A high-yield savings account offers significantly higher interest rates compared to a standard savings account, helping your personal savings grow faster over time. While traditional savings accounts provide easy access and lower minimum balance requirements, high-yield accounts typically require larger deposits but reward you with better returns. Choosing between them depends on your savings goals, liquidity needs, and preference for maximizing interest earnings.

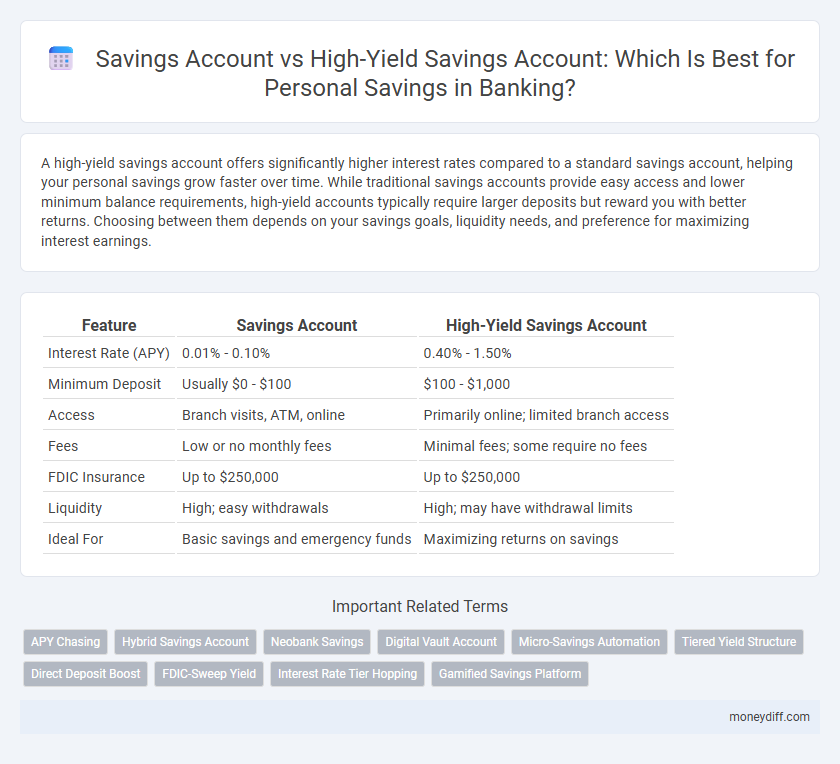

Table of Comparison

| Feature | Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate (APY) | 0.01% - 0.10% | 0.40% - 1.50% |

| Minimum Deposit | Usually $0 - $100 | $100 - $1,000 |

| Access | Branch visits, ATM, online | Primarily online; limited branch access |

| Fees | Low or no monthly fees | Minimal fees; some require no fees |

| FDIC Insurance | Up to $250,000 | Up to $250,000 |

| Liquidity | High; easy withdrawals | High; may have withdrawal limits |

| Ideal For | Basic savings and emergency funds | Maximizing returns on savings |

Understanding Savings Accounts: Basics and Benefits

Savings accounts offer a secure way to store personal funds while earning interest, typically featuring easy access and federal insurance up to $250,000 by the FDIC. High-yield savings accounts provide significantly higher interest rates compared to traditional savings accounts, maximizing growth potential for personal savings. Understanding the differences in interest rates, minimum balance requirements, and withdrawal limits helps individuals choose the optimal account to meet financial goals.

What Is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers significantly higher interest rates compared to traditional savings accounts, often provided by online banks and credit unions. These accounts typically have the same FDIC insurance coverage as regular savings accounts, ensuring security for personal savings while maximizing growth potential. The higher annual percentage yield (APY) makes high-yield savings accounts ideal for individuals aiming to earn more on their savings without sacrificing liquidity or access.

Key Differences Between Traditional and High-Yield Savings Accounts

Traditional savings accounts typically offer lower interest rates, ranging from 0.01% to 0.10% APY, while high-yield savings accounts provide significantly higher returns, often between 0.40% and 2.00% APY. High-yield accounts usually require higher minimum balances or initial deposits and may have more limited access or withdrawal restrictions compared to traditional savings accounts. FDIC insurance protects both account types up to $250,000 per depositor, ensuring secure personal savings regardless of the interest rate offered.

Interest Rates: How They Impact Your Savings Growth

High-yield savings accounts offer significantly higher interest rates than standard savings accounts, resulting in faster growth of your personal savings over time. The compound interest in high-yield accounts maximizes earnings by reinvesting interest, whereas traditional savings accounts usually provide minimal returns. Choosing a high-yield account can substantially boost your savings potential by capitalizing on superior interest rate advantages.

Accessibility and Convenience: Comparing Account Features

Savings accounts offer easy access through ATM withdrawals, online banking, and branch visits, making them highly convenient for everyday transactions and emergency funds. High-yield accounts typically limit monthly withdrawals and often require online-only access, which may reduce immediate accessibility but provide higher interest earnings. Evaluating the balance between liquidity needs and maximizing returns is essential when choosing between these account features.

Fees and Minimum Balance Requirements

Savings accounts typically have low or no fees with minimal minimum balance requirements, making them accessible for everyday personal savings. High-yield accounts often require higher minimum balances to avoid fees but offer significantly better interest rates, maximizing growth on larger deposits. Understanding fee structures and balance thresholds is crucial for selecting the account that aligns with individual financial goals and liquidity needs.

Security and FDIC Insurance Protection

Savings accounts and high-yield accounts both provide FDIC insurance coverage up to $250,000 per depositor, ensuring the security of personal funds held at insured banks. While standard savings accounts typically offer lower interest rates with the same level of FDIC protection, high-yield accounts combine elevated returns with the identical federal insurance, maximizing both security and growth potential. Choosing between these accounts depends on balancing the desire for safer, insured deposits and optimizing returns through higher interest rates under FDIC guidelines.

Best Uses: When to Choose Each Account Type

Savings accounts offer easy access and stable interest rates, ideal for emergency funds or short-term savings with minimal risk. High-yield accounts deliver significantly higher interest rates, making them suitable for building wealth over time when you can forgo immediate access to funds. Choosing between them depends on your liquidity needs and financial goals, prioritizing stability for emergencies or maximizing returns for long-term savings growth.

Top Tips for Maximizing Personal Savings

Maximize personal savings by choosing a high-yield savings account that offers interest rates significantly above the national average, often exceeding 4% APY, compared to traditional savings accounts with rates below 0.5%. Automate monthly transfers to your savings account to benefit from compound interest and reduce the temptation to spend. Regularly review and compare banking fees and interest rates to ensure you are getting the best returns on your savings.

Choosing the Right Account for Your Financial Goals

Savings accounts typically offer lower interest rates but provide easy access to funds and minimal risk, making them suitable for short-term goals or emergency funds. High-yield savings accounts deliver significantly higher interest rates, ideal for growing personal savings over time while maintaining liquidity. Assess factors like interest rates, account fees, and your savings timeline to choose the most effective account tailored to your financial objectives.

Related Important Terms

APY Chasing

High-yield savings accounts typically offer APYs ranging from 3% to 5%, significantly outperforming traditional savings accounts with average APYs below 0.10%. Maximizing APY through high-yield accounts accelerates compound interest growth, making them ideal for personal savings optimization.

Hybrid Savings Account

Hybrid savings accounts combine the low minimum balance requirements and easy access of traditional savings accounts with the higher interest rates typical of high-yield accounts, offering a balanced option for personal savings growth. These accounts often feature tiered interest rates, allowing savers to maximize returns while maintaining liquidity, making them ideal for individuals seeking both stability and enhanced earnings.

Neobank Savings

Neobank savings accounts offer higher interest rates compared to traditional savings accounts, enabling faster growth of personal savings through competitive APYs often exceeding 3%. These high-yield accounts also provide seamless digital access, low fees, and enhanced user experience, making them ideal for tech-savvy savers seeking efficient money management.

Digital Vault Account

Digital Vault Accounts offer enhanced security features and competitive interest rates compared to traditional savings accounts, making them ideal for long-term personal savings. High-yield accounts within digital vaults provide significantly higher annual percentage yields (APYs), often exceeding 2%, enabling savers to grow their funds faster while maintaining easy online access.

Micro-Savings Automation

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, making them ideal for maximizing micro-savings automation through automated transfers and round-up features. Integrating micro-savings automation tools with high-yield accounts enables consistent growth on small deposits, optimizing personal savings efficiently.

Tiered Yield Structure

A tiered yield structure in savings accounts offers variable interest rates based on account balances, typically providing higher rates for larger deposits, while high-yield accounts usually maintain consistently elevated rates regardless of balance size. Understanding the tiered rates in traditional savings accounts versus the flat, often superior yields in high-yield options helps optimize personal savings growth strategies.

Direct Deposit Boost

High-yield savings accounts offer interest rates up to 5 times higher than standard savings accounts, significantly increasing earnings through direct deposit boosts that reward consistent monthly deposits. Consumers leveraging direct deposit boosts can maximize their returns with rates typically ranging from 3% to 4.5% APY, compared to the average 0.05% APY in traditional savings accounts.

FDIC-Sweep Yield

High-yield savings accounts typically offer significantly higher FDIC-sweep yields compared to traditional savings accounts, maximizing interest earnings by automatically transferring excess funds into FDIC-insured sweep vehicles. While standard savings accounts provide ease of access and consistent interest, high-yield options optimize returns through aggregated federal insurance coverage and better rate terms.

Interest Rate Tier Hopping

Savings accounts offer stable interest rates with minimal fluctuation, making them suitable for consistent, low-risk personal savings, while high-yield accounts enable interest rate tier hopping by allowing customers to maximize returns through tiered rates that increase with higher balances. Choosing a high-yield account can significantly enhance earnings on personal savings due to escalating interest tiers, especially when balances approach defined thresholds for higher rates.

Gamified Savings Platform

Savings accounts traditionally offer stable interest rates with easy access to funds, while high-yield accounts provide significantly higher returns by leveraging market-linked interest strategies. Gamified savings platforms enhance these accounts by integrating interactive features and rewards, increasing user engagement and promoting consistent saving habits through motivation and behavioral incentives.

Savings Account vs High-Yield Account for personal savings Infographic

moneydiff.com

moneydiff.com