Credit unions offer member-focused banking with personalized services and local branch access, emphasizing community trust and financial education. Digital cooperatives provide fully online banking experiences with lower fees, greater convenience, and advanced technological tools for managing accounts anywhere. Both prioritize customer ownership, but credit unions balance traditional service with personal interaction, while digital cooperatives excel in accessibility and innovation.

Table of Comparison

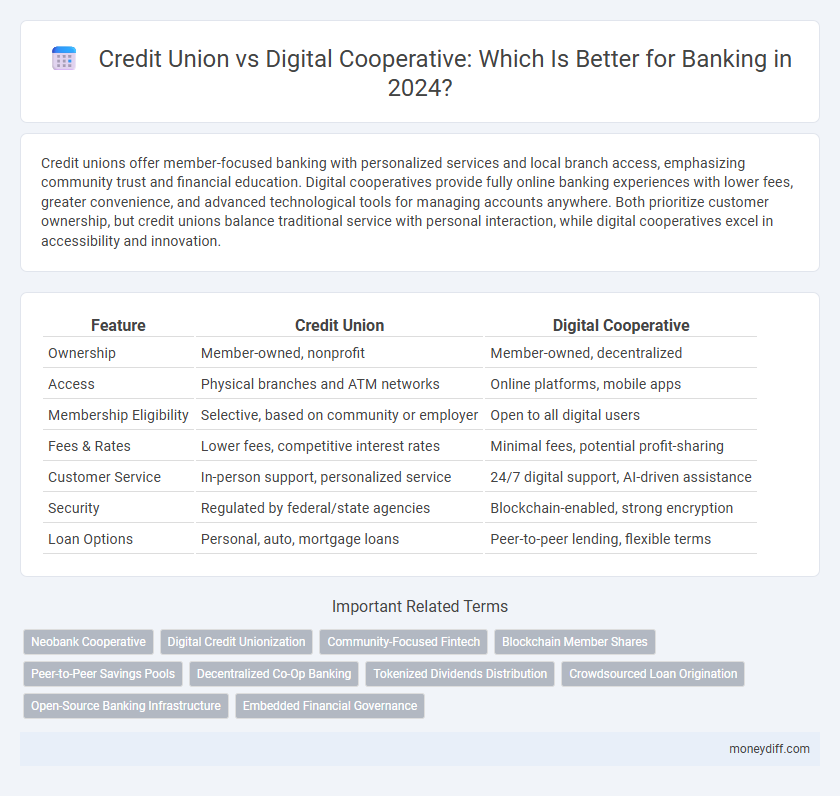

| Feature | Credit Union | Digital Cooperative |

|---|---|---|

| Ownership | Member-owned, nonprofit | Member-owned, decentralized |

| Access | Physical branches and ATM networks | Online platforms, mobile apps |

| Membership Eligibility | Selective, based on community or employer | Open to all digital users |

| Fees & Rates | Lower fees, competitive interest rates | Minimal fees, potential profit-sharing |

| Customer Service | In-person support, personalized service | 24/7 digital support, AI-driven assistance |

| Security | Regulated by federal/state agencies | Blockchain-enabled, strong encryption |

| Loan Options | Personal, auto, mortgage loans | Peer-to-peer lending, flexible terms |

Understanding Credit Unions: Traditional Member-Owned Banking

Credit unions are member-owned financial cooperatives that offer personalized banking services with a focus on community and financial education. They provide lower fees and better interest rates compared to traditional banks, emphasizing member benefits rather than profits. These institutions prioritize trust and local engagement, making them a preferred choice for individuals seeking collaborative and stable banking solutions.

What Are Digital Cooperatives? Next-Gen Collaborative Finance

Digital cooperatives redefine banking by leveraging blockchain technology and decentralized platforms to offer members transparent, secure financial services without traditional intermediaries. These next-gen collaborative finance models enable peer-to-peer lending, profit-sharing, and democratic decision-making, contrasting with credit unions' localized, member-owned structure bound by conventional regulations. Emphasizing technological innovation and global accessibility, digital cooperatives provide scalable, user-driven financial solutions that enhance inclusivity and operational efficiency in the evolving banking landscape.

Membership and Eligibility: Who Can Join?

Credit unions require members to share a common bond such as employment, geographic location, or association membership, ensuring eligibility is restricted to specific groups. Digital cooperatives offer broader access, often welcoming individuals globally with fewer restrictions, leveraging technology to facilitate inclusive membership. Both structures emphasize member ownership, but digital cooperatives prioritize accessibility and convenience in joining criteria.

Digital Experience: Online Services and Accessibility

Digital cooperatives offer seamless online services, including mobile banking, real-time account management, and 24/7 customer support, enhancing overall accessibility for tech-savvy users. Credit unions may provide similar digital experiences but often with limited features compared to the advanced platforms of digital cooperatives. Enhanced digital interfaces and user-friendly mobile apps in digital cooperatives drive higher member engagement and satisfaction in banking transactions.

Governance Structure: How Decisions Are Made

Credit unions operate under a democratic governance structure where members elect a volunteer board of directors responsible for major decisions, emphasizing member control and community focus. Digital cooperatives use decentralized decision-making platforms, often leveraging blockchain technology, allowing members to participate directly in governance through transparent voting mechanisms. This shift enables real-time member engagement and greater inclusion in strategic choices compared to traditional credit union models.

Interest Rates and Fees: Comparing Cost-Effectiveness

Credit unions typically offer lower interest rates on loans and higher rates on savings accounts compared to digital cooperatives, making them more cost-effective for members seeking traditional banking benefits. Digital cooperatives often provide reduced fees and streamlined online services, which minimize overhead and can lower overall costs for account holders. Evaluating specific rates and fee structures reveals that credit unions favor long-term savings, while digital cooperatives excel in transactional cost efficiency.

Community Impact: Local vs. Global Reach

Credit unions emphasize community impact by serving local members, fostering financial inclusion, and supporting regional economic development through tailored services and grassroots initiatives. Digital cooperatives leverage technology to offer banking services globally, enabling a broader reach that connects diverse communities while promoting cooperative values across borders. Both models enhance financial empowerment, but credit unions prioritize localized engagement whereas digital cooperatives focus on scalable, worldwide access.

Security and Privacy in Credit Unions vs Digital Cooperatives

Credit Unions typically offer robust security protocols backed by federal insurance like the National Credit Union Share Insurance Fund (NCUSIF), ensuring member deposits up to $250,000 are protected. Digital cooperatives emphasize advanced encryption methods and decentralized data storage to enhance privacy, often leveraging blockchain technology to minimize unauthorized data access. Despite the technological edge of digital cooperatives, Credit Unions maintain regulated compliance standards that provide a consistent layer of security and privacy assurance for members.

Financial Products and Services: Flexibility and Innovation

Credit unions offer personalized financial products such as low-interest loans and member-focused savings accounts, emphasizing community trust and traditional banking stability. Digital cooperatives leverage technology to provide innovative services including real-time account management, digital wallets, and AI-driven financial planning tools, enhancing flexibility and user experience. The integration of fintech solutions in digital cooperatives enables rapid adaptation to market trends, while credit unions maintain a strong commitment to member-centric, reliable financial services.

Which is Right for You? Key Considerations for Savvy Banking

Credit unions offer personalized service, competitive interest rates, and member-owned benefits, making them ideal for individuals seeking community-focused banking with lower fees. Digital cooperatives provide seamless online access, innovative financial technology, and convenience for tech-savvy users prioritizing mobile banking and instant transactions. Choosing between them depends on your preference for in-person interaction versus digital efficiency, as well as your need for local community involvement versus advanced technological features.

Related Important Terms

Neobank Cooperative

Neobank cooperatives combine the member-owned structure of credit unions with innovative digital banking technology, offering lower fees and higher interest rates on deposits through seamless mobile platforms. These digital cooperatives leverage next-generation fintech solutions to enhance user experience, financial inclusion, and real-time transaction capabilities compared to traditional credit unions.

Digital Credit Unionization

Digital credit unionization leverages blockchain technology to enhance member ownership, transparency, and decentralized decision-making, differentiating it from traditional credit unions. This innovative approach streamlines banking services, reduces operational costs, and increases accessibility for members through secure, digital platforms.

Community-Focused Fintech

Credit unions operate as member-owned financial institutions emphasizing local community support and personalized services, while digital cooperatives leverage fintech innovations to create scalable, technology-driven platforms that maintain cooperative values and provide seamless, community-focused banking experiences. Both prioritize financial inclusion and member benefits but differ in delivery methods, with credit unions rooted in physical branches and digital cooperatives offering accessible, real-time digital financial services.

Blockchain Member Shares

Credit Unions typically offer member shares recorded on traditional ledgers, whereas Digital Cooperatives leverage blockchain technology to securely manage member shares through decentralized, immutable ledgers, enhancing transparency and member control. Blockchain-based member shares enable real-time verification and increased liquidity, distinguishing Digital Cooperatives as innovative alternatives in banking governance.

Peer-to-Peer Savings Pools

Credit unions offer member-owned financial services with regulated savings pools, emphasizing community trust and personalized loans, while digital cooperatives leverage blockchain technology to create transparent, automated peer-to-peer savings pools that reduce intermediaries and increase access to liquidity. Peer-to-peer savings pools in digital cooperatives enable real-time, decentralized fund allocations enhancing efficiency compared to traditional credit union models.

Decentralized Co-Op Banking

Decentralized co-op banking leverages blockchain technology to enable member-owned financial institutions with increased transparency, security, and control compared to traditional credit unions. This model reduces intermediaries and operational costs, fostering real-time transactions and democratic governance within the cooperative banking framework.

Tokenized Dividends Distribution

Credit unions distribute dividends based on member shares, typically using traditional financial systems, whereas digital cooperatives leverage blockchain technology to enable tokenized dividends distribution, offering real-time, transparent, and secure payment of earnings directly to members' digital wallets. This tokenization enhances liquidity, fractional ownership, and traceability of profit-sharing, revolutionizing member engagement and financial inclusivity within cooperative banking models.

Crowdsourced Loan Origination

Credit unions leverage member deposits and local relationships to offer personalized loan origination with community trust, while digital cooperatives utilize crowdsourced platforms to pool funds from a broader network, enhancing loan access through technology-driven transparency and efficiency. Crowdsourced loan origination in digital cooperatives accelerates funding speed and democratizes credit decisions by leveraging collective member input and decentralized risk assessment models.

Open-Source Banking Infrastructure

Credit unions traditionally rely on proprietary banking systems, whereas digital cooperatives leverage open-source banking infrastructure to enhance transparency, reduce costs, and foster community-driven innovation. Open-source platforms enable digital cooperatives to customize services rapidly and maintain security through collective development, distinguishing them from credit unions' conventional technology stacks.

Embedded Financial Governance

Credit unions leverage embedded financial governance through member-driven policies and regulatory frameworks, ensuring transparent, community-focused financial management. Digital cooperatives implement smart contracts and blockchain technology to automate compliance and enhance real-time governance, increasing efficiency and trust in decentralized banking operations.

Credit Union vs Digital Cooperative for banking. Infographic

moneydiff.com

moneydiff.com