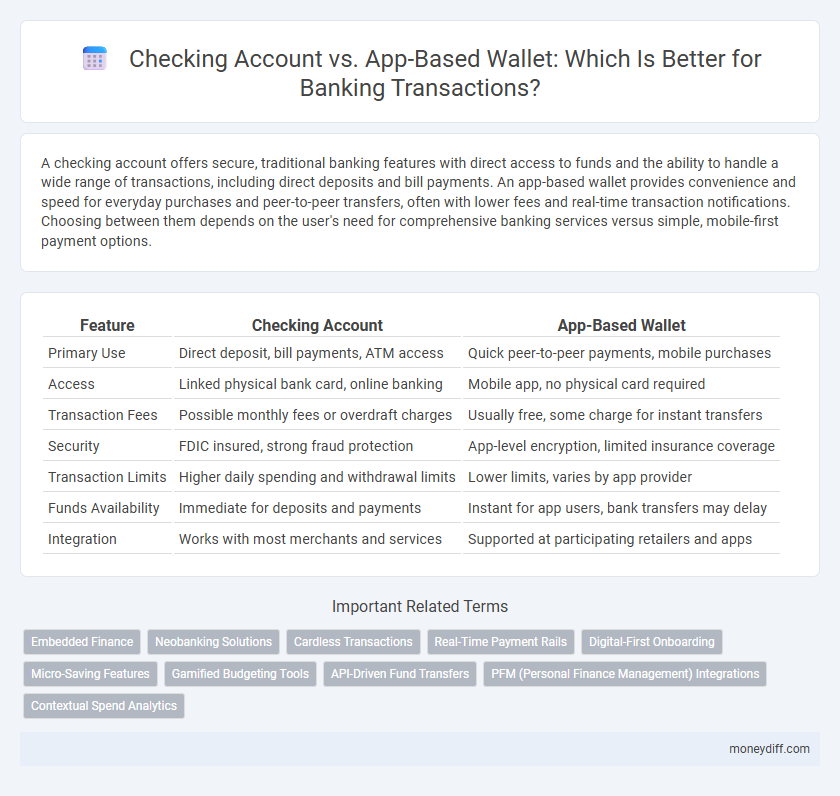

A checking account offers secure, traditional banking features with direct access to funds and the ability to handle a wide range of transactions, including direct deposits and bill payments. An app-based wallet provides convenience and speed for everyday purchases and peer-to-peer transfers, often with lower fees and real-time transaction notifications. Choosing between them depends on the user's need for comprehensive banking services versus simple, mobile-first payment options.

Table of Comparison

| Feature | Checking Account | App-Based Wallet |

|---|---|---|

| Primary Use | Direct deposit, bill payments, ATM access | Quick peer-to-peer payments, mobile purchases |

| Access | Linked physical bank card, online banking | Mobile app, no physical card required |

| Transaction Fees | Possible monthly fees or overdraft charges | Usually free, some charge for instant transfers |

| Security | FDIC insured, strong fraud protection | App-level encryption, limited insurance coverage |

| Transaction Limits | Higher daily spending and withdrawal limits | Lower limits, varies by app provider |

| Funds Availability | Immediate for deposits and payments | Instant for app users, bank transfers may delay |

| Integration | Works with most merchants and services | Supported at participating retailers and apps |

Introduction to Checking Accounts and App-Based Wallets

Checking accounts provide a traditional banking solution offering direct access to funds through checks, debit cards, and ATMs, essential for everyday financial transactions and bill payments. App-based wallets leverage mobile technology to enable secure, instant payments and money transfers without physical cards, integrating features like digital receipts, rewards, and budgeting tools. Both financial tools facilitate seamless transactions but differ in accessibility, security protocols, and user experience.

Key Features of Checking Accounts

Checking accounts offer FDIC insurance up to $250,000, ensuring the safety of funds, and provide unlimited debit card transactions with check-writing capabilities. They typically include features like direct deposit, bill pay, and overdraft protection, allowing seamless management of everyday expenses. Unlike app-based wallets, checking accounts provide physical access to cash through ATMs and branch services, combining convenience with comprehensive financial tools.

Key Features of App-Based Wallets

App-based wallets offer instant transaction processing, seamless integration with multiple payment platforms, and enhanced security through biometric authentication and encryption protocols. They support contactless payments, peer-to-peer transfers, and real-time balance updates, ensuring greater convenience compared to traditional checking accounts. These wallets also provide features like expense tracking, reward programs, and easy access via smartphones, making them ideal for on-the-go financial management.

Security Measures: Checking Accounts vs App-Based Wallets

Checking accounts offer robust security measures including FDIC insurance, fraud detection systems, and multi-factor authentication, providing a high level of protection for users' funds. App-based wallets implement encryption, biometric authentication, and tokenization to secure transactions and prevent unauthorized access, yet they generally lack federal insurance coverage like checking accounts. Users should weigh the security features and insurance protections when choosing between traditional checking accounts and app-based wallets for financial transactions.

Accessibility and Convenience Comparison

Checking accounts offer widespread accessibility with physical branches and ATMs nationwide, ensuring convenient cash withdrawals and deposits. App-based wallets provide seamless digital transactions anytime, bypassing traditional banking hours and locations, ideal for quick peer-to-peer payments and online shopping. However, checking accounts support a broader range of services, such as direct deposits and bill payments, enhancing overall banking convenience.

Transaction Fees and Hidden Costs

Checking accounts generally feature transparent fee structures with monthly maintenance fees ranging from $0 to $15 and typically charge overdraft fees around $35 per incident, whereas app-based wallets often offer free basic transactions but may impose foreign exchange fees up to 3% and variable merchant fees. Hidden costs in checking accounts can include ATM out-of-network fees averaging $2.50 per withdrawal, while app-based wallets might charge fees for instant transfers, commonly around 1% to 1.5% of the amount. Evaluating these financial service options requires consideration of both overt transaction fees and less obvious costs to optimize spending efficiency.

Speed of Transactions

Checking accounts typically offer reliable transaction speeds with settlements processed within one to two business days, making them suitable for traditional banking needs. App-based wallets enable near-instantaneous payments and fund transfers, leveraging real-time processing technology for seamless everyday transactions. Consumers prioritizing speed benefit from app-based wallets' ability to facilitate instant peer-to-peer payments and contactless purchases.

Integration with Other Financial Tools

Checking accounts offer seamless integration with a wide range of financial tools such as budgeting apps, payroll services, and investment platforms, enabling comprehensive money management. App-based wallets prioritize ease of use for payments and peer-to-peer transfers but often provide limited compatibility with traditional financial software and tax systems. Choosing between the two depends on the need for advanced financial tracking versus quick, convenient transaction capabilities.

User Demographics and Preferences

Millennials and Gen Z show a marked preference for app-based wallets due to their convenience, real-time transaction tracking, and seamless integration with digital services. In contrast, Baby Boomers and Gen Xers tend to favor traditional checking accounts for their perceived security and established banking relationships. High-frequency users often opt for app-based wallets to expedite payments, while infrequent transactors prioritize checking accounts for broader acceptance and physical branch access.

Choosing the Right Option for Your Financial Needs

Checking accounts provide traditional banking features such as direct deposit, check writing, and FDIC insurance, making them ideal for managing regular expenses and long-term financial activities. App-based wallets offer convenience with instant transfers, contactless payments, and seamless integration with digital services, catering to users who prioritize mobility and quick transactions. Assess your spending habits, security preferences, and access needs to determine whether a checking account or app-based wallet better aligns with your financial lifestyle.

Related Important Terms

Embedded Finance

Checking accounts provide traditional banking services with FDIC insurance and direct access to branch networks, supporting extensive transaction capabilities including wire transfers and bill payments. App-based wallets leverage embedded finance technology to offer seamless, real-time transactions and integration with diverse digital platforms, enhancing user convenience and instant payment processing without requiring a conventional bank account.

Neobanking Solutions

Neobanking solutions often offer app-based wallets that provide seamless, real-time transaction processing and lower fees compared to traditional checking accounts, which may involve longer processing times and higher maintenance costs. These digital wallets integrate with various financial services, enhancing user convenience through instant transfers, bill payments, and budgeting tools within a single app interface.

Cardless Transactions

Cardless transactions through app-based wallets offer enhanced convenience and faster processing compared to traditional checking accounts, eliminating the need for physical cards and allowing instant payments via smartphones. While checking accounts provide robust security and direct linkage to bank funds, app-based wallets integrate multiple payment methods and utilize biometric authentication for seamless, secure cardless transactions.

Real-Time Payment Rails

Real-time payment rails enable app-based wallets to process transactions instantly, offering greater convenience for peer-to-peer payments and mobile purchases compared to traditional checking accounts, which often rely on batch processing leading to delays. The seamless integration of app-based wallets with digital platforms enhances transaction speed and accessibility, making them preferable for modern, fast-paced financial activities.

Digital-First Onboarding

Digital-first onboarding streamlines the setup process for both checking accounts and app-based wallets, enabling faster verification through biometric authentication and instant identity checks. While checking accounts offer robust regulatory compliance and access to traditional banking services, app-based wallets prioritize seamless integration with mobile payments and peer-to-peer transactions, enhancing user convenience in digital finance ecosystems.

Micro-Saving Features

Checking accounts offer micro-saving features through linked sub-accounts or rounding up transactions to the nearest dollar, enabling automatic transfers into savings. App-based wallets provide seamless micro-saving options via real-time rounding of digital payments and personalized saving goals integrated directly within the transaction interface.

Gamified Budgeting Tools

Checking accounts provide traditional financial services with integrated gamified budgeting tools that track spending patterns and reward savings milestones, enhancing user engagement and financial discipline. App-based wallets offer instant transaction notifications and gamified challenges that encourage responsible spending while seamlessly syncing with other digital financial products for a holistic money management experience.

API-Driven Fund Transfers

API-driven fund transfers in checking accounts offer direct integration with traditional banking infrastructure, ensuring secure, real-time transaction processing and compliance with regulatory standards. In contrast, app-based wallets leverage open APIs for seamless peer-to-peer payments and instant fund availability but may face limitations in transaction limits and merchant acceptance compared to checking accounts.

PFM (Personal Finance Management) Integrations

Checking accounts offer robust PFM integrations that provide comprehensive expense tracking, budgeting tools, and automatic categorization of transactions, enhancing financial oversight. App-based wallets prioritize seamless transaction speed and convenience but often have limited PFM features, making them less effective for detailed personal finance management.

Contextual Spend Analytics

Checking accounts offer robust contextual spend analytics through detailed transaction histories and integration with financial management tools, enabling precise tracking and categorization of expenses. App-based wallets provide real-time spend insights and instant notifications, enhancing day-to-day transactional awareness and promoting proactive financial decisions.

Checking Account vs App-Based Wallet for transactions. Infographic

moneydiff.com

moneydiff.com