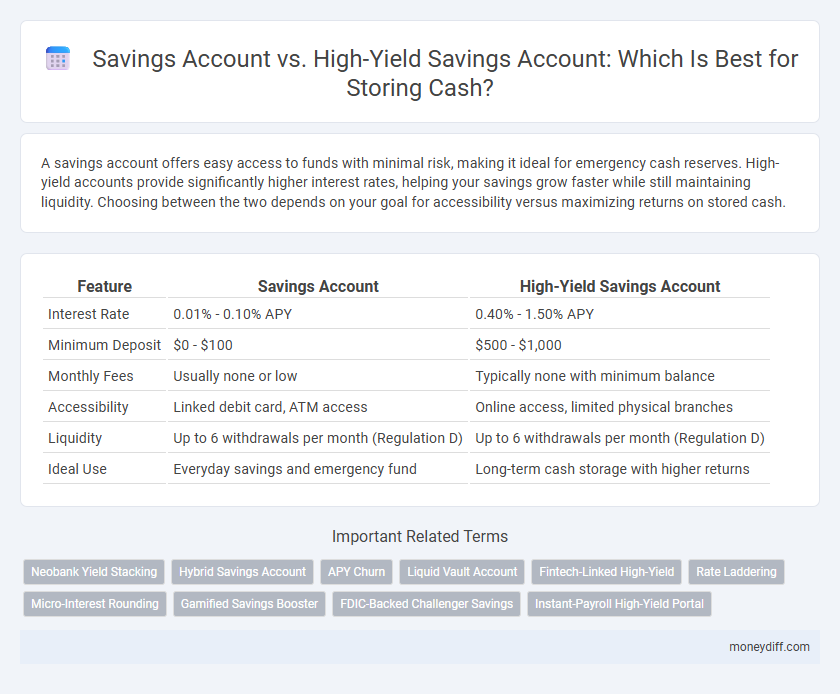

A savings account offers easy access to funds with minimal risk, making it ideal for emergency cash reserves. High-yield accounts provide significantly higher interest rates, helping your savings grow faster while still maintaining liquidity. Choosing between the two depends on your goal for accessibility versus maximizing returns on stored cash.

Table of Comparison

| Feature | Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 0.40% - 1.50% APY |

| Minimum Deposit | $0 - $100 | $500 - $1,000 |

| Monthly Fees | Usually none or low | Typically none with minimum balance |

| Accessibility | Linked debit card, ATM access | Online access, limited physical branches |

| Liquidity | Up to 6 withdrawals per month (Regulation D) | Up to 6 withdrawals per month (Regulation D) |

| Ideal Use | Everyday savings and emergency fund | Long-term cash storage with higher returns |

Understanding Savings Accounts and High-Yield Accounts

Savings accounts typically offer lower interest rates but provide easy access to funds and FDIC insurance protection up to $250,000 per depositor. High-yield accounts, often offered by online banks, deliver significantly higher annual percentage yields (APYs) while maintaining the same federal insurance, making them ideal for growing cash savings faster. Understanding the differences in interest rates, accessibility, and fees is crucial for selecting the right account to optimize cash storage and growth.

Key Differences Between Savings and High-Yield Accounts

Savings accounts typically offer lower interest rates, often below 1%, making them suitable for emergency funds and short-term savings, while high-yield accounts provide significantly higher annual percentage yields (APYs), often above 2%, enhancing long-term growth potential. Both account types offer FDIC insurance up to $250,000, ensuring depositor protection, but high-yield accounts may require higher minimum balances or limit monthly withdrawals more strictly. Ease of access is another key difference; savings accounts usually allow more frequent transactions without penalties, whereas high-yield accounts prioritize higher earnings over liquidity.

Interest Rates: How Much Can You Earn?

Savings accounts typically offer interest rates ranging from 0.01% to 0.10%, providing minimal growth on stored cash. High-yield savings accounts deliver significantly higher returns, often between 3.00% and 4.50%, making them more effective for maximizing earnings on idle funds. Choosing a high-yield account can substantially increase interest income over time compared to traditional savings options.

Accessibility and Withdrawal Limits

Savings accounts typically offer easier access to funds with fewer restrictions on withdrawals, making them suitable for everyday cash needs. High-yield accounts often impose limits on the number of monthly withdrawals and may require transfers to linked accounts for fund access. Accessibility in savings accounts is generally more flexible, while high-yield accounts prioritize higher interest returns over immediate liquidity.

Fees and Minimum Balance Requirements

Savings accounts typically have low or no monthly fees and minimal minimum balance requirements, making them accessible for everyday cash storage. High-yield savings accounts often require higher minimum balances to avoid fees but offer significantly better interest rates, maximizing returns on stored cash. Choosing between the two depends on balancing fee structures and minimum balance thresholds against the potential earnings on deposited funds.

Safety and Security of Your Funds

Savings accounts typically offer federal insurance through the FDIC or NCUA, safeguarding deposits up to $250,000 per account holder, which guarantees principal protection and stability. High-yield accounts also benefit from the same federal insurance coverage, ensuring that increased interest rates do not compromise the safety of your funds. Both account types maintain stringent security protocols, including encryption and fraud monitoring, to protect your cash from unauthorized access.

Best Uses for Savings Accounts

Savings accounts offer secure, accessible storage for emergency funds and everyday savings with federal insurance protection provided by the FDIC up to $250,000. Their low minimum balance requirements and easy access via ATM or online banking make them ideal for short-term savings goals and liquidity needs. High-yield accounts provide better interest rates but often require higher minimum deposits and limited withdrawals, making traditional savings accounts best for everyday cash management and financial safety.

When to Choose a High-Yield Account

Choosing a high-yield savings account is ideal when aiming to maximize interest earnings on idle cash while maintaining liquidity. These accounts typically offer annual percentage yields (APYs) several times higher than traditional savings accounts, making them suitable for emergency funds or short-term goals without sacrificing access. Opt for a high-yield account if you prioritize higher returns and can manage potential minimum balance requirements or limited transaction allowances.

Online vs Traditional Banking Options

High-yield savings accounts offered by online banks typically provide interest rates several times higher than traditional brick-and-mortar savings accounts, maximizing cash growth with minimal fees. Online platforms enable seamless access to account management, automated transfers, and higher liquidity compared to conventional banking options that often have lower yields and more restrictive withdrawal policies. Choosing between online high-yield accounts and traditional savings accounts depends on the balance of prioritizing convenience, interest earnings, and in-person customer support preferences.

Deciding Which Account Fits Your Cash Storage Needs

Choosing between a traditional savings account and a high-yield savings account depends on your cash storage goals, interest rate preferences, and accessibility needs. High-yield savings accounts typically offer interest rates that are 10 to 25 times higher than standard savings accounts, effectively maximizing your earnings on idle cash. Consider factors like minimum balance requirements, withdrawal limits, and online access features to determine which account best aligns with your liquidity requirements and financial growth objectives.

Related Important Terms

Neobank Yield Stacking

Neobank yield stacking leverages multiple high-yield accounts and savings products to maximize interest earnings on stored cash, surpassing traditional savings account rates that typically offer minimal returns. This strategy optimizes liquidity and compound interest, enabling customers to achieve higher effective yields by diversifying funds across various high-yield online banking platforms.

Hybrid Savings Account

Hybrid Savings Accounts combine the liquidity of traditional savings accounts with higher interest rates typically found in high-yield accounts, offering an optimal balance for cash storage. This account type maximizes earnings through competitive APYs while maintaining easy access to funds, making it a strategic choice for maximizing savings growth without sacrificing flexibility.

APY Churn

Savings accounts typically offer lower APYs around 0.01% to 0.10%, leading to minimal interest growth on stored cash, while high-yield accounts provide significantly higher APYs often ranging from 3% to 5%, enhancing returns through compounding. Frequent APY churn in high-yield accounts can affect earnings, necessitating regular monitoring to maximize interest benefits and avoid unexpected rate drops.

Liquid Vault Account

A Liquid Vault Account offers higher interest rates compared to traditional savings accounts while maintaining easy access to funds, making it an ideal choice for cash storage. This account combines the benefits of liquidity with competitive yields, outperforming standard savings and high-yield accounts in terms of both flexibility and returns.

Fintech-Linked High-Yield

Fintech-linked high-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, often ranging from 3% to 5% APY versus the national average below 0.1%, enabling faster growth of stored cash while maintaining FDIC insurance. These accounts leverage advanced digital platforms for seamless account management, instant transfers, and real-time balance updates, providing both convenience and superior returns for cash storage.

Rate Laddering

Rate laddering in savings accounts involves spreading cash across multiple accounts with varying interest rates and maturities to optimize returns while maintaining liquidity; high-yield accounts typically offer superior rates but may have limited accessibility and tiered rate structures. Choosing a blend of savings and high-yield accounts allows depositors to balance higher interest earnings against easy access to funds, leveraging rate laddering strategies to maximize overall yield and minimize risk.

Micro-Interest Rounding

Savings accounts typically apply micro-interest rounding, often leading to interest earnings rounded down to the nearest cent, which can reduce the effective yield on small balances; high-yield accounts usually offer more precise interest calculations with minimal rounding impact, maximizing returns on deposited cash. Choosing a high-yield account can significantly increase accumulated interest over time by avoiding micro-rounding losses common in traditional savings accounts.

Gamified Savings Booster

Savings accounts offer stable interest rates for secure cash storage, but high-yield accounts paired with a gamified savings booster platform can significantly accelerate growth by rewarding consistent deposits with points, badges, or financial incentives that enhance user engagement and saving discipline. Financial institutions integrating gamification elements typically see increased customer retention and higher average balances compared to traditional savings accounts.

FDIC-Backed Challenger Savings

FDIC-backed challenger savings accounts offer higher interest rates compared to traditional savings accounts, ensuring your cash remains secure while maximizing returns. These accounts combine the reliability of federal insurance with competitive APYs, making them an advantageous option for savers seeking both safety and growth.

Instant-Payroll High-Yield Portal

Instant-Payroll High-Yield Portal offers significantly higher interest rates compared to traditional savings accounts, maximizing cash growth while maintaining liquidity for payroll needs. This platform ensures instant access to funds with competitive APYs, ideal for businesses seeking efficient cash storage without sacrificing earnings.

Savings Account vs High-Yield Account for storing cash. Infographic

moneydiff.com

moneydiff.com