Brick-and-mortar banks provide personalized customer service and in-person access to ATMs and branches, which can be essential for complex transactions and cash handling. Digital-only banks offer streamlined mobile experiences, lower fees, and fast account setup, appealing to tech-savvy users seeking convenience. Choosing between the two depends on preferences for face-to-face interaction versus digital efficiency and cost savings.

Table of Comparison

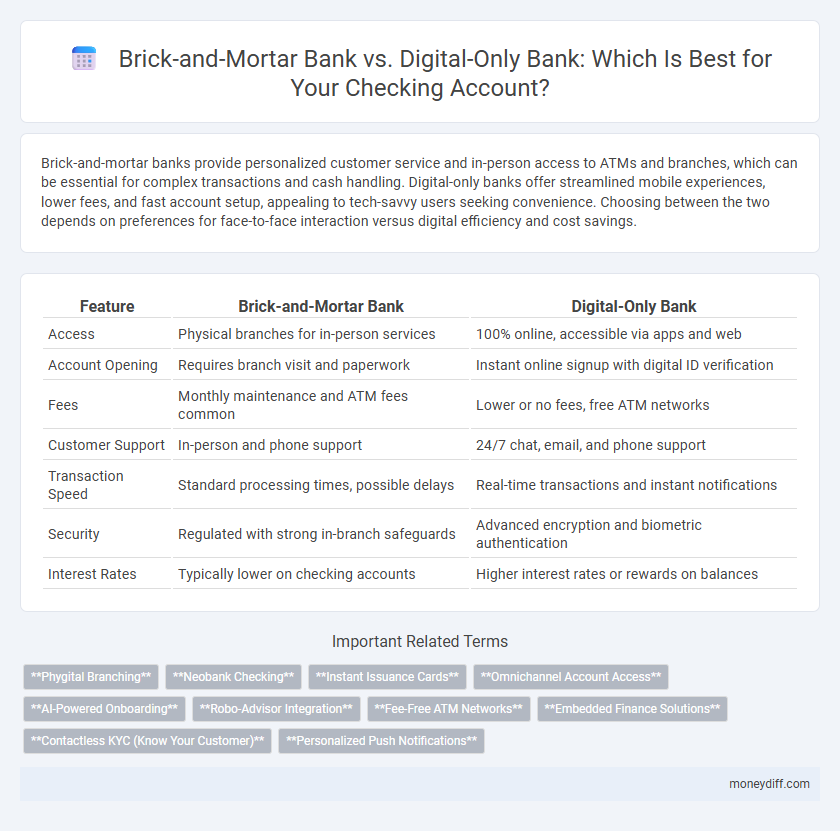

| Feature | Brick-and-Mortar Bank | Digital-Only Bank |

|---|---|---|

| Access | Physical branches for in-person services | 100% online, accessible via apps and web |

| Account Opening | Requires branch visit and paperwork | Instant online signup with digital ID verification |

| Fees | Monthly maintenance and ATM fees common | Lower or no fees, free ATM networks |

| Customer Support | In-person and phone support | 24/7 chat, email, and phone support |

| Transaction Speed | Standard processing times, possible delays | Real-time transactions and instant notifications |

| Security | Regulated with strong in-branch safeguards | Advanced encryption and biometric authentication |

| Interest Rates | Typically lower on checking accounts | Higher interest rates or rewards on balances |

Overview: Brick-and-Mortar Banks vs Digital-Only Banks

Brick-and-mortar banks offer physical branches, providing face-to-face customer service and access to in-person cash transactions, which appeals to clients valuing personal interaction and localized support. Digital-only banks operate entirely online, delivering lower fees, higher interest rates on checking accounts, and seamless mobile banking experiences tailored for tech-savvy customers. Evaluating factors like accessibility, fees, technology features, and customer preferences is essential when choosing between traditional physical banks and innovative digital-only institutions.

Account Accessibility: In-Person vs Online Services

Brick-and-mortar banks offer the advantage of in-person services, enabling customers to visit branches for cash deposits, withdrawals, and personalized support. Digital-only banks provide 24/7 online access to checking accounts through mobile apps and websites, facilitating convenient transactions without geographical limitations. While brick-and-mortar banks emphasize physical accessibility, digital-only banks prioritize seamless online service availability and rapid digital account management.

Fees and Charges: Comparing Costs of Checking Accounts

Brick-and-mortar banks often impose higher monthly maintenance fees and minimum balance requirements for checking accounts, while digital-only banks typically offer no-fee accounts with no minimum balance. Many digital banks also eliminate overdraft fees and provide free ATMs within extensive networks, reducing overall banking costs. Consumers seeking lower expenses and transparent fee structures tend to find digital-only banks more cost-effective for everyday checking account use.

Interest Rates: Traditional vs Digital Checking Account Yields

Digital-only banks typically offer higher interest rates on checking accounts compared to brick-and-mortar banks, due to lower overhead costs and increased competition in the online banking space. Traditional banks often provide lower yields but compensate with personalized services and physical branch accessibility. Consumers prioritizing higher returns on checking balances may find digital-only accounts more advantageous, while those valuing in-person support may prefer brick-and-mortar options.

Security and Fraud Protection Features

Brick-and-mortar banks provide in-person verification and physical security measures, enhancing protection against fraud and unauthorized access to checking accounts. Digital-only banks invest heavily in advanced encryption, multi-factor authentication, and real-time fraud monitoring to safeguard customer data and prevent identity theft. Both banking models enforce Federal Deposit Insurance Corporation (FDIC) protection, ensuring insured deposits up to $250,000, which maintains customer confidence in financial security.

Customer Support: Face-to-Face vs Virtual Assistance

Brick-and-mortar banks provide in-person customer support, allowing account holders to resolve checking account issues through face-to-face interactions with bank representatives, which many customers find reassuring for complex inquiries. Digital-only banks rely on virtual assistance via chatbots, video calls, and 24/7 online support, offering convenience and faster response times but limited physical interaction. The choice between the two often depends on customer preferences for personal engagement versus technological accessibility in managing their checking accounts.

Technology Integration and Mobile Banking Tools

Digital-only banks excel in technology integration, offering seamless mobile banking tools such as real-time transaction alerts, AI-powered budgeting, and instant account access without branch visits. Brick-and-mortar banks provide mobile apps but may lag in updating features, often requiring physical branch interactions for complex services. Customers prioritizing advanced digital experiences benefit more from digital-only banks, while those valuing in-person support lean toward traditional institutions.

ATM Access and Network Reach

Brick-and-mortar banks offer extensive ATM networks, providing customers with convenient cash withdrawal and deposit options nationwide, often without additional fees. Digital-only banks typically rely on partner ATM networks, which may limit fee-free access but often reimburse out-of-network charges to enhance customer convenience. Choosing between these options depends on the importance of physical ATM availability versus the benefits of digital banking features and fee reimbursement policies.

Account Opening and Maintenance Experience

Brick-and-mortar banks offer in-person account opening, providing personalized assistance and immediate identity verification, which benefits customers seeking direct interaction. Digital-only banks streamline the process through fully online applications, enabling quick account setup via mobile apps or websites without physical location constraints. Maintenance typically involves either branch visits for brick-and-mortar banks or app-based management with automated features and real-time notifications in digital-only banks, enhancing convenience and accessibility.

Which Bank Type is Best for Your Checking Needs?

Brick-and-mortar banks offer personalized service and in-branch access, ideal for customers who prefer face-to-face interactions and complex transactions. Digital-only banks provide lower fees, higher interest rates on checking accounts, and 24/7 online access, appealing to tech-savvy users prioritizing convenience and cost savings. Selecting the best bank type depends on your preference for physical presence versus digital efficiency and your specific checking account needs.

Related Important Terms

Phygital Branching

Phygital branching combines the tangible benefits of brick-and-mortar banks, such as face-to-face customer service and physical cash access, with the convenience and speed of digital-only banking through integrated mobile apps and online platforms. This hybrid approach enhances checking account management by offering seamless, omnichannel experiences that improve customer satisfaction and operational efficiency in the banking sector.

Neobank Checking

Neobank checking accounts offer seamless digital-first experiences with lower fees, higher interest rates, and real-time transaction alerts, outperforming traditional brick-and-mortar banks in convenience and cost-efficiency. These digital-only banks leverage advanced mobile apps and instant payment technologies, enhancing user accessibility and financial management without physical branch limitations.

Instant Issuance Cards

Brick-and-mortar banks often provide instant issuance cards at physical branches, enabling customers to receive a ready-to-use debit card immediately upon account opening. Digital-only banks typically expedite card delivery through expedited shipping but rarely offer instant issuance, prioritizing streamlined online onboarding over immediate in-person card access.

Omnichannel Account Access

Brick-and-mortar banks offer seamless omnichannel account access through physical branches, ATMs, and digital platforms, ensuring customers can manage checking accounts via in-person service, mobile apps, and online banking. Digital-only banks provide fully integrated account access with real-time updates across mobile and web interfaces, but lack physical locations for cash deposits or face-to-face assistance.

AI-Powered Onboarding

AI-powered onboarding in digital-only banks streamlines checking account setup through automated identity verification, reducing processing time from days to minutes and enhancing security with biometric authentication. Brick-and-mortar banks increasingly integrate AI tools for onboarding but often face limitations in real-time data processing compared to fully digital platforms.

Robo-Advisor Integration

Brick-and-mortar banks increasingly incorporate robo-advisor integration into their checking accounts, offering personalized investment management alongside traditional services. Digital-only banks excel in seamless robo-advisor features with real-time algorithmic portfolio adjustments, providing clients automated, low-cost financial planning within their mobile apps.

Fee-Free ATM Networks

Brick-and-mortar banks often provide extensive fee-free ATM networks through partnerships with established financial institutions, ensuring convenient cash access without surcharge fees. Digital-only banks typically rely on nationwide or global ATM alliances offering fee reimbursements or no fees at all, enhancing customer convenience despite lacking physical branches.

Embedded Finance Solutions

Brick-and-mortar banks integrating embedded finance solutions offer seamless in-branch access to personalized financial products, enhancing customer convenience and trust. Digital-only banks leverage embedded finance to provide real-time expense management, instant credit access, and API-driven third-party services, optimizing checking account functionalities for tech-savvy users.

Contactless KYC (Know Your Customer)

Contactless KYC leverages biometric authentication and AI-powered identity verification to streamline account opening in both brick-and-mortar and digital-only banks, reducing onboarding time significantly. Digital-only banks often integrate seamless remote KYC processes, eliminating the need for physical branch visits while ensuring compliance with AML and regulatory standards.

Personalized Push Notifications

Brick-and-mortar banks leverage personalized push notifications to enhance customer engagement by delivering tailored alerts about account activity, fraud detection, and exclusive in-branch offers. Digital-only banks excel in real-time, AI-driven personalized push notifications that provide instant updates on transactions, budgeting insights, and custom financial advice, improving user experience and financial management.

Brick-and-Mortar Bank vs Digital-Only Bank for checking accounts. Infographic

moneydiff.com

moneydiff.com