Infographic

moneydiff.com

moneydiff.com