Mobile banking apps provide streamlined access to essential financial services such as account management, transfers, and bill payments with a focus on security and user-friendly interfaces. Super apps, however, integrate a wide range of financial and lifestyle services, offering a one-stop platform that combines money management, shopping, communication, and more for greater convenience. Choosing between mobile banking and super apps depends on whether users prioritize specialized banking features or multifunctional ecosystems for holistic money management.

Table of Comparison

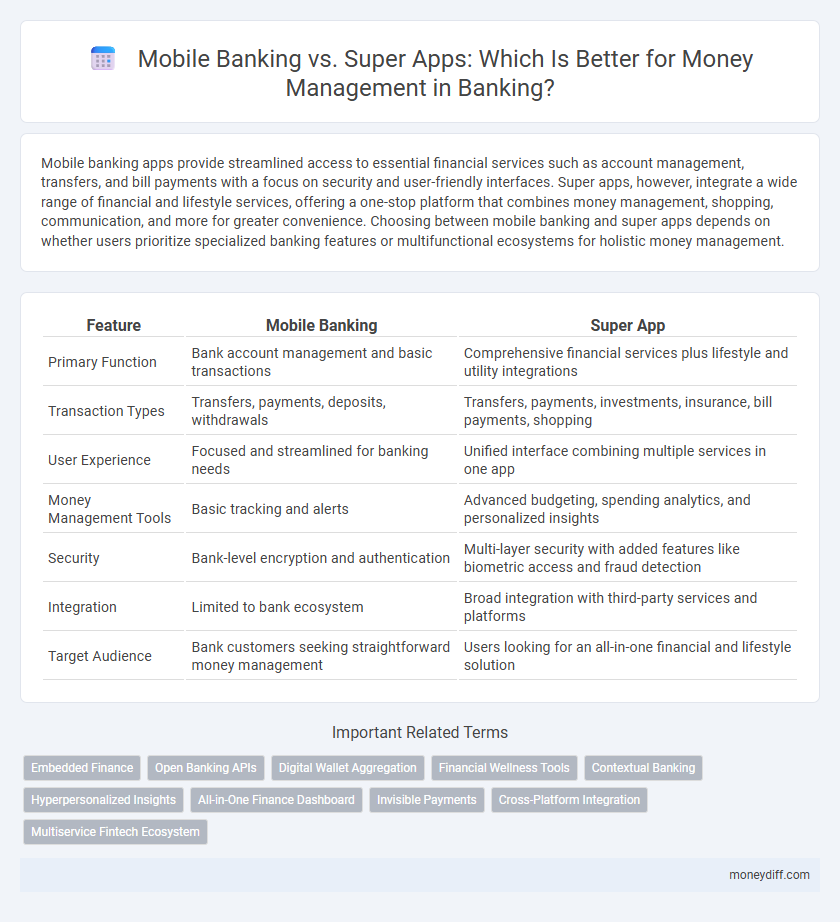

| Feature | Mobile Banking | Super App |

|---|---|---|

| Primary Function | Bank account management and basic transactions | Comprehensive financial services plus lifestyle and utility integrations |

| Transaction Types | Transfers, payments, deposits, withdrawals | Transfers, payments, investments, insurance, bill payments, shopping |

| User Experience | Focused and streamlined for banking needs | Unified interface combining multiple services in one app |

| Money Management Tools | Basic tracking and alerts | Advanced budgeting, spending analytics, and personalized insights |

| Security | Bank-level encryption and authentication | Multi-layer security with added features like biometric access and fraud detection |

| Integration | Limited to bank ecosystem | Broad integration with third-party services and platforms |

| Target Audience | Bank customers seeking straightforward money management | Users looking for an all-in-one financial and lifestyle solution |

Introduction to Mobile Banking and Super Apps

Mobile banking enables users to perform financial transactions through dedicated banking apps or mobile websites, offering services like balance checks, fund transfers, and bill payments. Super apps integrate multiple financial and non-financial services, such as banking, e-commerce, and utility payments, within a single platform, enhancing convenience and user engagement. Both platforms leverage secure APIs and biometric authentication to ensure safe and seamless money management experiences.

Key Features of Mobile Banking Apps

Mobile banking apps prioritize secure, real-time access to account balances, funds transfer, bill payments, and ATM locators, ensuring streamlined financial management. Advanced features include biometric authentication, push notifications for transaction alerts, and budgeting tools tailored to individual spending patterns. Integration with customer support and personalized financial insights further enhances user experience, distinguishing mobile banking from broader super app functionalities.

What Makes a Super App Unique?

A Super App integrates diverse financial services such as payments, investments, loans, and insurance into a single platform, offering seamless money management unlike traditional Mobile Banking apps that primarily focus on basic transactions. Its unique ecosystem leverages advanced AI-driven personalized recommendations and real-time analytics to optimize user financial decisions. This comprehensive approach enhances user engagement and convenience by consolidating multiple financial needs within one accessible, secure interface.

User Experience: Comparing Interfaces

Mobile banking apps offer streamlined interfaces designed specifically for financial transactions, ensuring quick access to account balances, transfers, and bill payments with minimal navigation. Super apps integrate multiple services beyond banking, such as shopping and messaging, which can complicate the user interface and reduce transaction speed. User experience in mobile banking prioritizes simplicity and efficiency, while super apps emphasize multifunctionality, affecting ease of use and task-specific performance.

Security Measures in Mobile Banking vs Super Apps

Mobile banking apps typically implement robust security protocols such as multifactor authentication, biometric verification, and end-to-end encryption to safeguard user transactions and personal data. Super apps, integrating multiple financial services, often employ advanced AI-driven fraud detection systems and real-time monitoring to address the increased risk of cyber threats within a consolidated platform. Both platforms continuously update their security frameworks to comply with regulatory standards like PSD2 and GDPR, ensuring enhanced protection for money management activities.

Financial Tools and Services Offered

Mobile banking apps provide essential financial tools such as account monitoring, fund transfers, bill payments, and basic budgeting features, focusing primarily on core banking functions. Super apps integrate these services with a broader ecosystem, combining payments, investment options, insurance, loans, and personalized financial planning into a single platform. The comprehensive range of services in super apps enhances user convenience by centralizing money management, whereas mobile banking apps excel in delivering streamlined, secure access to traditional banking products.

Integration with External Services

Mobile banking apps primarily offer direct access to bank accounts and basic financial services, ensuring secure and efficient money management within a single institution. Super apps, however, integrate a wide range of external services such as investment platforms, bill payments, insurance, and peer-to-peer transfers, creating a comprehensive financial ecosystem. This seamless integration enhances user convenience by centralizing diverse monetary transactions and financial activities in one unified interface.

Cost and Fees for Users

Mobile banking apps typically charge lower fees for basic transactions and offer free account management, making them cost-effective for everyday banking needs. Super apps, while providing a broader range of financial services within one platform, often include higher fees for premium features and integrated services due to their extensive ecosystem. Users focused on minimizing costs should evaluate transaction fees and monthly maintenance charges when choosing between mobile banking and super apps for money management.

Accessibility and Cross-Platform Availability

Mobile banking apps provide streamlined access to core financial services with optimized performance on iOS and Android, ensuring secure and fast transactions. Super apps integrate multiple services, including payments, investments, and budgeting tools, across a unified platform accessible on smartphones, tablets, and web browsers. Cross-platform availability in super apps enhances user convenience by enabling seamless money management across devices, while traditional mobile banking apps focus on specialized banking functions with high security standards.

Which Solution Fits Your Money Management Needs?

Mobile banking apps provide streamlined access to essential financial transactions such as transfers, bill payments, and account monitoring, offering simplicity and security for users focused solely on banking needs. Super apps integrate multiple financial services, including budgeting tools, investment options, and peer-to-peer payments, delivering a comprehensive money management experience within a single platform. Choosing the right solution depends on your preference for specialized, efficient banking functions or a versatile ecosystem that consolidates diverse money management features.

Related Important Terms

Embedded Finance

Mobile banking apps streamline financial services by providing users with direct access to account management, payments, and transfers, emphasizing security and ease of use. Super apps integrate embedded finance features within broader platforms, offering seamless money management alongside services like shopping and communication, enhancing user engagement through a unified ecosystem.

Open Banking APIs

Mobile banking apps provide secure, user-friendly interfaces tailored for specific financial institutions, leveraging Open Banking APIs to enable seamless account aggregation and transaction initiation. Super apps integrate multiple financial services, including payments, investments, and loans, through Open Banking APIs, offering a comprehensive money management ecosystem within a single platform for enhanced user convenience and data-driven insights.

Digital Wallet Aggregation

Mobile banking platforms offer direct access to individual bank accounts with features tailored for basic transactions and balance monitoring, while super apps provide comprehensive digital wallet aggregation, enabling users to manage multiple financial services, loyalty programs, and payment methods within a single interface for enhanced convenience and seamless money management. Integrating diverse digital wallets into super apps streamlines financial activities by consolidating funds, monitoring spending trends, and facilitating cross-platform payments, making them a preferred solution for users seeking holistic money management tools.

Financial Wellness Tools

Mobile banking apps offer essential financial wellness tools like budgeting, transaction tracking, and alerts, enabling users to manage finances efficiently within a focused environment. Super apps integrate these capabilities with additional services such as investment options, bill payments, and personalized financial advice, creating a comprehensive ecosystem that enhances overall money management and financial health.

Contextual Banking

Mobile banking platforms offer streamlined access to traditional banking services such as account management, transfers, and bill payments, optimizing financial tasks within a secure environment. Super apps integrate contextual banking by embedding personalized financial services into diverse lifestyle features, enabling seamless money management tailored to users' real-time needs and activities.

Hyperpersonalized Insights

Mobile banking apps deliver hyperpersonalized insights by analyzing individual spending habits and financial goals, enabling tailored budgeting and investment recommendations. Super apps integrate diverse financial services within one platform, offering a holistic view of money management that adapts dynamically to user behavior and lifestyle changes.

All-in-One Finance Dashboard

Mobile banking apps provide essential features like account balances, transfers, and bill payments, while super apps integrate an all-in-one finance dashboard offering comprehensive money management tools such as budgeting, investment tracking, and personalized financial insights. The all-in-one finance dashboard within super apps enhances user experience by consolidating multiple financial services into a single platform, enabling seamless control over spending, savings, and financial goals.

Invisible Payments

Invisible payments in mobile banking streamline transactions by enabling seamless fund transfers and bill payments without manual input, enhancing user convenience. Super apps integrate invisible payment technology across services, offering a unified platform that automates money management and real-time financial tracking for comprehensive control.

Cross-Platform Integration

Mobile banking apps excel in providing secure, streamlined access to core financial services with optimized user experiences across iOS and Android platforms, ensuring seamless transaction management and account monitoring. Super apps offer unified cross-platform integration by embedding diverse financial products, such as payments, loans, and investments, within a single interface, enabling users to manage money while simultaneously accessing non-banking services without switching apps.

Multiservice Fintech Ecosystem

Mobile banking apps provide streamlined access to core financial services like payments, transfers, and account management, emphasizing convenience and security for users. Super apps integrate multiple financial functions such as investments, insurance, loans, and budgeting tools within a single multiservice fintech ecosystem, enhancing user engagement through comprehensive money management solutions.

Mobile Banking vs Super App for money management. Infographic

moneydiff.com

moneydiff.com