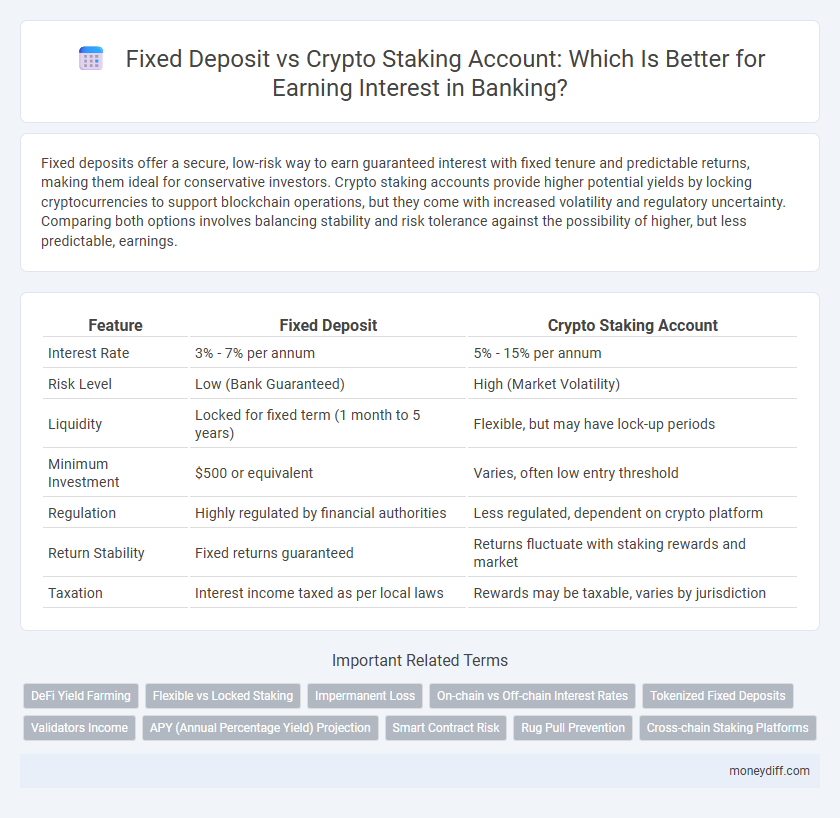

Fixed deposits offer a secure, low-risk way to earn guaranteed interest with fixed tenure and predictable returns, making them ideal for conservative investors. Crypto staking accounts provide higher potential yields by locking cryptocurrencies to support blockchain operations, but they come with increased volatility and regulatory uncertainty. Comparing both options involves balancing stability and risk tolerance against the possibility of higher, but less predictable, earnings.

Table of Comparison

| Feature | Fixed Deposit | Crypto Staking Account |

|---|---|---|

| Interest Rate | 3% - 7% per annum | 5% - 15% per annum |

| Risk Level | Low (Bank Guaranteed) | High (Market Volatility) |

| Liquidity | Locked for fixed term (1 month to 5 years) | Flexible, but may have lock-up periods |

| Minimum Investment | $500 or equivalent | Varies, often low entry threshold |

| Regulation | Highly regulated by financial authorities | Less regulated, dependent on crypto platform |

| Return Stability | Fixed returns guaranteed | Returns fluctuate with staking rewards and market |

| Taxation | Interest income taxed as per local laws | Rewards may be taxable, varies by jurisdiction |

Understanding Fixed Deposits: Traditional Savings Explained

Fixed deposits offer a secure and predictable way to earn interest by locking funds for a fixed tenure with guaranteed returns typically ranging from 5% to 7% annually, depending on the bank and economic conditions. Unlike crypto staking accounts, fixed deposits are insured by government schemes such as the FDIC or DICGC, providing principal safety against market volatility. Understanding the rigid withdrawal restrictions and comparatively lower but stable interest rates helps investors balance risk and liquidity needs in traditional banking.

What Is Crypto Staking? A Modern Interest-Earning Method

Crypto staking is a process where cryptocurrency holders lock their digital assets in a blockchain network to support its operations and security, earning rewards in the form of interest or additional tokens. Unlike traditional fixed deposits offered by banks with fixed interest rates and guaranteed returns, crypto staking offers potentially higher yields but with increased market volatility and risks. This modern method combines the principles of decentralized finance (DeFi) with passive income strategies, appealing to investors seeking alternatives to conventional banking interest accounts.

Risk Comparison: Fixed Deposit vs Crypto Staking

Fixed deposits offer guaranteed returns with minimal risk as they are typically insured by government agencies, making them a secure option for conservative investors. Crypto staking accounts provide higher potential yields by locking digital assets in blockchain networks but carry significant risks including market volatility, regulatory uncertainty, and possible loss of principal due to smart contract vulnerabilities. Understanding risk tolerance and investment goals is crucial when choosing between the stable, low-risk nature of fixed deposits and the high-risk, high-reward profile of crypto staking.

Potential Returns: Interest Rates and Profitability

Fixed deposits typically offer fixed interest rates ranging from 4% to 7% annually, providing predictable and guaranteed returns backed by banks. Crypto staking accounts, however, can yield significantly higher annual percentage rates (APRs), often between 8% and 20%, but carry increased volatility and risk due to cryptocurrency price fluctuations. While fixed deposits ensure capital safety with moderate returns, crypto staking promises superior profitability for investors willing to accept market uncertainties.

Safety and Security of Funds

Fixed deposits offer high safety and security with government-backed insurance and fixed returns, minimizing risks to principal amount. Crypto staking accounts provide potentially higher yields but expose investors to market volatility, hacking risks, and lack of regulatory protections. Choosing between the two depends on prioritizing guaranteed capital preservation versus seeking higher but riskier interest income.

Liquidity and Withdrawal Flexibility

Fixed deposits in traditional banking offer limited liquidity with penalties for early withdrawal, making them less flexible for accessing funds before maturity. Crypto staking accounts typically provide greater withdrawal flexibility and faster liquidity, although the availability and timing can vary depending on the blockchain protocol and staking terms. Investors must balance the predictable returns and security of fixed deposits against the potentially higher interest rates and variable withdrawal conditions found in crypto staking.

Minimum Investment Requirements

Fixed deposits typically require a minimum investment ranging from $500 to $1,000, providing a low-risk, stable interest return regulated by financial institutions. Crypto staking accounts often have varying minimum thresholds, sometimes as low as $50, but can demand higher amounts depending on the cryptocurrency network's protocol and platform rules. Investors should consider these minimum investment requirements alongside factors like risk tolerance and the volatility of cryptocurrency markets when choosing between fixed deposits and crypto staking for earning interest.

Tax Implications on Earned Interest

Fixed deposits in banks offer interest income that is typically subject to standard income tax rates and may be eligible for tax exemptions under specific sections like 80C in some countries. Crypto staking rewards are often treated as taxable income at the fair market value at the time of receipt, and tax regulations can vary significantly across jurisdictions, sometimes leading to complexities in reporting and potential capital gains tax upon liquidation. Investors must evaluate the tax treatment of earned interest and staking rewards in their country to optimize after-tax returns effectively.

Regulatory Oversight and Investor Protection

Fixed deposits operate under stringent regulatory oversight by central banks, ensuring robust investor protection and guaranteed returns with minimal risk. Crypto staking accounts, while offering potentially higher yields, lack comprehensive regulatory frameworks, exposing investors to higher volatility and limited legal safeguards. Investors prioritizing security and regulatory compliance often prefer fixed deposits over crypto staking for stable interest earnings.

Suitability: Which Option Fits Your Financial Goals?

Fixed deposits offer assured returns and low risk, making them suitable for conservative investors seeking capital preservation and predictable income. Crypto staking accounts provide higher potential yields but come with increased volatility and regulatory uncertainty, aligning better with investors willing to accept risk for greater rewards. Assess your risk tolerance, investment horizon, and liquidity needs to determine whether the stability of fixed deposits or the growth potential of crypto staking better fits your financial goals.

Related Important Terms

DeFi Yield Farming

Fixed deposits offer guaranteed interest with minimal risk, typically providing rates between 4% to 7% annually, whereas DeFi yield farming through crypto staking accounts can yield significantly higher returns, often exceeding 15% APY but with increased volatility and smart contract risk. DeFi platforms leverage blockchain technology to enable users to earn compound interest by staking cryptocurrencies in decentralized liquidity pools, presenting an innovative alternative to traditional fixed deposit schemes.

Flexible vs Locked Staking

Fixed deposits offer a locked interest rate with capital locked for a predetermined period, ensuring stable returns but limited liquidity. Crypto staking accounts provide flexible options where assets can be unstaked or switched, often yielding higher variable interest but with increased market volatility risk.

Impermanent Loss

Fixed deposits offer guaranteed interest rates with minimal risk, while crypto staking accounts provide higher potential returns but expose investors to impermanent loss due to market volatility and fluctuating token prices. Understanding impermanent loss is crucial for evaluating the real profitability of crypto staking compared to the stable, predictable yield of fixed deposits.

On-chain vs Off-chain Interest Rates

Fixed deposits in traditional banking offer off-chain interest rates typically ranging from 4% to 7% annually with guaranteed returns and regulatory protection. In contrast, crypto staking accounts provide on-chain interest rates that can exceed 10% to 20%, driven by blockchain protocols and network participation but come with higher volatility and regulatory uncertainty.

Tokenized Fixed Deposits

Tokenized Fixed Deposits combine the stability of traditional fixed deposits with blockchain efficiency, offering higher liquidity and transparent interest accrual compared to conventional banking products. Crypto staking accounts provide variable returns tied to network performance but carry higher volatility and regulatory risks than tokenized fixed deposits backed by established financial institutions.

Validators Income

Fixed deposits offer guaranteed interest rates determined by banks, while crypto staking accounts generate validator income through blockchain network participation, potentially yielding higher but variable returns. Validators earn rewards for maintaining transaction integrity, making staking a decentralized alternative with risks tied to market volatility and network performance.

APY (Annual Percentage Yield) Projection

Fixed deposits typically offer a stable APY ranging from 3% to 7% annually, providing guaranteed returns with low risk, whereas crypto staking accounts can yield between 5% and 20% APY, subject to market volatility and platform security. Investors prioritizing predictable income may prefer fixed deposits, while those seeking higher returns and willing to accept higher risk might consider crypto staking for enhanced APY potential.

Smart Contract Risk

Fixed Deposit accounts offer guaranteed interest with minimal risk due to traditional banking regulations, whereas Crypto Staking Accounts rely on smart contracts that carry inherent risks such as code vulnerabilities, hacking exploits, and potential lock-up periods leading to loss of principal. Investors must weigh the security of regulated fixed income products against the decentralized, often unregulated nature of smart contract protocols with variable interest rates and smart contract audits impacting risk exposure.

Rug Pull Prevention

Fixed deposits provide regulated, low-risk interest income secured by banking institutions and government insurance, significantly minimizing the risk of rug pulls compared to crypto staking accounts. Crypto staking offers higher potential returns but carries inherent risks of rug pulls due to lack of regulation and reliance on smart contract security.

Cross-chain Staking Platforms

Fixed deposits offer guaranteed interest rates with minimal risk, while crypto staking accounts on cross-chain platforms provide potentially higher yields by locking assets across multiple blockchain networks, leveraging interoperability for optimized rewards. Cross-chain staking platforms enable users to diversify risk and maximize returns by accessing staking opportunities beyond a single blockchain ecosystem.

Fixed Deposit vs Crypto Staking Account for earning interest Infographic

moneydiff.com

moneydiff.com