Retail banks offer established infrastructure and a wide range of personalized financial services, making them reliable for comprehensive money management. Challenger banks prioritize innovative technology and user-friendly digital experiences, often providing lower fees and faster transactions for everyday banking needs. Choosing between the two depends on the level of convenience, cost efficiency, and technological integration desired for managing personal finances.

Table of Comparison

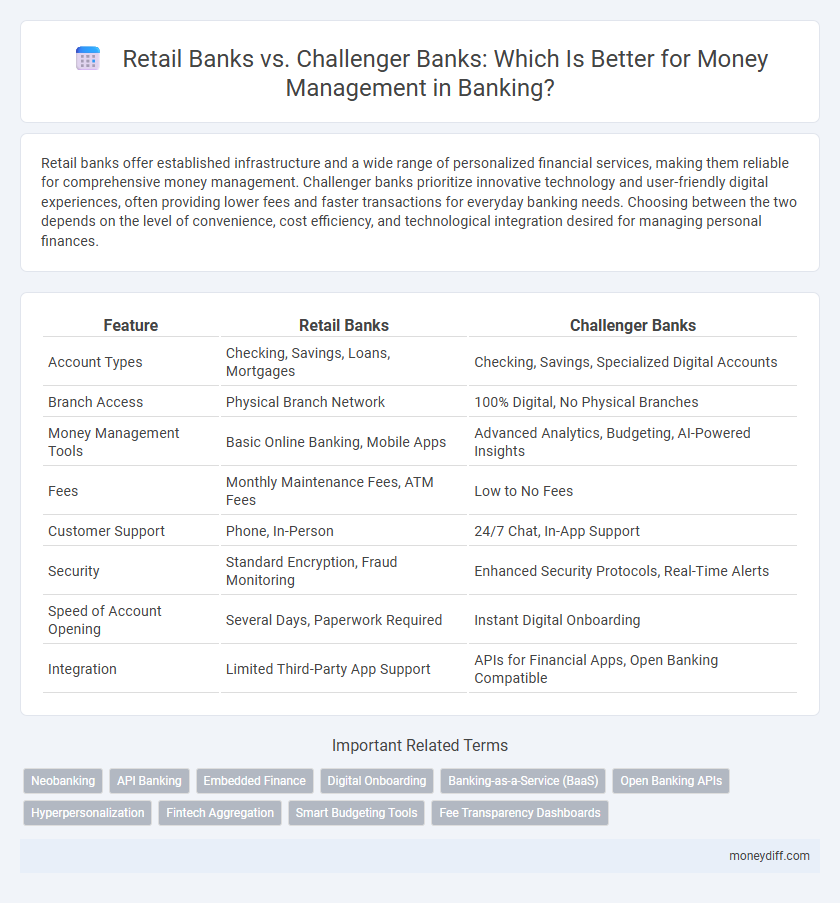

| Feature | Retail Banks | Challenger Banks |

|---|---|---|

| Account Types | Checking, Savings, Loans, Mortgages | Checking, Savings, Specialized Digital Accounts |

| Branch Access | Physical Branch Network | 100% Digital, No Physical Branches |

| Money Management Tools | Basic Online Banking, Mobile Apps | Advanced Analytics, Budgeting, AI-Powered Insights |

| Fees | Monthly Maintenance Fees, ATM Fees | Low to No Fees |

| Customer Support | Phone, In-Person | 24/7 Chat, In-App Support |

| Security | Standard Encryption, Fraud Monitoring | Enhanced Security Protocols, Real-Time Alerts |

| Speed of Account Opening | Several Days, Paperwork Required | Instant Digital Onboarding |

| Integration | Limited Third-Party App Support | APIs for Financial Apps, Open Banking Compatible |

Retail Banks vs Challenger Banks: An Overview

Retail banks offer extensive branch networks, personalized customer service, and a wide range of financial products tailored for traditional money management. Challenger banks leverage digital platforms, providing seamless mobile experiences, lower fees, and innovative budgeting tools aimed at tech-savvy customers. Both retail and challenger banks cater to different user preferences, with retail banks emphasizing stability and in-person support, while challenger banks prioritize convenience and technology-driven solutions.

Key Features of Traditional Retail Banks

Traditional retail banks offer extensive branch networks providing in-person services essential for complex transactions and personalized financial advice. They deliver a broad range of products including checking and savings accounts, mortgages, and personal loans, supported by established security measures and regulatory compliance. Their integration with ATM networks and robust customer support systems ensures reliable access to funds and assistance for everyday money management needs.

What Sets Challenger Banks Apart?

Challenger banks distinguish themselves through innovative digital-first platforms, offering seamless money management with real-time spending insights, automated savings tools, and lower fees compared to traditional retail banks. Their agility in adopting technology enables personalized financial services, such as AI-driven budgeting and instant payment notifications, enhancing user control and convenience. Unlike retail banks, challenger banks often bypass physical branches, reducing overhead costs and passing savings to customers through competitive interest rates and reduced transaction charges.

Account Opening: Simplicity and Speed

Retail banks typically require extensive documentation and in-person visits for account opening, resulting in longer processing times. Challenger banks leverage digital platforms with streamlined verification processes, enabling customers to open accounts swiftly, often within minutes. This speed and simplicity in account opening make challenger banks highly appealing for tech-savvy users seeking efficient money management.

Fees and Charges: A Comparative Analysis

Retail banks typically impose higher fees and charges on services such as account maintenance, overdrafts, and ATM usage, reflecting their extensive branch networks and traditional infrastructure costs. Challenger banks often offer lower or no fees, leveraging digital platforms to reduce operational expenses and attract tech-savvy customers seeking cost-effective money management solutions. Comparing fee structures highlights the growing consumer preference for transparent, affordable banking options provided by challenger banks in the competitive financial landscape.

Digital Tools for Money Management

Retail banks offer comprehensive digital tools for money management, including mobile apps with budgeting features, automated alerts, and integrated bill payments, leveraging established customer bases and extensive banking infrastructure. Challenger banks emphasize innovative, user-friendly digital platforms with real-time transaction categorization, AI-driven financial insights, and seamless integrations with third-party financial services to enhance personalized money management. Both banking types prioritize security and convenience but differ in digital agility and customization, impacting user experience and control over personal finances.

Security Measures and Consumer Protection

Retail banks implement robust security measures such as multi-factor authentication, encryption protocols, and fraud detection algorithms to safeguard customer accounts and transactions. Challenger banks leverage advanced technologies like biometric verification and real-time transaction monitoring to enhance consumer protection against cyber threats. Both banking models adhere to regulatory frameworks like PCI DSS and GDPR to ensure comprehensive data privacy and secure money management for users.

Customer Service: Traditional vs Digital Support

Retail banks offer personalized customer service through extensive branch networks and in-person consultations, providing direct interaction and immediate assistance. Challenger banks prioritize digital support with user-friendly apps, AI-driven chatbots, and 24/7 online availability, ensuring convenience and rapid response times. Customers seeking hands-on guidance may prefer retail banks, while tech-savvy users often favor challenger banks' seamless digital experience for money management.

Integration with Personal Finance Apps

Retail banks often provide seamless integration with major personal finance apps, allowing users to track spending, set budgets, and manage accounts within a unified platform. Challenger banks, while increasingly enhancing app compatibility, typically offer more specialized APIs that support real-time notifications and advanced analytics for improved money management. The choice between these banks depends on the level of integration and the specific financial tools users require for effective budgeting and expense tracking.

Choosing the Right Banking Partner for Your Financial Goals

Retail banks offer extensive branch networks, personalized customer service, and a broad range of financial products ideal for traditional money management needs. Challenger banks provide innovative digital platforms with lower fees, real-time transaction tracking, and automated budgeting tools tailored for tech-savvy consumers seeking convenience and cost-efficiency. Evaluating factors such as accessibility, service features, and technological integration helps in choosing the right banking partner aligned with your specific financial goals.

Related Important Terms

Neobanking

Neobanks leverage advanced digital platforms and AI-driven tools to offer personalized money management solutions, often outperforming traditional retail banks in user experience and cost efficiency. These challenger banks prioritize seamless mobile interfaces, real-time analytics, and low fees, attracting a tech-savvy audience seeking innovative financial services beyond conventional retail banking.

API Banking

Retail banks offer established API banking services that integrate with traditional money management tools, providing customers with secure access to account information and payment functionalities. Challenger banks leverage advanced API banking platforms to deliver innovative, real-time money management features, such as instant payments, automated budgeting, and personalized financial insights.

Embedded Finance

Retail banks leverage established customer bases and extensive branch networks to integrate embedded finance solutions seamlessly within traditional money management services, enhancing user convenience and trust. Challenger banks prioritize digital innovation and agility, embedding advanced financial tools like real-time budgeting, payment automation, and personalized wealth management directly into their platforms, driving superior customer engagement and financial control.

Digital Onboarding

Retail banks offer comprehensive digital onboarding platforms integrating identity verification and secure document submission, enhancing customer trust with established brand reliability. Challenger banks prioritize speed and user experience in digital onboarding, utilizing AI-driven KYC processes to streamline account opening and enable instant access to money management tools.

Banking-as-a-Service (BaaS)

Retail banks leverage established infrastructures and customer bases to offer comprehensive money management services, while challenger banks innovate rapidly through Banking-as-a-Service (BaaS) models, enabling seamless integration of financial products via APIs for personalized and efficient user experiences. BaaS platforms empower challenger banks to scale quickly, reduce operational costs, and deliver real-time data insights, transforming traditional banking by enhancing customer-centric money management solutions.

Open Banking APIs

Retail banks leverage Open Banking APIs to provide customers seamless access to consolidated financial data and traditional banking services, ensuring robust security and comprehensive product offerings. Challenger banks exploit Open Banking APIs to deliver innovative, user-centric money management tools, enabling real-time insights and personalized financial recommendations through agile digital platforms.

Hyperpersonalization

Retail banks leverage extensive customer data and traditional channels to offer personalized money management solutions, while challenger banks utilize advanced AI and machine learning algorithms to deliver hyperpersonalized, real-time financial insights and tailored services through digital platforms. The hyperpersonalization in challenger banks enhances user experience by predicting individual financial behaviors and preferences, enabling seamless money management and proactive financial planning.

Fintech Aggregation

Retail banks offer established financial services with broad branch networks, while challenger banks leverage fintech aggregation to provide seamless, personalized money management through integrated apps and real-time financial insights. Fintech aggregation enables challenger banks to consolidate multiple financial accounts, optimizing budgeting, spending analysis, and investment tracking within a single platform.

Smart Budgeting Tools

Retail banks often provide basic budgeting tools integrated with traditional accounts, while challenger banks leverage advanced AI-driven smart budgeting tools that offer real-time expense tracking, personalized spending insights, and automated savings goals. These innovative features enable challenger banks to deliver more efficient and user-friendly money management solutions tailored to tech-savvy consumers.

Fee Transparency Dashboards

Retail banks often lack clear fee transparency dashboards, leading to customer confusion over hidden charges and account fees. Challenger banks prioritize user-friendly fee transparency dashboards that provide real-time updates on transaction costs, fostering better money management and financial control.

Retail Banks vs Challenger Banks for money management. Infographic

moneydiff.com

moneydiff.com