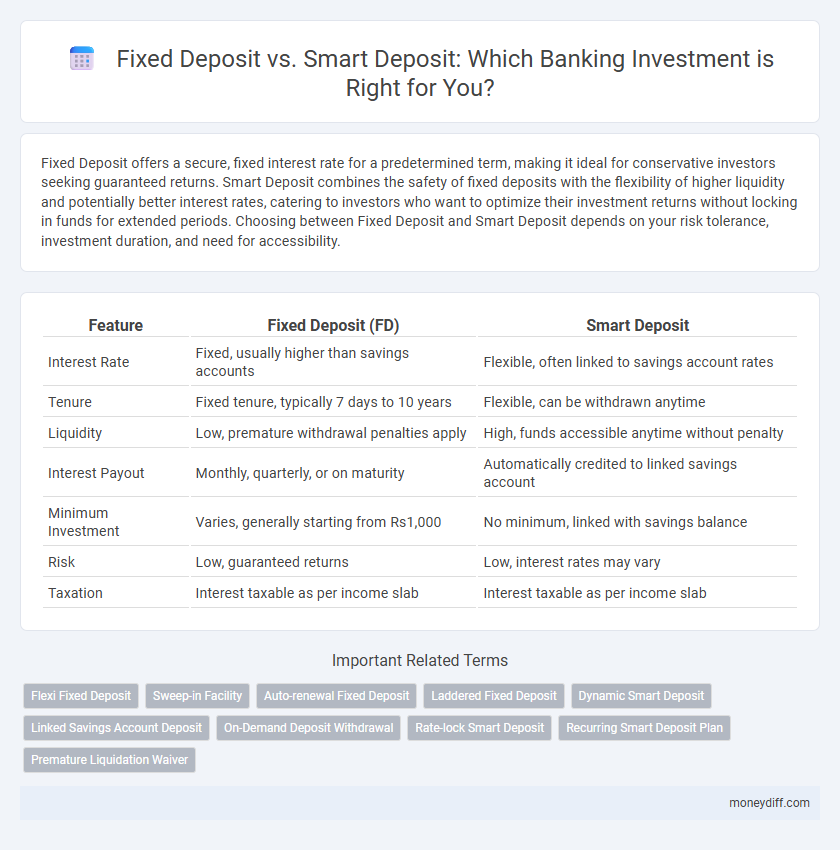

Fixed Deposit offers a secure, fixed interest rate for a predetermined term, making it ideal for conservative investors seeking guaranteed returns. Smart Deposit combines the safety of fixed deposits with the flexibility of higher liquidity and potentially better interest rates, catering to investors who want to optimize their investment returns without locking in funds for extended periods. Choosing between Fixed Deposit and Smart Deposit depends on your risk tolerance, investment duration, and need for accessibility.

Table of Comparison

| Feature | Fixed Deposit (FD) | Smart Deposit |

|---|---|---|

| Interest Rate | Fixed, usually higher than savings accounts | Flexible, often linked to savings account rates |

| Tenure | Fixed tenure, typically 7 days to 10 years | Flexible, can be withdrawn anytime |

| Liquidity | Low, premature withdrawal penalties apply | High, funds accessible anytime without penalty |

| Interest Payout | Monthly, quarterly, or on maturity | Automatically credited to linked savings account |

| Minimum Investment | Varies, generally starting from Rs1,000 | No minimum, linked with savings balance |

| Risk | Low, guaranteed returns | Low, interest rates may vary |

| Taxation | Interest taxable as per income slab | Interest taxable as per income slab |

Understanding Fixed Deposits: A Traditional Safe Haven

Fixed deposits remain a traditional safe haven for conservative investors seeking guaranteed returns with minimal risk. These time-bound deposits offer fixed interest rates over a specified tenure, ensuring capital preservation and predictable income. Compared to smart deposits, fixed deposits provide stability without the variability linked to market-driven rates or flexible withdrawal features.

Decoding Smart Deposits: The Modern Banking Solution

Smart Deposits combine the safety of Fixed Deposits with enhanced liquidity and flexibility, allowing investors to earn higher interest rates while accessing funds before maturity. Unlike traditional Fixed Deposits, Smart Deposits automatically optimize returns by sweeping surplus funds into higher-yield instruments without disrupting the principal. This modern banking solution caters to dynamic investment needs, offering seamless management and maximizing the growth potential of idle funds.

Interest Rates: Fixed Deposits vs Smart Deposits

Fixed Deposits typically offer a fixed interest rate ranging from 5% to 7% per annum, providing stable and predictable returns over a specified tenure. Smart Deposits, however, feature dynamic interest rates that can vary between 4.5% and 8%, often linked to market trends or linked account balances, allowing for potentially higher earnings. Comparing these, Fixed Deposits suit risk-averse investors valuing certainty, while Smart Deposits attract those seeking flexible, possibly higher interest with some rate variability.

Liquidity and Withdrawal Flexibility

Fixed Deposits offer higher interest rates but restrict liquidity with penalties on premature withdrawal, making them less flexible for urgent cash needs. Smart Deposits provide enhanced withdrawal flexibility by allowing partial or full withdrawals without significant penalties, ensuring better liquidity for investors. Choosing between the two depends on the investor's priority for high returns versus immediate access to funds.

Risk Factors: Which Option is Safer?

Fixed Deposits offer guaranteed returns with minimal risk, backed by bank insurance schemes such as the FDIC in the US or Deposit Insurance and Credit Guarantee Corporation (DICGC) in India, making them a safer option for conservative investors. Smart Deposits may provide higher flexibility and potentially better interest rates but often involve market-linked components or early withdrawal penalties, increasing risk exposure. Investors prioritizing capital preservation should prefer Fixed Deposits due to their stable principal protection and predictable interest earnings.

Minimum Investment Requirements

Fixed Deposit accounts typically require a higher minimum investment, often starting at $1,000 or more, making them less accessible for budget-conscious investors. Smart Deposit options usually offer lower minimum investment thresholds, sometimes as low as $100, providing greater flexibility and ease of entry. Investors prioritizing accessibility and smaller capital commitments often prefer Smart Deposits for their affordability and convenience.

Tax Implications for Both Deposits

Fixed deposits often attract Tax Deducted at Source (TDS) on the interest earned if it exceeds the threshold limit, impacting overall returns. Smart deposits, typically structured with flexible withdrawal options and varying interest calculations, may offer tax-saving benefits under specific government schemes but require careful examination of applicable tax rules. Investors must assess the taxability of interest income and potential exemptions to optimize after-tax gains between fixed and smart deposits.

Tenure and Returns: Comparing Growth Potential

Fixed Deposits offer a fixed tenure ranging from 7 days to 10 years with a guaranteed interest rate, providing predictable returns but limited flexibility. Smart Deposits typically feature flexible tenures and variable interest rates linked to market conditions, potentially yielding higher returns depending on economic trends. Comparing growth potential, Fixed Deposits ensure steady capital appreciation, while Smart Deposits may outperform during favorable market cycles but carry higher risk.

Who Should Choose Fixed Deposits?

Fixed Deposits are ideal for conservative investors seeking guaranteed returns with minimal risk and fixed interest rates over a predetermined tenure. They suit individuals prioritizing capital preservation and steady income, such as retirees or risk-averse savers. Those needing predictable maturity dates and protection from market volatility should choose Fixed Deposits over more flexible options like Smart Deposits.

Who Benefits Most from Smart Deposits?

Smart Deposits benefit investors seeking flexibility and higher interest rates by allowing automatic rollover of principal and interest without locking funds for extended periods, unlike traditional Fixed Deposits. They are ideal for individuals with fluctuating liquidity needs or those aiming to optimize returns through dynamic interest rate environments. Corporates and high-net-worth individuals often leverage Smart Deposits to balance short-term cash management with yield maximization.

Related Important Terms

Flexi Fixed Deposit

Flexi Fixed Deposit combines the high interest rates of traditional Fixed Deposits with the liquidity of a savings account, allowing investors to earn better returns while maintaining easy access to funds. Unlike standard Fixed Deposits, Flexi Fixed Deposits enable automatic sweeping of surplus savings into fixed deposits, optimizing investment growth without locking in the entire corpus.

Sweep-in Facility

Fixed Deposit offers a guaranteed interest rate with fixed tenure, while Smart Deposit integrates a Sweep-in Facility that automatically transfers surplus funds from your Savings Account to a high-interest Fixed Deposit, optimizing returns without locking liquidity. This seamless liquidity management ensures you earn higher interest on idle funds while retaining easy access to cash for daily transactions.

Auto-renewal Fixed Deposit

Fixed Deposit offers a guaranteed interest rate with an auto-renewal option that ensures seamless reinvestment at maturity, maintaining capital growth without manual intervention. Smart Deposit enhances flexibility by allowing partial withdrawals and dynamic interest rates, but lacks the consistent auto-renewal feature that traditional Fixed Deposits provide.

Laddered Fixed Deposit

Laddered Fixed Deposits offer staggered maturity dates, enabling investors to access funds periodically and capitalize on varying interest rates, enhancing liquidity and returns compared to traditional Fixed Deposits. Smart Deposits integrate automation and flexible tenure options, yet laddering remains a strategic choice for risk management and optimizing interest income in fixed-income banking investments.

Dynamic Smart Deposit

Dynamic Smart Deposit offers flexible interest rates that adjust with market fluctuations, providing potentially higher returns compared to traditional Fixed Deposits with fixed interest rates. Investors benefit from liquidity and automated reinvestment features in Dynamic Smart Deposits, enhancing portfolio growth without compromising capital security.

Linked Savings Account Deposit

Linked Savings Account Deposits in a Fixed Deposit scheme offer guaranteed returns with a fixed tenure, ideal for risk-averse investors seeking capital safety, whereas Smart Deposits provide flexible withdrawal options and potentially higher interest rates by linking directly to savings accounts for enhanced liquidity and accessibility. Comparing liquidity, interest rates, and tenure commitment helps investors choose between the stable, predetermined earnings of Fixed Deposits and the adaptable, benefit-driven Smart Deposit linked to savings accounts.

On-Demand Deposit Withdrawal

Fixed Deposit offers a fixed tenure with higher interest rates but limits on early withdrawal, whereas Smart Deposit provides flexible on-demand withdrawal options allowing investors to access funds anytime without penalties, enhancing liquidity. Smart Deposit combines competitive interest rates with the convenience of immediate fund access, making it ideal for investors prioritizing both returns and flexibility.

Rate-lock Smart Deposit

Fixed Deposit offers a guaranteed fixed interest rate over a specified tenure, providing predictable returns ideal for risk-averse investors. Rate-lock Smart Deposit combines the benefits of fixed returns with flexibility by locking in a competitive interest rate while allowing early withdrawal without penalties, optimizing investment growth and liquidity.

Recurring Smart Deposit Plan

The Recurring Smart Deposit Plan offers flexible monthly contributions with higher interest rates compared to traditional Fixed Deposits, enhancing long-term wealth accumulation. It combines disciplined saving habits with the benefit of compounding interest, making it ideal for investors seeking steady growth and liquidity.

Premature Liquidation Waiver

Fixed Deposit accounts typically impose penalties on premature withdrawal, reducing overall returns, whereas Smart Deposit options often include a premature liquidation waiver that allows investors to access funds without penalty, enhancing liquidity. This waiver feature makes Smart Deposits a more flexible investment choice for those seeking both security and quick access to capital.

Fixed Deposit vs Smart Deposit for investment Infographic

moneydiff.com

moneydiff.com