Choosing between a credit card and a Buy Now, Pay Later (BNPL) platform for purchases depends on spending habits and repayment preferences. Credit cards offer rewards, fraud protection, and the ability to build credit, while BNPL platforms provide interest-free installments and simplified budgeting without affecting credit scores. Understanding fees, interest rates, and repayment terms is essential to maximize benefits and avoid financial pitfalls.

Table of Comparison

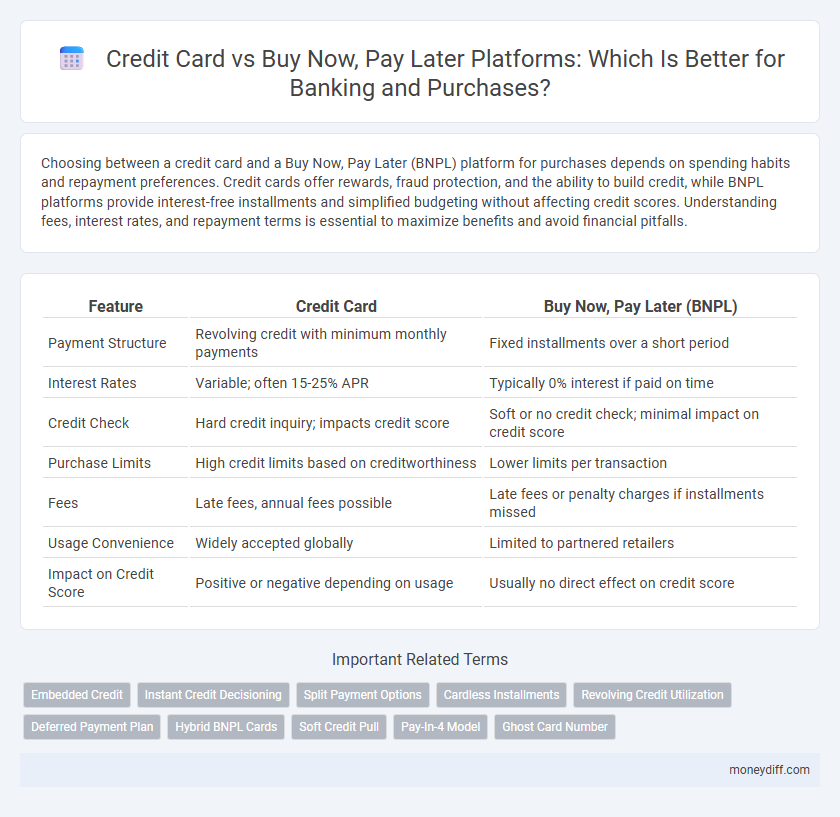

| Feature | Credit Card | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Payment Structure | Revolving credit with minimum monthly payments | Fixed installments over a short period |

| Interest Rates | Variable; often 15-25% APR | Typically 0% interest if paid on time |

| Credit Check | Hard credit inquiry; impacts credit score | Soft or no credit check; minimal impact on credit score |

| Purchase Limits | High credit limits based on creditworthiness | Lower limits per transaction |

| Fees | Late fees, annual fees possible | Late fees or penalty charges if installments missed |

| Usage Convenience | Widely accepted globally | Limited to partnered retailers |

| Impact on Credit Score | Positive or negative depending on usage | Usually no direct effect on credit score |

Understanding Credit Cards and Buy Now, Pay Later (BNPL) Platforms

Credit cards offer a revolving credit line with interest charges on unpaid balances, making them suitable for flexible spending but potentially costly if not managed well. Buy Now, Pay Later (BNPL) platforms provide interest-free installment payments over a short term, appealing to consumers seeking immediate affordability without traditional credit checks. Both options impact credit scores differently, with credit cards reporting to major bureaus while BNPL platforms may or may not affect credit history depending on the provider.

Key Features: Credit Cards vs BNPL Platforms

Credit cards offer revolving credit with flexible repayment terms, rewards programs, and widespread acceptance, enabling users to build credit history. Buy Now, Pay Later (BNPL) platforms provide interest-free installment plans with fixed payment schedules and simplified approval processes, appealing to consumers seeking transparent budgeting. Both options differ in interest charges, credit impact, and merchant partnerships, influencing purchasing decisions based on consumer preferences and financial goals.

Eligibility and Application Process Comparison

Credit card application processes often require comprehensive credit history, income verification, and higher credit scores to approve eligibility, reflecting stricter lending standards. Buy Now, Pay Later (BNPL) platforms typically offer a more streamlined eligibility process with minimal credit checks and faster approvals, making them accessible to a broader range of consumers. While credit cards provide revolving credit with established credit reporting, BNPL services focus on installment payments without significantly impacting credit scores during application.

Interest Rates and Fees: What You Need to Know

Credit cards typically carry interest rates averaging between 15% to 25% APR, with fees including annual charges and late payment penalties. Buy Now, Pay Later (BNPL) platforms often offer interest-free installments but may impose late fees or service charges if payments are missed. Understanding the specific terms and potential costs of each option is crucial for managing expenses and avoiding unexpected charges.

Impact on Credit Score: Credit Cards vs BNPL

Credit cards impact credit scores by reporting payment history, credit utilization, and account age to credit bureaus, which can either improve or harm scores based on user behavior. Buy Now, Pay Later (BNPL) platforms often do not report to credit bureaus unless payments are delinquent, resulting in limited positive impact on credit scores but potential negative effects if accounts go into collections. Responsible credit card use builds credit over time, while BNPL services primarily offer short-term financing with minimal influence on long-term credit profiles.

Repayment Flexibility and Terms

Credit cards offer revolving credit lines with minimum monthly payments, typically accruing interest if balances are not paid in full, providing moderate repayment flexibility. Buy Now, Pay Later (BNPL) platforms split purchases into fixed installments over short periods, often with zero interest if paid on time, enhancing predictability in repayment schedules. While credit cards provide broader credit access and potential rewards, BNPL improves consumer budgeting by limiting debt accumulation and simplifying repayment terms.

Rewards, Cashback, and Promotions

Credit cards typically offer extensive rewards programs, including cashback, points, and exclusive promotions that enhance purchasing power and value. Buy Now, Pay Later platforms provide flexible payment options without interest, but their rewards and cashback opportunities are often limited or nonexistent. Consumers seeking maximized financial benefits during purchases should carefully evaluate credit card incentives versus the convenience of BNPL services.

Security and Consumer Protection Measures

Credit cards offer robust security features such as fraud detection, zero-liability policies, and encrypted transactions, ensuring strong consumer protection. Buy Now, Pay Later platforms implement risk assessments and dispute resolution mechanisms but may have less comprehensive fraud protection compared to traditional credit cards. Regulatory oversight for credit cards is typically stricter, providing enhanced legal remedies for consumers against unauthorized charges and privacy breaches.

Common Pitfalls and Hidden Risks

Credit cards often carry high interest rates and compound fees that can escalate debt quickly if balances are not paid in full each month. Buy Now, Pay Later (BNPL) platforms may impose strict repayment schedules and hidden late fees, leading to unexpected financial strain and potential credit score damage. Both options require careful evaluation of terms to avoid overspending and long-term financial consequences.

Choosing the Right Option for Smart Money Management

Credit cards offer flexible revolving credit with rewards and fraud protection, ideal for frequent purchases and building credit history, while Buy Now, Pay Later platforms provide interest-free installments without impacting credit scores, suited for budget-conscious consumers seeking short-term financing. Understanding spending habits, repayment capabilities, and potential fees is crucial to selecting the right payment method that aligns with smart money management goals. Evaluating interest rates, late payment penalties, and overall cost helps optimize financial health and avoid debt accumulation.

Related Important Terms

Embedded Credit

Embedded credit within Buy Now, Pay Later platforms offers seamless purchasing by integrating financing options directly into checkout processes, enhancing user convenience beyond traditional credit card use. Unlike credit cards, embedded credit provides real-time credit approval and tailored spending limits, optimizing customer experience and merchant conversion rates.

Instant Credit Decisioning

Credit card transactions leverage instant credit decisioning through established credit bureaus, enabling real-time approval based on comprehensive credit histories and risk assessments. Buy Now, Pay Later platforms utilize alternative data and proprietary algorithms for instant credit decisions, offering fast, flexible approvals without impacting traditional credit scores.

Split Payment Options

Credit cards offer flexible split payment options with interest accrual based on outstanding balances, while Buy Now, Pay Later (BNPL) platforms provide interest-free installments over a fixed period, often without impacting credit scores. BNPL appeals to consumers seeking short-term, transparent repayment plans, whereas credit cards deliver broader purchasing power and rewards but may incur higher costs if balances are not paid promptly.

Cardless Installments

Cardless installment options offered by Buy Now, Pay Later platforms provide flexible, interest-free payment plans without requiring a traditional credit card, appealing to consumers seeking quick approval and simplified budgeting. Unlike credit cards that involve revolving credit and potential interest charges, BNPL services enhance purchase accessibility with transparent, fixed installment schedules, reducing the risk of debt accumulation.

Revolving Credit Utilization

Credit card revolving credit utilization directly impacts credit scores by influencing credit utilization ratios, whereas Buy Now, Pay Later platforms typically rely on fixed installment payments without revolving credit lines, limiting their effect on utilization metrics. High utilization of credit cards can increase interest costs and reduce creditworthiness, while BNPL options provide short-term financing with usually no interest but do not build revolving credit history.

Deferred Payment Plan

Credit cards offer revolving credit with interest applied to unpaid balances, providing flexible deferred payment plans but potentially high costs. Buy Now, Pay Later platforms allow interest-free installment payments over fixed periods, promoting transparent budgeting and often lower fees for short-term deferred payment options.

Hybrid BNPL Cards

Hybrid BNPL cards combine the flexibility of Buy Now, Pay Later platforms with the widespread acceptance and rewards features of traditional credit cards, offering consumers seamless installment payments at millions of merchants globally. These cards enhance purchasing power by integrating real-time credit decisioning and transparent fee structures, reducing the risk of debt accumulation compared to conventional credit cards and standalone BNPL services.

Soft Credit Pull

Buy Now, Pay Later platforms often use a soft credit pull, which does not impact credit scores, making them attractive for users cautious about credit inquiries. In contrast, traditional credit card applications typically involve a hard credit pull that can temporarily lower credit scores, impacting consumers' creditworthiness evaluation.

Pay-In-4 Model

The Pay-In-4 model within Buy Now, Pay Later platforms offers interest-free, short-term installment payments that enhance purchasing power without impacting credit scores, unlike traditional credit cards which may involve higher interest rates and potential credit risks. Consumers benefit from transparent fee structures and flexible repayment schedules, making Pay-In-4 an attractive alternative for managing expenses and budgeting effectively in e-commerce transactions.

Ghost Card Number

Ghost card numbers, virtual credit card identifiers generated for secure, limited-use transactions, offer a significant advantage over Buy Now, Pay Later platforms by enhancing fraud protection and control during online purchases. Unlike BNPL services that extend credit with deferred payments, ghost cards minimize risk exposure by restricting transaction amounts and merchant access, streamlining secure digital payments in banking.

Credit Card vs Buy Now, Pay Later Platform for purchasing Infographic

moneydiff.com

moneydiff.com