An ATM network offers widespread access to cash by allowing customers to withdraw money using physical debit or credit cards at numerous locations. Cardless withdrawal simplifies the process by enabling users to access cash through mobile apps or digital codes without needing their card, enhancing convenience and security. While ATM networks provide extensive reach, cardless withdrawal reduces the risk of card loss or theft during transactions.

Table of Comparison

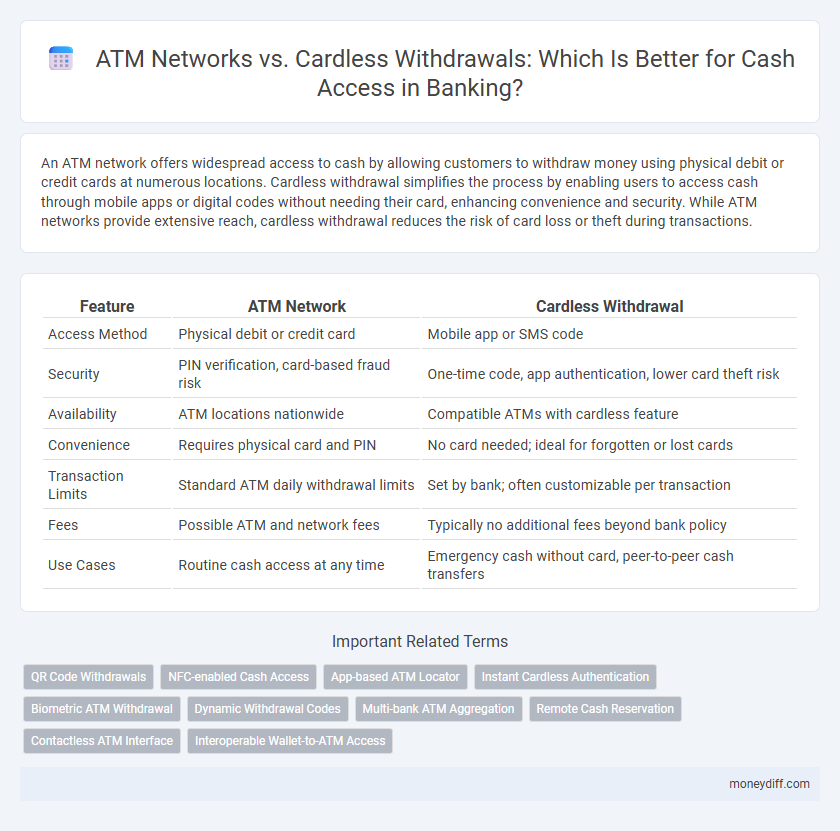

| Feature | ATM Network | Cardless Withdrawal |

|---|---|---|

| Access Method | Physical debit or credit card | Mobile app or SMS code |

| Security | PIN verification, card-based fraud risk | One-time code, app authentication, lower card theft risk |

| Availability | ATM locations nationwide | Compatible ATMs with cardless feature |

| Convenience | Requires physical card and PIN | No card needed; ideal for forgotten or lost cards |

| Transaction Limits | Standard ATM daily withdrawal limits | Set by bank; often customizable per transaction |

| Fees | Possible ATM and network fees | Typically no additional fees beyond bank policy |

| Use Cases | Routine cash access at any time | Emergency cash without card, peer-to-peer cash transfers |

Overview of ATM Network and Cardless Withdrawal

The ATM network provides extensive access to cash withdrawals through physical machines located globally, supporting a wide range of debit and credit cards for convenient, immediate cash access. Cardless withdrawal enables users to access cash without a physical card by utilizing mobile banking apps, authentication codes, or biometric verification, enhancing security and convenience. Both methods offer distinct advantages, with the ATM network ensuring broad availability and cardless withdrawal delivering innovative, contactless transaction options.

How Traditional ATM Networks Work

Traditional ATM networks enable cash access by connecting bank customers to their accounts through a secure electronic system, allowing withdrawals, deposits, and balance inquiries at physical ATM locations. These networks rely on card-based authentication using magnetic stripes or EMV chips to verify identities and process transactions instantly. The extensive infrastructure supports interoperability among different banks, ensuring users can access cash from a wide range of ATMs globally.

Cardless Withdrawal: Definition and Process

Cardless withdrawal allows customers to access cash from ATMs without using a physical debit or credit card by utilizing mobile banking apps or one-time generated codes. The process typically involves authenticating identity through biometrics or PIN on the app, selecting the withdrawal amount, and receiving a secure transaction code to enter at the ATM. This digital method enhances security and convenience by reducing card skimming risks and enabling quick access to cash anytime.

Security Features: ATM Cards vs Cardless Methods

ATM cards provide secure access through PIN authentication and EMV chip technology, reducing the risk of unauthorized use and card skimming. Cardless withdrawal methods leverage biometric verification and one-time QR codes, enhancing security by minimizing physical card theft and duplication. Both approaches implement encryption and fraud detection systems, but cardless transactions often offer real-time alerts and user control for added protection.

Accessibility and Convenience Comparison

ATM networks provide extensive accessibility with thousands of machines available worldwide, allowing cardholders to withdraw cash anytime without needing internet connectivity. Cardless withdrawal offers enhanced convenience through mobile app integration, eliminating the need for a physical card and enabling secure, quick cash access via QR codes or one-time PINs. While ATM networks excel in widespread availability, cardless withdrawal improves user experience by streamlining transactions and reducing reliance on plastic cards.

Transaction Fees and Costs Analysis

ATM network withdrawals typically incur a standard fee between $2 to $4 per transaction, varying by bank and ATM operator, while cardless withdrawals often carry higher fees ranging from $3 to $6 due to additional processing and security measures. Comparing cost-effectiveness, traditional ATM access remains more economical for frequent or high-volume cash needs, whereas cardless options provide convenience at a premium, especially in banks leveraging biometric or mobile authentication technologies. Understanding these fee structures helps consumers optimize their withdrawal strategies by balancing cost with accessibility and security preferences.

Limits and Restrictions of Both Methods

ATM networks impose daily withdrawal limits typically ranging from $300 to $1,000 per card, with fees varying by bank and network. Cardless withdrawal often features lower transaction limits, generally capped around $200 to $500, and may require smartphone app verification, limiting accessibility for some users. Both methods enforce security restrictions such as PIN entry or biometric authentication, but cardless options may provide enhanced fraud protection through real-time alerts and tokenized transactions.

Technological Requirements and User Experience

ATM network cash access requires physical infrastructure, including card readers and secure PIN entry pads, enabling seamless transactions with widespread availability. Cardless withdrawal leverages mobile banking apps and QR codes or one-time passwords, reducing dependency on cards and enhancing security through biometric or device authentication. User experience improves as cardless methods offer faster, contactless access but depend on reliable smartphone connectivity and app functionality.

Risks and Fraud Prevention Measures

ATM networks expose users to skimming, card trapping, and PIN theft, requiring robust physical security measures and encryption protocols to mitigate fraud. Cardless withdrawal leverages mobile authentication and dynamic QR codes, reducing the risk of card skimming but introducing vulnerabilities related to mobile malware and phishing attacks. Financial institutions implement multi-factor authentication, real-time transaction monitoring, and biometric verification to enhance fraud prevention across both cash access methods.

Future Trends in Cash Access Solutions

The future of cash access solutions is increasingly shifting towards cardless withdrawal technologies, leveraging biometric authentication and mobile wallets to enhance security and user convenience. ATM networks are rapidly integrating contactless interfaces and QR code scanning to support seamless transactions without physical cards. This evolution is driven by advancements in digital banking platforms and consumer demand for faster, safer, and more flexible cash access methods.

Related Important Terms

QR Code Withdrawals

QR code withdrawals enable seamless cash access without physical cards by linking bank accounts directly to mobile devices, enhancing security and convenience compared to traditional ATM networks. This method reduces dependency on ATM hardware and card skimming risks, while allowing banks to offer contactless, faster transaction experiences through integrated mobile banking apps.

NFC-enabled Cash Access

NFC-enabled cash access leverages near-field communication technology to facilitate cardless withdrawals, enhancing convenience and security by allowing users to authenticate transactions via smartphones without physical cards. This innovation complements traditional ATM networks by reducing dependency on plastic cards and decreasing transaction times while maintaining wide accessibility across NFC-compatible terminals.

App-based ATM Locator

App-based ATM locators enhance cash accessibility by providing real-time maps of nearby ATM networks, improving user convenience and reducing withdrawal time. Cardless withdrawal technology complements this by enabling secure cash access through smartphone authentication, eliminating the need for physical cards.

Instant Cardless Authentication

ATM networks provide widespread cash access but often require physical cards, leading to potential security risks and inconvenience. Instant cardless authentication leverages mobile technology and biometric verification, enabling secure, seamless withdrawals without the need for a physical card, enhancing both user experience and transaction speed.

Biometric ATM Withdrawal

Biometric ATM withdrawal enhances cash access by enabling secure, cardless transactions through fingerprint or facial recognition, reducing dependence on physical cards and minimizing fraud risks. This technology leverages biometric data within ATM networks to streamline authentication, offering faster and more convenient access compared to traditional card-based methods.

Dynamic Withdrawal Codes

Dynamic withdrawal codes enhance cash access by allowing secure, cardless ATM withdrawals through time-sensitive, single-use codes generated via mobile banking apps. This innovation reduces fraud risk compared to traditional ATM networks relying on physical cards, streamlining user convenience and security in cash transactions.

Multi-bank ATM Aggregation

Multi-bank ATM aggregation enhances cash access by enabling customers to withdraw cash from a wide range of ATMs across different banks using their cards, increasing convenience and reducing dependency on a single bank's ATM network. Cardless withdrawal technology further complements this by allowing secure cash access through mobile authentication, eliminating the need for physical cards while leveraging the aggregated ATM infrastructure for seamless multi-bank usability.

Remote Cash Reservation

Remote Cash Reservation enables users to secure cash through mobile apps before visiting an ATM, reducing wait times and enhancing convenience compared to traditional ATM networks that require physical card insertion. This method streamlines access by allowing cash withdrawals without a card, leveraging secure digital authentication to prevent fraud and improve transaction speed.

Contactless ATM Interface

Contactless ATM interfaces enhance cash access by enabling cardless withdrawals through smartphone authentication, reducing dependency on physical cards while increasing transaction speed and security. This technology leverages NFC and biometric verification, integrating seamlessly with traditional ATM networks to offer a hybrid solution that caters to evolving consumer preferences for convenience and safety.

Interoperable Wallet-to-ATM Access

Interoperable wallet-to-ATM access enhances cash withdrawal convenience by allowing users to access multiple ATM networks without physical cards, leveraging biometric or QR code authentication for seamless transactions. This technology reduces dependency on card-based systems, increases security, and expands accessibility across diverse banking institutions.

ATM Network vs Cardless Withdrawal for cash access. Infographic

moneydiff.com

moneydiff.com