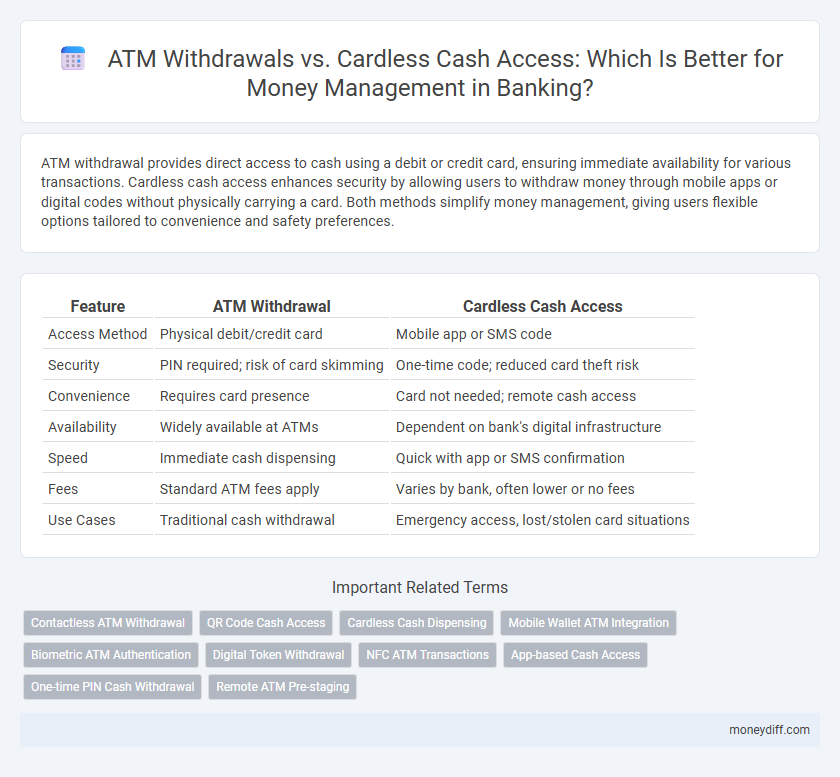

ATM withdrawal provides direct access to cash using a debit or credit card, ensuring immediate availability for various transactions. Cardless cash access enhances security by allowing users to withdraw money through mobile apps or digital codes without physically carrying a card. Both methods simplify money management, giving users flexible options tailored to convenience and safety preferences.

Table of Comparison

| Feature | ATM Withdrawal | Cardless Cash Access |

|---|---|---|

| Access Method | Physical debit/credit card | Mobile app or SMS code |

| Security | PIN required; risk of card skimming | One-time code; reduced card theft risk |

| Convenience | Requires card presence | Card not needed; remote cash access |

| Availability | Widely available at ATMs | Dependent on bank's digital infrastructure |

| Speed | Immediate cash dispensing | Quick with app or SMS confirmation |

| Fees | Standard ATM fees apply | Varies by bank, often lower or no fees |

| Use Cases | Traditional cash withdrawal | Emergency access, lost/stolen card situations |

Understanding Traditional ATM Withdrawals

Traditional ATM withdrawals require a physical debit or credit card inserted into the machine, followed by PIN authentication to securely access funds. This method offers immediate cash access but demands carrying a card and poses risks like card skimming or theft. For effective money management, understanding transaction limits, fees, and daily withdrawal caps associated with traditional ATMs is essential.

What Is Cardless Cash Access?

Cardless Cash Access enables users to withdraw money from ATMs using a mobile app without the need for a physical debit or credit card, enhancing security and convenience. This technology relies on secure authentication methods such as one-time codes or biometric verification to authorize withdrawals. By eliminating card dependency, Cardless Cash Access reduces the risk of card skimming and theft, improving money management flexibility in banking.

Security: ATM Withdrawals vs Cardless Methods

ATM withdrawals require physical card insertion and PIN entry, providing strong two-factor authentication that helps prevent unauthorized access. Cardless cash access leverages mobile app authentication and dynamic QR codes, enhancing security by eliminating card skimming risks but relying heavily on device security and network encryption. Both methods incorporate advanced fraud detection systems, with cardless options offering real-time transaction alerts that improve immediate threat identification.

Convenience Factors in Cash Access

ATM withdrawal offers quick, straightforward access to cash through card insertion, while cardless cash access enhances convenience by enabling withdrawals via mobile apps or digital codes, eliminating the need for physical cards. Cardless options reduce the risk of card loss or theft and provide flexibility for users who prefer contactless transactions. Both methods streamline money management, but cardless cash access increasingly caters to modern, tech-savvy customers seeking faster and safer cash withdrawals.

Fees and Charges: A Comparative View

ATM withdrawal fees typically range from $2 to $5 per transaction, depending on the bank and network used, while cardless cash access often incurs a flat service charge or a percentage fee that can vary between 1% and 3% of the withdrawal amount. Some banks waive fees for cardless transactions to promote digital banking, making them a cost-effective option compared to traditional ATM withdrawals that may include additional surcharges for out-of-network usage. Understanding these fee structures is essential for optimizing money management strategies and minimizing unnecessary costs during cash access.

Technology: How Each Method Works

ATM withdrawal uses a physical debit or credit card inserted into the machine, where users input their PIN to authenticate and dispense cash directly from their bank account. Cardless cash access operates through mobile banking apps that generate a secure code or use biometric verification, allowing users to withdraw money from ATMs without a physical card. Both methods rely on real-time transaction processing and encryption for secure money management, but cardless access leverages advanced mobile technology to enhance convenience and reduce card-related risks.

Limitations and Availability

ATM withdrawal typically requires a physical card and may have daily limits imposed by banks, restricting large or frequent cash access. Cardless cash access offers enhanced convenience as it relies on mobile authentication but is limited to participating banks and compatible ATMs, reducing widespread availability. Both methods have regional constraints and potential security concerns that influence their usability for effective money management.

Impact on Daily Money Management

ATM withdrawal allows immediate access to physical cash, supporting daily budgeting and in-person transactions with tangible money control. Cardless cash access enhances convenience and security by enabling cash withdrawals via smartphone or biometric verification, reducing reliance on physical cards and streamlining money management. Both methods impact daily money handling by offering flexibility; traditional ATM withdrawals suit cash-dependent users while cardless options cater to tech-savvy customers seeking contactless financial solutions.

User Experience and Satisfaction

ATM withdrawal provides users with a familiar and direct way to access cash, ensuring reliability and quick transactions. Cardless cash access enhances user experience by offering greater convenience and security through mobile authentication, reducing the risk of lost or stolen cards. Satisfaction levels rise with the flexibility and seamlessness offered by cardless options, especially among tech-savvy customers seeking efficient money management solutions.

Future Trends in Cash Withdrawal Methods

ATM withdrawal remains a fundamental method for cash access, yet cardless cash withdrawals are rapidly transforming transaction security and convenience by leveraging biometric authentication and mobile banking apps. Future trends indicate a shift towards contactless technologies and real-time transaction processing, reducing fraud risk and enhancing user experience. Integration of AI-driven analytics and blockchain in withdrawal systems promises to optimize money management through personalized cash flow insights and transparent, secure transactions.

Related Important Terms

Contactless ATM Withdrawal

Contactless ATM withdrawal enhances money management by enabling secure, fast access to cash without inserting a card, reducing fraud risks through encrypted mobile authentication. This method streamlines transactions and provides real-time alerts, improving overall cash flow control and user convenience.

QR Code Cash Access

QR Code Cash Access revolutionizes money management by enabling secure, cardless ATM withdrawals through smartphone authentication, reducing dependency on physical cards and enhancing transaction speed. This technology leverages dynamic QR codes to authorize cash access, minimizing fraud risks and providing seamless, contactless convenience compared to traditional ATM withdrawals.

Cardless Cash Dispensing

Cardless cash dispensing offers enhanced security and convenience by allowing users to withdraw money via mobile apps without needing a physical card, reducing the risk of card skimming and theft. This technology integrates biometric authentication and real-time transaction alerts, streamlining money management and providing greater control over cash access.

Mobile Wallet ATM Integration

Mobile wallet ATM integration enhances money management by enabling customers to perform cardless cash access, reducing reliance on physical cards and increasing transaction security through biometric authentication and encrypted mobile credentials. This technology streamlines ATM withdrawals by allowing instant cash access via mobile devices, improving convenience and minimizing fraud risks in banking operations.

Biometric ATM Authentication

Biometric ATM authentication enhances security and convenience in both ATM withdrawal and cardless cash access by using fingerprint or facial recognition to verify identity, reducing fraud risks and eliminating the need for physical cards. This technology streamlines money management by enabling faster, safer transactions and providing users with flexible access to cash through secure, personalized verification methods.

Digital Token Withdrawal

Digital token withdrawal enhances money management by enabling secure, cardless cash access through one-time codes sent to mobile devices, reducing fraud risks associated with traditional ATM withdrawals. This method offers real-time transaction tracking and greater convenience, streamlining cash access while maintaining stringent security protocols in banking operations.

NFC ATM Transactions

NFC ATM transactions enhance money management by enabling secure, contactless withdrawals that eliminate the need for physical cards, reducing fraud risks associated with card skimming. Cardless cash access leverages near-field communication technology to streamline ATM withdrawals through mobile devices, offering faster, more convenient, and safer financial transactions compared to traditional ATM withdrawals.

App-based Cash Access

App-based cash access allows users to withdraw money securely without a physical card by generating a one-time code through their banking app, enhancing convenience and reducing the risk of card skimming or theft common with traditional ATM withdrawals. This digital method integrates seamlessly with mobile banking platforms, offering real-time transaction alerts and greater control over cash management compared to conventional card-based ATM transactions.

One-time PIN Cash Withdrawal

One-time PIN cash withdrawal enhances security and convenience by allowing customers to access their funds without physical cards, reducing the risk of card skimming and loss. This method streamlines money management through instant, secure access at ATMs, combining digital authentication with traditional cash access for improved user control.

Remote ATM Pre-staging

Remote ATM pre-staging enhances money management by allowing users to securely withdraw cash without a card, reducing the risk of card skimming and enabling precise control over withdrawal amounts via mobile banking apps. This digital approach streamlines cash access, improves transaction speed, and offers greater convenience compared to traditional ATM withdrawals.

ATM Withdrawal vs Cardless Cash Access for money management. Infographic

moneydiff.com

moneydiff.com