Traditional banking offers physical branches and personalized customer service, appealing to those who prefer in-person interactions and established trust. Neobanking provides a fully digital experience with lower fees, faster account setup, and seamless mobile access, ideal for tech-savvy users seeking convenience. Comparing account features, neobanks often excel in innovation, while traditional banks maintain a broader range of services and ATM networks.

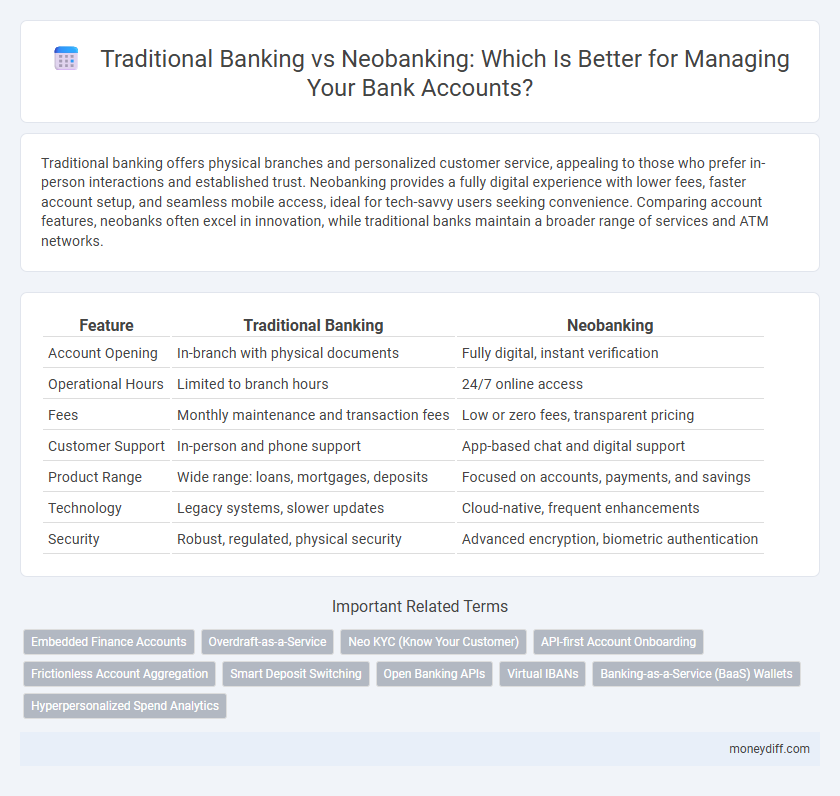

Table of Comparison

| Feature | Traditional Banking | Neobanking |

|---|---|---|

| Account Opening | In-branch with physical documents | Fully digital, instant verification |

| Operational Hours | Limited to branch hours | 24/7 online access |

| Fees | Monthly maintenance and transaction fees | Low or zero fees, transparent pricing |

| Customer Support | In-person and phone support | App-based chat and digital support |

| Product Range | Wide range: loans, mortgages, deposits | Focused on accounts, payments, and savings |

| Technology | Legacy systems, slower updates | Cloud-native, frequent enhancements |

| Security | Robust, regulated, physical security | Advanced encryption, biometric authentication |

Understanding Traditional Banking vs Neobanking

Traditional banking relies on physical branches, offering services such as savings and checking accounts, loans, and in-person customer support, while neobanking operates entirely online, providing digital-only accounts with seamless mobile access, lower fees, and faster transactions. Traditional banks tend to have higher operational costs and stricter regulatory requirements, whereas neobanks leverage technology to deliver user-friendly interfaces, real-time notifications, and innovative financial tools tailored for tech-savvy customers. Understanding these differences helps consumers choose between the established reliability of traditional banks and the convenience and agility of neobanks for managing their accounts.

Key Features of Traditional Bank Accounts

Traditional bank accounts offer features such as in-person branch access, comprehensive customer service, and physical check deposit capabilities. These accounts often include options for savings, checking, and certificates of deposit with established security protocols and FDIC insurance. Customers benefit from a wide network of ATMs and the ability to conduct complex transactions with personalized assistance.

Neobank Accounts: What Sets Them Apart?

Neobank accounts distinguish themselves by offering fully digital, branchless banking experiences with seamless mobile app interfaces and real-time transaction notifications. Unlike traditional banking, neobanks provide lower fees, faster account setup processes, and enhanced integration with financial technology services, enabling personalized budgeting tools and instant payment options. Their commitment to user-centric design and agility in adopting innovative features makes neobank accounts particularly attractive for tech-savvy customers seeking convenience and transparency.

Account Opening Process: Simplicity and Speed

Traditional banking typically involves a multi-step account opening process requiring physical branch visits, extensive paperwork, and identity verification, often resulting in delays of several days. Neobanks leverage fully digital platforms with AI-driven KYC (Know Your Customer) processes, enabling customers to open accounts within minutes using mobile apps or websites. This streamlined, contactless approach significantly enhances user convenience by reducing wait times and eliminating the need for in-person documentation.

Fees and Charges: Comparing Costs

Traditional banking often involves higher fees and charges, including maintenance fees, overdraft penalties, and ATM surcharges, which can significantly increase the cost of managing accounts. Neobanks typically offer lower or no maintenance fees, minimal overdraft charges, and free ATM withdrawals within their network, providing a more cost-effective alternative for account holders. Transparent fee structures and digital-first services make neobanking a preferred choice for consumers seeking to minimize banking costs.

Digital Experience and Accessibility

Traditional banking offers in-person service and physical branches but often lacks seamless digital experience and instant accessibility. Neobanks provide fully digital platforms with intuitive interfaces, real-time transaction notifications, and 24/7 account access via mobile apps. Enhanced digital features including AI-driven budgeting tools and faster onboarding processes make neobanks more accessible for tech-savvy and underserved customers.

Security Measures in Traditional Banks vs Neobanks

Traditional banks employ extensive security measures including FDIC insurance, multi-factor authentication, and encrypted transactions to safeguard customer accounts. Neobanks leverage advanced biometric verification and artificial intelligence-driven fraud detection but often lack the same level of federal insurance coverage. Both banking models prioritize customer data protection, yet traditional banks typically offer more comprehensive regulatory oversight and established cybersecurity frameworks.

Customer Support and Service Quality

Traditional banking offers personalized in-branch customer support with face-to-face interactions, ensuring direct assistance for complex banking needs. Neobanking provides 24/7 digital customer service through chatbots and mobile apps, emphasizing quick responses and convenience. Service quality in traditional banks benefits from established trust and regulatory compliance, while neobanks excel in technological innovation and seamless user experiences.

Integrations and Financial Tools

Traditional banking accounts provide limited integrations, mostly confined to core banking services and a few third-party apps, resulting in less seamless financial management. Neobanking platforms offer extensive integrations with budgeting tools, payment gateways, and investment apps, enhancing user experience through streamlined financial tracking and automation. The advanced API ecosystems of neobanks facilitate real-time data syncing, improving financial decision-making and efficiency for account holders.

Which is Right for You: Traditional Banking or Neobanking?

Traditional banking offers extensive branch networks, face-to-face customer service, and a wide range of financial products ideal for customers valuing personal interactions and physical access. Neobanking provides streamlined, digital-only platforms with lower fees, instant account opening, and innovative mobile features suitable for tech-savvy users seeking convenience and cost-efficiency. Choosing the right option depends on preferences for in-person services versus digital accessibility and the importance of comprehensive product offerings versus simplicity and speed.

Related Important Terms

Embedded Finance Accounts

Traditional banking offers embedded finance accounts with established infrastructure and regulatory compliance, but often involves slower onboarding and higher fees; neobanking leverages digital platforms to provide embedded finance accounts with seamless integration, real-time access, and lower operational costs, enhancing customer experience and scalability. Embedded finance accounts in neobanks streamline payment processing, lending, and wealth management services directly within third-party apps, accelerating innovation in financial ecosystems.

Overdraft-as-a-Service

Traditional banking accounts often include overdraft facilities embedded within broader financial services, typically requiring credit checks and manual approval processes that can delay fund access. Neobanking leverages Overdraft-as-a-Service APIs to offer instant, flexible overdraft limits with real-time risk assessment, enhancing customer experience and reducing operational costs.

Neo KYC (Know Your Customer)

Neobanking leverages advanced digital Neo KYC processes, enabling instant identity verification through biometric authentication and AI-driven document analysis, significantly reducing onboarding time compared to traditional banking's manual and paper-based KYC methods. This streamlined approach enhances customer experience and compliance accuracy while maintaining stringent anti-fraud measures.

API-first Account Onboarding

Traditional banking offers account onboarding through in-branch visits and legacy systems, often resulting in slower processing times and limited integration capabilities; neobanking leverages API-first account onboarding to enable seamless digital identity verification, instant account opening, and real-time data synchronization, enhancing customer experience and operational efficiency. This API-driven approach allows neobanks to integrate third-party services swiftly, automate compliance checks, and provide personalized financial products, setting a new standard for digital-first account management.

Frictionless Account Aggregation

Traditional banking often involves fragmented account management across multiple institutions, resulting in time-consuming processes and limited real-time financial insights. Neobanking leverages frictionless account aggregation technology to seamlessly consolidate multiple accounts within a single, user-friendly interface, enabling instant access to comprehensive financial data and enhanced decision-making.

Smart Deposit Switching

Smart Deposit Switching enables seamless transfer of recurring deposits between Traditional Banks and Neobanks, enhancing user control over finances and maximizing interest earnings. This feature leverages real-time APIs to automate deposit redirection without manual intervention, improving account flexibility and financial management efficiency.

Open Banking APIs

Traditional banking relies on legacy systems and branch networks, often limiting seamless integration, whereas neobanking leverages Open Banking APIs to provide real-time account access, enhanced user experience, and streamlined financial management. Open Banking APIs enable neobanks to aggregate customer data securely, offer personalized services, and facilitate instant transactions across multiple financial platforms without physical branch dependency.

Virtual IBANs

Traditional banking typically involves physical branch visits and offers limited virtual IBAN services, while neobanking provides seamless account management with full access to virtual IBANs for enhanced international transactions and real-time fund allocation. Virtual IBANs in neobanks streamline cross-border payments, reduce processing time, and improve reconciliation efficiency compared to the slower, less flexible solutions in conventional banks.

Banking-as-a-Service (BaaS) Wallets

Traditional banking accounts typically rely on physical branches and legacy systems, limiting real-time integration and customization, whereas Neobanking leverages Banking-as-a-Service (BaaS) wallets to offer seamless, API-driven financial services with enhanced user experience and faster onboarding. BaaS wallets enable neobanks to provide instant payments, personalized financial products, and scalable digital wallets without the overhead of traditional banking infrastructure.

Hyperpersonalized Spend Analytics

Traditional banking offers basic spend analytics derived from standard transaction categorizations, while neobanking leverages AI-driven hyperpersonalized spend analytics providing real-time insights tailored to individual financial behaviors and goals. Neobanks utilize machine learning algorithms to deliver customized budgeting advice, detect spending patterns, and suggest optimized saving strategies directly within digital account interfaces.

Traditional Banking vs Neobanking for accounts. Infographic

moneydiff.com

moneydiff.com