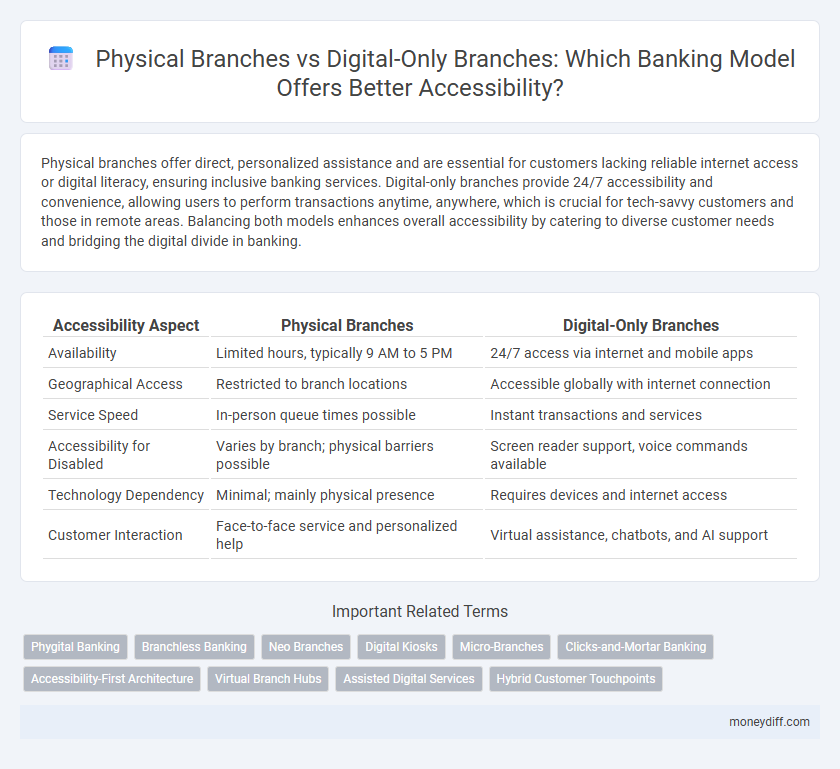

Physical branches offer direct, personalized assistance and are essential for customers lacking reliable internet access or digital literacy, ensuring inclusive banking services. Digital-only branches provide 24/7 accessibility and convenience, allowing users to perform transactions anytime, anywhere, which is crucial for tech-savvy customers and those in remote areas. Balancing both models enhances overall accessibility by catering to diverse customer needs and bridging the digital divide in banking.

Table of Comparison

| Accessibility Aspect | Physical Branches | Digital-Only Branches |

|---|---|---|

| Availability | Limited hours, typically 9 AM to 5 PM | 24/7 access via internet and mobile apps |

| Geographical Access | Restricted to branch locations | Accessible globally with internet connection |

| Service Speed | In-person queue times possible | Instant transactions and services |

| Accessibility for Disabled | Varies by branch; physical barriers possible | Screen reader support, voice commands available |

| Technology Dependency | Minimal; mainly physical presence | Requires devices and internet access |

| Customer Interaction | Face-to-face service and personalized help | Virtual assistance, chatbots, and AI support |

Physical vs Digital-Only Banking: An Accessibility Overview

Physical branches provide tactile accessibility benefits, including in-person assistance and specialized services for customers with disabilities such as braille documents or wheelchair-friendly facilities. Digital-only banking offers 24/7 access and customizable interfaces like screen readers and voice commands, expanding reach to users who face geographical or mobility limitations. Hybrid models combining physical and digital elements optimize accessibility by catering to diverse customer needs through personalized touchpoints and inclusive technology.

Understanding Accessibility Needs in Banking

Physical branches offer personalized assistance and accommodate customers with limited digital literacy or disabilities, ensuring inclusivity for underserved populations. Digital-only branches provide 24/7 access with user-friendly interfaces and adaptive technologies like screen readers and voice commands, enhancing convenience for tech-savvy clients. Banks must analyze demographic data and accessibility requirements to create hybrid models that address diverse customer needs effectively.

Navigating In-Person Banking: Accessibility at Physical Branches

Physical bank branches offer crucial accessibility features such as wheelchair ramps, braille signage, and dedicated service desks designed for customers with disabilities. These locations provide direct human interaction, enabling personalized assistance for complex banking needs that digital platforms may not fully address. Physical branches also serve individuals without reliable internet access, ensuring inclusive financial services for all demographic groups.

Digital-Only Banks: Accessibility Features and Limitations

Digital-only banks enhance accessibility by offering 24/7 online services with user-friendly mobile apps designed for various disabilities, including screen readers and voice commands. However, limitations exist in the absence of in-person support, which can pose challenges for customers with complex needs or those lacking digital literacy and reliable internet access. These factors highlight the importance of integrating robust customer support and digital education to improve overall accessibility in digital-only banking.

Technology Barriers: Digital-Only Banking and the Accessibility Gap

Physical branches provide critical access for customers with limited digital literacy, ensuring personalized assistance and face-to-face support that digital-only banks cannot fully replicate. Technology barriers such as lack of reliable internet access or smartphone ownership contribute to the accessibility gap, disproportionately affecting older adults and low-income populations. Bridging this divide requires inclusive digital solutions and maintaining physical locations to serve all demographics effectively.

Physical Branches: Personalized Assistance for Diverse Needs

Physical branches provide personalized assistance that caters to diverse customer needs, including complex transactions and financial advice tailored to individual circumstances. They offer accessibility for customers who may have limited digital literacy or prefer face-to-face interactions, ensuring inclusivity across all demographics. Physical locations also support services like cash deposits and notarizations, which digital-only branches cannot effectively replicate.

The Role of ATMs and Adaptive Equipment in Branch Accessibility

ATMs equipped with adaptive technology such as tactile keypads, audio guidance, and screen readers significantly enhance accessibility for customers with disabilities in both physical and digital-only banking environments. Physical branches continue to integrate these adaptive features to support visually and mobility-impaired clients, ensuring compliance with accessibility standards. Digital-only branches complement this by offering remote access to adaptive tools but rely heavily on the availability of nearby ATMs and assistive devices for comprehensive accessibility.

Mobile Apps and Online Platforms: Enhancing Digital Inclusion

Mobile apps and online platforms enhance digital inclusion by providing 24/7 access to banking services, especially for users in remote or underserved areas. Advanced features such as biometric authentication, voice recognition, and multilingual interfaces improve accessibility for diverse populations, including the elderly and individuals with disabilities. These digital tools reduce dependency on physical branches, enabling seamless financial management through intuitive, secure, and user-friendly experiences across various devices.

Inclusive Banking: Addressing Disabilities Across Platforms

Physical branches provide tactile cues, face-to-face assistance, and adaptive devices essential for customers with visual, hearing, or mobility impairments, ensuring comprehensive accessibility. Digital-only branches leverage screen readers, voice commands, and customizable interfaces but may exclude individuals lacking digital literacy or reliable internet access. Combining physical accessibility features with inclusive digital design fosters equitable banking experiences for people with various disabilities across platforms.

Future Trends: Bridging Accessibility in Hybrid Banking Models

Hybrid banking models are evolving to bridge the accessibility gap by integrating physical branches with advanced digital platforms, enhancing customer reach and convenience. Future trends emphasize adaptive technologies such as AI-driven kiosks and biometric authentication in branches, combined with seamless mobile banking experiences to cater to diverse user needs. This integrated approach ensures financial inclusion, offering personalized service while maintaining the flexibility of digital access in underserved and urban areas alike.

Related Important Terms

Phygital Banking

Phygital banking combines the accessibility of physical branches with the convenience of digital-only services, enhancing customer experience by seamlessly integrating in-person support and online banking tools. This hybrid model addresses diverse customer needs, improving financial inclusion by offering personalized assistance alongside 24/7 digital access.

Branchless Banking

Branchless banking enhances accessibility by providing financial services through digital platforms, eliminating the need for physical branches and reducing geographic and time constraints for customers. This digital-only approach supports underserved populations by enabling 24/7 access to banking services via smartphones and internet connectivity, significantly increasing financial inclusion.

Neo Branches

Neo branches enhance accessibility by integrating digital technologies within physical locations, offering seamless customer experiences without sacrificing human interaction. These hybrid models reduce geographic limitations evident in traditional branches and compensate for the exclusive reliance on digital-only branches, catering effectively to diverse user needs.

Digital Kiosks

Digital kiosks enhance banking accessibility by providing self-service options in physical locations, bridging the gap between traditional branches and fully digital banking. These kiosks offer features such as cash deposits, withdrawals, and account management, enabling customers to access essential services without visiting staffed branches.

Micro-Branches

Micro-branches enhance accessibility by providing localized physical banking services in underserved areas, combining the convenience of digital technology with personalized customer support. These compact units utilize advanced digital tools to facilitate efficient transactions while maintaining human interaction, bridging the gap between fully digital-only branches and traditional full-service locations.

Clicks-and-Mortar Banking

Clicks-and-mortar banking combines physical branches with digital platforms, enhancing accessibility by allowing customers to choose between in-person service and online convenience. This hybrid approach caters to diverse preferences, improving user experience and expanding reach beyond the limitations of digital-only or branch-exclusive models.

Accessibility-First Architecture

Physical branches provide essential tactile interfaces and face-to-face support crucial for customers with limited digital literacy or disabilities, ensuring comprehensive accessibility compliance under regulations like the ADA. Digital-only branches implement Accessibility-First Architecture through screen reader compatibility, voice commands, and high-contrast designs, optimizing financial services for users with visual, auditory, and motor impairments while expanding reach beyond geographic constraints.

Virtual Branch Hubs

Virtual Branch Hubs enhance accessibility by providing 24/7 banking services through digital platforms, eliminating geographical and time barriers inherent in physical branches. These hubs integrate AI-driven support, secure transaction processing, and personalized financial advice, ensuring inclusive access for customers regardless of location or mobility constraints.

Assisted Digital Services

Physical branches enhance accessibility by offering assisted digital services where trained staff help customers navigate online banking platforms, bridging the gap for less tech-savvy users. Digital-only branches rely on virtual support tools like chatbots and video calls but may struggle to fully replicate the personalized assistance available in physical locations.

Hybrid Customer Touchpoints

Hybrid customer touchpoints combine physical branches and digital-only platforms to enhance banking accessibility, offering clients the flexibility to choose between in-person services and seamless online interactions. This integrated approach improves overall customer experience by leveraging the convenience of digital channels alongside the personalized support available at physical locations.

Physical Branches vs Digital-Only Branches for accessibility. Infographic

moneydiff.com

moneydiff.com