A savings account offers easy access to funds and typically features lower interest rates, making it suitable for short-term savings and emergency funds. A high-yield account provides significantly higher interest rates, allowing your money to grow faster, but may come with restrictions like minimum balances or limited withdrawals. Choosing between the two depends on your financial goals, liquidity needs, and willingness to meet account requirements.

Table of Comparison

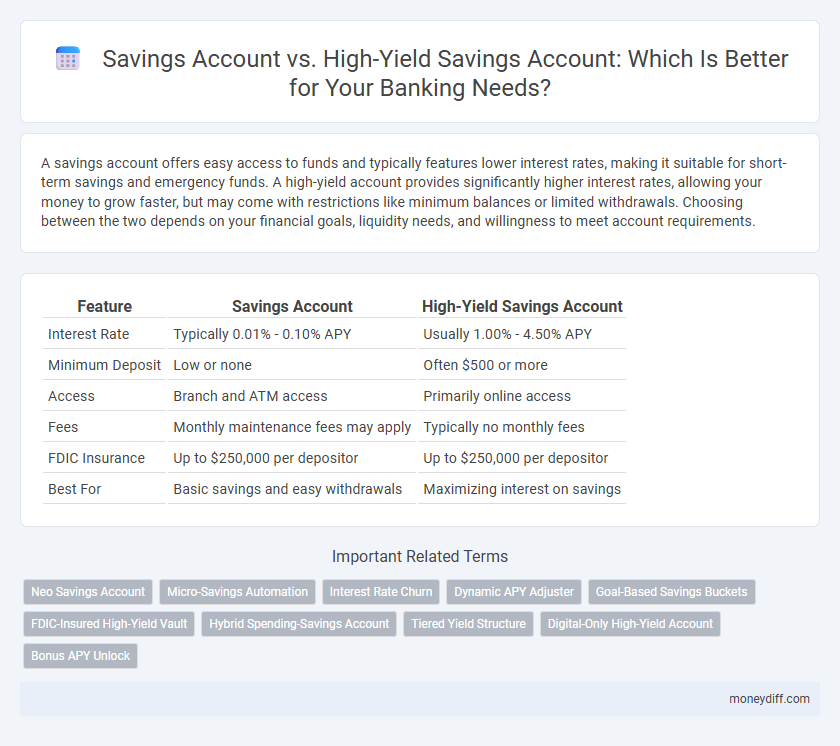

| Feature | Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate | Typically 0.01% - 0.10% APY | Usually 1.00% - 4.50% APY |

| Minimum Deposit | Low or none | Often $500 or more |

| Access | Branch and ATM access | Primarily online access |

| Fees | Monthly maintenance fees may apply | Typically no monthly fees |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Best For | Basic savings and easy withdrawals | Maximizing interest on savings |

Understanding the Basics: Savings Account vs High-Yield Account

Savings accounts offer easy access to funds with low minimum balance requirements and typically provide a standard interest rate around 0.01% to 0.10%. High-yield savings accounts deliver significantly higher interest rates, often between 0.40% and 4.50%, but may require higher minimum deposits or limited transaction capabilities. Evaluating factors such as liquidity, interest rate, and fees is essential for choosing the best option to grow savings efficiently.

Key Features of Traditional Savings Accounts

Traditional savings accounts offer FDIC insurance up to $250,000, ensuring the safety of deposits while providing easy access to funds through ATM withdrawals and transfers. These accounts typically feature lower interest rates compared to high-yield accounts but maintain minimal balance requirements and no monthly fees. Customers benefit from convenient banking services such as online access, mobile deposits, and automatic savings options, making traditional savings accounts ideal for emergency funds and short-term savings goals.

What Sets High-Yield Savings Accounts Apart?

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, often providing annual percentage yields (APYs) that exceed 3%, which can substantially grow your savings over time. These accounts typically require higher minimum deposits or balances but compensate with better returns and may come with online-only access to reduce overhead costs. Unlike standard savings accounts, high-yield versions use optimized interest compounding and benefit from competitive rates driven by digital banks or financial institutions aiming to attract savers.

Interest Rates: Comparing Potential Earnings

Savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10% APY, resulting in modest potential earnings. High-yield savings accounts provide significantly higher rates, often between 3.00% and 4.50% APY, maximizing interest income over time. Choosing a high-yield account can substantially increase passive growth on deposits, especially when compounded regularly.

Accessibility and Account Flexibility

Savings accounts offer easy accessibility with ATM withdrawals and branch visits, making them ideal for frequent transactions. High-yield accounts typically have limited access options, such as restrictions on withdrawals and transfers, designed to encourage savings growth. The flexibility of savings accounts suits everyday banking needs, while high-yield accounts prioritize higher interest returns over immediate access.

Fees and Minimum Balance Requirements

Savings accounts typically have low or no monthly fees and require minimal minimum balances, making them accessible for everyday banking needs. High-yield accounts often offer higher interest rates but may impose higher minimum balance requirements and fees if thresholds are not maintained. Evaluating fee structures and minimum balance policies is crucial for maximizing returns while minimizing costs in choosing between savings and high-yield accounts.

Security and FDIC Insurance

Savings accounts and high-yield savings accounts both offer FDIC insurance up to $250,000 per depositor, ensuring the security of funds in case of bank failure. High-yield accounts typically come from online banks with the same FDIC protection but provide higher interest rates without compromising safety. Customers should verify FDIC membership of their financial institution to guarantee full insurance coverage on their deposits.

Online vs Brick-and-Mortar Bank Options

High-yield savings accounts offered by online banks generally provide significantly higher interest rates compared to traditional brick-and-mortar bank savings accounts, often exceeding national averages by 1-2 percentage points. Online banks reduce overhead costs, enabling them to pass on better returns, while brick-and-mortar banks typically offer more personalized customer service and immediate access to physical branches. Consumers prioritizing higher yields and lower fees may prefer online options, whereas those valuing in-person support and cash deposits tend to favor brick-and-mortar institutions.

Which Account Best Fits Different Financial Goals?

Savings accounts provide easy access to funds with lower interest rates, making them suitable for emergency funds or short-term savings. High-yield accounts offer significantly higher interest rates, ideal for growing long-term savings or maximizing returns on idle cash. Choosing between the two depends on liquidity needs and the priority of interest growth versus instant access.

Choosing the Right Account for Your Money Management Strategy

Choosing the right account between a traditional savings account and a high-yield savings account depends on your financial goals and liquidity needs. High-yield accounts offer significantly higher interest rates, often above 3.5% APY, maximizing your earnings on deposits compared to standard savings accounts with rates typically below 0.5% APY. Evaluate factors such as minimum balance requirements, withdrawal limits, and potential fees to optimize your money management strategy.

Related Important Terms

Neo Savings Account

Neo Savings Accounts offer competitive interest rates that often outperform traditional savings accounts, making them an ideal choice for customers seeking higher returns with digital convenience. These accounts typically feature low fees, seamless mobile banking access, and quick fund transfers, enhancing user experience while maximizing savings growth potential.

Micro-Savings Automation

Micro-savings automation in high-yield accounts leverages automated transfers to maximize interest earnings with minimal effort, offering higher APYs compared to traditional savings accounts that often have lower interest rates and manual deposit requirements. Integrating micro-savings automation enables users to consistently build their savings by rounding up transactions or setting small, frequent deposits, optimizing growth while maintaining liquidity.

Interest Rate Churn

Savings accounts typically offer lower interest rates ranging from 0.01% to 0.10%, resulting in minimal growth over time, while high-yield accounts provide substantially higher interest rates between 0.40% and 5.00%, leading to greater earnings through interest rate churn. Frequent rate adjustments in high-yield accounts can affect overall returns, making it crucial for account holders to monitor rate changes and switch accounts strategically to maximize interest income.

Dynamic APY Adjuster

Savings accounts typically offer a fixed APY with lower interest rates, while high-yield accounts feature a dynamic APY adjuster that responds to market conditions, providing higher returns based on prevailing interest rates. The dynamic APY adjuster in high-yield accounts optimizes earnings by automatically increasing or decreasing the annual percentage yield to maximize savings growth efficiently.

Goal-Based Savings Buckets

Goal-based savings buckets in banking allow customers to allocate funds within savings accounts tailored to specific objectives, while high-yield accounts offer higher interest rates but typically lack the compartmentalization features of goal-based buckets. Utilizing a combination of standard savings accounts for organized goal tracking and high-yield accounts for maximizing interest earnings optimizes both financial discipline and growth potential.

FDIC-Insured High-Yield Vault

FDIC-insured high-yield vault accounts offer significantly higher interest rates compared to traditional savings accounts while maintaining federal insurance protection up to $250,000 per depositor, ensuring both growth and security. These accounts are ideal for customers seeking better returns without sacrificing the safety provided by standard savings options.

Hybrid Spending-Savings Account

A Hybrid Spending-Savings Account combines the liquidity of a traditional savings account with higher interest rates similar to high-yield accounts, offering seamless access to funds while maximizing earnings on balances. This account type optimizes cash flow management by integrating transactional capabilities with competitive APY, ideal for customers seeking both convenience and growth.

Tiered Yield Structure

Savings accounts typically offer a fixed interest rate with minimal variation, while high-yield accounts utilize a tiered yield structure that increases interest rates as balances reach higher thresholds, maximizing returns for larger deposits. This tiered system incentivizes account holders to maintain higher balances, effectively optimizing earnings compared to standard savings accounts.

Digital-Only High-Yield Account

Digital-only high-yield savings accounts offer significantly higher interest rates, often ranging from 3% to 5% APY, compared to traditional savings accounts with rates below 0.5%, maximizing growth on deposited funds. These accounts provide seamless online access, minimal fees, and advanced features like automated savings tools, making them ideal for tech-savvy customers seeking optimal returns without physical branch visits.

Bonus APY Unlock

High-yield savings accounts often feature bonus APY unlock tiers that reward customers for maintaining higher balances or meeting specific deposit requirements, significantly increasing earnings compared to standard savings accounts. This tiered interest rate structure incentivizes larger or consistent deposits, enabling savers to maximize returns while benefiting from FDIC insurance protection.

Savings Account vs High-Yield Account for banking. Infographic

moneydiff.com

moneydiff.com