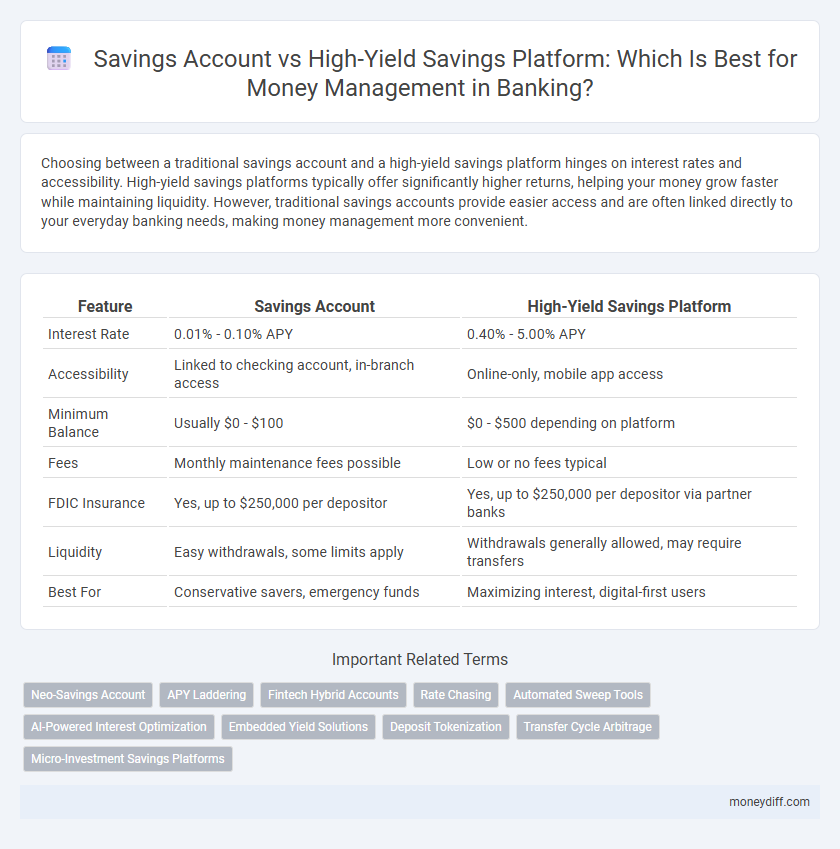

Choosing between a traditional savings account and a high-yield savings platform hinges on interest rates and accessibility. High-yield savings platforms typically offer significantly higher returns, helping your money grow faster while maintaining liquidity. However, traditional savings accounts provide easier access and are often linked directly to your everyday banking needs, making money management more convenient.

Table of Comparison

| Feature | Savings Account | High-Yield Savings Platform |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 0.40% - 5.00% APY |

| Accessibility | Linked to checking account, in-branch access | Online-only, mobile app access |

| Minimum Balance | Usually $0 - $100 | $0 - $500 depending on platform |

| Fees | Monthly maintenance fees possible | Low or no fees typical |

| FDIC Insurance | Yes, up to $250,000 per depositor | Yes, up to $250,000 per depositor via partner banks |

| Liquidity | Easy withdrawals, some limits apply | Withdrawals generally allowed, may require transfers |

| Best For | Conservative savers, emergency funds | Maximizing interest, digital-first users |

Introduction to Savings Accounts and High-Yield Savings Platforms

Savings accounts provide a secure and accessible way to store money while earning interest, typically offering lower rates set by traditional banks. High-yield savings platforms leverage online banking technology to deliver significantly higher interest rates, often several times above the national average, maximizing growth potential for deposited funds. Both options ensure FDIC insurance protection, but high-yield platforms usually require digital access and may have specific minimum balance requirements.

Key Features of Traditional Savings Accounts

Traditional savings accounts offer FDIC insurance, ensuring deposits up to $250,000 are protected, and provide easy access to funds through ATMs and branch services. These accounts typically have low minimum balance requirements and offer steady, albeit lower, interest rates compared to high-yield alternatives. Their primary features emphasize security and liquidity, making them suitable for emergency funds and short-term savings goals.

Core Advantages of High-Yield Savings Platforms

High-yield savings platforms offer significantly higher interest rates compared to traditional savings accounts, allowing money to grow faster through compound interest. These platforms typically provide easy online access and lower fees, enhancing convenience and cost-effectiveness for money management. Enhanced liquidity options and FDIC insurance also ensure that funds remain both accessible and secure while maximizing returns.

Interest Rates Comparison: Traditional vs High-Yield

High-yield savings platforms offer interest rates typically ranging from 3% to 5%, significantly outperforming traditional savings accounts that average around 0.01% to 0.10%. This marked difference in annual percentage yields (APY) can substantially increase the growth of deposited funds over time. Choosing a high-yield savings option maximizes returns while maintaining liquidity, compared to the minimal interest accrual in standard bank savings accounts.

Accessibility and Account Flexibility

A traditional savings account offers widespread accessibility through branches and ATMs, supporting easy deposits and withdrawals, while high-yield savings platforms primarily operate online, providing 24/7 access with digital tools but limited physical presence. High-yield accounts often impose restrictions on transaction frequency and may require minimum balances or initial deposits to earn peak interest rates, contrasting with the flexible withdrawal options typically available in standard savings accounts. Choosing between these options depends on balancing the need for immediate access and ease of transactions against the goal of maximizing interest earnings through enhanced account terms.

Safety and Security: FDIC and Institutional Insurance

Savings accounts at traditional banks provide FDIC insurance coverage up to $250,000 per depositor, ensuring principal protection and security. High-yield savings platforms often partner with multiple FDIC-insured banks, offering aggregated insurance coverage that can exceed $1 million by distributing funds across institutions. Both options maintain strong institutional safeguards, but comprehensive insurance limits and regulatory oversight are key factors enhancing safety in money management strategies.

Fees, Minimum Balances, and Account Requirements

Savings accounts typically have lower fees and minimal or no minimum balance requirements, making them accessible for everyday money management. High-yield savings platforms often require higher minimum balances to avoid fees but offer significantly better interest rates, boosting long-term savings growth. Understanding each account's fee structures and balance prerequisites is crucial for optimizing returns and minimizing costs in personal finance.

Digital Banking Experience and User Convenience

High-yield savings platforms offer significantly better interest rates compared to traditional savings accounts, making them a superior option for maximizing returns on idle funds. Digital banking features such as intuitive mobile apps, real-time transaction alerts, and seamless fund transfers enhance user convenience and accessibility. These platforms also leverage AI-driven insights and automated savings tools that simplify money management and promote disciplined financial habits.

Ideal Use Cases for Each Account Type

Savings accounts suit individuals seeking easy access to funds with minimal risk, ideal for emergency funds and short-term goals. High-yield savings platforms benefit those aiming to maximize interest earnings on idle cash, perfect for medium to long-term savings with less frequent withdrawals. Selecting the right account aligns with liquidity needs and financial goals, balancing convenience and growth potential.

Choosing the Best Option for Your Money Management Goals

Savings accounts at traditional banks offer ease of access and FDIC insurance, typically providing lower interest rates around 0.01% to 0.10%, suitable for short-term savings and emergency funds. High-yield savings platforms deliver significantly higher annual percentage yields (APYs), often ranging from 3.50% to 4.50%, making them ideal for maximizing growth on emergency funds or medium-term savings. Selecting the best option depends on your liquidity needs, risk tolerance, and financial goals, balancing interest returns with accessibility and account features.

Related Important Terms

Neo-Savings Account

Neo-Savings Accounts offer significantly higher interest rates compared to traditional savings accounts, leveraging advanced digital platforms to optimize money growth and accessibility. These accounts feature seamless integration with budgeting tools and instant transfers, making them ideal for tech-savvy users seeking efficient and lucrative money management solutions.

APY Laddering

High-yield savings platforms offer significantly higher APYs compared to traditional savings accounts, enabling superior returns through strategic APY laddering that staggers deposits across multiple tiers to maximize interest accumulation. This approach optimizes liquidity and growth by aligning deposit amounts with ascending interest rates, enhancing overall money management efficiency.

Fintech Hybrid Accounts

Fintech hybrid accounts combine the liquidity and security of traditional savings accounts with the superior interest rates offered by high-yield savings platforms, optimizing money management for tech-savvy consumers. These accounts often feature seamless digital access, automated savings tools, and integration with budgeting apps, enhancing financial control and growth potential.

Rate Chasing

High-yield savings platforms offer interest rates that are significantly higher than traditional savings accounts, enabling faster growth of deposited funds through rate chasing strategies. Consumers seeking optimal returns should continuously monitor and switch between platforms to capitalize on the best available rates in the competitive banking sector.

Automated Sweep Tools

Automated sweep tools in high-yield savings platforms efficiently transfer excess funds from checking accounts to higher-interest savings, optimizing cash flow and maximizing returns. Traditional savings accounts often lack these seamless automation features, leading to missed opportunities for increased earnings and enhanced money management.

AI-Powered Interest Optimization

AI-powered high-yield savings platforms leverage machine learning algorithms to automatically optimize interest rates by dynamically shifting funds across various financial products, surpassing the fixed-rate returns of traditional savings accounts. This approach maximizes growth potential and offers personalized money management strategies based on user behavior and market trends, ensuring higher overall yields.

Embedded Yield Solutions

Embedded yield solutions within high-yield savings platforms offer significantly higher interest rates compared to traditional savings accounts, enabling more efficient capital growth. These platforms integrate seamless automation and dynamic allocation of funds, enhancing liquidity while maximizing returns through optimized yield strategies.

Deposit Tokenization

Deposit tokenization in high-yield savings platforms enhances security and liquidity by converting deposits into digital tokens, enabling seamless transactions and better tracking compared to traditional savings accounts. This innovation improves interest rates and accessibility while reducing counterparty risks inherent in conventional banking systems.

Transfer Cycle Arbitrage

Savings accounts typically offer lower interest rates with standard transfer cycles, while high-yield savings platforms leverage transfer cycle arbitrage to optimize fund movements between accounts, maximizing interest earnings and liquidity. Utilizing rapid transfer protocols and strategically timing deposits allows users to capitalize on interest rate differentials and enhance overall returns in money management.

Micro-Investment Savings Platforms

Micro-investment savings platforms offer higher interest rates compared to traditional savings accounts, enabling users to grow their funds faster through automated contributions and fractional investing. These platforms combine the security of savings accounts with the potential for enhanced returns, making them ideal for disciplined micro-investors seeking efficient money management.

Savings Account vs High-Yield Savings Platform for money management. Infographic

moneydiff.com

moneydiff.com