Personal bankers offer tailored financial advice through direct human interaction, understanding individual needs and providing personalized solutions. Robo-advisors use algorithms and data-driven models to deliver automated investment management and portfolio optimization with lower fees. Choosing between the two depends on a preference for personalized service versus cost-effective, technology-driven guidance.

Table of Comparison

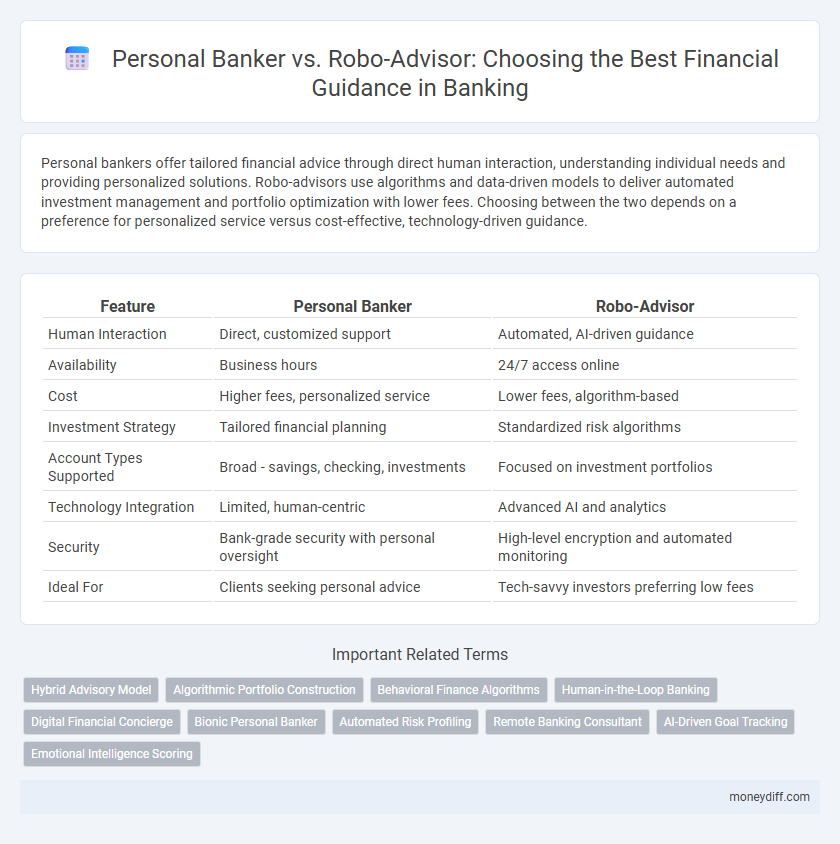

| Feature | Personal Banker | Robo-Advisor |

|---|---|---|

| Human Interaction | Direct, customized support | Automated, AI-driven guidance |

| Availability | Business hours | 24/7 access online |

| Cost | Higher fees, personalized service | Lower fees, algorithm-based |

| Investment Strategy | Tailored financial planning | Standardized risk algorithms |

| Account Types Supported | Broad - savings, checking, investments | Focused on investment portfolios |

| Technology Integration | Limited, human-centric | Advanced AI and analytics |

| Security | Bank-grade security with personal oversight | High-level encryption and automated monitoring |

| Ideal For | Clients seeking personal advice | Tech-savvy investors preferring low fees |

Understanding Personal Bankers and Robo-Advisors

Personal bankers offer tailored financial advice through direct human interaction, enabling personalized solutions based on individual client profiles and goals. Robo-advisors utilize advanced algorithms and real-time data analysis to provide automated, cost-efficient investment management with minimal human involvement. Understanding the key differences between the personalized approach of personal bankers and the technology-driven model of robo-advisors helps clients select the most appropriate financial guidance option.

Key Differences Between Personal Bankers and Robo-Advisors

Personal bankers provide personalized financial guidance through one-on-one interactions, offering tailored advice based on an individual's unique financial situation and goals. Robo-advisors utilize algorithms and automated processes to deliver investment recommendations and portfolio management with lower fees and 24/7 accessibility. While personal bankers excel in building trust and addressing complex queries, robo-advisors offer efficiency and cost-effectiveness suited for routine financial planning.

Benefits of Human Personal Bankers

Human personal bankers provide tailored financial advice by considering a client's unique financial situation, goals, and risk tolerance, ensuring personalized service beyond algorithmic recommendations. They offer empathetic support and build trust through face-to-face interactions, addressing complex concerns that automated systems might overlook. Personalized guidance from a human enables clients to make informed decisions, manage emotions during market fluctuations, and receive proactive financial planning.

Advantages of Using Robo-Advisors

Robo-advisors offer personalized investment portfolios with low fees by leveraging advanced algorithms and automation, ensuring efficient portfolio management tailored to individual risk tolerance. They provide 24/7 accessibility and quick rebalancing without human error, catering to tech-savvy clients seeking convenience and consistency. Integration with various financial accounts enables comprehensive financial analysis, enhancing decision-making efficiency compared to traditional personal bankers.

Costs: Personal Bankers vs Robo-Advisors

Personal bankers typically charge higher fees, averaging 1%-2% of assets under management, due to personalized service and human interaction. Robo-advisors offer lower-cost financial guidance with fees ranging from 0.25% to 0.50%, leveraging automated algorithms for portfolio management. Choosing between the two depends on budget constraints and preference for human expertise versus cost-efficient technology-driven advice.

Personalization in Financial Planning

Personal bankers offer tailored financial planning by assessing individual client needs, goals, and risk tolerance through personalized consultations. They provide customized advice and adjust strategies based on evolving personal circumstances, ensuring a dynamic and client-focused experience. Robo-advisors use algorithm-driven models but may lack the nuanced understanding and adaptability found in human-led financial guidance.

Accessibility and Convenience Comparison

Personal bankers offer direct, personalized financial guidance accessible through scheduled appointments or branch visits, providing tailored advice and immediate human interaction. Robo-advisors deliver 24/7 convenience with online platforms and mobile apps, enabling users to access automated investment management and financial planning anytime, anywhere without geographical limitations. While personal bankers excel in customized service through face-to-face engagement, robo-advisors prioritize ease of access and rapid decision-making through technology-driven solutions.

Security and Privacy Considerations

Personal bankers offer personalized financial guidance with strict adherence to regulatory standards like GDPR and PCI DSS, ensuring confidential handling of sensitive client information through secure, encrypted communication channels. Robo-advisors rely on advanced algorithms and cybersecurity protocols but may pose higher risks of data breaches due to centralized cloud storage and potential vulnerabilities in automated platforms. Evaluating security features such as multi-factor authentication, end-to-end encryption, and compliance certifications is crucial when choosing between human advisors and digital financial tools.

Ideal Clients for Personal Bankers vs Robo-Advisors

Personal bankers are ideal for clients seeking personalized financial advice, complex portfolio management, and relationship-driven service, often catering to high-net-worth individuals and those with multifaceted financial needs. Robo-advisors suit tech-savvy clients with simpler investment goals, limited budgets, or those preferring automated, low-cost solutions for retirement planning and basic wealth management. Clients prioritizing human interaction, tailored strategies, and holistic financial planning benefit more from personal bankers, whereas clients valuing convenience, low fees, and algorithm-driven portfolio optimization are better matched with robo-advisors.

Making the Right Choice for Your Financial Goals

Personal bankers offer tailored financial advice through personalized interaction and in-depth understanding of your unique financial situation and goals. Robo-advisors provide algorithm-driven investment management with low fees, ideal for hands-off investors seeking automated portfolio adjustments. Selecting the right option depends on your preference for human expertise versus automated efficiency aligned with your financial aspirations and risk tolerance.

Related Important Terms

Hybrid Advisory Model

The hybrid advisory model combines the personalized expertise of a personal banker with the efficiency and data-driven insights of a robo-advisor, offering clients tailored financial guidance and real-time portfolio management. This approach leverages human judgment for complex decision-making while utilizing technology to optimize investment strategies and enhance customer experience.

Algorithmic Portfolio Construction

Algorithmic portfolio construction in robo-advisors utilizes advanced machine learning models and real-time market data to create diversified, risk-adjusted investment portfolios tailored to individual financial goals. Personal bankers rely on human expertise and qualitative assessments, often resulting in less frequent and more subjective portfolio adjustments compared to the continuous, data-driven optimization provided by robo-advisory platforms.

Behavioral Finance Algorithms

Behavioral finance algorithms integrated into robo-advisors analyze client data to identify cognitive biases and emotional triggers, enabling personalized investment strategies that adapt dynamically to market changes. Personal bankers leverage human intuition and experience to interpret complex emotional and psychological factors, providing tailored financial guidance that can address nuanced client concerns beyond algorithmic predictions.

Human-in-the-Loop Banking

Personal bankers offer personalized financial guidance by leveraging human expertise to address unique client needs, emotional nuances, and complex decision-making that algorithms may overlook. Robo-advisors provide algorithm-driven investment advice with efficiency and lower costs but lack the adaptive judgment and empathetic interaction found in human-in-the-loop banking models.

Digital Financial Concierge

A Digital Financial Concierge combines the personalized, relationship-driven approach of a Personal Banker with the data-driven insights and real-time analytics of a Robo-Advisor, offering tailored financial guidance through AI-powered platforms. This hybrid service enhances user experience by providing customized investment strategies, risk assessments, and seamless access to financial products, optimizing both human expertise and automated efficiency.

Bionic Personal Banker

Bionic Personal Bankers combine expert human financial advisors with advanced AI technology to deliver personalized investment strategies, outperforming traditional Robo-Advisors by offering tailored advice based on real-time market data and individual financial goals. This hybrid approach enhances decision-making accuracy, client engagement, and adaptive wealth management, making it an optimal solution for comprehensive financial guidance.

Automated Risk Profiling

Automated risk profiling in robo-advisors uses algorithms to analyze client data and market trends, providing personalized investment strategies with consistent precision and speed. Personal bankers offer tailored financial guidance through direct interaction, allowing for nuanced understanding of client needs but may lack the continuous data-driven adjustments enabled by automated systems.

Remote Banking Consultant

A Remote Banking Consultant combines personalized financial advice typical of a Personal Banker with the efficiency and data-driven insights of a Robo-Advisor, offering tailored investment strategies and real-time portfolio management through secure digital platforms. This hybrid approach enhances customer experience by providing accessible, expert guidance and continuous monitoring without the need for in-person visits.

AI-Driven Goal Tracking

AI-driven goal tracking in robo-advisors leverages machine learning algorithms to provide personalized financial recommendations and real-time progress monitoring, enhancing the precision of investment strategies. Personal bankers offer tailored advice through human insight and relationship-based understanding, but may lack the data-driven efficiency and continuous optimization that AI-powered platforms deliver.

Emotional Intelligence Scoring

Personal bankers utilize emotional intelligence scoring to tailor financial advice by interpreting clients' emotional cues and behavioral patterns, fostering trust and personalized engagement. Robo-advisors, relying on algorithmic emotional analysis, provide data-driven recommendations but lack the nuanced empathy critical for complex financial decision-making.

Personal Banker vs Robo-Advisor for financial guidance. Infographic

moneydiff.com

moneydiff.com