Savings accounts offer secure, easy access to funds with modest interest rates, ideal for everyday banking needs. High-yield digital accounts provide significantly higher interest rates, maximizing returns on deposits while often requiring minimal fees and offering convenient online management. Choosing between these depends on your priority for liquidity versus growth potential in managing your money.

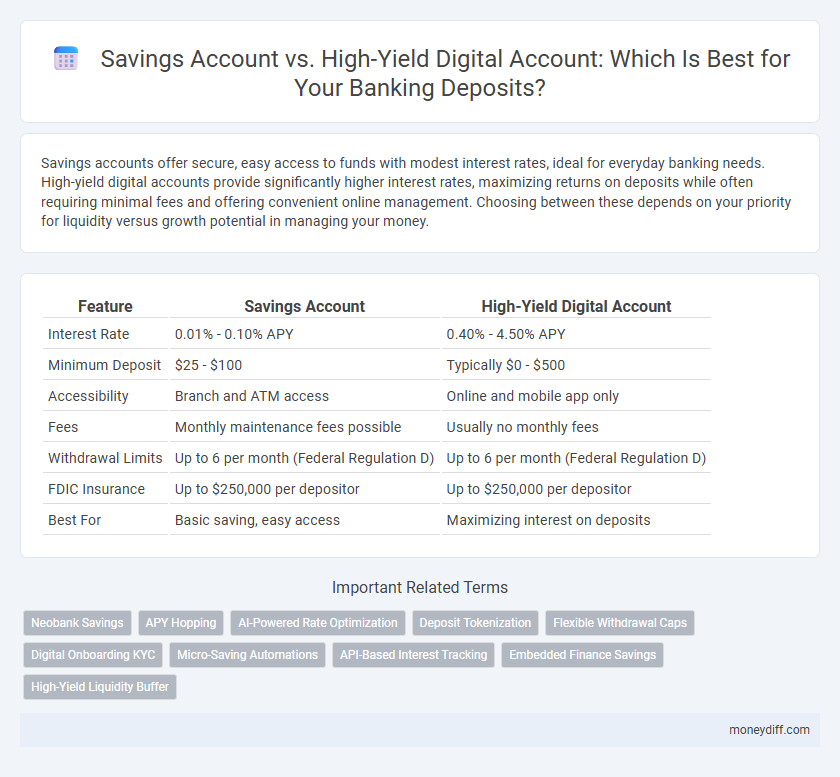

Table of Comparison

| Feature | Savings Account | High-Yield Digital Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 0.40% - 4.50% APY |

| Minimum Deposit | $25 - $100 | Typically $0 - $500 |

| Accessibility | Branch and ATM access | Online and mobile app only |

| Fees | Monthly maintenance fees possible | Usually no monthly fees |

| Withdrawal Limits | Up to 6 per month (Federal Regulation D) | Up to 6 per month (Federal Regulation D) |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Best For | Basic saving, easy access | Maximizing interest on deposits |

Understanding Savings Accounts: Features and Benefits

Savings accounts offer a secure place to store funds while earning interest, typically with easy access through ATMs and online banking. High-yield digital accounts provide significantly higher interest rates compared to traditional savings, often exceeding 3% APY, by operating entirely online and reducing overhead costs. Understanding the features of both accounts, including minimum balance requirements, fees, and withdrawal limits, helps optimize deposit growth and liquidity management.

What Is a High-Yield Digital Account?

A high-yield digital account is an online savings account that offers significantly higher interest rates compared to traditional savings accounts, allowing deposits to grow faster. These accounts typically have lower fees and minimum balance requirements due to their digital-only nature, making them accessible and cost-effective for customers. By leveraging online platforms, high-yield digital accounts provide seamless account management and instant access to funds, optimizing returns on deposited money.

Interest Rates: Traditional vs Digital Savings

Traditional savings accounts typically offer interest rates ranging from 0.01% to 0.10%, reflecting their low-risk, widely accessible nature. High-yield digital savings accounts provide significantly higher returns, often between 3.5% and 4.5%, by operating with lower overhead costs and online-only platforms. Consumers looking to maximize deposit growth usually prefer digital high-yield options for their superior interest rates and ease of access via mobile banking.

Fees and Minimum Balance Requirements

Savings accounts typically have lower minimum balance requirements but may charge maintenance fees that reduce overall returns on deposits. High-yield digital accounts often require higher minimum balances but offer fee-free structures, maximizing interest earnings on deposits. Comparing fee schedules and minimum balance thresholds is essential for optimizing savings growth and minimizing costs.

Accessibility and Convenience

Savings accounts offer in-person branch access, ATM networks, and easy cash deposits, making them ideal for customers valuing physical banking convenience. High-yield digital accounts provide 24/7 online and mobile access, with seamless fund transfers and instant balance updates, maximizing accessibility for tech-savvy users. Digital accounts often lack physical locations, which can limit cash deposit options but enhance overall convenience through automated tools and lower fees.

Security and FDIC Insurance Considerations

Savings accounts and high-yield digital accounts both offer FDIC insurance up to $250,000 per depositor, ensuring deposit protection in the event of bank failure. Traditional savings accounts provide strong security through established brick-and-mortar banks with physical branch access and robust fraud detection systems. High-yield digital accounts leverage advanced encryption and multi-factor authentication while maintaining FDIC coverage via partner banks, making them a secure option for maximizing interest earnings.

Digital Account Technology: Mobile Apps and Online Tools

High-yield digital accounts leverage advanced mobile apps and online tools that offer real-time transaction monitoring, automated savings features, and seamless fund transfers, enhancing user convenience and financial control. These platforms typically provide higher interest rates compared to traditional savings accounts, maximizing returns on deposits through cutting-edge technology integrations. Enhanced security measures such as biometric authentication and instant fraud alerts further protect funds while enabling efficient account management from any device.

Withdrawal Limits and Account Flexibility

Savings accounts often impose strict withdrawal limits, typically restricting customers to six transactions per month due to federal regulations, which can limit access to funds for frequent transactions. High-yield digital accounts usually offer greater flexibility, allowing unlimited withdrawals or transfers, enhancing liquidity and user control over deposits. Prioritizing accounts with fewer withdrawal restrictions can be crucial for depositors seeking easier access to their funds without compromising interest earnings.

Customer Support: In-Person vs Digital Service

Savings accounts typically offer in-person customer support through local branches, providing personalized assistance and immediate issue resolution for deposit management. High-yield digital accounts rely primarily on digital service channels, such as mobile apps, online chat, and email support, delivering convenient 24/7 access but limited face-to-face interaction. Customers prioritizing direct human engagement and brick-and-mortar services may prefer savings accounts, while tech-savvy clients valuing quick, digital communication often choose high-yield digital accounts.

Choosing the Best Account for Your Financial Goals

Savings accounts typically offer lower interest rates but provide easy access to funds and widespread branch availability, making them suitable for emergency savings or short-term goals. High-yield digital accounts deliver significantly higher annual percentage yields (APYs) and often minimal fees, ideal for maximizing returns on long-term deposits while requiring online access and fewer physical branches. Selecting the best account depends on balancing liquidity needs, interest rate preferences, and your comfort with digital banking platforms to align with your specific financial objectives.

Related Important Terms

Neobank Savings

Neobank savings accounts offer significantly higher annual percentage yields (APYs) compared to traditional savings accounts, often exceeding 3%, which accelerates deposit growth through compounded interest. Digital-only platforms reduce overhead costs, enabling neobanks to provide instant access, no minimum balance requirements, and fee-free transactions, enhancing overall customer value for depositors.

APY Hopping

High-yield digital accounts typically offer APYs that are 2 to 5 times higher than traditional savings accounts, making them a preferred choice for maximizing interest earnings through APY hopping strategies. Savers can capitalize on promotional rates from various online banks, frequently moving deposits to accounts with superior yields to optimize returns without sacrificing liquidity or safety.

AI-Powered Rate Optimization

AI-powered rate optimization in high-yield digital accounts dynamically adjusts interest rates based on real-time market trends, often outperforming traditional savings accounts with fixed or lower rates. This technology enhances deposit growth potential by leveraging machine learning algorithms to maximize returns while maintaining liquidity and security.

Deposit Tokenization

Savings accounts typically offer lower interest rates on deposits, while high-yield digital accounts leverage deposit tokenization to enhance security and liquidity, enabling safer and more efficient asset management. Deposit tokenization transforms traditional deposits into blockchain-backed digital tokens, reducing fraud risk and accelerating transaction settlements in banking.

Flexible Withdrawal Caps

Savings accounts typically offer limited withdrawal caps, restricting the number of monthly transactions to six due to federal regulations, whereas high-yield digital accounts often provide more flexible withdrawal options with fewer or no limits, enhancing liquidity for depositors. This flexibility in high-yield digital accounts supports easier access to funds while delivering higher interest rates, making them preferable for customers valuing both growth and accessibility.

Digital Onboarding KYC

High-yield digital savings accounts leverage streamlined digital onboarding with automated KYC processes, reducing account opening time to minutes compared to traditional savings accounts that require in-branch verification. Enhanced biometric authentication and real-time identity validation improve security and customer experience, making digital accounts more attractive for deposits in the banking sector.

Micro-Saving Automations

Micro-saving automations integrated into high-yield digital accounts enable seamless, incremental deposits that significantly enhance compound interest gains compared to traditional savings accounts. These automated features optimize cash flow management and maximize growth potential by leveraging higher APYs and real-time transfer capabilities tailored for digital platforms.

API-Based Interest Tracking

High-yield digital accounts leverage API-based interest tracking to provide real-time updates on accrued interest, enabling customers to monitor growth dynamically compared to traditional savings accounts that typically offer fixed interest rates with delayed reporting. This API integration enhances transparency and allows for seamless automation in interest calculations, optimizing deposit management for tech-savvy users.

Embedded Finance Savings

Embedded finance savings accounts offer higher interest rates compared to traditional savings accounts by integrating financial services within digital platforms, enabling seamless deposits and withdrawals. These high-yield digital accounts leverage technology to provide enhanced user experiences and competitive returns, making them ideal for modern deposit strategies.

High-Yield Liquidity Buffer

High-yield digital accounts offer significantly higher interest rates compared to traditional savings accounts, making them ideal for maximizing returns on a liquidity buffer without sacrificing accessibility. These accounts provide instant access to funds while maintaining a competitive annual percentage yield (APY), enhancing cash flow management for depositors.

Savings Account vs High-Yield Digital Account for deposits Infographic

moneydiff.com

moneydiff.com