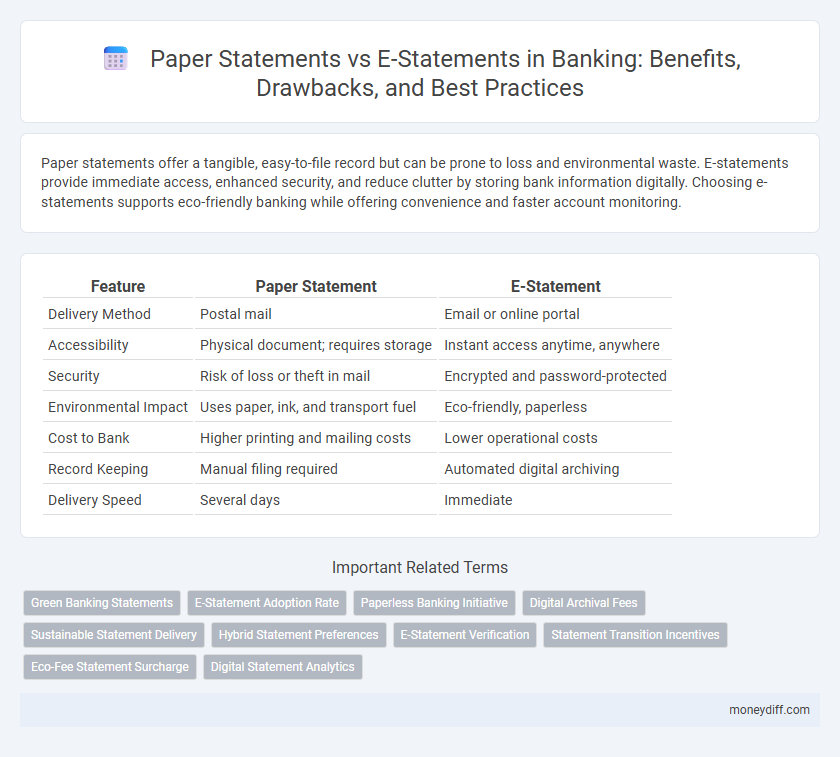

Paper statements offer a tangible, easy-to-file record but can be prone to loss and environmental waste. E-statements provide immediate access, enhanced security, and reduce clutter by storing bank information digitally. Choosing e-statements supports eco-friendly banking while offering convenience and faster account monitoring.

Table of Comparison

| Feature | Paper Statement | E-Statement |

|---|---|---|

| Delivery Method | Postal mail | Email or online portal |

| Accessibility | Physical document; requires storage | Instant access anytime, anywhere |

| Security | Risk of loss or theft in mail | Encrypted and password-protected |

| Environmental Impact | Uses paper, ink, and transport fuel | Eco-friendly, paperless |

| Cost to Bank | Higher printing and mailing costs | Lower operational costs |

| Record Keeping | Manual filing required | Automated digital archiving |

| Delivery Speed | Several days | Immediate |

Understanding Paper Statements vs E-Statements

Paper statements provide a tangible record of banking transactions, offering easy access without the need for electronic devices, but they involve printing and mailing costs and environmental impact. E-statements deliver secure, instant access to account information online, enhancing convenience and reducing paper waste, though they require internet access and digital literacy. Both formats ensure transaction transparency, but e-statements are increasingly preferred for their efficiency and eco-friendliness.

Environmental Impact: Paper vs Digital

Paper statements in banking contribute significantly to deforestation, water consumption, and carbon emissions due to the production and transportation of physical mail. E-statements drastically reduce environmental impact by eliminating the need for paper and lowering energy consumption associated with printing and delivery. Transitioning to digital statements supports sustainable banking practices by minimizing waste and carbon footprints.

Security Considerations: Which is Safer?

E-statements offer enhanced security features such as encryption, password protection, and reduced risk of physical document loss or theft compared to paper statements. Paper statements, while tangible, are vulnerable to interception through mail theft or unauthorized access in physical storage. Banks increasingly invest in secure digital platforms to ensure the confidentiality and integrity of e-statements, making them a safer option for protecting sensitive financial information.

Accessibility and Convenience Compared

E-statements offer instant access anytime through secure online banking platforms, eliminating delays caused by postal delivery associated with paper statements. Customers can easily search, download, and store digital statements on multiple devices, enhancing convenience and reducing physical clutter. Paper statements require manual filing and risk delays or loss, limiting accessibility compared to the streamlined, on-demand availability of e-statements.

Costs and Fees Involved

Paper statements in banking often incur additional costs such as printing, mailing fees, and postage, which can increase overall expenses for both banks and customers. E-statements eliminate most of these costs by delivering statements electronically, resulting in lower or no fees for customers and reduced operational expenses for banks. Choosing e-statements contributes to cost savings and often includes incentives like fee waivers or discounts, making it a more economical option.

Record Keeping and Organization

E-statements provide efficient record keeping through digital storage, enabling quick search and retrieval of transaction history, which enhances organization and reduces physical clutter. Paper statements require physical filing systems that can lead to disorganization and space constraints, making long-term storage challenging. Transitioning to e-statements supports seamless integration with financial management software, improving overall document management and accuracy.

Legal Acceptance and Documentation

Paper statements serve as legally recognized documents in banking, often preferred for official records and dispute resolution due to their physical authenticity. E-statements offer digital convenience and secure storage but may require additional verification to be accepted as legal proof in certain jurisdictions. Banks increasingly implement encryption and digital signature technologies to enhance the legal validity of e-statements while complying with regulatory standards.

Transitioning from Paper to E-Statements

Transitioning from paper statements to e-statements in banking reduces environmental impact by minimizing paper usage and supports faster, secure access to account information. E-statements enhance convenience through immediate delivery and easy digital archiving, eliminating postal delays and physical storage needs. Banks increasingly promote e-statements as part of digital banking initiatives, improving customer engagement and operational efficiency.

Customer Preferences and Demographics

Younger customers, particularly millennials and Gen Z, show a strong preference for e-statements due to convenience and environmental concerns, while older demographics often favor paper statements for tangibility and ease of understanding. Studies indicate that urban and tech-savvy users are more inclined towards digital banking services, whereas rural and less digitally literate customers rely more on traditional paper communications. Banks targeting diverse demographics tailor statement delivery options to enhance customer satisfaction and reduce operational costs.

Future Trends in Banking Statements

The future of banking statements is shifting towards digital transformation, with e-statements offering enhanced accessibility, real-time updates, and eco-friendly benefits compared to traditional paper statements. Financial institutions are increasingly leveraging blockchain technology and AI to improve security, personalization, and user experience in electronic statements. This transition supports regulatory compliance and cost reduction while meeting customer demand for instant, secure, and convenient account information delivery.

Related Important Terms

Green Banking Statements

E-statements significantly reduce paper consumption, minimizing deforestation and lowering carbon footprints associated with traditional paper statements in banking. Choosing paperless statements supports green banking initiatives by promoting sustainability and reducing waste linked to printing, mailing, and physical storage.

E-Statement Adoption Rate

The adoption rate of e-statements in banking has surged significantly, with over 70% of customers opting for digital statements due to their convenience and environmental benefits. Financial institutions report that e-statements reduce processing costs by up to 60% compared to paper statements, driving accelerated digital transformation in customer communications.

Paperless Banking Initiative

E-statements significantly reduce paper waste and processing costs, aligning with the paperless banking initiative aimed at enhancing environmental sustainability and operational efficiency. Customers benefit from secure, instant access to their banking information, minimizing the risk of physical document loss and promoting digital record-keeping.

Digital Archival Fees

E-statements eliminate digital archival fees by enabling secure, long-term electronic storage without physical space requirements. Paper statements incur recurring costs for printing, mailing, and physical archive management, increasing overall banking expenses.

Sustainable Statement Delivery

Paper statements generate significant environmental waste through paper consumption and transportation emissions, while e-statements drastically reduce the carbon footprint by eliminating physical delivery and enabling instant digital access. Adopting e-statements supports sustainable banking practices by conserving natural resources and minimizing landfill contributions associated with traditional paper-based statements.

Hybrid Statement Preferences

Hybrid statement preferences in banking combine the convenience of e-statements with the security and tangibility of paper statements, catering to diverse customer needs. This approach increases customer satisfaction by offering options for digital access while retaining physical copies for record-keeping and detailed review.

E-Statement Verification

E-Statement verification enhances security by allowing customers to access encrypted digital statements directly through secure banking portals, reducing the risk of mail theft and fraud associated with paper statements. Digital timestamps and authentication features enable instant validation of transaction records, promoting accurate financial tracking and compliance adherence.

Statement Transition Incentives

Banks encourage customers to switch from paper statements to e-statements by offering statement transition incentives such as fee waivers, cashback rewards, and access to enhanced digital tools. These incentives reduce costs for financial institutions while promoting environmentally friendly practices and improving customer convenience through instant online access.

Eco-Fee Statement Surcharge

Paper statements in banking often incur an eco-fee statement surcharge to cover the environmental costs of printing and mailing physical documents. E-statements eliminate these fees, promoting eco-friendly banking practices while reducing customer expenses and lowering the bank's carbon footprint.

Digital Statement Analytics

Digital statement analytics in banking leverages e-statements to provide real-time transaction insights, enhanced security features, and customized spending reports unavailable with traditional paper statements. E-statements facilitate data-driven decision-making through advanced algorithms and AI, offering greater accuracy and customer convenience while reducing carbon footprint and operational costs for banks.

Paper Statement vs E-Statement for banking. Infographic

moneydiff.com

moneydiff.com