Personal loans offer fixed interest rates and predictable repayment schedules secured by banks or credit unions, providing stability and potentially lower rates for borrowers with strong credit. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, often allowing for faster approval and more flexible terms but typically higher interest rates. Understanding the differences in risk, cost, and eligibility can help borrowers choose between the traditional security of personal loans and the innovative, community-driven model of peer-to-peer lending.

Table of Comparison

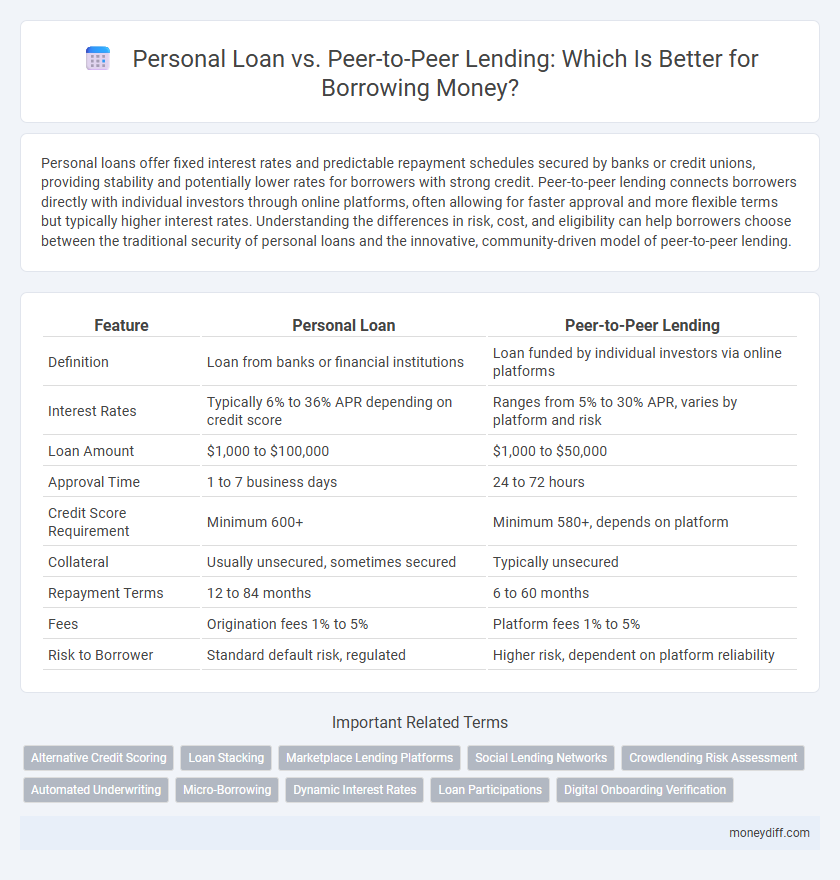

| Feature | Personal Loan | Peer-to-Peer Lending |

|---|---|---|

| Definition | Loan from banks or financial institutions | Loan funded by individual investors via online platforms |

| Interest Rates | Typically 6% to 36% APR depending on credit score | Ranges from 5% to 30% APR, varies by platform and risk |

| Loan Amount | $1,000 to $100,000 | $1,000 to $50,000 |

| Approval Time | 1 to 7 business days | 24 to 72 hours |

| Credit Score Requirement | Minimum 600+ | Minimum 580+, depends on platform |

| Collateral | Usually unsecured, sometimes secured | Typically unsecured |

| Repayment Terms | 12 to 84 months | 6 to 60 months |

| Fees | Origination fees 1% to 5% | Platform fees 1% to 5% |

| Risk to Borrower | Standard default risk, regulated | Higher risk, dependent on platform reliability |

Understanding Personal Loans and Peer-to-Peer Lending

Personal loans are fixed-term, unsecured loans offered by banks or credit unions, typically featuring fixed interest rates and set repayment schedules based on creditworthiness and income verification. Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors, often providing competitive interest rates and more flexible approval criteria, but may carry varying risk levels depending on the lender pool. Understanding differences in funding sources, interest rate structures, and credit requirements is essential for choosing between traditional personal loans and P2P lending solutions.

Key Differences Between Personal Loans and P2P Lending

Personal loans are typically offered by banks or credit unions with fixed interest rates and structured repayment terms, while peer-to-peer (P2P) lending involves borrowing directly from individual investors through online platforms, often resulting in variable rates based on credit scores and investor demand. Personal loans provide predictable monthly payments and may require a strong credit history, whereas P2P lending offers potentially faster approval and more flexible terms but can carry higher risk due to less regulatory oversight. Understanding differences in interest rates, approval processes, and repayment options is crucial when choosing between traditional personal loans and P2P lending options.

Interest Rates Comparison: Banks vs. P2P Platforms

Personal loan interest rates from banks typically range between 6% and 24%, influenced by credit scores and financial history, whereas peer-to-peer (P2P) lending platforms often offer rates from 5% to 30%, depending on borrower risk levels. Unlike banks, P2P platforms use a risk-based pricing model that can result in competitive rates for borrowers with strong credit profiles but higher costs for riskier applicants. Comparing these options requires analyzing individual creditworthiness, loan terms, and platform-specific fees to determine the most cost-effective borrowing solution.

Eligibility and Approval Process for Borrowers

Personal loans typically require a strong credit score, steady income, and verified employment for eligibility, with approval processes often completed within a few business days through traditional banks or credit unions. Peer-to-peer lending platforms may have more flexible eligibility criteria, focusing on creditworthiness and borrower profile but can involve a lengthier approval process due to investor approval and platform review. Borrowers with lower credit scores might find peer-to-peer lending more accessible, while those needing quick access to funds might prefer the streamlined process of personal loans from financial institutions.

Loan Terms and Flexibility

Personal loans from banks typically offer fixed interest rates, defined repayment schedules, and loan terms ranging from one to seven years, providing predictable monthly payments. Peer-to-peer lending platforms often allow more flexible loan terms, including variable interest rates and customizable repayment periods, influenced by borrower creditworthiness and investor preferences. Borrowers seeking more adaptable and potentially faster funding might prefer P2P lending, while those prioritizing stable, long-term repayment plans may opt for traditional personal loans.

Fees and Hidden Charges to Watch Out For

Personal loans typically involve origination fees, prepayment penalties, and possible late payment charges, which can increase the overall borrowing cost. Peer-to-peer lending may have platform fees, service charges, and investor fees that are sometimes less transparent but can add up unexpectedly. Borrowers should carefully review the fee schedules and terms of both options to avoid hidden costs that impact affordability.

Impact on Credit Score: Personal Loans vs. P2P Lending

Personal loans typically involve checks by traditional credit bureaus, directly influencing credit scores through timely repayments or defaults. Peer-to-peer (P2P) lending platforms may report borrower activity to credit agencies, but the impact varies depending on the platform's policies and visibility to lenders. Borrowers should consider that consistent repayment on personal loans generally enhances credit profiles more predictably than P2P lending, which may have limited or delayed effects on credit scoring models.

Risks and Security for Borrowers

Personal loans from banks typically offer stronger regulatory protections and established security protocols, reducing the risk of fraud or default consequences for borrowers. Peer-to-peer lending platforms may carry higher risk due to less stringent oversight, increasing vulnerability to platform failure or data breaches. Assessing credit terms and platform reputation is crucial to mitigate risks and ensure secure borrowing experiences.

Which Option Is Better for Different Financial Goals?

Personal loans from banks offer fixed interest rates and structured repayment terms, making them ideal for borrowers seeking predictable monthly payments for consolidating debt or financing large expenses. Peer-to-peer lending platforms provide more flexible lending criteria and potentially lower interest rates, suitable for individuals with good credit aiming to fund smaller projects or entrepreneurship ventures. Choosing between the two depends on creditworthiness, loan amount, and financial goals, with banks favoring stability and peer-to-peer lending favoring accessibility and cost-efficiency.

Tips for Choosing the Right Borrowing Option

Evaluate interest rates, repayment terms, and eligibility criteria carefully when choosing between personal loans and peer-to-peer lending platforms. Assess your credit score and loan amount needed, as personal loans often offer fixed rates while peer-to-peer lending provides flexibility but may involve varying rates. Prioritize lenders with transparent fees, quick approval processes, and positive user reviews to ensure a suitable and cost-effective borrowing experience.

Related Important Terms

Alternative Credit Scoring

Personal loans typically rely on traditional credit scoring models like FICO, while peer-to-peer lending platforms often utilize alternative credit scoring methods incorporating social, transactional, and behavioral data to evaluate borrower risk more dynamically. This approach enables broader access to credit for individuals with limited or non-traditional credit histories, enhancing financial inclusion in the lending market.

Loan Stacking

Personal loan borrowers face stricter credit assessments and fixed interest rates, reducing risks linked to loan stacking compared to peer-to-peer lending platforms where multiple simultaneous loans increase default probability and complicate credit risk evaluation. Peer-to-peer lending offers faster approval and flexible terms but demands vigilant monitoring of total debt exposure to prevent over-leverage and financial strain.

Marketplace Lending Platforms

Marketplace lending platforms have revolutionized the borrowing landscape by offering personal loans through peer-to-peer lending, which often provides competitive interest rates compared to traditional banks. These platforms leverage technology to match borrowers directly with individual lenders, reducing overhead costs and enabling faster loan approvals with more flexible credit criteria.

Social Lending Networks

Personal loans from traditional banks offer fixed interest rates and predictable repayment schedules, providing a secure borrowing option with regulatory protections. Peer-to-peer lending through social lending networks connects borrowers directly with individual investors, often resulting in competitive rates and flexible terms but with higher risk due to less stringent oversight.

Crowdlending Risk Assessment

Personal loan risk assessment relies heavily on credit scores, income verification, and standardized underwriting criteria, ensuring regulated financial security and predictable repayment behavior. Peer-to-peer lending risk assessment incorporates borrower profiles, platform algorithms, and investor sentiment, exposing lenders to higher default variability but offering diversified risk through multiple small loans in crowdfunding models.

Automated Underwriting

Automated underwriting in personal loans leverages advanced algorithms and credit data to swiftly assess borrower risk, enabling faster approval times and standardized credit evaluations. Peer-to-peer lending platforms utilize automated underwriting models tailored to connect individual lenders with borrowers while incorporating social risk metrics and platform-specific criteria for customized credit decisions.

Micro-Borrowing

Personal loans from banks typically offer fixed interest rates and structured repayment schedules, providing stability for micro-borrowing needs with formal credit evaluations. Peer-to-peer lending platforms allow micro-borrowers access to funds through direct investor connections, often featuring flexible terms and competitive rates but with varying risk profiles depending on platform policies and borrower creditworthiness.

Dynamic Interest Rates

Personal loans typically feature fixed interest rates, providing predictable monthly payments, while peer-to-peer lending often employs dynamic interest rates that adjust based on the borrower's credit profile and market demand. The variability in P2P lending interest rates can offer lower initial rates but introduces potential fluctuations that impact overall borrowing costs compared to traditional personal loans.

Loan Participations

Personal loans offer fixed interest rates and predictable repayment schedules directly from banks, whereas peer-to-peer lending involves multiple investors funding the loan, creating loan participations that diversify risk but may face variable rates and fluctuating terms. Loan participations in P2P lending distribute credit exposure among investors, enhancing liquidity and potentially higher returns compared to traditional bank personal loans.

Digital Onboarding Verification

Digital onboarding verification for personal loans typically involves automated credit checks and identity verification through secure banking systems, ensuring swift approval within traditional financial frameworks. In peer-to-peer lending, digital verification leverages blockchain technology and biometric authentication to facilitate trust among individual lenders and borrowers while maintaining regulatory compliance.

Personal Loan vs Peer-to-Peer Lending for borrowing Infographic

moneydiff.com

moneydiff.com