Cheque books offer a traditional method for withdrawals, allowing customers to write and submit physical cheques that require manual processing. Smart Payment Requests provide a faster, digital alternative by enabling instant, secure transfers through mobile or online banking platforms without the need for paper-based transactions. Choosing between the two depends on convenience, processing speed, and preference for digital versus physical transaction records.

Table of Comparison

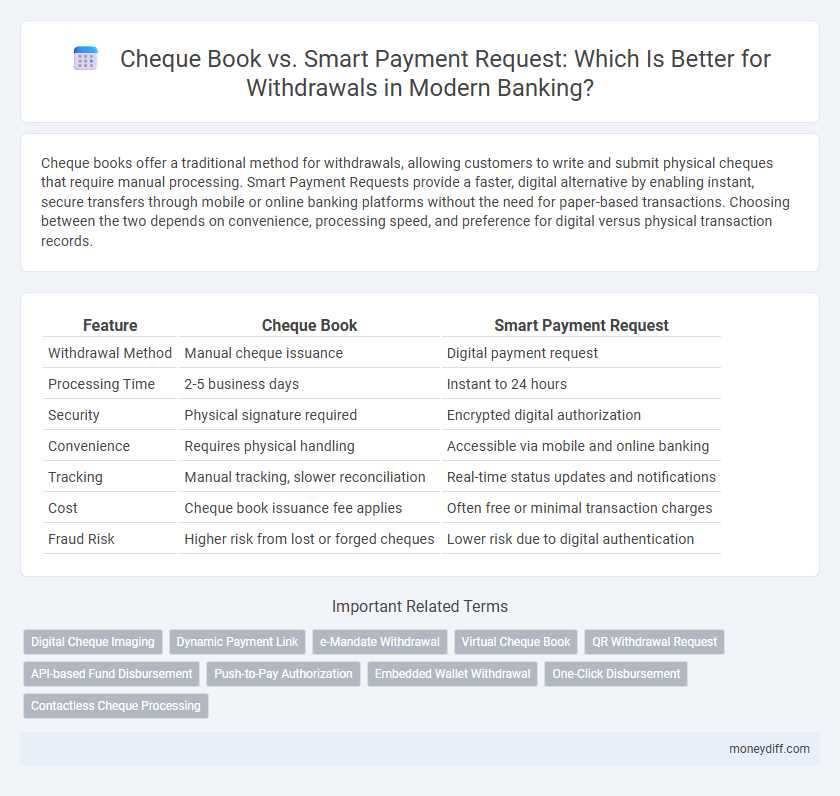

| Feature | Cheque Book | Smart Payment Request |

|---|---|---|

| Withdrawal Method | Manual cheque issuance | Digital payment request |

| Processing Time | 2-5 business days | Instant to 24 hours |

| Security | Physical signature required | Encrypted digital authorization |

| Convenience | Requires physical handling | Accessible via mobile and online banking |

| Tracking | Manual tracking, slower reconciliation | Real-time status updates and notifications |

| Cost | Cheque book issuance fee applies | Often free or minimal transaction charges |

| Fraud Risk | Higher risk from lost or forged cheques | Lower risk due to digital authentication |

Cheque Book vs Smart Payment Request: An Overview

Cheque books enable traditional withdrawal methods through physical checks, offering familiarity and security for account holders. Smart Payment Requests utilize digital platforms to facilitate faster, contactless withdrawals by sending electronic payment prompts directly to the payer. The comparison highlights cheque books as paper-based tools with processing delays, whereas Smart Payment Requests provide real-time, convenient, and traceable transactions suited for modern banking needs.

How Cheque Books Work in Traditional Banking

Cheque books in traditional banking function as authorized payment tools allowing account holders to withdraw funds by writing cheques, which are then processed manually by banks. Each cheque contains essential details such as the payer's signature, date, payee name, and amount, enabling secure and traceable transactions. This process involves physical handling and clearing through banking networks, often leading to longer processing times compared to digital alternatives.

Understanding Smart Payment Requests

Smart Payment Requests enable seamless and secure withdrawals by allowing customers to initiate payments directly through digital banking platforms without the need for physical cheque books. This method reduces processing time, minimizes fraud risks, and enhances transaction transparency compared to traditional cheque-based withdrawals. Adopting Smart Payment Requests streamlines cash management for both banks and customers, promoting efficient and paperless financial operations.

Security Features: Cheque Books vs Digital Payment Requests

Cheque books rely on physical security measures such as watermarks, microprinting, and signature verification to prevent fraud, but remain vulnerable to theft or forgery. Smart payment requests leverage digital encryption, multi-factor authentication, and real-time transaction monitoring to enhance security and reduce the risk of unauthorized withdrawals. Banks increasingly favor smart payment requests due to their ability to provide traceable, instantaneous verification compared to traditional cheque processing.

Speed and Convenience: Comparing Withdrawal Methods

Cheque book withdrawals require physical presence and manual processing, leading to longer transaction times and delays. Smart payment requests enable instant digital withdrawals through mobile apps or online platforms, significantly enhancing speed and convenience. This shift aligns with increasing consumer demand for quick, hassle-free banking experiences.

Cost Implications for Users

Cheque books typically involve costs such as issuance fees, processing charges, and potential stop-payment fees, impacting user expenses. Smart payment requests reduce or eliminate these fees by leveraging digital platforms, enabling cost-efficient and faster withdrawal transactions. Users benefit from minimized transactional costs and increased transparency when opting for smart payment requests over traditional cheque withdrawals.

Record Keeping and Transaction Tracking

Cheque books provide a tangible, sequential record of withdrawals, enabling straightforward reconciliation and tracking through physical stubs and bank statements. Smart Payment Requests offer real-time digital transaction tracking with automated records stored securely in online banking systems, enhancing quick access and audit capabilities. Both methods support effective record keeping, but Smart Payment Requests streamline electronic monitoring and reduce manual entry errors compared to traditional cheque books.

Compatibility with Modern Banking Services

Smart Payment Requests offer seamless integration with mobile banking apps, allowing instant withdrawal authorizations and real-time transaction tracking, which enhances user convenience. Cheque books require physical handling and manual processing, making them less compatible with digital platforms and slower in execution. Modern banking services prioritize digital solutions like Smart Payment Requests to support secure, efficient, and paperless withdrawal processes.

User Experience and Accessibility

Cheque books require physical presence and manual handling, limiting accessibility and slowing withdrawal processes compared to Smart Payment Requests, which offer instant, digital transactions via mobile apps or online platforms. Smart Payment Requests enhance user experience by providing real-time notifications, reducing errors, and enabling withdrawals anytime, anywhere without visiting a bank branch. This digital method supports better accessibility for users with mobility challenges and promotes seamless financial management through integrated banking systems.

Future Trends in Withdrawal Methods

Smart payment requests are rapidly surpassing traditional cheque books as the preferred withdrawal method due to enhanced security features and real-time processing capabilities. Financial institutions are increasingly integrating biometric authentication and blockchain technology to streamline smart payment requests, reducing fraud and settlement times. Emerging trends indicate a shift towards mobile-first banking platforms that prioritize instant, digital withdrawals over manual cheque transactions.

Related Important Terms

Digital Cheque Imaging

Digital cheque imaging transforms traditional cheque book withdrawals by enabling instant electronic processing, reducing fraud risk through image verification and providing faster fund access compared to physical cheque handling. Smart Payment Requests complement this by offering real-time payment initiation and tracking, streamlining withdrawals within banking apps without the need for paper cheques.

Dynamic Payment Link

Dynamic Payment Links in Smart Payment Requests offer enhanced security and real-time transaction tracking compared to traditional cheque books, reducing fraud risks and processing times. Unlike static cheque books, these digital links enable instant, contactless withdrawals and seamless integration with mobile banking platforms, improving user convenience and operational efficiency.

e-Mandate Withdrawal

e-Mandate withdrawal offers a secure and automated alternative to traditional cheque book transactions, enabling customers to authorize recurring payments directly from their bank accounts without manual intervention. This digital-first approach enhances transaction speed, reduces processing errors, and provides real-time tracking compared to the slower clearance process associated with cheque book withdrawals.

Virtual Cheque Book

A Virtual Cheque Book offers a secure, paperless alternative to traditional cheque books, enabling users to issue and manage cheques electronically through online banking platforms. Smart Payment Requests streamline withdrawal processes by allowing instant, authenticated fund transfers without the need for physical signatures, reducing processing time and minimizing fraud risks.

QR Withdrawal Request

QR Withdrawal Request via Smart Payment eliminates the need for physical cheque books by enabling secure, instant fund withdrawals through scanned codes linked to the user's bank account. This method reduces processing time and errors associated with manual cheque handling, enhancing convenience and transaction transparency for both banks and customers.

API-based Fund Disbursement

API-based fund disbursement enables faster, more secure withdrawals compared to traditional cheque books by automating payment processing and reducing manual errors. Smart Payment Requests leverage real-time data validation and digital authorization, enhancing transparency and efficiency in fund transfer workflows.

Push-to-Pay Authorization

Push-to-Pay Authorization in Smart Payment Requests offers real-time, secure withdrawal approvals directly from a user's mobile device, eliminating the delays and risks associated with traditional cheque book transactions. This digital method enhances convenience, reduces fraud risks, and provides instant transaction confirmation compared to the manual process of cheque issuance and clearing.

Embedded Wallet Withdrawal

Cheque books require manual processing and physical handling, resulting in slower withdrawal times and increased operational costs compared to Smart Payment Requests, which enable instant, secure, and paperless Embedded Wallet Withdrawals. Smart Payment Requests leverage real-time banking APIs to facilitate seamless fund transfers directly into embedded wallets, enhancing customer convenience and reducing transaction friction.

One-Click Disbursement

Smart Payment Requests enable one-click disbursement, streamlining withdrawals by eliminating manual processing associated with cheque books, thereby enhancing transaction speed and reducing operational overhead. This digital mechanism leverages secure electronic authentication to facilitate immediate fund transfers, outperforming traditional cheque-based withdrawals in efficiency and user convenience.

Contactless Cheque Processing

Smart Payment Requests expedite withdrawals through contactless cheque processing, eliminating the need for physical cheque books and reducing transaction time significantly. This technology enhances security by enabling remote verification and digital authorization, streamlining banking operations and improving customer convenience.

Cheque Book vs Smart Payment Request for withdrawals. Infographic

moneydiff.com

moneydiff.com