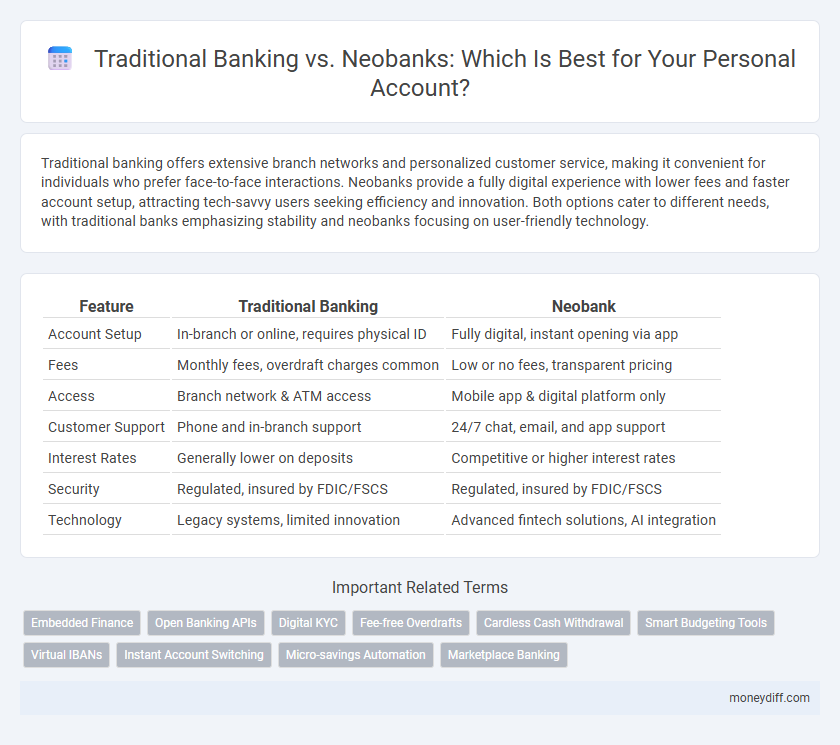

Traditional banking offers extensive branch networks and personalized customer service, making it convenient for individuals who prefer face-to-face interactions. Neobanks provide a fully digital experience with lower fees and faster account setup, attracting tech-savvy users seeking efficiency and innovation. Both options cater to different needs, with traditional banks emphasizing stability and neobanks focusing on user-friendly technology.

Table of Comparison

| Feature | Traditional Banking | Neobank |

|---|---|---|

| Account Setup | In-branch or online, requires physical ID | Fully digital, instant opening via app |

| Fees | Monthly fees, overdraft charges common | Low or no fees, transparent pricing |

| Access | Branch network & ATM access | Mobile app & digital platform only |

| Customer Support | Phone and in-branch support | 24/7 chat, email, and app support |

| Interest Rates | Generally lower on deposits | Competitive or higher interest rates |

| Security | Regulated, insured by FDIC/FSCS | Regulated, insured by FDIC/FSCS |

| Technology | Legacy systems, limited innovation | Advanced fintech solutions, AI integration |

Understanding Traditional Banking and Neobanks

Traditional banking involves physical branches, offering in-person services such as cash deposits, withdrawals, and personalized financial advice, with regulatory oversight ensuring security and trust. Neobanks operate entirely online through mobile apps, providing low-cost, user-friendly digital services like instant account setup, spending analytics, and seamless money transfers. Understanding these differences helps consumers choose between robust, face-to-face services of traditional banks and the innovative, convenient features of neobanks for personal accounts.

Key Features of Traditional Banks for Personal Accounts

Traditional banks offer personal accounts with extensive branch networks, allowing face-to-face customer service and in-person transactions. They provide a wide range of financial products such as checking and savings accounts, loans, and credit cards, backed by established regulatory frameworks ensuring deposit protection. Customers benefit from comprehensive services like ATM access, personalized financial advice, and robust fraud prevention measures.

What Sets Neobanks Apart for Individuals

Neobanks distinguish themselves by offering fully digital banking experiences with streamlined account management, instant transaction notifications, and no physical branch visits required. Their advanced mobile apps provide real-time budgeting tools, personalized financial insights, and faster account opening processes compared to traditional banks. Lower fees and innovative integration with third-party financial services further enhance the appeal of neobanks for personal accounts.

Account Opening Process: Traditional Banks vs Neobanks

Traditional banks require customers to visit branches in person, submit physical documents, and undergo longer verification processes for personal account opening. Neobanks offer streamlined digital onboarding with instant identity verification through mobile apps, enabling account setup in minutes without physical paperwork. Faster, more convenient procedures make neobanks highly attractive for tech-savvy individuals seeking efficient personal banking solutions.

Fees and Maintenance Charges Compared

Traditional banking often involves higher fees and maintenance charges for personal accounts, including monthly account fees, overdraft penalties, and ATM withdrawal costs. Neobanks typically offer lower or no fees for account maintenance, free domestic and international transfers, and reduced charges on ATM usage due to their digital-only infrastructure. Customers prioritize these cost savings and transparent fee structures when choosing between conventional banks and neobanks for personal banking services.

Accessibility: Branch Networks vs Digital Platforms

Traditional banking offers extensive branch networks providing face-to-face service and cash access but may limit convenience due to fixed locations and hours. Neobanks leverage digital platforms with 24/7 accessibility through mobile apps and online portals, enabling instant account management and real-time transactions. This digital-first approach increases accessibility for tech-savvy users while reducing reliance on physical branches.

Security Measures and Customer Protection

Traditional banking institutions implement robust security protocols such as multi-factor authentication, encryption, and FDIC insurance to safeguard personal accounts and protect customers' funds. Neobanks prioritize advanced cybersecurity measures including biometric verification, real-time fraud monitoring, and automatic transaction alerts to enhance customer protection in a fully digital environment. Both banking models emphasize regulatory compliance and data privacy to ensure secure and reliable personal banking experiences.

Digital Tools, Apps, and User Experience

Neobanks leverage advanced digital tools and intuitive mobile apps to offer seamless, user-friendly personal account management, providing real-time notifications, budgeting features, and instant transfers. Traditional banks often rely on legacy systems with less agile app interfaces, resulting in slower updates and limited customization options. Enhanced user experience in neobanks is driven by continuous app improvements and AI-driven personal finance insights, making them more attractive for tech-savvy consumers.

Customer Support and Dispute Resolution

Traditional banking offers in-person branch services and dedicated phone support, facilitating direct customer interactions that often lead to quicker resolution for complex disputes. Neobanks rely heavily on digital channels like chatbots and mobile apps, offering 24/7 support but sometimes facing limitations in handling nuanced issues or urgent dispute resolution. Customers seeking personalized assistance may prefer traditional banks, while tech-savvy users prioritize the convenience and speed of neobank customer support systems.

Choosing the Best Fit: Which Option Suits Your Needs?

Traditional banking offers extensive branch networks, personalized customer service, and established security protocols, making it ideal for individuals who prefer face-to-face interactions and access to a wide range of financial products. Neobanks provide a fully digital experience with lower fees, streamlined account management via mobile apps, and faster transaction processing, appealing to tech-savvy users seeking convenience and cost-efficiency. Assessing your banking priorities, such as physical accessibility, technological preferences, and fee sensitivity, will guide you in selecting the best fit for your personal account needs.

Related Important Terms

Embedded Finance

Traditional banking personal accounts rely on physical branches and legacy systems, limiting seamless integration with digital services; neobanks leverage embedded finance to offer personalized, real-time financial products directly within apps, enhancing user experience and operational efficiency. Embedded finance enables neobanks to embed payment, lending, and investment options into everyday platforms, driving innovation beyond conventional banking boundaries.

Open Banking APIs

Traditional banking relies on legacy systems with limited integration capabilities, whereas neobanks leverage Open Banking APIs to offer seamless real-time data sharing and enhanced personalization for personal accounts. Open Banking APIs enable neobanks to aggregate financial data from multiple sources, providing users with consolidated views and innovative services that traditional banks struggle to match.

Digital KYC

Traditional banking relies on in-person verification and physical documentation for KYC processes, leading to longer account opening times and increased operational costs. Neobanks leverage fully digital KYC solutions using AI-driven identity verification, biometric authentication, and instant document scanning to streamline onboarding and enhance user experience in personal accounts.

Fee-free Overdrafts

Traditional banks often impose substantial fees for overdraft protection, whereas neobanks typically offer fee-free overdraft options with transparent terms, attracting customers seeking to avoid costly penalties. This shift towards fee-free overdrafts in neobanks enhances financial accessibility and budgeting flexibility for personal account holders.

Cardless Cash Withdrawal

Traditional banking offers cardless cash withdrawal through ATM apps tied to physical accounts, providing convenience but often limited by branch network and processing times. Neobanks excel with instant cardless ATM withdrawals via mobile apps, leveraging real-time authentication and digital-first infrastructure for seamless, secure access to funds worldwide.

Smart Budgeting Tools

Traditional banking often provides basic budgeting tools that require manual input and lack advanced analytics, limiting users' ability to track and optimize spending effectively. Neobanks leverage AI-driven smart budgeting tools with real-time insights, automated expense categorization, and personalized financial recommendations, enhancing users' control over their personal finances.

Virtual IBANs

Traditional banking offers physical branch access and established trust but often lacks modern digital features like Virtual IBANs, which enable simplified international transactions and account reconciliation. Neobanks specialize in digital-first personal accounts with integrated Virtual IBANs, providing faster, cost-effective cross-border payments and enhanced financial transparency for global users.

Instant Account Switching

Instant account switching in neobanks offers immediate transfer of direct debits and incoming payments, enhancing customer convenience compared to traditional banks, which often require several days or weeks to complete the process. This real-time switching capability reduces account downtime and accelerates access to new banking features, making neobanks more appealing for personal account management.

Micro-savings Automation

Traditional banking offers limited automation for micro-savings, often requiring manual transfers and minimal integration with budgeting tools. Neobanks excel in micro-savings automation by leveraging AI-driven features, such as round-up transactions and personalized saving rules, to help customers effortlessly grow their personal accounts.

Marketplace Banking

Traditional banking relies on physical branches and established financial infrastructure, offering personalized services but limited digital innovation, while neobanks operate entirely online, leveraging API-driven Marketplace Banking to provide integrated financial products like loans, insurance, and investment options through seamless third-party partnerships. Marketplace Banking enables neobanks to deliver customized personal account solutions with enhanced user experience, cost efficiency, and real-time financial management tools, reshaping consumer expectations in digital banking.

Traditional Banking vs Neobank for personal accounts. Infographic

moneydiff.com

moneydiff.com