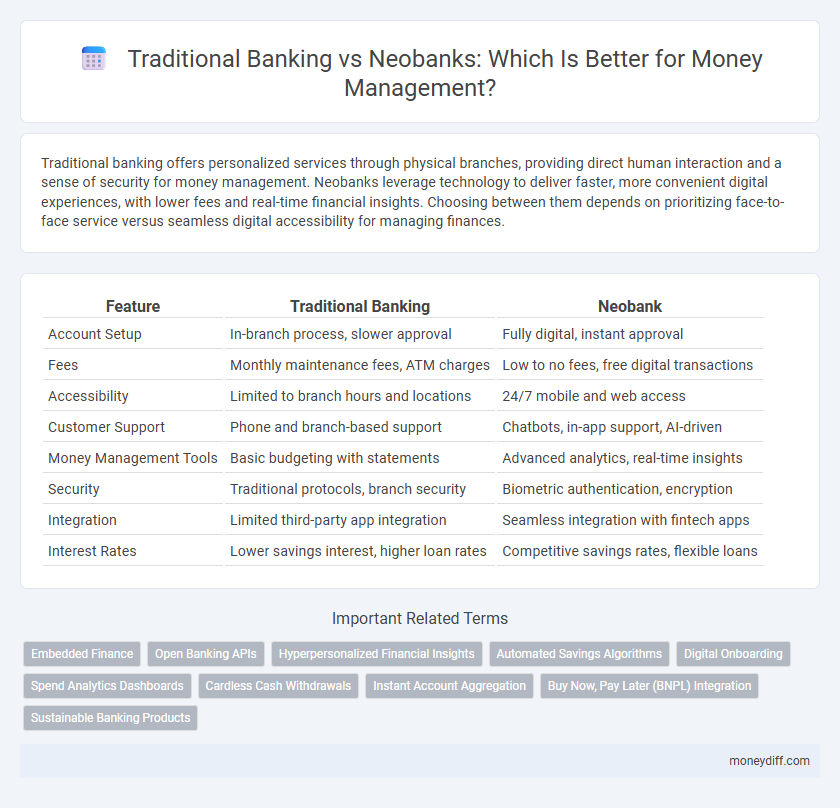

Traditional banking offers personalized services through physical branches, providing direct human interaction and a sense of security for money management. Neobanks leverage technology to deliver faster, more convenient digital experiences, with lower fees and real-time financial insights. Choosing between them depends on prioritizing face-to-face service versus seamless digital accessibility for managing finances.

Table of Comparison

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Account Setup | In-branch process, slower approval | Fully digital, instant approval |

| Fees | Monthly maintenance fees, ATM charges | Low to no fees, free digital transactions |

| Accessibility | Limited to branch hours and locations | 24/7 mobile and web access |

| Customer Support | Phone and branch-based support | Chatbots, in-app support, AI-driven |

| Money Management Tools | Basic budgeting with statements | Advanced analytics, real-time insights |

| Security | Traditional protocols, branch security | Biometric authentication, encryption |

| Integration | Limited third-party app integration | Seamless integration with fintech apps |

| Interest Rates | Lower savings interest, higher loan rates | Competitive savings rates, flexible loans |

Introduction to Traditional Banking and Neobanks

Traditional banking relies on physical branches, offering in-person services such as cash deposits, withdrawals, and personalized financial advice. Neobanks operate exclusively online, providing digital-first money management through mobile apps with features like real-time spending analytics and instant transfers. Both models differ in accessibility, fees, and customer experience, catering to diverse banking preferences.

Key Features of Traditional Banks

Traditional banks offer extensive branch networks and personalized customer service, providing in-person consultations and physical access to cash through ATMs. They typically provide a broad range of financial products, including loans, mortgages, and savings accounts with FDIC insurance, ensuring security and reliability. Established regulatory compliance and robust fraud protection mechanisms enhance trust and stability for customers managing their money.

Distinct Advantages of Neobanks

Neobanks offer distinct advantages in money management through seamless digital access, reduced fees, and real-time transaction tracking that traditional banks often lack. Their user-friendly mobile apps incorporate AI-driven budgeting tools and personalized financial insights, enhancing customer control over spending and savings. Integration with other fintech services enables a holistic approach to finance, positioning neobanks as innovative alternatives in the evolving banking landscape.

Account Opening and Onboarding Experience

Traditional banking typically requires customers to visit a branch for account opening, involving extensive paperwork and longer processing times, which can delay access to funds. Neobanks offer a fully digital onboarding experience with instant account setup using biometric verification and minimal documentation, enhancing convenience and speed. The streamlined digital process of neobanks significantly reduces friction, making money management more accessible and efficient compared to conventional banking methods.

Digital Tools and User Experience

Traditional banking relies on physical branches and legacy systems, often resulting in limited digital tools and a less intuitive user experience. Neobanks leverage advanced mobile apps and AI-powered features to offer seamless money management, real-time insights, and personalized financial advice. Enhanced digital interfaces and instant transaction capabilities make neobanks preferred for tech-savvy users seeking efficient, convenient banking solutions.

Fees, Charges, and Transparency

Traditional banking often involves higher fees, including maintenance charges, overdraft penalties, and limited transparency regarding hidden costs. Neobanks typically offer lower or no fees, with clear, upfront pricing structures accessible via user-friendly apps. Enhanced transparency in neobanks enables better money management by allowing customers to track expenses and avoid unexpected charges more effectively.

Security and Regulatory Protections

Traditional banking offers robust security measures and comprehensive regulatory protections, including FDIC insurance and strict oversight by federal agencies that safeguard customer deposits and data. Neobanks, while leveraging advanced cybersecurity technologies, often rely on partner banks for regulatory compliance and deposit insurance, which can vary in transparency and scope. Both options prioritize customer security, but traditional banks typically provide a more established framework for regulatory protection and risk management.

Money Management Tools and Insights

Traditional banking offers comprehensive money management tools such as detailed transaction histories, budgeting features, and automated alerts, but often with limited real-time insights and slower update cycles. Neobanks leverage advanced AI-driven analytics to provide personalized financial insights, real-time spending categorization, and goal-based saving features directly through intuitive mobile apps. Enhanced integration with digital wallets and seamless API connectivity in neobanks empowers users with instantaneous money management capabilities unmatched by conventional banks.

Customer Support: Human vs. Digital

Traditional banking provides personalized customer support through in-branch representatives and dedicated phone lines, ensuring face-to-face interaction and immediate resolution of complex issues. Neobanks employ AI-driven chatbots and 24/7 digital support platforms, offering rapid responses and seamless access via mobile apps. The choice between human and digital support impacts the user experience, with traditional banks emphasizing empathetic assistance and neobanks prioritizing convenience and efficiency.

Which Option Is Right for Your Money Management Needs?

Traditional banking offers established services with widespread branch access, robust security features, and personalized financial advice, ideal for individuals valuing in-person support and conventional banking infrastructure. Neobanks provide streamlined digital platforms, lower fees, and innovative budgeting tools suited for tech-savvy users seeking convenience and real-time money management on mobile devices. Choosing the right option depends on your preference for either comprehensive physical banking networks or agile, cost-effective digital financial solutions tailored to modern money management.

Related Important Terms

Embedded Finance

Embedded finance integrates banking services directly into non-bank platforms, enabling neobanks to offer seamless money management without traditional branch dependencies. Traditional banking relies on physical infrastructure and legacy systems, limiting flexibility, whereas neobanks leverage embedded finance to provide personalized, real-time financial solutions within everyday digital experiences.

Open Banking APIs

Open Banking APIs enable neobanks to provide seamless, real-time access to multiple financial services and customer data, enhancing personalized money management beyond the capabilities of traditional banking systems. Traditional banks often face legacy system limitations, whereas neobanks leverage open API ecosystems to offer innovative budgeting tools, instant transaction tracking, and aggregated account views for improved financial control.

Hyperpersonalized Financial Insights

Neobanks leverage advanced AI and machine learning algorithms to deliver hyperpersonalized financial insights, offering tailored budgeting, spending analysis, and investment recommendations that traditional banks typically lack. Traditional banking relies on generic financial products and limited data analytics, resulting in less customized money management solutions compared to the dynamic, user-centric platforms provided by neobanks.

Automated Savings Algorithms

Traditional banking relies on conventional methods with limited automation in savings, while neobanks leverage advanced automated savings algorithms that analyze spending patterns to optimize and personalize money management. These algorithms enable real-time adjustments and seamless transfers to savings accounts, significantly enhancing users' financial discipline and growth potential.

Digital Onboarding

Digital onboarding in neobanks leverages AI-driven identity verification and instant account setup, significantly reducing processing time compared to traditional banking's manual and branch-dependent procedures. Enhanced mobile app interfaces and seamless integration with digital wallets further streamline money management, offering users faster access to financial services and real-time transaction monitoring.

Spend Analytics Dashboards

Traditional banking platforms often feature spend analytics dashboards with limited customization and delayed transaction updates, impacting real-time money management accuracy. Neobanks leverage advanced AI-driven spend analytics dashboards that provide instant, detailed insights and personalized budgeting tools, enhancing users' ability to track and optimize daily expenditures efficiently.

Cardless Cash Withdrawals

Cardless cash withdrawals enhance money management by offering secure, convenient access to funds without physical cards, a feature increasingly supported by neobanks compared to traditional banks. Neobanks leverage mobile apps and biometric authentication to streamline cardless transactions, reducing dependency on branch visits and improving user experience.

Instant Account Aggregation

Traditional banking often lacks seamless instant account aggregation, requiring customers to manually consolidate financial data from multiple sources, whereas neobanks leverage advanced APIs to provide real-time aggregation of accounts across various institutions, enhancing money management efficiency. This instant overview enables users to monitor balances, track spending, and optimize cash flow without delays, offering a superior digital financial experience compared to conventional banks.

Buy Now, Pay Later (BNPL) Integration

Traditional banking often faces limitations in integrating Buy Now, Pay Later (BNPL) services due to legacy systems and regulatory constraints, slowing innovation in money management. Neobanks, leveraging agile digital platforms, seamlessly incorporate BNPL options, enhancing user experience with real-time credit access and streamlined payment flexibility.

Sustainable Banking Products

Traditional banking offers established sustainable banking products such as green loans and eco-friendly savings accounts, leveraging extensive regulatory frameworks to support environmental initiatives. Neobanks, leveraging digital platforms, provide innovative sustainable money management tools with real-time impact tracking and seamless integration of carbon footprint offset options.

Traditional Banking vs Neobank for money management. Infographic

moneydiff.com

moneydiff.com