A Checking Account offers traditional banking features such as unlimited transactions, direct deposits, and check writing suitable for everyday expenses. Spend Management Accounts focus on budgeting tools, spending controls, and real-time transaction tracking to help users manage daily finances more efficiently. Choosing between the two depends on whether you prioritize comprehensive banking services or enhanced financial oversight for daily transactions.

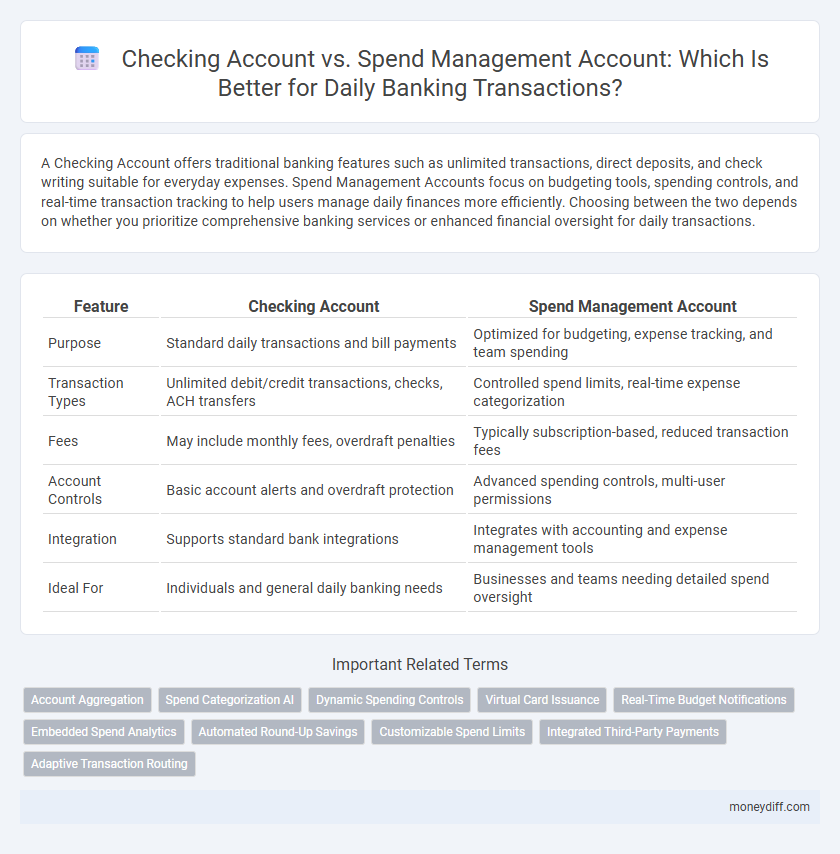

Table of Comparison

| Feature | Checking Account | Spend Management Account |

|---|---|---|

| Purpose | Standard daily transactions and bill payments | Optimized for budgeting, expense tracking, and team spending |

| Transaction Types | Unlimited debit/credit transactions, checks, ACH transfers | Controlled spend limits, real-time expense categorization |

| Fees | May include monthly fees, overdraft penalties | Typically subscription-based, reduced transaction fees |

| Account Controls | Basic account alerts and overdraft protection | Advanced spending controls, multi-user permissions |

| Integration | Supports standard bank integrations | Integrates with accounting and expense management tools |

| Ideal For | Individuals and general daily banking needs | Businesses and teams needing detailed spend oversight |

Introduction to Daily Transaction Accounts

Checking accounts provide a traditional banking solution for daily transactions, offering unlimited withdrawals, deposits, and access to checks and debit cards. Spend management accounts integrate advanced budgeting tools and real-time spending controls, enhancing financial oversight for users managing multiple expenses. Both account types facilitate everyday financial activities, but spend management accounts prioritize detailed expense tracking and spending limits.

What is a Checking Account?

A checking account is a deposit account offered by banks that allows easy access to funds for daily transactions through checks, debit cards, or electronic transfers. It provides features like no or low monthly fees, unlimited withdrawals, and direct deposit capabilities, making it ideal for managing everyday expenses and bill payments. Unlike spend management accounts, checking accounts typically do not include advanced budgeting tools or spending analytics.

What is a Spend Management Account?

A Spend Management Account is a specialized banking solution designed to streamline daily transactions by integrating budgeting, expense tracking, and payment controls within a single platform. Unlike traditional checking accounts, these accounts offer enhanced visibility into spending patterns and real-time management tools that help businesses and individuals maintain financial discipline. Features often include automated expense categorization, customizable spending limits, and seamless integration with accounting software, making them ideal for efficient cash flow management.

Core Features Comparison

Checking accounts offer unlimited transactions, debit card access, and ATM withdrawals, ideal for everyday spending and bill payments. Spend management accounts provide advanced expense tracking, multi-user access, and real-time budgeting tools designed for precise control over daily expenses. Core features highlight checking accounts for flexibility and ease, while spend management accounts emphasize enhanced financial oversight and accountability.

Fees and Cost Structures

Checking accounts typically charge monthly maintenance fees, overdraft fees, and minimum balance penalties, which can increase the overall cost of daily transactions. Spend management accounts often offer transparent fee structures with low or no transaction fees, designed to optimize cash flow and expense tracking for businesses. Evaluating fees such as transfer costs, ATM usage, and account access charges is crucial for minimizing expenses in daily financial operations.

User Experience and Accessibility

Checking accounts offer broad accessibility with physical branch support and widespread ATM networks, ensuring ease for daily cash withdrawals and deposits. Spend management accounts prioritize seamless digital user experience with real-time transaction tracking, customizable spending controls, and integrated budgeting tools tailored for mobile-first users. While checking accounts provide traditional banking flexibility, spend management accounts enhance accessibility through intuitive interfaces and instant notifications, optimizing everyday financial management.

Security and Fraud Protection

Checking accounts offer basic security features such as FDIC insurance and fraud alerts, but may have limited real-time monitoring capabilities. Spend management accounts provide enhanced security with advanced fraud detection algorithms, instant transaction notifications, and tighter spending controls tailored for daily transactions. These specialized accounts reduce the risk of unauthorized expenses by enabling customizable limits and quick card freezing options.

Integration with Financial Tools

Checking accounts offer basic integration with financial tools, allowing users to link their accounts to budgeting apps and online payment platforms for streamlined daily transactions. Spend management accounts provide advanced integration features, including real-time expense tracking, automated categorization, and seamless connectivity with enterprise resource planning (ERP) systems for enhanced financial oversight. These capabilities enable businesses and individuals to optimize cash flow management and ensure accurate financial reporting.

Suitability for Different User Profiles

Checking accounts provide seamless access to funds with features like unlimited transactions and ATM withdrawals, making them ideal for individuals with frequent daily expenses and bill payments. Spend management accounts offer advanced budgeting tools and real-time spending controls, suiting users who prioritize expense tracking and financial discipline. Both account types support direct deposits and electronic payments, but the choice depends on whether ease of access or detailed spending oversight is the primary need.

Making the Right Choice for Your Finances

Choosing between a checking account and a spend management account depends on your transaction needs and financial goals. Checking accounts offer unlimited access to funds with features like direct deposit and bill pay, ideal for routine expenses and cash flow management. Spend management accounts provide enhanced budgeting tools, real-time spending controls, and integration with financial apps to optimize daily money management and prevent overspending.

Related Important Terms

Account Aggregation

A Spend Management Account integrates advanced account aggregation technology, enabling users to consolidate multiple checking accounts and financial services into a single dashboard for streamlined daily transactions. This aggregation enhances expense tracking and budgeting accuracy compared to traditional checking accounts, which typically lack comprehensive multi-account visibility.

Spend Categorization AI

Spend Management Accounts utilize advanced AI-driven spend categorization to automatically classify daily transactions, enhancing budgeting accuracy and financial insights compared to traditional Checking Accounts, which typically lack such intelligent analytics. This AI technology streamlines expense tracking by organizing purchases into relevant categories in real-time, promoting more effective money management and personalized financial planning.

Dynamic Spending Controls

Dynamic spending controls in checking accounts allow real-time transaction monitoring and personalized alert settings, enhancing security and budgeting for daily expenses. Spend management accounts offer more granular control with features like automated spending limits, category-based restrictions, and instant card freezes, optimizing expense tracking for businesses and individuals.

Virtual Card Issuance

Checking accounts typically provide physical and virtual card issuance for daily transactions, ensuring seamless access to funds, whereas spend management accounts prioritize virtual cards with enhanced controls and customizable spending limits to optimize corporate expense tracking and fraud prevention. Virtual card issuance in spend management accounts streamlines payment processes by enabling instant card generation tied to specific budgets or vendors, significantly reducing risk compared to traditional checking account cards.

Real-Time Budget Notifications

Checking accounts typically provide basic transaction features without real-time budget notifications, limiting immediate spending awareness; spend management accounts enhance daily financial control by delivering instant alerts on budget status, helping users avoid overspending and better manage cash flow. Real-time budget notifications integrated into spend management accounts support proactive financial decisions and more efficient daily transaction tracking compared to traditional checking accounts.

Embedded Spend Analytics

Checking accounts provide basic transaction capabilities with limited insights, whereas spend management accounts enhance daily transactions through embedded spend analytics, offering real-time tracking and categorization of expenses. This integration enables users to optimize budgeting, detect spending patterns, and improve financial decision-making directly within their account interface.

Automated Round-Up Savings

Checking accounts provide fundamental transaction capabilities with minimal automation, while spend management accounts enhance daily financial control by integrating automated round-up savings features that transfer spare change from purchases into dedicated savings goals. Automated round-up technology optimizes cash flow management and encourages incremental saving without altering spending habits, offering a seamless method to boost savings effortlessly during routine transactions.

Customizable Spend Limits

Checking accounts offer basic transaction capabilities with fixed spending limits set by the bank, while spend management accounts provide highly customizable spend limits tailored to individual or business needs, enabling precise control over daily transactions. Enhanced features in spend management accounts include real-time limit adjustments, category-specific restrictions, and multi-user access controls to optimize financial oversight and prevent overspending.

Integrated Third-Party Payments

Checking accounts offer basic daily transaction capabilities but often lack seamless integration with third-party payment platforms, limiting real-time spend tracking and management. Spend management accounts provide enhanced features such as automated expense categorization, direct integration with payment gateways, and real-time synchronization with accounting software, optimizing financial control for businesses and individuals.

Adaptive Transaction Routing

Adaptive Transaction Routing in checking accounts optimizes daily transactions by intelligently directing payments through multiple pathways to reduce fees and enhance authorization success. Spend management accounts leverage this technology to provide seamless, real-time allocation of expenses, ensuring efficient budgeting and improved cash flow control for businesses.

Checking Account vs Spend Management Account for daily transactions Infographic

moneydiff.com

moneydiff.com