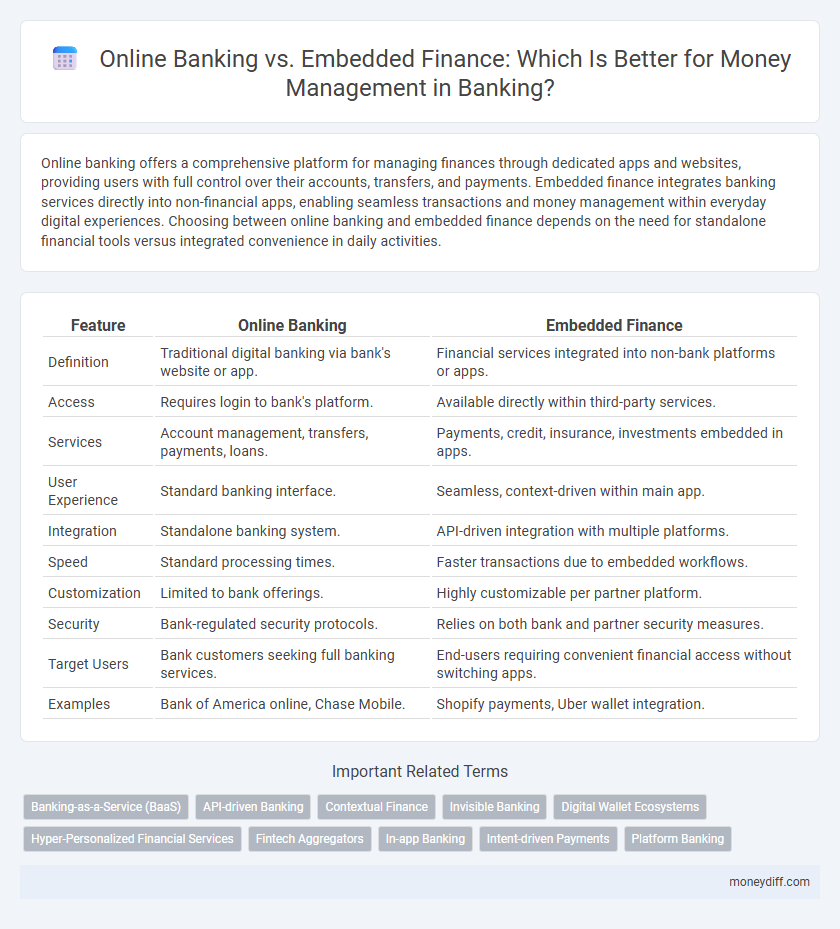

Online banking offers a comprehensive platform for managing finances through dedicated apps and websites, providing users with full control over their accounts, transfers, and payments. Embedded finance integrates banking services directly into non-financial apps, enabling seamless transactions and money management within everyday digital experiences. Choosing between online banking and embedded finance depends on the need for standalone financial tools versus integrated convenience in daily activities.

Table of Comparison

| Feature | Online Banking | Embedded Finance |

|---|---|---|

| Definition | Traditional digital banking via bank's website or app. | Financial services integrated into non-bank platforms or apps. |

| Access | Requires login to bank's platform. | Available directly within third-party services. |

| Services | Account management, transfers, payments, loans. | Payments, credit, insurance, investments embedded in apps. |

| User Experience | Standard banking interface. | Seamless, context-driven within main app. |

| Integration | Standalone banking system. | API-driven integration with multiple platforms. |

| Speed | Standard processing times. | Faster transactions due to embedded workflows. |

| Customization | Limited to bank offerings. | Highly customizable per partner platform. |

| Security | Bank-regulated security protocols. | Relies on both bank and partner security measures. |

| Target Users | Bank customers seeking full banking services. | End-users requiring convenient financial access without switching apps. |

| Examples | Bank of America online, Chase Mobile. | Shopify payments, Uber wallet integration. |

Understanding Online Banking: Key Features and Benefits

Online banking offers users convenient access to account management, fund transfers, bill payments, and real-time transaction monitoring through secure digital platforms provided by traditional financial institutions. Key benefits include 24/7 accessibility, robust security measures like multi-factor authentication, and seamless integration with mobile devices for on-the-go financial control. This platform empowers customers with instant account updates and personalized financial insights, enhancing effective money management within a trusted banking environment.

What Is Embedded Finance? A New Frontier in Money Management

Embedded finance integrates financial services directly into non-financial platforms such as e-commerce apps, enabling seamless payments, lending, and insurance within user workflows. Unlike traditional online banking, which requires users to navigate separate banking portals, embedded finance offers real-time financial interactions embedded in everyday activities, enhancing convenience and personalization. This innovation drives a new frontier in money management by leveraging APIs and partnerships to deliver tailored financial solutions at the point of need.

Comparing Account Accessibility: Online Banking vs Embedded Finance

Online banking offers direct access to traditional bank accounts through secure web portals or mobile apps, providing full control over deposits, transfers, and payments. Embedded finance integrates financial services seamlessly within non-banking apps, enabling users to manage money without switching platforms, often through third-party partnerships with banks and fintechs. While online banking ensures comprehensive functionality tied to established banks, embedded finance excels in convenience and contextual account accessibility tailored to specific user activities.

Security Measures: Which Platform Offers Better Protection?

Online banking platforms implement multi-factor authentication, end-to-end encryption, and real-time fraud monitoring to safeguard user accounts and transactions. Embedded finance integrates security protocols directly within non-banking apps, leveraging secure APIs and tokenization to minimize data exposure during money management activities. While both systems prioritize robust security, embedded finance benefits from seamless, app-specific controls that reduce external attack vectors compared to traditional online banking portals.

User Experience: Seamless Money Management Solutions

Online banking offers robust platforms with comprehensive features such as real-time account monitoring and secure transaction processing, ensuring users maintain direct control over their finances. Embedded finance integrates banking services within non-financial apps, delivering seamless, context-driven money management without requiring users to switch platforms. Both solutions prioritize intuitive interfaces and swift access, enhancing user experience by simplifying financial tasks and promoting efficient money management.

Integration with Financial Tools: Online Banking and Embedded Finance

Online banking platforms offer secure access to core banking services with standard integrations to budgeting apps and payment processors, ensuring seamless transaction tracking and account management. Embedded finance enhances this by integrating financial services directly within non-banking apps like e-commerce or payroll systems, providing real-time credit, payments, and investment options without requiring users to switch platforms. This deeper integration boosts user experience and operational efficiency by embedding money management tools contextually into daily activities.

Cost and Fees: Evaluating Affordability for Consumers

Online banking typically involves higher fees and maintenance costs due to legacy infrastructure and security measures, whereas embedded finance integrates financial services directly within non-bank platforms, often reducing overhead and passing savings to consumers. Embedded finance offers more competitive transaction and service fees by leveraging streamlined digital ecosystems, improving affordability for everyday money management. Cost comparisons reveal that consumers benefit from lower fees and minimal hidden charges in embedded finance solutions compared to traditional online banking models.

Personalization: Tailored Services in Online Banking vs Embedded Finance

Online banking offers personalization through customizable dashboards, transaction alerts, and budgeting tools tailored to individual spending habits. Embedded finance enhances personalization by integrating financial services directly into non-financial platforms, providing context-specific recommendations and seamless money management within users' everyday activities. This integration leads to a more intuitive and proactive approach to personal finance, leveraging real-time data for highly relevant financial solutions.

Financial Insights: Advanced Analytics and Budgeting Tools

Online banking platforms provide users with robust financial insights through advanced analytics and customizable budgeting tools, enabling detailed transaction tracking and spending categorization. Embedded finance integrates these capabilities directly into non-financial apps, offering seamless access to real-time financial data and personalized budget recommendations within everyday services. This integration enhances user engagement by delivering contextualized money management insights without requiring a separate banking interface.

Future Trends: The Evolution of Digital Money Management Platforms

Online banking continues to evolve with advanced AI-driven personalization and enhanced cybersecurity measures, offering users seamless access to payments, investments, and budgeting tools. Embedded finance integrates financial services directly into non-financial apps, enabling real-time money management within everyday platforms like e-commerce and ride-sharing, driving higher user engagement. Future trends indicate convergence between these models, leveraging APIs and open banking to create unified, intuitive digital ecosystems that prioritize user convenience and financial inclusivity.

Related Important Terms

Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) enables seamless integration of financial services within non-bank platforms, offering embedded finance that enhances user experience by providing direct access to money management tools without switching apps. Unlike traditional online banking, embedded finance leverages APIs to deliver tailored financial solutions, driving increased customer engagement and operational efficiency.

API-driven Banking

API-driven banking enables seamless integration between online banking platforms and embedded finance solutions, allowing users to manage money efficiently within various digital environments. This integration enhances financial data accessibility, real-time transaction processing, and personalized money management tools, improving user experience and operational agility in digital banking ecosystems.

Contextual Finance

Online banking offers users direct access to their financial accounts through dedicated platforms, enabling real-time money management with comprehensive control over transactions, savings, and investments. Embedded finance integrates these financial services directly within non-bank digital environments like e-commerce or apps, providing seamless contextual finance experiences that optimize spending and budgeting by leveraging user behavior and transactional context.

Invisible Banking

Invisible Banking integrates financial services seamlessly into everyday digital experiences, offering money management without the need to access traditional online banking platforms. This approach enhances user convenience by embedding payment, lending, and investment tools directly within non-financial apps, driving higher engagement and frictionless transactions.

Digital Wallet Ecosystems

Digital wallet ecosystems enhance money management by integrating seamless payment solutions and personalized financial services, offering greater convenience than traditional online banking platforms. Embedded finance within digital wallets enables real-time transaction tracking, budgeting tools, and instant access to credit, creating a holistic digital money management experience.

Hyper-Personalized Financial Services

Online banking delivers hyper-personalized financial services through tailored dashboards and real-time transaction alerts, enabling users to manage their money efficiently within a secure platform. Embedded finance integrates these personalized features directly into non-banking apps, offering seamless access to budgeting, payments, and investments without switching platforms.

Fintech Aggregators

Fintech aggregators leverage embedded finance to integrate multiple financial services directly into non-banking platforms, enhancing money management by providing seamless, real-time access to accounts, payments, and investments. Unlike traditional online banking, which requires users to navigate separate portals, fintech aggregators unify diverse financial data and services into a single interface, driving more personalized and efficient financial decisions.

In-app Banking

In-app banking within embedded finance platforms offers seamless money management by integrating financial services directly into non-bank applications, enhancing user convenience and engagement compared to traditional online banking portals. This integration facilitates real-time transactions, personalized financial insights, and fewer friction points, driving higher adoption and improved cash flow control for users.

Intent-driven Payments

Intent-driven payments in online banking allow users to initiate and authorize transactions directly within their banking app, ensuring secure and transparent money management. Embedded finance integrates payment capabilities into non-bank platforms, enabling seamless, context-aware transactions that optimize user intent without redirecting to traditional banking interfaces.

Platform Banking

Platform banking integrates online banking and embedded finance to offer seamless money management through APIs, enabling financial institutions to provide tailored services within third-party platforms. This approach enhances user experience by combining real-time account access, payment initiation, and personalized financial products directly within everyday applications.

Online Banking vs Embedded Finance for money management. Infographic

moneydiff.com

moneydiff.com