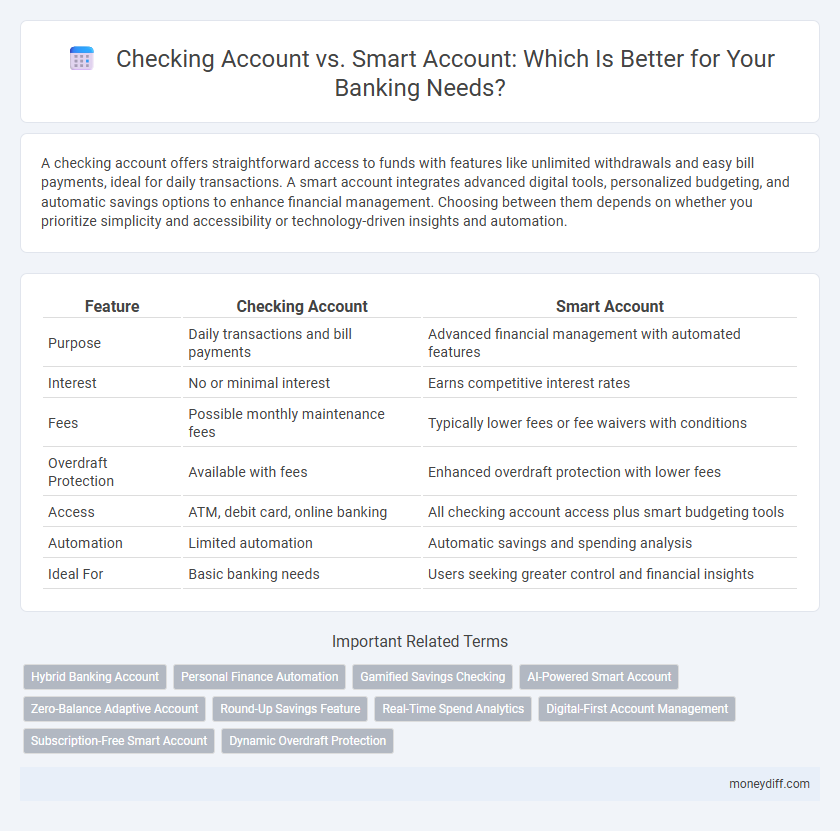

A checking account offers straightforward access to funds with features like unlimited withdrawals and easy bill payments, ideal for daily transactions. A smart account integrates advanced digital tools, personalized budgeting, and automatic savings options to enhance financial management. Choosing between them depends on whether you prioritize simplicity and accessibility or technology-driven insights and automation.

Table of Comparison

| Feature | Checking Account | Smart Account |

|---|---|---|

| Purpose | Daily transactions and bill payments | Advanced financial management with automated features |

| Interest | No or minimal interest | Earns competitive interest rates |

| Fees | Possible monthly maintenance fees | Typically lower fees or fee waivers with conditions |

| Overdraft Protection | Available with fees | Enhanced overdraft protection with lower fees |

| Access | ATM, debit card, online banking | All checking account access plus smart budgeting tools |

| Automation | Limited automation | Automatic savings and spending analysis |

| Ideal For | Basic banking needs | Users seeking greater control and financial insights |

Understanding Checking Accounts: Features and Functions

Checking accounts offer easy access to funds through debit cards, checks, and online banking, making them ideal for everyday transactions. They typically provide features such as unlimited withdrawals, bill payments, and sometimes overdraft protection, facilitating smooth cash flow management. Unlike smart accounts, checking accounts prioritize liquidity and convenience without emphasizing automated savings or investment tools.

What Is a Smart Account? Key Differences Explained

A Smart Account integrates traditional checking features with automated budgeting tools, real-time spending alerts, and enhanced security protocols, offering a more intuitive banking experience than a standard checking account. Unlike checking accounts that primarily focus on deposits, withdrawals, and payments, Smart Accounts use artificial intelligence to analyze spending patterns and optimize cash flow. Key differences include seamless integration with financial apps, personalized financial insights, and often higher interest rates or cash-back rewards linked to smart spending behaviors.

Fees and Charges: Comparing Checking and Smart Accounts

Checking accounts typically involve monthly maintenance fees ranging from $5 to $15, with potential charges for overdrafts, ATM usage, and minimum balance failures. Smart accounts often offer lower or no maintenance fees and waive overdraft charges, promoting cost-effectiveness through fee-free digital transactions and automated budgeting tools. Understanding fee structures and associated charges is crucial for choosing between traditional checking accounts and technologically advanced smart accounts tailored for digital banking efficiency.

Account Accessibility: Online and Mobile Banking Options

Checking accounts typically offer robust online and mobile banking features, including real-time transaction alerts, easy bill payments, and instant transfers, enhancing everyday financial management. Smart accounts elevate accessibility by integrating AI-driven tools for personalized spending insights, automated saving options, and seamless multi-device synchronization. Both account types enable 24/7 account monitoring, but smart accounts prioritize user experience with advanced digital capabilities tailored to modern banking needs.

Minimum Balance Requirements: Which Account Is More Flexible?

Checking accounts typically require a higher minimum balance compared to smart accounts, which often have low or no minimum balance requirements, making them more accessible for users with varying financial situations. Smart accounts provide greater flexibility by minimizing the risk of fees associated with falling below the minimum balance threshold. This feature is particularly beneficial for customers seeking cost-effective banking solutions with fewer restrictions.

Interest Rates: Earning Potential in Checking vs Smart Accounts

Smart accounts typically offer higher interest rates compared to traditional checking accounts, maximizing earning potential on deposited funds. While checking accounts prioritize easy access and liquidity, smart accounts combine these features with competitive interest, enabling customers to grow their balances more effectively. Comparing average annual percentage yields (APYs) reveals smart accounts often outperform checking accounts in passive income generation.

Security Features: Protecting Your Money

Checking accounts offer fundamental security features such as FDIC insurance, fraud monitoring, and standard encryption protocols to safeguard your money. Smart accounts build on these protections by integrating advanced security measures like biometric authentication, real-time transaction alerts, and multi-layer encryption for enhanced fraud prevention. These innovations in smart accounts provide heightened security, reducing the risk of unauthorized access and ensuring better protection of your financial assets.

Convenience and Usability: Everyday Banking Needs

A checking account provides straightforward access to funds through debit cards and unlimited transactions, making it ideal for daily purchases and bill payments. Smart accounts enhance convenience by integrating digital tools such as mobile app controls, automated budgeting features, and real-time transaction alerts. These smart functionalities streamline everyday banking tasks, offering improved usability and proactive financial management.

Ideal User Profiles: Who Should Choose Which Account?

Checking accounts suit individuals seeking straightforward access to funds with unlimited transactions, ideal for daily expenses and bill payments. Smart accounts benefit tech-savvy users wanting integrated digital tools, automated savings, and personalized financial insights for enhanced money management. Choosing between the two depends on preferences for simplicity versus advanced features and financial planning needs.

Making the Right Choice: Checking Account vs Smart Account

Choosing between a checking account and a smart account depends on your banking habits and financial goals. Checking accounts offer easy access to funds with unlimited transactions, ideal for daily expenses and bill payments, while smart accounts combine checking features with savings benefits, often providing higher interest rates and budgeting tools. Evaluating transaction frequency, interest earnings, and account fees helps determine the most efficient option for managing your money effectively.

Related Important Terms

Hybrid Banking Account

A Hybrid Banking Account combines the flexibility of a Checking Account with the advanced features of a Smart Account, offering seamless access to funds alongside automated savings and personalized financial insights. This hybrid solution optimizes everyday transactions while enhancing money management through integrated digital tools and real-time data analytics.

Personal Finance Automation

Checking accounts provide basic transaction capabilities such as deposits, withdrawals, and bill payments, while smart accounts integrate advanced personal finance automation features like budgeting tools, automatic savings, and spending analytics. Leveraging smart accounts enables users to optimize cash flow management and financial goal tracking through real-time insights and automated alerts.

Gamified Savings Checking

Gamified Savings Checking accounts combine traditional checking features with interactive financial incentives, encouraging users to save through rewards, challenges, and progress tracking. This innovative approach contrasts with standard checking accounts by promoting active money management and increasing user engagement in personal finance.

AI-Powered Smart Account

AI-powered Smart Accounts leverage advanced machine learning algorithms to provide personalized budgeting, real-time fraud detection, and automatic savings optimization, outperforming traditional checking accounts in both security and financial management. These smart accounts integrate seamless digital interfaces and predictive analytics to enhance user experience and deliver tailored financial insights, making them ideal for modern banking needs.

Zero-Balance Adaptive Account

A Zero-Balance Adaptive Account combines the flexibility of a checking account with intelligent fund management, automatically sweeping excess funds into higher-yield savings or investment options to optimize liquidity and returns. This smart account eliminates minimum balance requirements, reduces fees, and adapts to the account holder's spending and saving patterns for maximum financial efficiency.

Round-Up Savings Feature

Checking accounts typically provide basic transaction capabilities without automated savings, whereas smart accounts offer round-up savings features that automatically transfer the spare change from each purchase into a savings fund, enhancing effortless financial growth. This micro-investment approach leverages everyday spending data to boost savings habits and optimize cash flow management.

Real-Time Spend Analytics

Checking accounts offer basic tracking of transactions but often lack detailed real-time spend analytics, limiting immediate insights into spending patterns. In contrast, smart accounts integrate advanced real-time spend analytics, enabling customers to monitor expenses instantly and make informed financial decisions.

Digital-First Account Management

Smart accounts leverage advanced digital-first account management tools, offering features like real-time spending insights, automated savings, and integrated budgeting apps that surpass traditional checking accounts. Enhanced security protocols and seamless mobile access provide users greater control and convenience in managing their finances online.

Subscription-Free Smart Account

A subscription-free Smart Account offers seamless digital banking with no monthly fees, advanced budgeting tools, and real-time spending insights, making it ideal for tech-savvy customers seeking cost-effective money management. Unlike traditional checking accounts, Smart Accounts integrate automated savings features and customizable alerts, enhancing financial control without recurring subscription costs.

Dynamic Overdraft Protection

Dynamic Overdraft Protection in checking accounts automatically covers transactions exceeding the balance by linking to a savings account or line of credit, preventing overdraft fees and declined payments. Smart accounts enhance this feature with real-time monitoring and adjustable limits tailored to spending patterns, offering greater financial control and flexibility.

Checking Account vs Smart Account for banking. Infographic

moneydiff.com

moneydiff.com