Debit cards offer direct access to your bank account for everyday spending, providing convenience and physical familiarity with secure chip technology. Virtual cards enhance online purchases with temporary card numbers that minimize fraud risk and control spending limits more precisely. Both options cater to different spending needs, with debit cards suited for in-person transactions and virtual cards optimized for safer digital payments.

Table of Comparison

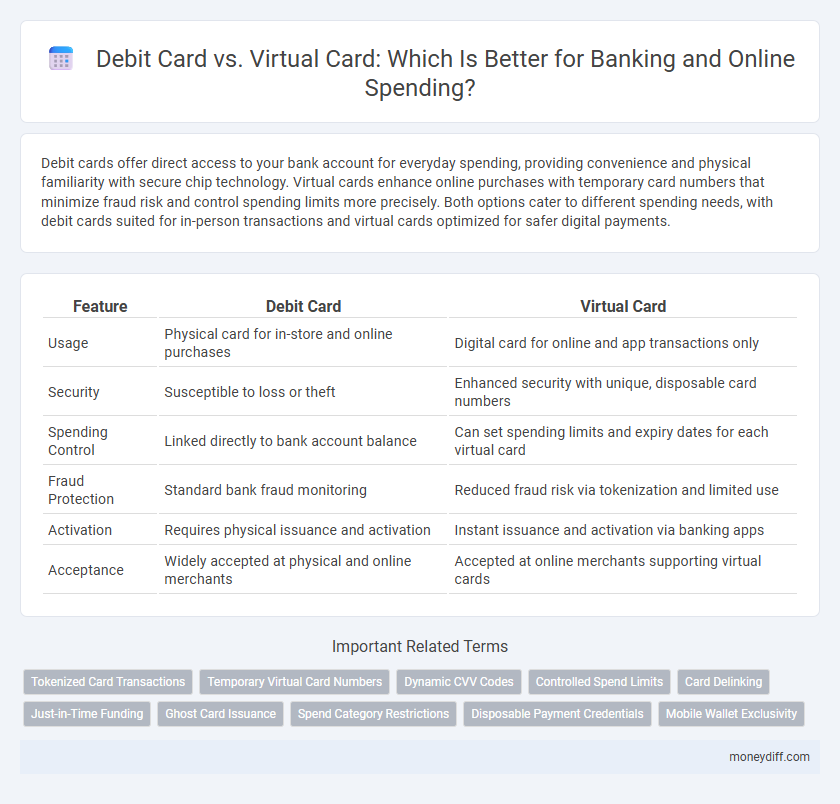

| Feature | Debit Card | Virtual Card |

|---|---|---|

| Usage | Physical card for in-store and online purchases | Digital card for online and app transactions only |

| Security | Susceptible to loss or theft | Enhanced security with unique, disposable card numbers |

| Spending Control | Linked directly to bank account balance | Can set spending limits and expiry dates for each virtual card |

| Fraud Protection | Standard bank fraud monitoring | Reduced fraud risk via tokenization and limited use |

| Activation | Requires physical issuance and activation | Instant issuance and activation via banking apps |

| Acceptance | Widely accepted at physical and online merchants | Accepted at online merchants supporting virtual cards |

Understanding Debit Cards: Features and Functions

Debit cards provide direct access to funds in a linked checking account, enabling secure in-store and online purchases with real-time transaction authorization. They feature PIN protection and often support contactless payments, enhancing both convenience and security. Unlike virtual cards, debit cards offer widespread acceptance at physical retail locations and ATMs, facilitating cash withdrawals and point-of-sale spending.

What is a Virtual Card? Key Characteristics Explained

A virtual card is a digital payment card designed for online transactions, providing enhanced security by generating unique card numbers for each purchase. Unlike physical debit cards, virtual cards minimize fraud risk by limiting exposure of real card details and often include customizable spending limits and expiration dates. These key characteristics make virtual cards an efficient tool for managing online spending and protecting sensitive banking information.

Security Comparison: Debit Card vs Virtual Card

Debit cards expose users to risks such as physical theft, skimming, and unauthorized use if lost or stolen, while virtual cards generate unique, temporary card numbers for each transaction, significantly reducing fraud potential. Virtual cards limit exposure by restricting merchant access to the actual bank account information, offering enhanced security through encryption and tokenization technologies. Banks increasingly favor virtual cards to protect consumers from online threats, emphasizing their superior ability to prevent data breaches and unauthorized charges compared to traditional debit cards.

Ease of Use: Everyday Spending Scenarios

Debit cards offer seamless access for everyday spending, including retail stores, ATMs, and online purchases, providing instant transactions and widespread acceptance. Virtual cards enhance security by generating unique card numbers for specific transactions or merchants, minimizing fraud risk during online shopping and subscription payments. Both options integrate with mobile wallets, but debit cards typically facilitate faster in-person payments due to physical card presence.

Online Shopping: Which Card Offers Better Protection?

Virtual cards provide enhanced protection for online shopping by generating unique, single-use card numbers that minimize exposure to fraud and unauthorized transactions. Debit cards, while convenient, are more susceptible to phishing attacks and skimming, potentially compromising the primary bank account linked to the card. Consumers prioritizing security during digital purchases benefit from virtual cards' ability to limit fraud impact and streamline expense tracking.

Fees and Charges: Debit Cards vs Virtual Cards

Debit cards typically incur minimal fees, with most banks charging no monthly maintenance but possible ATM withdrawal and foreign transaction fees, while virtual cards often have lower usage fees and reduced risk of fraud-related charges due to their temporary, single-use nature. Virtual cards frequently offer more flexible cost structures, such as pay-as-you-go models or lower international transaction fees, appealing to frequent online shoppers and businesses managing expense controls. Understanding these differences helps consumers optimize spending by minimizing unnecessary fees and protecting against fraud-related expenses.

International Transactions: Access and Costs

Debit cards offer widespread international acceptance at ATMs and point-of-sale terminals but often incur higher foreign transaction fees and currency conversion charges. Virtual cards provide enhanced security for online international spending with lower fraud risk and typically lower or no foreign transaction fees. Both options require evaluating access convenience and cost efficiency based on the cardholder's spending habits and target countries.

Integration with Budgeting Tools and Apps

Debit cards offer seamless integration with most budgeting tools and apps through direct transaction syncing, enabling real-time expense tracking and categorization. Virtual cards also support integration but often provide enhanced control with single-use or limited-duration numbers, helping users manage spending within specific budgets. Both types improve financial management, but virtual cards deliver added flexibility and security for digital and subscription payments.

Fraud Prevention and Liability Policies

Debit cards offer direct access to funds in linked bank accounts, but they carry higher liability risks in cases of fraud if unauthorized transactions are not reported promptly. Virtual cards generate unique, temporary card numbers for online transactions, significantly reducing the risk of data theft and providing enhanced fraud prevention through limited use and expiry controls. Banks typically limit customer liability for fraudulent charges on virtual cards, while debit card fraud policies vary by institution and regulatory guidelines, often requiring immediate customer action to minimize losses.

Which Card Suits Your Money Management Style?

Debit cards offer direct access to your checking account, ideal for those who prefer managing expenses with tangible funds and easy ATM withdrawals. Virtual cards provide enhanced security and control for online spending, perfect for individuals who prioritize fraud protection and budget tracking without physical cards. Choosing between them depends on whether you value physical card convenience or digital security for your money management style.

Related Important Terms

Tokenized Card Transactions

Debit cards offer physical access to funds with tokenized card transactions enhancing security by replacing sensitive data with unique tokens during each purchase, reducing fraud risk. Virtual cards enable immediate issuance and controlled spending limits, using dynamic tokenization to secure online and contactless transactions without exposing actual card details.

Temporary Virtual Card Numbers

Temporary virtual card numbers offer enhanced security for online spending by generating unique, time-limited card details linked to a primary debit card, reducing the risk of fraud and unauthorized charges. Unlike traditional debit cards, these virtual cards minimize exposure of actual card information while enabling controlled spending limits and expiration, making them ideal for secure digital transactions.

Dynamic CVV Codes

Debit cards with static CVV codes offer consistent security for in-person and online transactions, whereas virtual cards feature dynamic CVV codes that change periodically, significantly reducing fraud risk during digital purchases. Dynamic CVV technology enhances transaction safety by ensuring the security code is valid only for a limited time or single use, making virtual cards ideal for e-commerce environments.

Controlled Spend Limits

Debit cards offer real-time spending control with preset daily or transaction limits linked directly to your bank account, ensuring immediate fund availability and reducing overspending risks. Virtual cards provide enhanced security through customizable spend limits and expiration settings, ideal for managing specific expenses and preventing unauthorized use during online transactions.

Card Delinking

Debit cards are physically linked to a bank account, allowing direct access to funds but posing a higher risk if lost or stolen, whereas virtual cards can be easily delinked or deactivated instantly through digital banking platforms, minimizing fraud exposure. Virtual card delinking provides greater control over spending by allowing users to generate disposable card numbers for specific transactions without compromising the primary account.

Just-in-Time Funding

Debit cards provide direct access to funds in a linked bank account for immediate spending, while virtual cards utilize just-in-time funding to generate temporary card numbers that are funded only at the moment of transaction authorization, enhancing security and control. Just-in-time funding reduces fraud risk and overspending by limiting preloaded balances and enabling real-time transaction approval based on available funds.

Ghost Card Issuance

Debit cards provide direct access to funds for everyday spending, while virtual cards, often issued as ghost cards, enhance security by generating unique card numbers for online transactions without exposing primary account details. Ghost card issuance reduces fraud risk and streamlines expense management through controlled, trackable digital payment methods ideal for e-commerce and subscription services.

Spend Category Restrictions

Debit cards offer more flexibility for spending across various merchant categories, allowing transactions in physical stores, ATMs, and online platforms without category restrictions. Virtual cards often include spend category restrictions set by issuers to enhance security and control over online and subscription-based purchases, preventing transactions outside predefined merchant types.

Disposable Payment Credentials

Disposable payment credentials in virtual cards offer enhanced security by generating unique, single-use card numbers for each transaction, minimizing fraud risk compared to traditional debit cards. Debit cards provide direct access to bank accounts but lack the dynamic, disposable feature that protects sensitive information during online spending.

Mobile Wallet Exclusivity

Debit cards provide physical access for in-store purchases and ATM withdrawals, while virtual cards are designed exclusively for online and mobile wallet transactions, enhancing security by limiting exposure to card details. Mobile wallet exclusivity with virtual cards allows seamless integration with digital platforms such as Apple Pay and Google Pay, streamlining contactless payments and minimizing fraud risks.

Debit Card vs Virtual Card for spending Infographic

moneydiff.com

moneydiff.com