International wire transfers rely on traditional banking networks, often resulting in higher fees and longer processing times for sending money abroad. Blockchain remittance leverages decentralized technology to provide faster, more transparent, and cost-effective cross-border payments. The increased security and real-time tracking capabilities of blockchain make it a competitive alternative to conventional wire transfers for global money transfers.

Table of Comparison

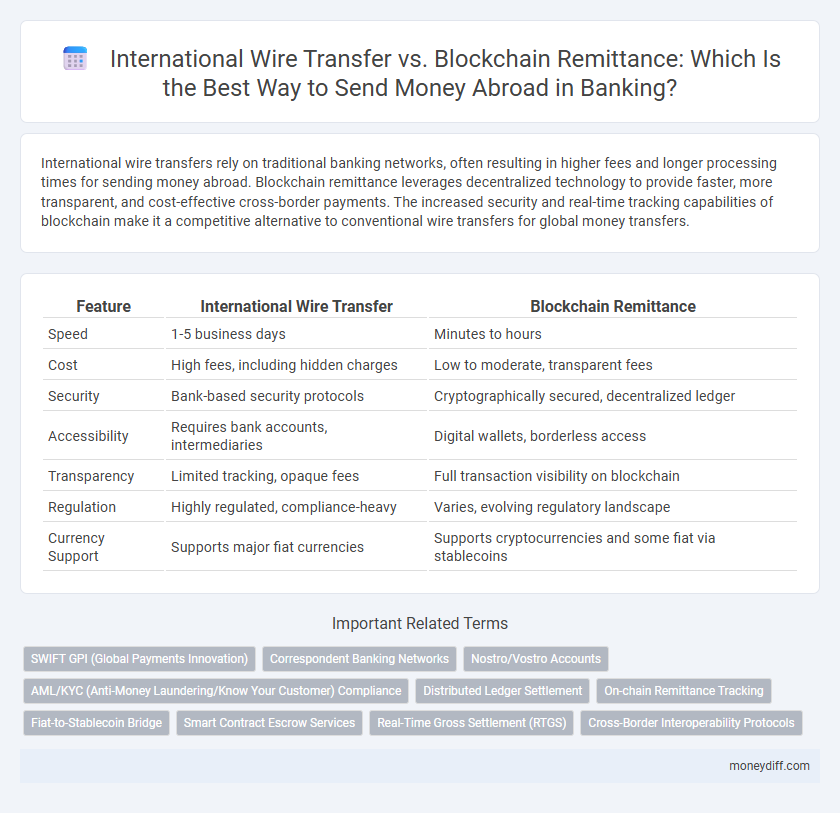

| Feature | International Wire Transfer | Blockchain Remittance |

|---|---|---|

| Speed | 1-5 business days | Minutes to hours |

| Cost | High fees, including hidden charges | Low to moderate, transparent fees |

| Security | Bank-based security protocols | Cryptographically secured, decentralized ledger |

| Accessibility | Requires bank accounts, intermediaries | Digital wallets, borderless access |

| Transparency | Limited tracking, opaque fees | Full transaction visibility on blockchain |

| Regulation | Highly regulated, compliance-heavy | Varies, evolving regulatory landscape |

| Currency Support | Supports major fiat currencies | Supports cryptocurrencies and some fiat via stablecoins |

Introduction: Evolving Methods for Sending Money Abroad

International wire transfers have traditionally dominated the landscape for sending money abroad, relying on established banking networks and SWIFT protocols to ensure secure cross-border transactions. Blockchain remittance introduces a decentralized approach using distributed ledger technology, offering faster settlement times and reduced transaction fees compared to conventional banking methods. As global demand for efficient and transparent money transfer solutions grows, these evolving methods reflect a significant shift in the financial industry's approach to international payments.

What Is an International Wire Transfer?

An international wire transfer is a traditional banking method for sending money across borders through secure electronic networks such as SWIFT or Fedwire. It involves the transfer of funds from one bank account to another, requiring details like the recipient's bank name, account number, and SWIFT/BIC code. This process typically takes one to five business days and includes fees that vary based on the banks and countries involved.

Understanding Blockchain-Based Remittance

Blockchain-based remittance leverages decentralized ledger technology to enable faster, more secure cross-border money transfers with lower fees compared to traditional international wire transfers. By eliminating intermediaries and using cryptocurrencies or stablecoins, blockchain remittances enhance transparency and reduce the risk of fraud or delays. Financial institutions adopting blockchain solutions can offer clients improved real-time tracking and settlement processes while maintaining regulatory compliance.

Speed Comparison: Wire Transfer vs Blockchain

International wire transfers typically take 2 to 5 business days due to intermediaries and banking hours, whereas blockchain remittance processes transactions within minutes by leveraging decentralized networks. Blockchain technology reduces settlement time drastically by eliminating the need for correspondent banks and manual reconciliation. Faster transaction speeds in blockchain remittance enable near-instant cross-border payments, enhancing efficiency in global money transfers.

Cost and Fees: Which Option Is Cheaper?

International wire transfers typically involve higher fees and less favorable exchange rates due to intermediary banks and regulatory compliance costs, often ranging from $30 to $50 per transaction. Blockchain remittance leverages decentralized ledgers to minimize transaction fees, frequently reducing costs to under $5 and offering more transparent currency conversions. Choosing blockchain for cross-border money transfers generally results in significant savings on both costs and fees compared to traditional banking wire services.

Security Features of Each Method

International wire transfers utilize established banking networks with encryption protocols and multi-factor authentication to ensure data security and prevent unauthorized access. Blockchain remittance employs decentralized ledger technology with cryptographic validation, ensuring transaction immutability and reducing the risk of fraud or tampering. Both methods incorporate robust security measures, but blockchain's transparency and decentralized nature offer enhanced protection against cyber threats and third-party interference.

Accessibility and Global Reach

International wire transfers rely on traditional banking networks that can limit accessibility, especially in regions with underbanked populations or stringent correspondent banking relationships. Blockchain remittance platforms leverage decentralized networks to provide faster and more affordable cross-border payments, expanding global reach to remote and underserved areas. By eliminating intermediaries, blockchain technology enhances accessibility for individuals in countries with limited banking infrastructure.

Transparency and Tracking Transactions

International wire transfers often rely on traditional banking networks like SWIFT, where transparency is limited by intermediary institutions and tracking can be delayed or incomplete. Blockchain remittance leverages decentralized ledger technology, providing real-time, immutable transaction records and enhanced transparency accessible to both sender and receiver. This distributed ledger system reduces the risk of fraud and enables precise tracking of funds throughout the entire transfer process.

Regulatory and Compliance Considerations

International wire transfers are subject to stringent regulatory frameworks such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws, requiring thorough customer due diligence and reporting to authorities like the Financial Crimes Enforcement Network (FinCEN). Blockchain remittance leverages decentralized ledger technology but must navigate evolving regulatory landscapes, including compliance with the Travel Rule and jurisdiction-specific digital asset regulations. Financial institutions must ensure adherence to KYC (Know Your Customer) protocols and data privacy standards to mitigate risks associated with cross-border transactions in both systems.

Choosing the Right Method for Sending Money Internationally

Choosing the right method for sending money internationally depends on factors such as cost, speed, and security. International wire transfers offer a reliable and widely accepted option with regulated processes but often come with higher fees and longer processing times. Blockchain remittance provides faster transactions and lower fees through decentralized networks, making it ideal for cost-sensitive and time-critical transfers.

Related Important Terms

SWIFT GPI (Global Payments Innovation)

International wire transfers using SWIFT GPI (Global Payments Innovation) offer enhanced transparency and faster transaction tracking compared to traditional methods, enabling banks to provide real-time payment status updates and reduce settlement times to under 24 hours. Blockchain remittance leverages decentralized ledgers to further lower costs and increase security, but SWIFT GPI remains the dominant global standard, facilitating interoperability among over 11,000 financial institutions in 200+ countries.

Correspondent Banking Networks

Correspondent banking networks rely on intermediary banks to facilitate international wire transfers, often resulting in higher fees and slower transaction times compared to blockchain remittance, which enables direct, real-time cross-border payments through decentralized ledgers. This traditional system's dependence on multiple correspondent banks increases operational complexity and opacity, whereas blockchain technology enhances transparency, reduces costs, and speeds up settlement processes.

Nostro/Vostro Accounts

International wire transfers rely heavily on Nostro and Vostro accounts to facilitate cross-border transactions by maintaining correspondent banking relationships and ensuring liquidity between financial institutions. Blockchain remittances eliminate the need for these intermediary accounts by using decentralized ledgers, which reduce settlement times and lower transaction costs.

AML/KYC (Anti-Money Laundering/Know Your Customer) Compliance

International wire transfers rely on established banking networks with stringent AML/KYC protocols enforced by financial institutions and regulatory bodies to verify sender and recipient identities, minimizing fraud and money laundering risks. Blockchain remittance platforms utilize decentralized ledgers combined with enhanced KYC processes and smart contracts to provide transparent transaction histories and real-time compliance monitoring, improving AML effectiveness while enabling faster cross-border payments.

Distributed Ledger Settlement

International wire transfers rely on traditional banking networks with correspondent banks, often causing delays and higher fees, whereas blockchain remittance utilizes distributed ledger technology to enable near-instant settlement and transparent, secure transactions. Distributed ledger settlement reduces intermediaries and minimizes transaction costs, offering a more efficient and traceable solution for cross-border money transfers.

On-chain Remittance Tracking

International wire transfers rely on traditional banking networks with limited transparency and longer processing times, whereas blockchain remittance offers on-chain remittance tracking that enables real-time visibility and enhanced security by recording transactions on an immutable ledger. This decentralized tracking system reduces errors and fraud risks, ensuring faster and more reliable cross-border payments.

Fiat-to-Stablecoin Bridge

International wire transfers rely on traditional banking networks that often involve multiple intermediaries, resulting in longer processing times and higher fees for cross-border transactions. The fiat-to-stablecoin bridge in blockchain remittance streamlines global money transfers by converting fiat currency into stablecoins, enabling near-instant settlements and reduced costs through decentralized networks.

Smart Contract Escrow Services

Smart contract escrow services in blockchain remittance ensure secure, transparent, and automated release of funds during international wire transfers, reducing fraud risk and enhancing trust between parties. Traditional international wire transfers depend on intermediary banks, resulting in longer processing times and higher fees compared to blockchain's efficient, real-time settlement through programmable escrow contracts.

Real-Time Gross Settlement (RTGS)

International wire transfers rely on the Real-Time Gross Settlement (RTGS) system for immediate, high-value cross-border transactions but often incur higher fees and longer processing times due to intermediary banks. Blockchain remittance leverages decentralized ledger technology to offer faster, cost-effective transfers with enhanced transparency, bypassing traditional RTGS infrastructure in many cases.

Cross-Border Interoperability Protocols

Cross-border interoperability protocols in international wire transfers rely on established banking networks like SWIFT, ensuring secure and compliant fund movement but often involve higher fees and longer processing times. Blockchain remittance leverages decentralized ledgers and standardized protocols such as Interledger and ISO 20022 to enable near-instant, cost-effective international payments with enhanced transparency and reduced reliance on intermediary banks.

International Wire Transfer vs Blockchain Remittance for sending money abroad. Infographic

moneydiff.com

moneydiff.com