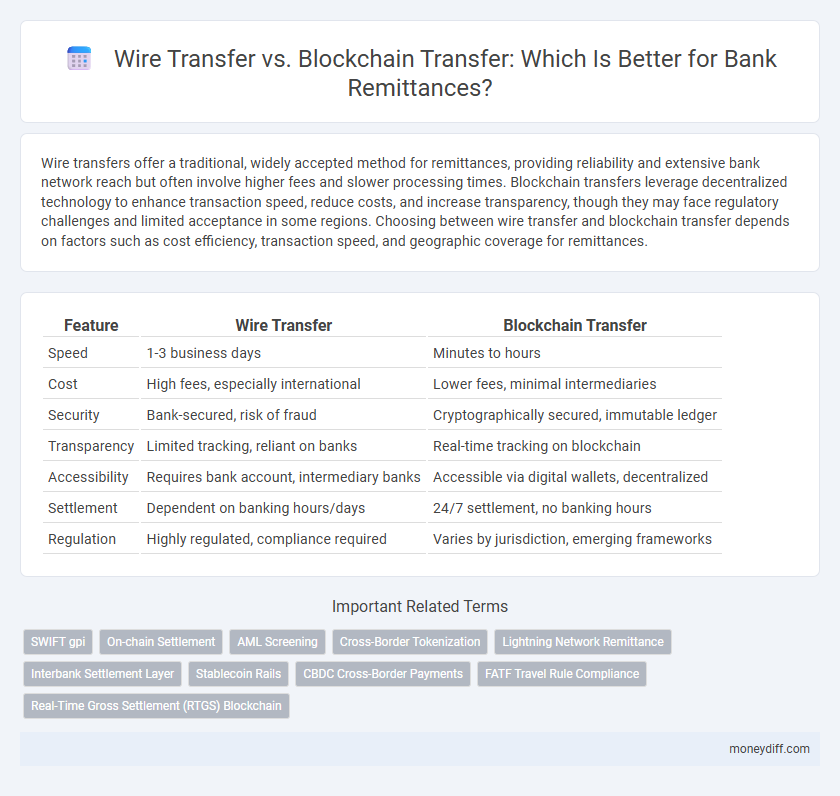

Wire transfers offer a traditional, widely accepted method for remittances, providing reliability and extensive bank network reach but often involve higher fees and slower processing times. Blockchain transfers leverage decentralized technology to enhance transaction speed, reduce costs, and increase transparency, though they may face regulatory challenges and limited acceptance in some regions. Choosing between wire transfer and blockchain transfer depends on factors such as cost efficiency, transaction speed, and geographic coverage for remittances.

Table of Comparison

| Feature | Wire Transfer | Blockchain Transfer |

|---|---|---|

| Speed | 1-3 business days | Minutes to hours |

| Cost | High fees, especially international | Lower fees, minimal intermediaries |

| Security | Bank-secured, risk of fraud | Cryptographically secured, immutable ledger |

| Transparency | Limited tracking, reliant on banks | Real-time tracking on blockchain |

| Accessibility | Requires bank account, intermediary banks | Accessible via digital wallets, decentralized |

| Settlement | Dependent on banking hours/days | 24/7 settlement, no banking hours |

| Regulation | Highly regulated, compliance required | Varies by jurisdiction, emerging frameworks |

Introduction to Remittances: Traditional vs. Modern Methods

Wire transfers have long been the cornerstone of traditional remittances, relying on established banking networks to move funds securely across borders with typical processing times of one to five business days. Blockchain transfers offer a modern alternative, utilizing decentralized ledger technology to enable near-instantaneous, transparent, and potentially lower-cost cross-border payments. The shift from legacy wired systems to blockchain-based remittances reflects growing demand for efficiency, reduced transaction fees, and enhanced security in global money transfers.

Understanding Wire Transfers in Banking

Wire transfers in banking are electronic funds transfers directly between banks or financial institutions, typically facilitated through networks like SWIFT or Fedwire, ensuring secure and reliable international and domestic payments. These transfers rely on intermediary banks that verify and route the transaction, often resulting in higher fees and longer processing times compared to blockchain methods. Wire transfers offer established regulatory compliance and dispute resolution mechanisms, making them a trusted option for large-value remittances.

The Rise of Blockchain Transfers

Blockchain transfers for remittances have surged due to their enhanced security, lower transaction fees, and faster processing times compared to traditional wire transfers. The decentralized ledger technology eliminates the need for intermediaries, reducing delays and the risk of fraud in cross-border payments. As more financial institutions integrate blockchain solutions, this method is rapidly becoming the preferred choice for global remittances.

Speed and Efficiency: Comparing Transfer Times

Wire transfers typically take 1 to 3 business days to process, with delays caused by interbank clearing systems and cross-border regulations. Blockchain transfers leverage decentralized ledgers, enabling near-instantaneous settlement often within minutes, significantly enhancing speed and operational efficiency. This rapid transfer time reduces costs and increases transparency, making blockchain a superior choice for timely remittances.

Cost Analysis: Fees and Hidden Charges

Wire transfers typically involve fixed fees ranging from $15 to $50 per transaction, often accompanied by hidden intermediary bank charges and less favorable exchange rates that increase overall costs. Blockchain transfers leverage decentralized networks, reducing transaction fees to as low as a few cents, while eliminating intermediary costs and enabling near-instant settlement times. Despite fluctuating network fees on some blockchain platforms, the transparent fee structure usually results in significant savings for international remittances compared to traditional wire transfers.

Security Measures: Wire Transfers vs. Blockchain

Wire transfers rely on established banking networks with encryption protocols and verification steps to prevent fraud, but are susceptible to delays and human errors. Blockchain transfers use decentralized ledgers with cryptographic security that enhances transparency and immutability, reducing risk of tampering or unauthorized access. Both methods implement multi-factor authentication and compliance with regulatory standards, yet blockchain offers faster settlement and reduced dependence on intermediary institutions.

Accessibility and User Experience

Wire transfers rely on traditional banking infrastructure, often requiring users to visit bank branches or use specific banking apps, which may limit accessibility for unbanked populations. Blockchain transfers offer enhanced accessibility by enabling users to send and receive funds globally through decentralized platforms without intermediaries, reducing transaction times and fees. The user experience of blockchain transfers is increasingly streamlined with user-friendly wallets and apps, though it can still present learning curves compared to the familiar interfaces of conventional wire transfers.

Regulation and Compliance in Remittances

Wire transfers in remittances are subject to stringent regulations such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements enforced by central banks and financial authorities, ensuring transparency and consumer protection. Blockchain transfers, while offering faster and cost-effective international payments, face evolving regulatory frameworks aimed at mitigating risks associated with anonymity, fraud, and cross-border compliance challenges. Financial institutions integrating blockchain for remittances must navigate complex jurisdictional regulations, implement Know Your Customer (KYC) protocols, and ensure adherence to Anti-Money Laundering (AML) standards to maintain legal compliance.

Transparency and Traceability of Funds

Wire transfers rely on traditional banking networks, often resulting in limited transparency and slower traceability due to intermediary banks and complex processing channels. Blockchain transfers offer enhanced transparency by providing a decentralized ledger where each transaction is recorded and visible to authorized parties in real-time. This immutable ledger improves traceability of funds, reducing the risk of fraud and enabling faster verification across borders in remittance processes.

Future Trends in International Money Transfers

Future trends in international money transfers increasingly favor blockchain transfers due to their enhanced security, lower transaction costs, and faster settlement times compared to traditional wire transfers. Blockchain technology enables decentralized verification, reducing reliance on intermediaries, which streamlines cross-border payments and increases transparency. As regulatory frameworks evolve, integration of blockchain with existing banking systems is expected to revolutionize remittance efficiency and global financial inclusion.

Related Important Terms

SWIFT gpi

Wire transfers via SWIFT gpi offer enhanced transparency and faster cross-border payments with detailed tracking for remittances, while blockchain transfers provide decentralized, secure transactions with reduced intermediaries and lower fees. Despite blockchain's innovation, SWIFT gpi remains the preferred network for banks due to its widespread adoption and regulatory compliance in global payment processing.

On-chain Settlement

Wire transfers rely on traditional banking networks for cross-border remittances, often resulting in delays due to intermediary banks and clearing processes, whereas blockchain transfers leverage on-chain settlement to enable near-instantaneous, transparent, and immutable transactions. On-chain settlement eliminates the need for intermediaries, reducing costs and increasing security by recording each transfer directly on a decentralized ledger.

AML Screening

Wire transfers rely heavily on traditional AML screening protocols using centralized databases and watchlists, often resulting in slower transaction times and increased risk of human error. Blockchain transfers leverage decentralized ledgers with integrated smart contract algorithms for real-time, automated AML compliance, enhancing transparency and reducing fraud in remittance processes.

Cross-Border Tokenization

Wire transfers rely on traditional banking networks with higher fees and longer processing times for cross-border remittances, while blockchain transfers leverage tokenization to enable faster, transparent, and cost-efficient international money movement. Cross-border tokenization enhances security and liquidity by converting fiat currency into digital tokens, facilitating seamless asset transfer across decentralized networks without intermediaries.

Lightning Network Remittance

Wire transfers rely on traditional banking networks, often resulting in higher fees and slower cross-border transactions, whereas Blockchain transfers using the Lightning Network enable near-instantaneous, low-cost remittances by leveraging off-chain scaling solutions and decentralized payment channels. The Lightning Network significantly reduces transaction latency and fees, making it ideal for micro-payments and frequent international money transfers within the banking remittance ecosystem.

Interbank Settlement Layer

Wire transfers rely on traditional interbank settlement layers like SWIFT and correspondent banking networks that often involve multiple intermediaries and longer processing times, increasing costs and settlement risk. Blockchain transfers utilize decentralized ledgers enabling near real-time interbank settlements with enhanced transparency, reduced fees, and lower counterparty risk through cryptographic verification and smart contract automation.

Stablecoin Rails

Wire transfers rely on traditional banking networks with higher fees and slower settlement times, while blockchain transfers using stablecoin rails enable near-instant, low-cost cross-border payments with enhanced transparency and reduced counterparty risk. The stability of stablecoins pegged to fiat currencies ensures predictable value during remittances, making them a transformative solution in global banking and financial services.

CBDC Cross-Border Payments

Wire transfers rely on traditional banking networks and often involve intermediaries, resulting in higher fees and longer settlement times for cross-border payments. In contrast, blockchain transfers utilizing Central Bank Digital Currencies (CBDCs) enable faster, more secure, and cost-effective remittances by eliminating intermediaries and providing real-time settlement with enhanced transparency.

FATF Travel Rule Compliance

Wire transfers remain widely used for remittances but face challenges in FATF Travel Rule compliance due to complex correspondent banking networks requiring detailed sender and recipient information. Blockchain transfers offer enhanced compliance by enabling transparent, immutable transaction records that facilitate easier verification of originator and beneficiary data in line with FATF regulations.

Real-Time Gross Settlement (RTGS) Blockchain

Wire transfers through Real-Time Gross Settlement (RTGS) systems offer immediate, final settlement of funds between banks, ensuring high reliability and regulatory compliance for large-value remittances. Blockchain transfers leverage decentralized ledgers to facilitate secure, transparent, and cost-efficient cross-border payments, with RTGS blockchain implementations combining instant settlement speeds and enhanced fraud prevention features.

Wire Transfer vs Blockchain Transfer for remittances Infographic

moneydiff.com

moneydiff.com