Traditional ATMs provide quick access to cash and banking services, allowing users to withdraw, deposit, and check account balances conveniently. Cryptocurrency ATMs enable buying and selling digital currencies like Bitcoin directly, offering a bridge between fiat money and crypto assets without requiring a bank account. While conventional ATMs support everyday banking needs, cryptocurrency ATMs cater to the growing demand for decentralized financial transactions and asset management.

Table of Comparison

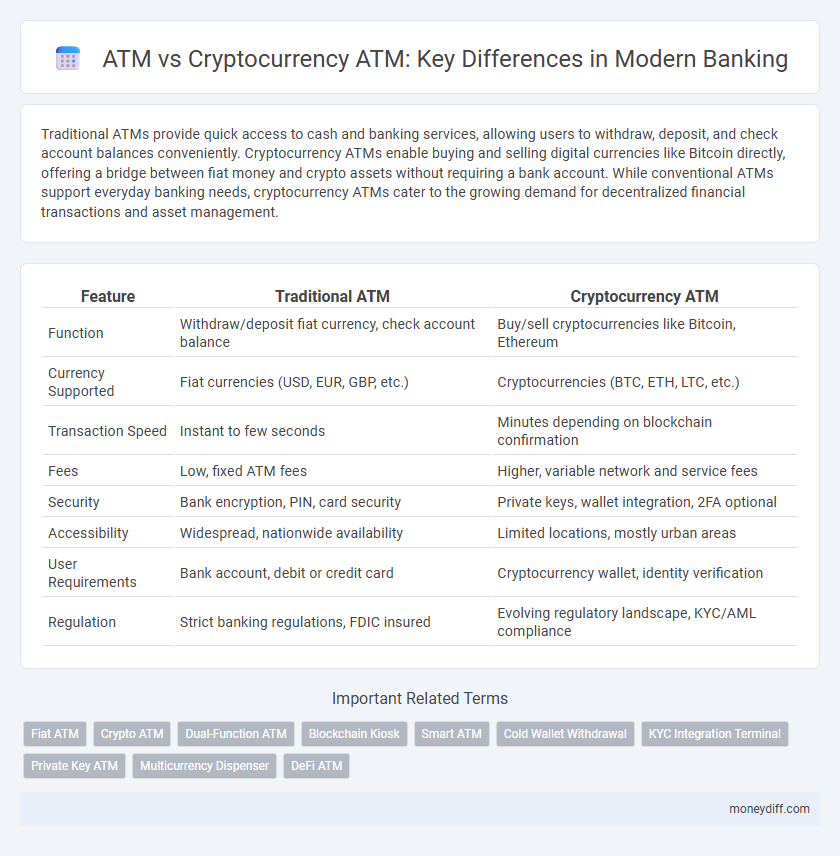

| Feature | Traditional ATM | Cryptocurrency ATM |

|---|---|---|

| Function | Withdraw/deposit fiat currency, check account balance | Buy/sell cryptocurrencies like Bitcoin, Ethereum |

| Currency Supported | Fiat currencies (USD, EUR, GBP, etc.) | Cryptocurrencies (BTC, ETH, LTC, etc.) |

| Transaction Speed | Instant to few seconds | Minutes depending on blockchain confirmation |

| Fees | Low, fixed ATM fees | Higher, variable network and service fees |

| Security | Bank encryption, PIN, card security | Private keys, wallet integration, 2FA optional |

| Accessibility | Widespread, nationwide availability | Limited locations, mostly urban areas |

| User Requirements | Bank account, debit or credit card | Cryptocurrency wallet, identity verification |

| Regulation | Strict banking regulations, FDIC insured | Evolving regulatory landscape, KYC/AML compliance |

Understanding Traditional ATMs and Cryptocurrency ATMs

Traditional ATMs enable customers to withdraw cash, check account balances, and perform basic banking transactions using debit or credit cards linked to their bank accounts. Cryptocurrency ATMs facilitate the buying and selling of digital currencies such as Bitcoin, allowing users to convert cash into crypto or vice versa, often requiring a digital wallet. Both types of ATMs serve different user needs, with traditional ATMs focusing on fiat currency access and cryptocurrency ATMs bridging the gap between physical cash and digital assets.

Key Differences Between ATMs and Crypto ATMs

Traditional ATMs allow users to withdraw fiat currency using bank cards, while cryptocurrency ATMs enable buying and selling digital assets like Bitcoin through wallets or QR codes. Crypto ATMs often require additional identity verification due to regulatory compliance, contrasting with the straightforward PIN authentication typical of traditional ATMs. Transaction speeds and fees differ significantly; crypto ATM transactions may take longer to confirm on the blockchain and generally incur higher fees compared to standard ATM withdrawals.

Accessibility: Location and Availability

Traditional ATMs dominate urban and suburban areas, offering widespread accessibility through extensive bank networks and convenient operating hours. Cryptocurrency ATMs are increasing in number but remain concentrated in major cities and financial hubs, limiting availability for broader populations. While standard ATMs provide reliable access for cash withdrawals and banking services, cryptocurrency ATMs cater to niche users seeking digital asset transactions with varying 24/7 access depending on location.

Security Features: Comparing Both ATM Types

Traditional ATMs use encrypted PIN entry and bank-controlled networks to ensure secure transactions, while Cryptocurrency ATMs employ blockchain encryption and multi-factor authentication for enhanced transaction security. Both systems incorporate real-time fraud detection, but Cryptocurrency ATMs often add biometric verification and cold wallet storage to mitigate hacking risks. Comparing security features reveals that Cryptocurrency ATMs focus more on decentralized ledger protection, whereas traditional ATMs rely heavily on centralized banking security protocols.

Transaction Speed and Processing Times

Cryptocurrency ATMs significantly reduce transaction speed and processing times compared to traditional banking ATMs by enabling near-instantaneous digital asset transfers on blockchain networks. Traditional ATMs often involve slower processing times due to bank verification protocols and interbank communication delays, typically taking several minutes per transaction. Faster validation on cryptocurrency platforms enhances user experience and efficiency in digital currency exchanges.

Supported Currencies: Fiat vs. Cryptocurrencies

Traditional ATMs primarily support fiat currencies such as USD, EUR, and GBP, allowing users to withdraw cash and check account balances linked to conventional bank accounts. Cryptocurrency ATMs enable transactions involving various digital currencies like Bitcoin, Ethereum, and Litecoin, facilitating buying and selling crypto assets directly with cash or digital wallets. The range of supported cryptocurrencies at these specialized ATMs is continuously expanding, providing greater access to decentralized finance alongside traditional banking services.

Fees and Transaction Costs Compared

Traditional ATMs typically charge fees ranging from $2 to $3.50 per withdrawal, with additional costs for out-of-network transactions, while cryptocurrency ATMs often impose higher fees between 6% and 12% per transaction due to their decentralized nature and increased regulatory compliance costs. These elevated fees on crypto ATMs reflect the complexity of digital asset processing, network volatility, and liquidity provisioning, making traditional ATMs a more cost-effective option for standard fiat withdrawals.

User Experience and Interface Usability

Traditional ATMs offer a straightforward, familiar interface optimized for quick cash withdrawals and balance inquiries, catering to a broad user base with minimal technical knowledge. Cryptocurrency ATMs provide a more complex user experience requiring digital wallet integration and understanding of blockchain transactions, which can hinder usability for non-technical users. Enhanced interface design focusing on intuitive navigation and real-time transaction feedback is crucial to improve accessibility and trust in cryptocurrency ATM services.

Regulatory Compliance and Legal Considerations

Traditional ATMs are subject to comprehensive banking regulations, including AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements imposed by financial regulators such as the FDIC and FINRA. Cryptocurrency ATMs face a rapidly evolving legal landscape, requiring operators to comply with both federal laws like the Bank Secrecy Act and diverse state-level regulations, including money transmitter licenses. Ensuring strict adherence to these frameworks is critical to mitigate risks of fraud, money laundering, and legal penalties in both traditional and crypto ATM operations.

Future Trends in ATM and Crypto ATM Banking

Future trends in ATM and cryptocurrency ATM banking emphasize enhanced security protocols and integration with digital wallets for seamless transactions. Biometric authentication and blockchain technology are set to revolutionize user verification and transaction transparency, reducing fraud risks. The convergence of traditional ATM networks with crypto ATMs will expand global accessibility, enabling instant fiat-to-crypto conversions and supporting the growing demand for decentralized finance services.

Related Important Terms

Fiat ATM

Fiat ATMs provide instant cash withdrawals and deposits directly linked to traditional bank accounts, ensuring seamless access to government-backed currency. Cryptocurrency ATMs offer digital asset transactions but often involve higher fees and limited fiat compatibility compared to conventional fiat ATMs.

Crypto ATM

Crypto ATMs enable users to buy and sell cryptocurrencies like Bitcoin and Ethereum directly with cash, offering faster transaction times and enhanced privacy compared to traditional ATMs that primarily handle fiat currency withdrawals and deposits. While traditional ATMs are widespread for everyday banking services, Crypto ATMs provide a vital gateway for users seeking decentralized financial transactions, often operating without the need for a bank account.

Dual-Function ATM

Dual-function ATMs integrate traditional banking services with cryptocurrency transactions, enabling users to withdraw cash and buy or sell cryptocurrencies like Bitcoin seamlessly. This innovation enhances customer convenience by bridging conventional financial systems and digital assets in a single, secure terminal.

Blockchain Kiosk

Blockchain kiosks integrate traditional ATM functionality with cryptocurrency transactions, enabling users to deposit, withdraw, and convert digital assets using secure blockchain technology. These advanced machines enhance financial accessibility by bridging conventional banking services with decentralized finance, offering real-time cryptocurrency support and improved transaction transparency.

Smart ATM

Smart ATMs enhance traditional banking by enabling cash withdrawals, deposits, bill payments, and account transfers while integrating biometric authentication and AI-driven fraud detection. Cryptocurrency ATMs facilitate digital asset transactions but lack the comprehensive banking services and regulatory compliance features offered by Smart ATMs, making the latter more versatile for modern finance.

Cold Wallet Withdrawal

Traditional ATMs enable direct cash withdrawal linked to bank accounts, while cryptocurrency ATMs facilitate cold wallet withdrawals by allowing users to securely dispense digital assets without exposing private keys online. Cold wallet withdrawals enhance security in crypto transactions by keeping funds offline, reducing the risk of hacking compared to conventional banking ATMs.

KYC Integration Terminal

Traditional ATMs rely on bank-issued cards and PINs for authentication, while cryptocurrency ATMs integrate advanced KYC systems using biometric verification and digital ID scanning to comply with anti-money laundering regulations. This enhanced KYC integration in crypto ATMs enables seamless identity verification, improving security and regulatory compliance in decentralized financial transactions.

Private Key ATM

Traditional ATMs enable cash withdrawals and deposits linked to bank accounts, while cryptocurrency ATMs facilitate digital asset transactions using private keys for secure access. Private Key ATMs enhance security in cryptocurrency banking by allowing users to directly manage their digital wallets without relying on third-party custodians.

Multicurrency Dispenser

Multicurrency dispensers in traditional ATMs offer a versatile banking solution by enabling customers to withdraw multiple fiat currencies from a single machine, enhancing convenience for international travelers and global banking clients. Cryptocurrency ATMs expand this functionality by integrating digital asset transactions, allowing users to buy or sell various cryptocurrencies alongside fiat withdrawals, thus bridging conventional banking with emerging blockchain technologies.

DeFi ATM

Traditional ATMs provide direct access to fiat currency withdrawals and deposits linked to centralized banking systems, while Cryptocurrency ATMs enable users to buy and sell digital assets such as Bitcoin and Ethereum, facilitating peer-to-peer transactions without intermediaries. DeFi ATMs integrate decentralized finance protocols, allowing secure, permissionless access to lending, borrowing, and staking services on blockchain networks, revolutionizing the banking experience by eliminating reliance on traditional financial institutions.

ATM vs Cryptocurrency ATM for banking. Infographic

moneydiff.com

moneydiff.com