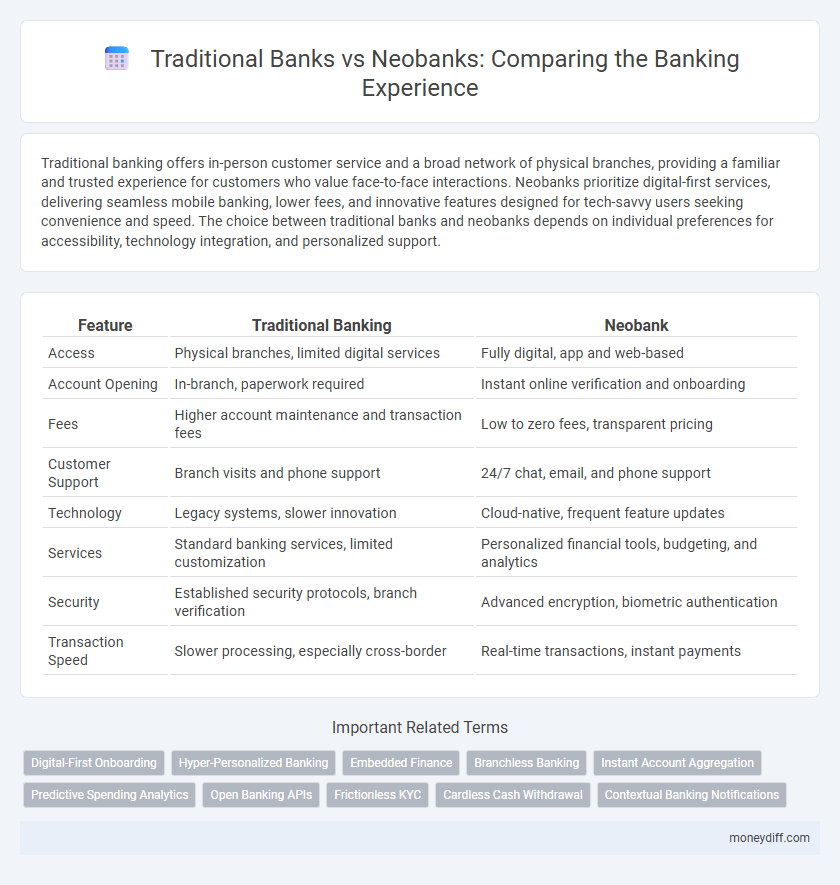

Traditional banking offers in-person customer service and a broad network of physical branches, providing a familiar and trusted experience for customers who value face-to-face interactions. Neobanks prioritize digital-first services, delivering seamless mobile banking, lower fees, and innovative features designed for tech-savvy users seeking convenience and speed. The choice between traditional banks and neobanks depends on individual preferences for accessibility, technology integration, and personalized support.

Table of Comparison

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Access | Physical branches, limited digital services | Fully digital, app and web-based |

| Account Opening | In-branch, paperwork required | Instant online verification and onboarding |

| Fees | Higher account maintenance and transaction fees | Low to zero fees, transparent pricing |

| Customer Support | Branch visits and phone support | 24/7 chat, email, and phone support |

| Technology | Legacy systems, slower innovation | Cloud-native, frequent feature updates |

| Services | Standard banking services, limited customization | Personalized financial tools, budgeting, and analytics |

| Security | Established security protocols, branch verification | Advanced encryption, biometric authentication |

| Transaction Speed | Slower processing, especially cross-border | Real-time transactions, instant payments |

Overview: Traditional Banks vs Neobanks

Traditional banks offer extensive branch networks, personalized customer service, and a wide range of financial products, often backed by established trust and regulatory compliance. Neobanks operate entirely online, providing streamlined digital platforms, lower fees, and faster account setup processes focused on user-friendly mobile experiences. Customers seeking comprehensive services may prefer traditional banks, while tech-savvy users prioritize neobanks for convenience and innovative digital features.

Core Differences in Banking Services

Traditional banking relies on physical branch networks offering personalized customer service, in-person transactions, and extensive product portfolios including loans, mortgages, and investment services. Neobanks operate entirely online with mobile-first platforms, providing streamlined, cost-efficient services such as instant account setup, lower fees, and real-time transaction notifications. Core differences lie in accessibility, operational costs, technological integration, and customer interaction methods, with neobanks emphasizing digital convenience and traditional banks focusing on comprehensive service breadth.

Onboarding & Account Opening Process

Traditional banking onboarding often involves physical branch visits, extensive paperwork, and longer processing times, making account opening less convenient. Neobanks leverage digital platforms and biometric verification to enable instant, fully online account opening with minimal documentation. This streamlined process enhances user experience, reduces friction, and accelerates access to banking services.

Digital Features and Technological Advancements

Traditional banking offers established physical branch networks and a wide range of in-person services, but often lags in digital innovations, relying on legacy systems that limit real-time processing and seamless mobile integration. Neobanks prioritize advanced digital features such as AI-driven financial management tools, instant payments, and intuitive app interfaces, providing enhanced convenience and personalized user experiences without physical locations. Technological advancements in neobanks enable greater agility in adopting blockchain, biometric security, and open banking APIs, reshaping how customers interact with financial services.

Fee Structures and Pricing Transparency

Traditional banking often involves complex fee structures with numerous hidden charges, including maintenance fees, overdraft penalties, and ATM usage costs. Neobanks prioritize pricing transparency by offering clear, straightforward fee schedules and many services with minimal or no fees. This shift enhances customer trust and lowers overall banking expenses, making neobanks increasingly attractive for cost-conscious consumers.

Security, Trust, and Regulatory Compliance

Traditional banks leverage longstanding regulatory frameworks and robust security protocols, ensuring high levels of trust and compliance through government oversight. Neobanks prioritize innovative technology and user-centric features while adhering to digital-specific regulatory standards, offering secure yet agile banking experiences. Both banking models emphasize security, but traditional banks benefit from established reputations, whereas neobanks focus on transparency and rapid adaptation to evolving compliance requirements.

Customer Support: Human vs Automated Experience

Traditional banking offers personalized customer support through in-branch visits and direct contact with bank representatives, fostering trust and immediate problem resolution. Neobanks rely heavily on automated systems and AI-driven chatbots, providing 24/7 support but sometimes lacking the nuanced understanding of complex issues that human agents offer. Customer satisfaction in banking often hinges on the balance between efficient digital assistance and the empathetic, tailored service found in traditional human interactions.

Mobile App Usability and Accessibility

Traditional banking apps often lag in mobile usability due to outdated interfaces and limited accessibility features, impacting customer satisfaction and ease of use. Neobanks prioritize intuitive design, seamless navigation, and enhanced accessibility, offering features like biometric login and real-time notifications that improve user experience. Mobile app usability in neobanks leads to higher engagement rates and accommodates diverse user needs, making digital banking more inclusive and efficient.

Product Offerings: Loans, Credit, and Savings

Traditional banking offers a wide range of loans, credit products, and savings accounts backed by established financial institutions with physical branches, providing personalized service and security. Neobanks focus on digital-first, user-friendly platforms delivering streamlined loan applications, instant credit decisions, and high-yield savings through innovative technology and lower fees. While traditional banks excel in comprehensive product variety and trust, neobanks prioritize convenience, speed, and competitive interest rates tailored to tech-savvy customers.

Future Trends: The Evolution of Banking

Future trends in banking highlight a significant shift from traditional banking to neobanks, driven by the demand for enhanced digital experiences and streamlined services. Neobanks leverage artificial intelligence, blockchain technology, and open banking APIs to offer personalized, real-time financial solutions that traditional banks often struggle to match. This evolution is reshaping customer expectations, as convenience, speed, and innovation become the cornerstones of modern banking experiences.

Related Important Terms

Digital-First Onboarding

Digital-first onboarding in neobanks streamlines account setup with instant identity verification and minimal paperwork, enhancing user convenience and reducing processing times compared to traditional banks. Traditional banking often relies on in-person visits and manual documentation, leading to slower onboarding and less seamless digital experiences.

Hyper-Personalized Banking

Traditional banking often relies on standardized services with limited customization, restricting the potential for hyper-personalized banking experiences. Neobanks leverage advanced data analytics and AI to deliver highly tailored financial products and real-time insights, enhancing customer engagement and satisfaction.

Embedded Finance

Traditional banking relies on physical branches and legacy systems, limiting seamless integration of financial services, whereas neobanks leverage embedded finance to offer API-driven, in-app banking experiences that enhance customer convenience and personalization. Embedded finance enables neobanks to integrate payments, lending, and insurance directly into digital platforms, transforming the banking experience with real-time, context-aware financial products.

Branchless Banking

Neobanks offer a fully branchless banking experience, utilizing digital platforms and mobile apps to provide seamless account management, real-time transactions, and personalized financial services, eliminating the need for physical branches. Traditional banks rely heavily on in-person branch interactions for customer service and transactions, which can result in slower processes and limited accessibility compared to the instant, 24/7 access offered by neobanks.

Instant Account Aggregation

Traditional banking often lacks real-time account aggregation, causing delays in financial overview and decision-making, whereas neobanks leverage advanced APIs to provide instant, seamless account aggregation across multiple financial institutions, enhancing user experience and financial management efficiency. Instant account aggregation in neobanks enables customers to access consolidated financial data instantly, facilitating better budgeting, personalized insights, and faster transaction tracking.

Predictive Spending Analytics

Traditional banking often relies on historical transaction data, offering limited predictive spending analytics that may lack real-time insights and personalized alerts. Neobanks leverage advanced AI and machine learning to provide dynamic, predictive spending analytics that enhance budgeting accuracy and proactive financial management for users.

Open Banking APIs

Traditional banking often relies on legacy systems with limited Open Banking API integration, resulting in slower, less flexible customer experiences, while neobanks leverage advanced Open Banking APIs to offer seamless, real-time financial services with enhanced personalization and innovation. Open Banking APIs in neobanks facilitate instant account aggregation, streamlined payments, and better data-driven insights, transforming the overall banking experience beyond conventional branch-based interactions.

Frictionless KYC

Traditional banking often involves lengthy KYC processes requiring physical document submission and in-branch verification, causing delays and customer inconvenience. Neobanks leverage digital identity verification and AI-driven automation to provide a frictionless KYC experience, enabling instant account opening and enhanced user satisfaction.

Cardless Cash Withdrawal

Traditional banking relies heavily on physical branches and cards for cash withdrawal, often requiring customers to visit ATMs or banks, which can be time-consuming and less flexible. Neobanks offer cardless cash withdrawal through mobile apps, enabling instant, secure transactions and enhancing the convenience of accessing funds without the need for physical cards.

Contextual Banking Notifications

Traditional banking relies on generic, delayed notifications that often lack personalization, while neobanks leverage real-time contextual banking notifications powered by AI to deliver tailored alerts based on spending patterns and location. This advanced notification system enhances customer engagement and empowers users to manage finances proactively with precise, actionable insights.

Traditional Banking vs Neobank for banking experience Infographic

moneydiff.com

moneydiff.com