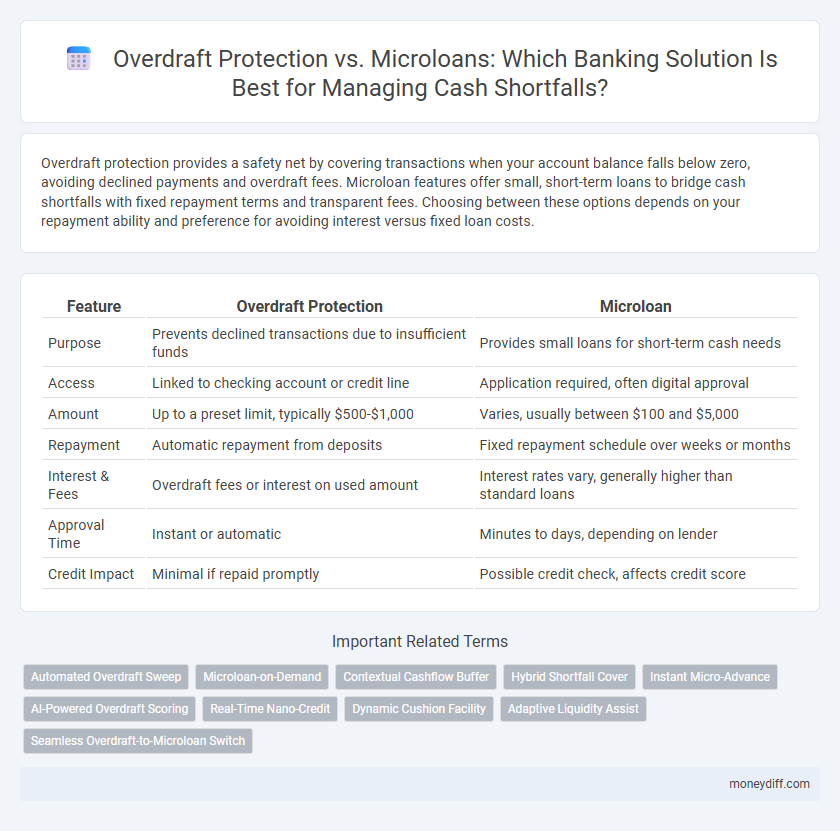

Overdraft protection provides a safety net by covering transactions when your account balance falls below zero, avoiding declined payments and overdraft fees. Microloan features offer small, short-term loans to bridge cash shortfalls with fixed repayment terms and transparent fees. Choosing between these options depends on your repayment ability and preference for avoiding interest versus fixed loan costs.

Table of Comparison

| Feature | Overdraft Protection | Microloan |

|---|---|---|

| Purpose | Prevents declined transactions due to insufficient funds | Provides small loans for short-term cash needs |

| Access | Linked to checking account or credit line | Application required, often digital approval |

| Amount | Up to a preset limit, typically $500-$1,000 | Varies, usually between $100 and $5,000 |

| Repayment | Automatic repayment from deposits | Fixed repayment schedule over weeks or months |

| Interest & Fees | Overdraft fees or interest on used amount | Interest rates vary, generally higher than standard loans |

| Approval Time | Instant or automatic | Minutes to days, depending on lender |

| Credit Impact | Minimal if repaid promptly | Possible credit check, affects credit score |

Understanding Overdraft Protection in Modern Banking

Overdraft protection in modern banking acts as a safety net that automatically covers transactions exceeding the available balance, preventing declined payments and costly fees. This feature links a checking account to a savings account, credit card, or a pre-approved line of credit to seamlessly cover shortfalls. Banks increasingly offer customizable overdraft protection plans that enhance financial flexibility and reduce reliance on high-interest microloans.

The Rise of Microloans for Short-Term Cash Needs

Microloans have surged as a preferred solution for short-term cash needs, offering quick access to small sums with structured repayment plans that minimize the risk of overdraft fees. Unlike overdraft protection, which may lead to high-interest charges and bank penalties, microloans provide transparency and affordability, promoting better financial management. This rise in microloan adoption reflects a shift towards tailored financial products designed to support consumers facing temporary cash shortfalls efficiently.

Overdraft Protection vs Microloan: Key Differences

Overdraft Protection provides immediate coverage by allowing transactions to exceed the account balance up to a preset limit, typically linked to a checking account, minimizing fees for short-term cash shortfalls. In contrast, Microloans offer structured, small-dollar loans with fixed repayment terms, suitable for longer-term solutions but may involve interest and credit checks. Choosing between Overdraft Protection and Microloan depends on the urgency, amount needed, and repayment ability during cash flow gaps.

Fees and Costs: Comparing Overdraft and Microloans

Overdraft protection typically incurs flat fees or per-transaction charges that can quickly add up during frequent use, whereas microloans often have fixed interest rates and repayment terms that may prove more predictable and transparent. Overdraft fees can range from $25 to $35 per occurrence, while microloan interest rates vary but may be lower over time if repaid promptly. Evaluating the total cost implications and fee structures of both options enables borrowers to manage cash shortfalls more cost-effectively and avoid unexpected financial burdens.

Application Process: Simplicity and Speed

Overdraft protection typically offers a simpler and faster application process, often integrated directly with existing checking accounts, enabling immediate access to funds during a cash shortfall. Microloan features usually require a more detailed application, including credit checks and approval timelines, which can delay fund availability. Selecting overdraft protection provides near-instant liquidity, while microloans may involve a more rigorous but potentially larger funding option.

Credit Impact: How Each Option Affects Your Score

Overdraft protection generally has a minimal immediate impact on your credit score since it is a service linked to your checking account rather than a loan. Microloans, however, are reported to credit bureaus and can positively or negatively affect your credit score depending on timely repayments and loan management. Selecting microloans can build credit history, whereas relying on overdraft protection primarily avoids fees without influencing creditworthiness.

Flexibility and Repayment Terms Analyzed

Overdraft protection offers flexible access to funds by covering shortfalls up to a predetermined limit with automatic repayment from the linked account. Microloan features provide structured borrowing with defined repayment schedules, often including fixed terms and interest rates tailored to small amounts. Evaluating flexibility and repayment terms reveals that overdraft protection favors immediate liquidity, while microloans emphasize planned repayment with clearer financial obligations.

Customer Eligibility and Accessibility

Overdraft Protection typically requires customers to have an established checking account in good standing with a history of responsible account management, making it easily accessible for existing bank clients. Microloan features often have broader eligibility criteria, targeting customers with limited access to traditional credit by assessing alternative data points such as transaction history and income flow. Both services aim to provide quick cash shortfall solutions, but microloans may offer greater accessibility to underserved or new banking customers without the stringent requirements of overdraft protection.

Risk Management: Pros and Cons for Consumers

Overdraft protection offers a safety net by covering transactions that exceed account balances, helping consumers avoid declined payments and potential fees, but it can lead to high interest charges and increased debt if frequently used. Microloans provide short-term, fixed-amount credit with defined repayment schedules, promoting responsible borrowing and better budgeting, though they may involve higher fees or stringent eligibility criteria. Consumers must weigh overdraft convenience against microloan discipline to effectively manage cash flow risks and minimize financial strain.

Choosing the Right Solution for Your Cash Shortfall

Overdraft protection offers immediate coverage for unexpected cash shortfalls by linking your checking account to a savings account or line of credit, preventing declined transactions and fees. Microloans provide a structured borrowing option with fixed repayment terms, ideal for planned short-term funding needs beyond overdraft limits. Selecting the right solution depends on factors such as repayment capacity, urgency, cost of funds, and the size of the cash shortfall.

Related Important Terms

Automated Overdraft Sweep

Automated Overdraft Sweep enables seamless transfers from linked accounts to cover cash shortfalls, reducing reliance on costly overdraft fees compared to traditional overdraft protection. This feature enhances liquidity management by instantly sweeping funds, unlike microloans which require application approval and interest payments.

Microloan-on-Demand

Microloan-on-demand services provide instant access to small, short-term funds to cover cash shortfalls, offering flexible repayment options and typically lower fees compared to traditional overdraft protection. These microloans enhance financial agility by enabling customers to manage unexpected expenses without incurring significant overdraft penalties or risking account holds.

Contextual Cashflow Buffer

Overdraft protection provides a seamless cashflow buffer by automatically covering shortfalls up to a predetermined limit, reducing the risk of bounced payments and fees. Microloan features offer targeted short-term liquidity with fixed repayment terms, enabling precise cashflow management during unexpected expenses.

Hybrid Shortfall Cover

Hybrid Shortfall Cover combines overdraft protection and microloan features to provide seamless access to funds during cash shortfalls, minimizing fees and interest costs. This strategic solution ensures liquidity by automatically triggering microloans when overdraft limits are reached, optimizing financial flexibility for account holders.

Instant Micro-Advance

Instant Micro-Advance provides immediate access to small funds during cash shortfalls, offering a flexible alternative to traditional overdraft protection by minimizing fees and approval times. This feature enhances liquidity management by allowing seamless, low-cost advances tailored to urgent financial needs without impacting credit scores.

AI-Powered Overdraft Scoring

AI-powered overdraft scoring enhances traditional overdraft protection by analyzing transaction history, spending patterns, and credit behavior in real time to determine eligibility and personalized limits, minimizing costly overdraft fees. Compared to microloan features, this technology offers instant, automated decisions and tailored coverage that proactively prevents cash shortfalls without the need for loan application processes or interest charges.

Real-Time Nano-Credit

Real-time nano-credit solutions provide instant access to microloans, ensuring seamless cash flow during shortfalls without the high fees associated with traditional overdraft protection. These digital lending features leverage advanced algorithms to approve small, short-term credit in seconds, enhancing financial stability and reducing reliance on costly overdraft fees.

Dynamic Cushion Facility

Dynamic Cushion Facility offers a flexible alternative to traditional overdraft protection by automatically adjusting credit limits based on real-time account activity, minimizing cash shortfalls and reducing reliance on costly microloans. Unlike fixed overdraft or microloan options, this feature dynamically buffers liquidity fluctuations, enhancing cash flow management and lowering overdraft fees for banking customers.

Adaptive Liquidity Assist

Adaptive Liquidity Assist enhances cash flow resilience by seamlessly integrating overdraft protection with microloan features, providing immediate access to funds during shortfalls without incurring high fees. This adaptive approach optimizes liquidity management by tailoring credit solutions to individual spending patterns and financial behavior.

Seamless Overdraft-to-Microloan Switch

Seamless overdraft-to-microloan switch enhances cash shortfall management by automatically converting overdraft usage into a structured microloan with lower interest rates and clear repayment terms, reducing penalty fees and improving financial stability. This feature integrates real-time account monitoring and instant credit evaluation to ensure uninterrupted access to funds while minimizing borrower stress and maintaining credit score integrity.

Overdraft Protection vs Microloan Feature for cash shortfall. Infographic

moneydiff.com

moneydiff.com