Monthly maintenance fees for traditional bank accounts often add a hidden cost that can accumulate over time, reducing overall savings. Subscription banking offers a fixed monthly fee that typically includes multiple services such as unlimited transactions, premium customer support, and digital tools, providing predictable and transparent account costs. Choosing subscription banking helps customers avoid unexpected charges and better manage their finances with a clear, consistent expense structure.

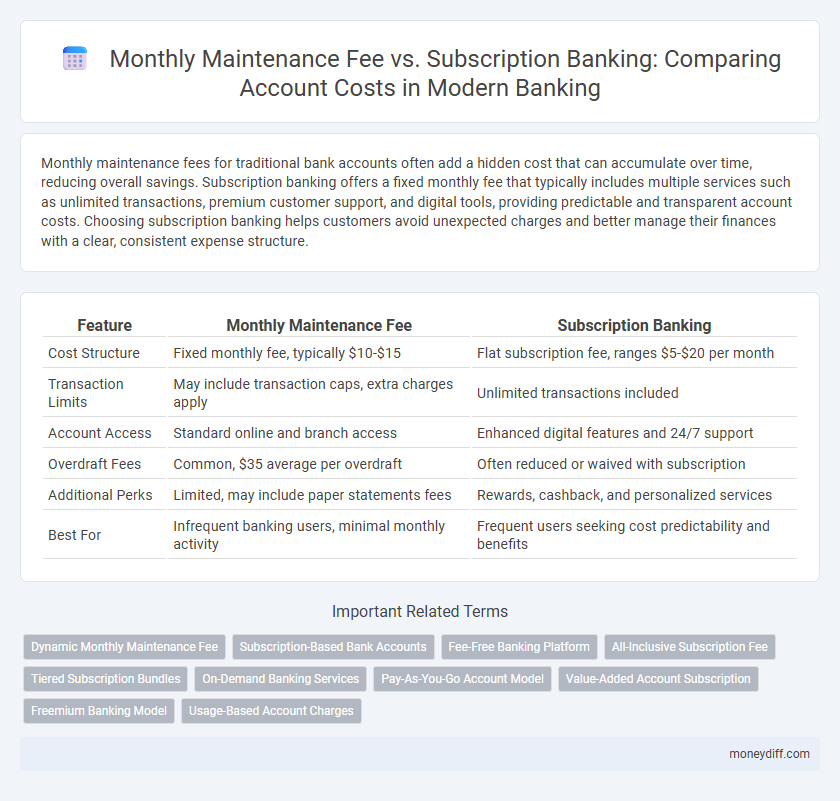

Table of Comparison

| Feature | Monthly Maintenance Fee | Subscription Banking |

|---|---|---|

| Cost Structure | Fixed monthly fee, typically $10-$15 | Flat subscription fee, ranges $5-$20 per month |

| Transaction Limits | May include transaction caps, extra charges apply | Unlimited transactions included |

| Account Access | Standard online and branch access | Enhanced digital features and 24/7 support |

| Overdraft Fees | Common, $35 average per overdraft | Often reduced or waived with subscription |

| Additional Perks | Limited, may include paper statements fees | Rewards, cashback, and personalized services |

| Best For | Infrequent banking users, minimal monthly activity | Frequent users seeking cost predictability and benefits |

Understanding Monthly Maintenance Fees

Monthly maintenance fees in banking represent fixed charges applied to checking or savings accounts, typically covering administrative costs such as account management, account statements, and customer service. These fees vary by financial institution and may be waived if customers meet specific criteria like maintaining a minimum balance or setting up direct deposits. Subscription banking, by contrast, often replaces these traditional fees with a flat monthly rate, offering bundled services like unlimited transactions, enhanced customer support, and added financial perks.

What Is Subscription Banking?

Subscription banking is a modern account model where customers pay a fixed monthly fee for unlimited transactions, premium services, and personalized financial tools, eliminating traditional fees such as overdraft or ATM charges. This approach offers transparency and predictability in banking costs, attracting users who prefer consistent budgeting over variable fees. Banks adopting subscription models leverage digital platforms to provide enhanced user experiences, including budgeting apps, financial insights, and priority customer support.

Comparing Account Costs: An Overview

Monthly maintenance fees typically range from $5 to $15, impacting overall account costs directly, while subscription banking offers a fixed monthly rate often including multiple banking services. Subscription models provide predictable expenses and may bundle benefits like waived ATM fees, higher interest rates, or financial advisory access. Comparing these account costs helps consumers determine whether a traditional fee structure or an all-inclusive subscription aligns better with their banking usage and budget.

Key Differences Between Maintenance Fees and Subscriptions

Monthly maintenance fees are fixed charges imposed by banks to cover account management costs, typically deducted regardless of account activity. Subscription banking offers a flat-rate, predictable monthly fee in exchange for enhanced services, such as waived ATM fees, free transfers, and personalized financial advice. Key differences include cost transparency, flexibility, and the inclusion of value-added perks versus standard account upkeep charges.

Value-Added Services in Subscription Banking

Subscription banking models eliminate traditional monthly maintenance fees by bundling value-added services such as personalized financial advice, higher interest rates on savings, and fee-free transactions into a single monthly payment. These services enhance customer experience by providing tailored financial tools, budgeting assistance, and rewards programs designed to optimize account management. Offering transparency and convenience, subscription banking delivers clear cost structures that often reduce overall expenses compared to standard maintenance fees.

Who Benefits From Monthly Maintenance Fees?

Monthly maintenance fees primarily benefit traditional banks by providing a steady revenue stream to cover operational costs such as customer service, branch maintenance, and security. These fees help banks sustain extensive physical networks and offer personalized services, attracting customers who value in-person banking and comprehensive account management. Customers frequently using full-service banking and maintaining minimum balance requirements typically absorb these fees in exchange for enhanced support and features.

Hidden Costs: What to Watch For

Monthly maintenance fees often appear straightforward but can conceal hidden costs such as minimum balance penalties and transaction limits that inflate account expenses. Subscription banking offers predictable, flat-rate pricing, reducing unexpected charges and providing clearer budgeting for account holders. Customers should carefully review fee disclosures and transaction policies to avoid costly surprises associated with traditional monthly maintenance accounts.

Flexibility and Customization of Subscription Accounts

Subscription banking offers greater flexibility and customization compared to traditional monthly maintenance fees by allowing customers to select specific services tailored to their needs, reducing unnecessary expenses. Users can adjust their subscription plans easily based on account usage and financial goals, enhancing cost efficiency and control. This model promotes transparency and adaptability, making it ideal for diverse banking customers seeking personalized account management.

Choosing the Right Account for Your Needs

Monthly maintenance fees typically range from $5 to $15, impacting overall account costs significantly, while subscription banking offers fixed monthly rates averaging $10 to $20 with added digital services. Customers prioritizing low fees and minimal transactions may prefer fee-free accounts, whereas those seeking budgeting tools and enhanced mobile features benefit from subscription models. Evaluating transaction frequency, service needs, and long-term fees ensures optimal account selection for financial efficiency.

Future Trends in Banking Fee Structures

Future trends in banking fee structures indicate a shift from traditional monthly maintenance fees toward subscription-based models that offer enhanced transparency and personalized services. Subscription banking allows customers to pay a fixed monthly fee for tailored product bundles, including premium account features, financial advice, and digital tools. This approach aligns with increasing demands for cost predictability and value-driven banking experiences in the digital era.

Related Important Terms

Dynamic Monthly Maintenance Fee

Dynamic monthly maintenance fees adjust based on account activity, balance thresholds, or usage patterns, providing a flexible cost structure that can reduce fees for low-activity customers. Subscription banking offers a fixed monthly fee with bundled services, but dynamic fees optimize costs by aligning charges more closely with individual account behavior and banking needs.

Subscription-Based Bank Accounts

Subscription-based bank accounts offer transparent, flat monthly fees that cover a wide range of services, eliminating unexpected charges commonly associated with traditional monthly maintenance fees. This model enhances budgeting ease for customers by bundling features such as unlimited transactions, ATM access, and premium support under a single predictable cost.

Fee-Free Banking Platform

Fee-free banking platforms eliminate monthly maintenance fees, offering customers cost-effective alternatives to traditional subscription banking models that charge recurring fees for account management. These platforms leverage digital tools to provide seamless account access and services without hidden costs, enhancing financial inclusion and customer satisfaction.

All-Inclusive Subscription Fee

All-inclusive subscription banking offers a fixed monthly fee covering most account costs, eliminating unpredictable charges commonly seen with monthly maintenance fees and per-transaction costs. This transparent pricing model enhances budgeting ease and often includes extras like free ATM usage, unlimited transactions, and priority customer support.

Tiered Subscription Bundles

Tiered subscription bundles in banking replace traditional monthly maintenance fees by offering scalable service packages tailored to customer needs, enhancing value through features like fee waivers, increased transaction limits, and premium support. These bundles optimize account costs by aligning fees with usage patterns, providing transparency and potentially reducing overall expenses for account holders.

On-Demand Banking Services

Monthly maintenance fees typically apply fixed charges for account upkeep, whereas subscription banking offers predictable, tiered pricing models that bundle on-demand banking services like real-time transfers and digital support. On-demand banking enhances customer flexibility by allowing users to pay only for the services they actively use, reducing overall account costs compared to traditional monthly fees.

Pay-As-You-Go Account Model

Pay-as-you-go account models eliminate monthly maintenance fees by charging customers only for the specific services they use, offering a cost-efficient alternative to traditional subscription banking that often includes fixed monthly charges regardless of account activity. This approach enhances financial flexibility and transparency, appealing to customers with variable transaction volumes or minimal banking needs.

Value-Added Account Subscription

Value-added account subscriptions often provide enhanced features such as fee waivers, higher interest rates, and personalized financial advice not typically included in monthly maintenance fee accounts. Subscription banking models deliver greater cost transparency and customizable benefits, potentially reducing overall expenses while maximizing account value.

Freemium Banking Model

The Freemium Banking Model offers basic account services without a monthly maintenance fee, attracting cost-conscious customers while generating revenue through premium subscription features such as enhanced analytics and priority support. This approach contrasts traditional accounts where fixed monthly maintenance fees apply regardless of usage, emphasizing customization and flexibility in account cost management.

Usage-Based Account Charges

Usage-based account charges in subscription banking offer a transparent alternative to traditional monthly maintenance fees by billing customers based on actual transaction activity and service usage. This model benefits account holders who have fluctuating banking needs, enabling cost savings by avoiding fixed monthly expenses regardless of account activity.

Monthly Maintenance Fee vs Subscription Banking for account costs. Infographic

moneydiff.com

moneydiff.com