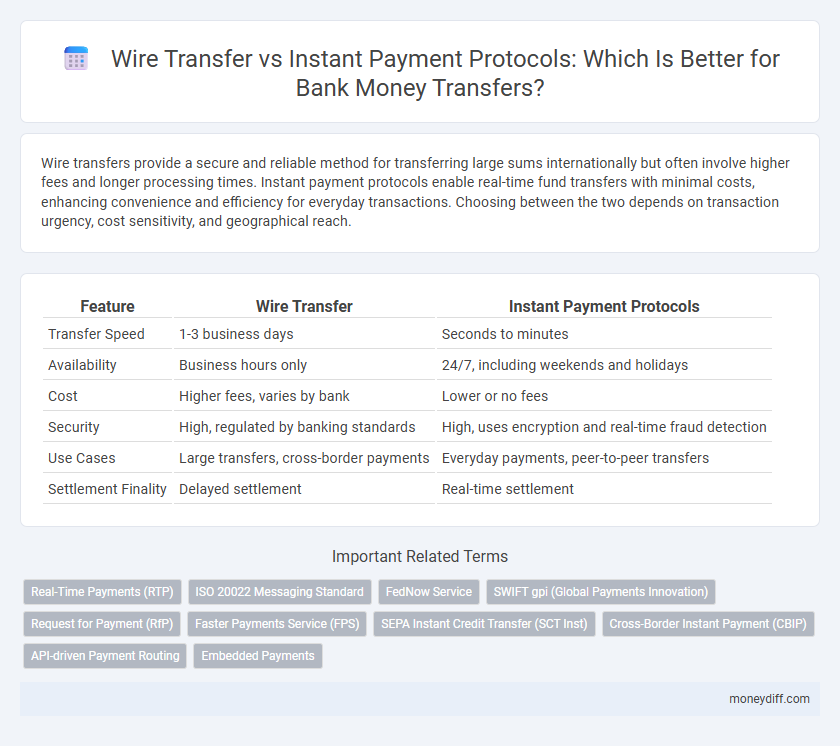

Wire transfers provide a secure and reliable method for transferring large sums internationally but often involve higher fees and longer processing times. Instant payment protocols enable real-time fund transfers with minimal costs, enhancing convenience and efficiency for everyday transactions. Choosing between the two depends on transaction urgency, cost sensitivity, and geographical reach.

Table of Comparison

| Feature | Wire Transfer | Instant Payment Protocols |

|---|---|---|

| Transfer Speed | 1-3 business days | Seconds to minutes |

| Availability | Business hours only | 24/7, including weekends and holidays |

| Cost | Higher fees, varies by bank | Lower or no fees |

| Security | High, regulated by banking standards | High, uses encryption and real-time fraud detection |

| Use Cases | Large transfers, cross-border payments | Everyday payments, peer-to-peer transfers |

| Settlement Finality | Delayed settlement | Real-time settlement |

Understanding Wire Transfers: Traditional Money Movement

Wire transfers remain a cornerstone of traditional money movement, enabling secure, bank-to-bank electronic funds transfers domestically and internationally. These transfers typically involve intermediaries such as correspondent banks, which can result in processing times ranging from several hours to multiple business days. Despite slower settlement times compared to instant payment protocols, wire transfers provide high transaction limits and robust fraud protection essential for large-value transfers.

What Are Instant Payment Protocols?

Instant Payment Protocols enable real-time money transfers, allowing funds to be sent and received within seconds, 24/7, across participating banks and financial institutions. Unlike traditional wire transfers, these protocols leverage advanced digital infrastructure and APIs to facilitate seamless, immediate settlements without relying on batch processing or delayed clearing cycles. Instant Payment systems such as RTP, SEPA Instant, and Faster Payments are transforming financial transactions by enhancing liquidity, improving customer experience, and reducing settlement risk in the banking sector.

Key Differences Between Wire Transfers and Instant Payments

Wire transfers typically process funds within one to three business days and involve intermediary banks, resulting in higher fees and reduced speed compared to instant payment protocols, which enable real-time fund transfers, often within seconds. Instant payment systems, supported by technologies like RTP (Real-Time Payments) or SEPA Instant Credit Transfer in Europe, provide 24/7 availability and improved transparency through immediate confirmation messages. Wire transfers are preferred for large-value, cross-border transactions requiring high security, whereas instant payments cater to domestic, low-value transfers demanding speed and convenience.

Transaction Speed: Wire Transfer vs Instant Payment Protocols

Wire transfers typically require several hours to several days to complete due to interbank processing and clearing times, especially for international transactions. Instant payment protocols enable near real-time fund settlement, with transactions often completing within seconds, ensuring immediate availability of funds. The difference in transaction speed significantly impacts liquidity management and customer experience in modern banking services.

Cost Comparison: Fees and Charges

Wire transfers typically involve higher fees and fixed charges set by banks, often ranging from $15 to $50 per transaction for domestic transfers and significantly more for international ones. Instant payment protocols generally offer lower or no fees, making them more cost-effective for frequent, small-value transfers due to minimal processing overhead. The cost disparity stems from the traditional clearing systems used in wire transfers versus real-time settlement mechanisms in instant payment networks.

Security Features and Fraud Risks

Wire transfer systems incorporate multi-factor authentication and encryption protocols that ensure secure transmission of funds, offering robust protection against unauthorized access. Instant payment protocols utilize advanced real-time monitoring and tokenization techniques, reducing the window for fraud but potentially increasing exposure to cyberattacks due to immediate settlement. Both methods require strong fraud detection systems; however, instant payments demand heightened vigilance in behavioral analytics and anomaly detection to mitigate evolving security threats.

Cross-Border Capabilities and International Transfers

Wire transfers traditionally dominate cross-border money transfers due to their wide acceptance across international banks and established correspondent networks, enabling large-value transactions with enhanced regulatory compliance. Instant Payment Protocols offer growing advantages through near real-time settlement and lower transaction fees but face limitations in interoperability and global reach, impacting their adoption for international transfers. Banks increasingly integrate both methods to optimize cross-border liquidity management and customer convenience while navigating jurisdictional differences and currency conversion complexities.

Accessibility and User Experience

Wire transfers often require manual initiation through bank branches or online platforms, which can limit accessibility and cause delays, whereas instant payment protocols enable seamless, real-time transactions via mobile apps and digital wallets, enhancing user convenience. Instant payment systems support 24/7 availability and typically offer straightforward interfaces designed for quick peer-to-peer transfers, significantly improving user experience. In contrast, wire transfers may involve higher fees and processing times, making instant payments a more accessible and user-friendly choice for consumers.

Regulatory Compliance and Legal Considerations

Wire transfers are subject to stringent regulatory compliance frameworks such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations, requiring detailed customer identification and transaction reporting to prevent fraud and money laundering. Instant payment protocols must also adhere to these regulations but operate within real-time transaction environments, demanding enhanced fraud detection systems and immediate compliance checks to mitigate risks associated with rapid fund transfers. Legal considerations include jurisdictional issues and dispute resolution mechanisms, where wire transfers follow established cross-border legal standards, while instant payments require evolving regulatory adaptations to address their innovative, time-sensitive nature.

Choosing the Right Method for Your Money Transfers

Wire transfers offer a secure and widely accepted method for transferring large sums internationally, typically processed within 1-3 business days with higher fees and detailed verification requirements. Instant payment protocols, such as RTP and Faster Payments, provide near real-time fund availability, lower costs, and convenience for domestic transfers, making them ideal for urgent or smaller transactions. Selecting the appropriate method depends on factors like transfer speed, cost, transaction size, and geographic location to balance efficiency with security.

Related Important Terms

Real-Time Payments (RTP)

Real-Time Payments (RTP) offer immediate fund transfers between banks, enhancing liquidity and reducing settlement risk compared to traditional wire transfers that often take hours or days to process. RTP systems leverage advanced APIs and 24/7 availability, enabling seamless, secure, and transparent transactions critical for modern banking and digital commerce.

ISO 20022 Messaging Standard

ISO 20022 messaging standard enhances wire transfers by enabling structured, interoperable financial messages, improving accuracy and compliance in cross-border payments. Instant payment protocols leveraging ISO 20022 facilitate real-time fund transfers with enriched data exchange, supporting faster settlement and superior transparency in banking transactions.

FedNow Service

FedNow Service enables real-time payments by processing transactions instantly, contrasting with traditional wire transfers that typically require several hours to days for settlement. Its 24/7 availability and immediate fund settlement enhance liquidity management and reduce counterparty risk in banking operations.

SWIFT gpi (Global Payments Innovation)

SWIFT gpi (Global Payments Innovation) enhances traditional wire transfers by offering faster processing times, increased transparency, and end-to-end tracking for international payments. Unlike instant payment protocols primarily designed for domestic use, SWIFT gpi supports cross-border transactions with improved speed, traceability, and cost-effectiveness, making it a preferred choice for global banking institutions.

Request for Payment (RfP)

Request for Payment (RfP) protocols streamline money transfers by enabling payees to send a digital invoice directly to the payer, facilitating faster and more transparent transactions compared to traditional wire transfers. While wire transfers rely on batch processing and intermediary banks, RfP integrated with instant payment protocols supports real-time settlement, improving cash flow management and reducing settlement risk in banking operations.

Faster Payments Service (FPS)

Faster Payments Service (FPS) enables near-instantaneous money transfers between bank accounts in the UK, significantly reducing processing times compared to traditional wire transfers that can take several hours to days. FPS supports transactions up to PS250,000 with enhanced security and 24/7 availability, making it a preferred choice for consumers and businesses seeking efficient, cost-effective payment solutions.

SEPA Instant Credit Transfer (SCT Inst)

SEPA Instant Credit Transfer (SCT Inst) enables real-time, 24/7 euro transfers across participating European banks, significantly reducing settlement times compared to traditional wire transfers that may take hours or days. SCT Inst enhances liquidity and cash flow management for businesses and consumers by offering instant fund availability and improved payment transparency within the Single Euro Payments Area.

Cross-Border Instant Payment (CBIP)

Cross-Border Instant Payment (CBIP) protocols enable near real-time fund transfers across international borders, significantly reducing the processing time compared to traditional wire transfers, which can take several hours to days. CBIP leverages standardized messaging formats and interoperable systems to enhance transparency, security, and cost-efficiency in global money transfers, making it a preferred choice for businesses and individuals requiring fast, reliable cross-border payments.

API-driven Payment Routing

API-driven payment routing in wire transfers offers robust security and extensive global reach, enabling banks to manage cross-border transactions efficiently with established settlement timelines. Instant payment protocols leverage real-time processing through APIs to facilitate immediate fund availability and enhanced customer experience, prioritizing speed and liquidity in domestic or regional transfers.

Embedded Payments

Embedded payments leverage Instant Payment Protocols to enable real-time fund transfers within platforms, offering faster settlement compared to traditional wire transfers that can take hours to days. Instant protocols enhance customer experience by integrating seamless, secure, and immediate payment processing directly into banking apps and e-commerce systems.

Wire Transfer vs Instant Payment Protocols for money transfer Infographic

moneydiff.com

moneydiff.com